Hi.

Since September of 2021, everyone has been talking about inflation after Chair Powell opened the window for multiple rate hikes in 2022 at the FOMC meeting, leading the market to increase FFR (Fed Fund Rates) expectations end-2022.

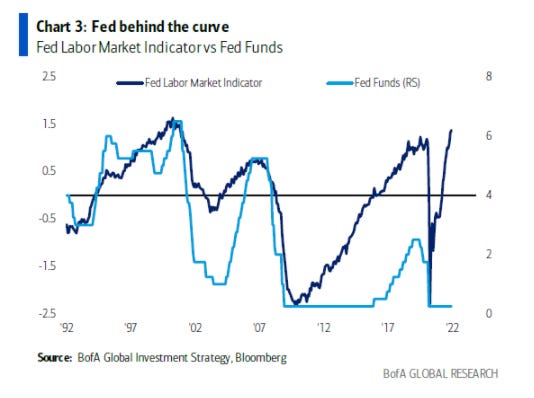

Recent data doesn’t help at all. December CPI inflation reading remains elevated with upside surprises ahead of several central bank meetings over the following weeks. While these readings generally are still being boosted by pandemic-related factors that should ease, Fed Labor Market Indicator suggests the FED is brutally behind the curve.

Investors’ skepticism has been growing, mainly reflected in the rising real interest rate, and pushing Nasdaq into correction territory, down just over 10% from its November all-time high.

However, what has caught my attention is that the Russell 2000 is almost entering bear market territory (-20%), while the S&P 500 is still down only 7% from the previous all-time high. The situation gets even uglier looking at the ratio between the Russell 2000 Growth ETF and the Russell 2000 Value ETF.

I’ve been holding a short position in the ratio since Jan/12 as a hedge in my portfolio since my exposure in long-duration companies is considerable. So if you consider it worth it, why don’t you subscribe to get access to my portfolio in real-time (Google Sheets)?

The chart shows that this is the second-worst drawdown, losing only the tech bubble. Although this isn’t a prediction for a crash, there would be a 40% plunge to reach the previous max drawdown.

Unlike the 2000’s crisis, weighting by market cap, tech companies are much more capitalized, with their respective businesses matured and generating tons of cash. Hence, it sounds reasonable a 40% downside from here as a worst-case scenario, since fundamentals increased.

On Friday, the S&P 500 lost the 200d moving average, which brings the market to a puzzle. I believe there are two plausible alternatives from now on: i) stocks recover rapidly over the next week, rebounding the 200d MA, or ii) S&P 500 will start shaking much more.

Nonetheless, the market opened a tremendous opportunity for buying great businesses whose prices suffered as much as poor quality companies in the past weeks.

There is a company in LatAm whose fundamentals have increased year over year, although stock prices plunged with the market.

MercadoLibre hosts the most prominent online commerce and payments ecosystem in Latin America. The company put a tremendous effort into enabling e-commerce and digital and mobile payment for customers delivering a suite of tech solutions.

Focusing on delivering compelling technological and commercial solutions that address distinctive customers and geographic challenges, MercadoLibre provides users with robust online commerce and payment tools in Latin America (635 million people).

The stock has been in my portfolio for years, and fundamentals are just improving, year over year. You can expect to receive my opinion and the interactive model next weekend for those with the paid subscription. Don’t miss it.

However, investors willing to buy momentum might disagree with MercadoLibre’s investment thesis. Paying for future cash flows in the current environment isn’t for everyone. It’s like catching a falling knife: you have to go slowly and carefully, adding the position.

For those, robust fundamentals have reversed last year’s oil price melt-down, with the market remaining in a surprising deficit (Omicron impact is far smaller than Delta) and more substantial 4Q21 offsetting residual effects.

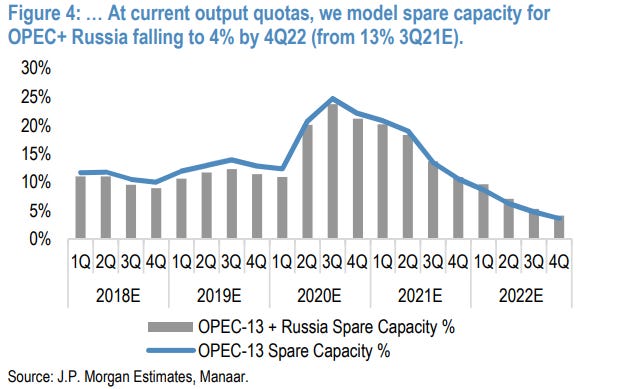

In general, OPEC+ spare capacity is hitting historically low levels, with insufficient buffers relative to demand. Lower production capacity means worse industry’s shock absorber, meaning that any tightness in the market could lead to higher premiums.

Considering that spare capacity is hitting a 25yr low, at 4%, and that OECD’s inventory might hit critical levels in 2022, there are significant odds for oil prices to overshoot in 2022 or 2023.

With that said, consensus forecasts for oil capacity should fall further in 2022, leading to significant upside risk for oil companies since the probability for a new leg higher for oil prices increased.

As a result, I’m currently holding a sizeable exposure to oil prices in FX, ETF, and equity. Majors E&P companies should do fine, and ETF is an excellent tool for getting exposed to the movement, but there is a massive skew to the upside for those willing to take directional exposure, such as Petrobras.

Of course, there would be opportunities in different countries, such as Russia and China. Still, both are going through specific events that might hurt stocks performance since premium risks are getting higher for those regions.

Don't forget to subscribe if you’d like to read my opinion about Petrobras. Besides the writing, there is an interactive model available to all subscribers.

If you can invest in Brazil, I’m soon writing about a junior E&P company that I see as a massive opportunity for capital multiplication.

Thanks for reading, and don’t forget to share with friends and colleagues.

Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money.