Time to turn bull again 🇧🇷🇧🇷🇧🇷

Hello, dear readers! I hope you've all been doing well in my absence. After a six-month hiatus, I'm thrilled to be back and reconnect with each of you through my writing.

I want to thank you for your patience and support during this time, and I can't wait to share my thoughts, experiences, and insights with you once again.

As we embark on this new chapter together, I hope you'll find my upcoming posts as engaging and thought-provoking as before. So, without further ado, let's dive right back in!

Summarizing

Brazilian equities are expected to outperform in the next 12 months due to several factors. The Brazilian Central Bank (BCB) is anticipated to reduce rates, providing a positive environment for equities. Brazilian equities, especially in the non-commodity sector, are considered attractive and undervalued, with a potential 27% increase in valuation. Historical data also suggests that a 14x P/E is conservative for these equities.

The Ibovespa index has dropped 10% recently, leading to low valuations and the possibility of being closer to the bottom. Despite headwinds, the Services PMI has returned to positive territory, and the composite index is potentially bottoming. Brazilian equities are trading at 7x forward earnings, which is considered inexpensive compared to the 12.5x historical average.

With the risk premium shifting from bonds to equities, investors should expect a rebound in equity prices and consider them as a hedge. As the BCB adopts a more lenient policy, a new structural bull market is likely to emerge, presenting attractive opportunities for investors, particularly in domestic companies.

Actionable Idea Below…

Turning Point

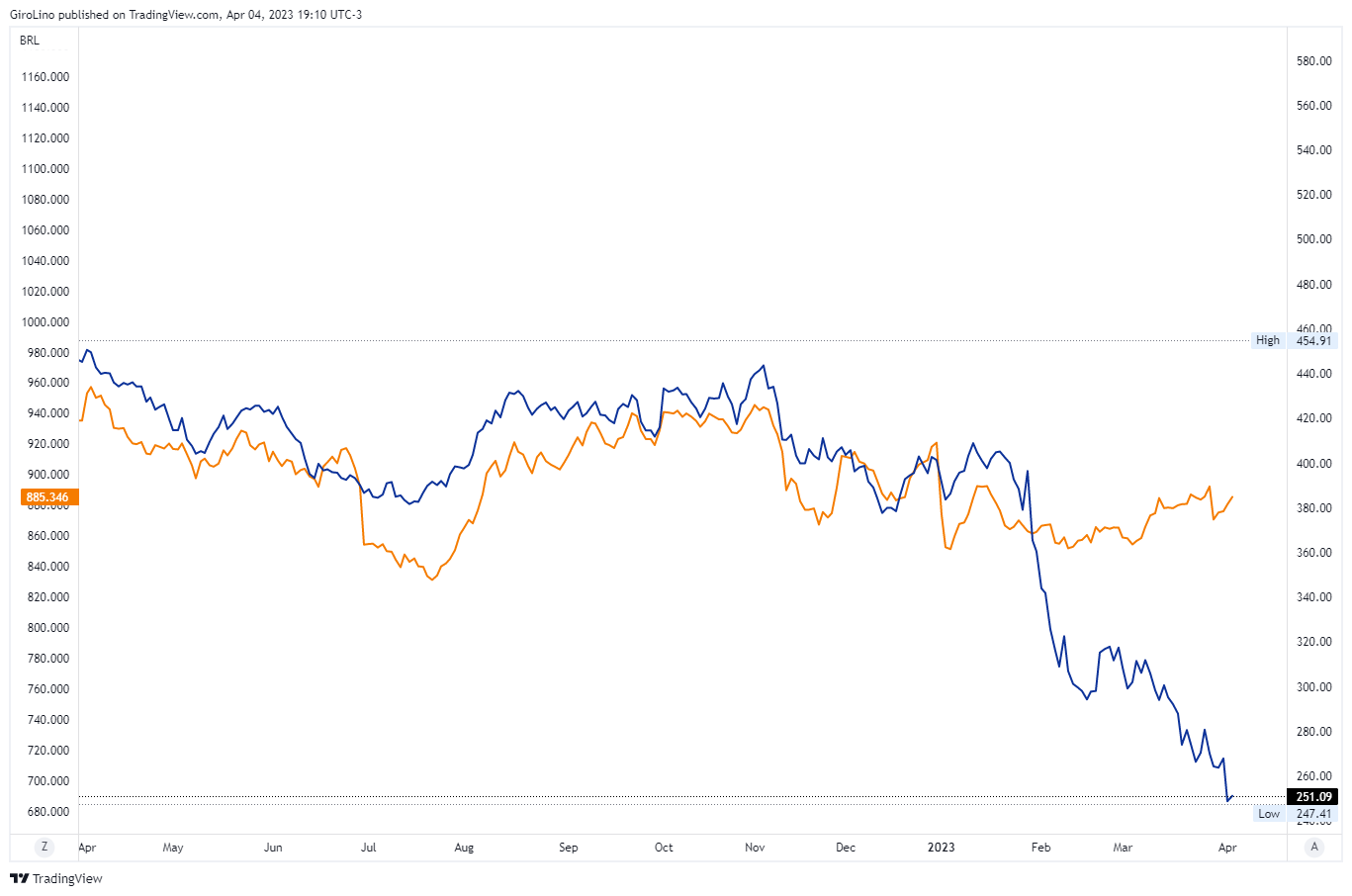

Throughout 2022, Brazilian assets ranked among the top global performers, with the BRL achieving a 15% total return and the Ibovespa rising by 6% (compared to a -20% performance for the MSCI All Country World).

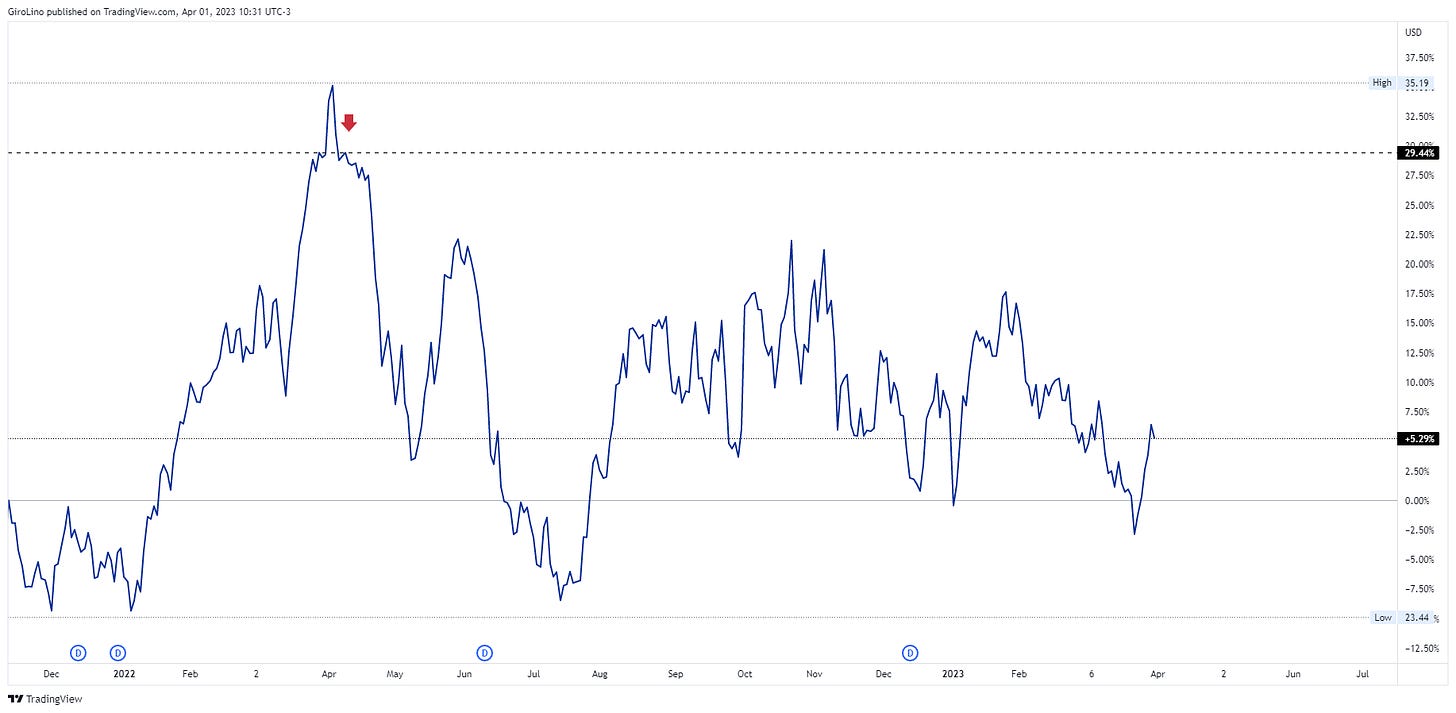

However, on April 10, 2022, we published an article discussing the Brazilian stock market EWZ, in which we anticipated a peak in stock prices and advised investors to consider factors such as i) inflationary pressures in the economy, ii) rising interest rates, and iii) the political climate.

And we were right…

Moving forward, the new year brought about a marked shift in this trend, with global markets experiencing a strong rally in February, while Brazil's momentum slowed down. While market rotation is typical at the start of a new year, Brazil's underperformance is likely due to more than just seasonal fluctuations.

There have been several "idiosyncratic episodes" where the performance of Brazilian assets has significantly deviated from global macro factors.

Recently, these episodes have been associated with election and leadership cycles, such as the 2016 impeachment, the 2018 election, and the 2022 election.

Despite favorable fundamentals for commodities to outperform markets, restrictive interest rate levels and supply chain disruptions have led to downward revisions of growth estimates.

We concluded that domestic equities and local interest rates present risk premiums akin to those observed in past periods of political volatility, which results in higher rates and an increased overall risk premium, reflected in the stock prices.

Cycle Review

We should consider the multiple interrelated and overlapping cycles that influence markets:

- Structural cycles: Long-term expectations of trend growth, inflation, and other factors can impact the long-term outlook.

- Global and Brazilian business cycles: Changes in growth and inflation relative to trends affect medium-term returns.

- Mini-cycles in risk appetite: These are often driven by significant changes in growth rates or rate shocks caused by geopolitical or political risks or substantial shifts in monetary policy.

- Risk-appetite cycles: These cycles are shorter and tend to occur more frequently than business cycles, often featuring more significant swings than growth.

As a result, price directions may change if headlines continue to perform poorly, potentially causing a more dramatic effect on the Brazilian business cycle.

Additionally, rising inflation has been a crucial factor in recessions since WW2, as it forces central banks to tighten and deleverage. However, anchored inflation, partly due to fewer oil shocks after the shale revolution, has enabled central banks to proactively buffer the business cycle.

Furthermore, improved inventory management, a reduced output share from the most cyclical sectors, and digitalization have lessened the impact of industrial fluctuations. Consequently, fiscal tightening has become a less significant contributor to US recessions since the 1970s.

Since the 1990s, economists have posited that financial imbalances and asset price crashes are sources of recession risk, closely tied to risk-appetite cycles.

We should exercise caution, as growth and inflation trends may have reached an inflection point, with business cycles beginning to experience consequences such as cost pressure and supply disruption.

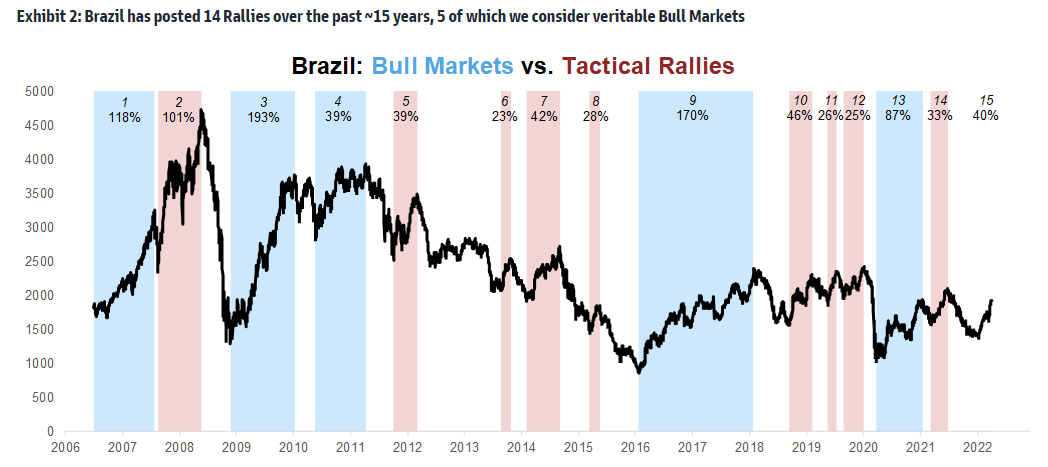

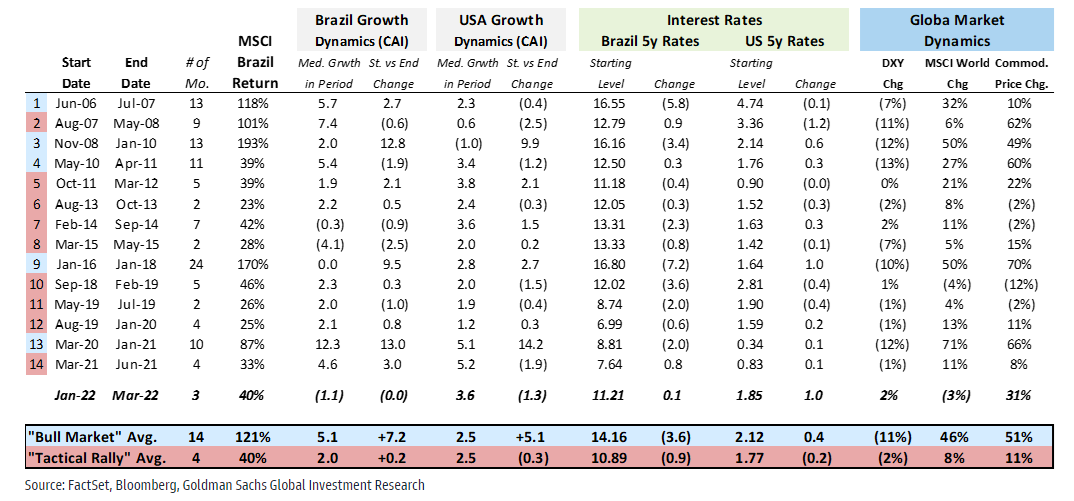

The table above demonstrates consistent patterns for every bull market that has occurred in Brazil: i) falling local interest rates, ii) accelerating growth rates (Brazil's CAI), and iii) stable global markets.

Emerging market (EM) equities EEM 0.00 and local bond yields typically exhibit negative correlation (especially for high-yielding EMs), so it is unsurprising that Brazilian interest rates rally during equity bull markets.

In the context of EM equities, a quantitative perspective is often essential. For example, between 2016 and 2018, Brazilian equities EWZ 0.00 saw a 170% positive return. At the beginning of this period, the Brazil 5-year rates were 16.8%, and they experienced a negative 7.8% change, reaching a 9% yield by the end.

This interest rate level is so high that the Equity Risk Premium (Equity Yield - Bond Yield) is negative, meaning that index investing may not be worth the risk.

Taking into account the negative 7.8% impact on rates, this would translate to a ~90% increase in equity value, partially explaining the 170% bull market rally.

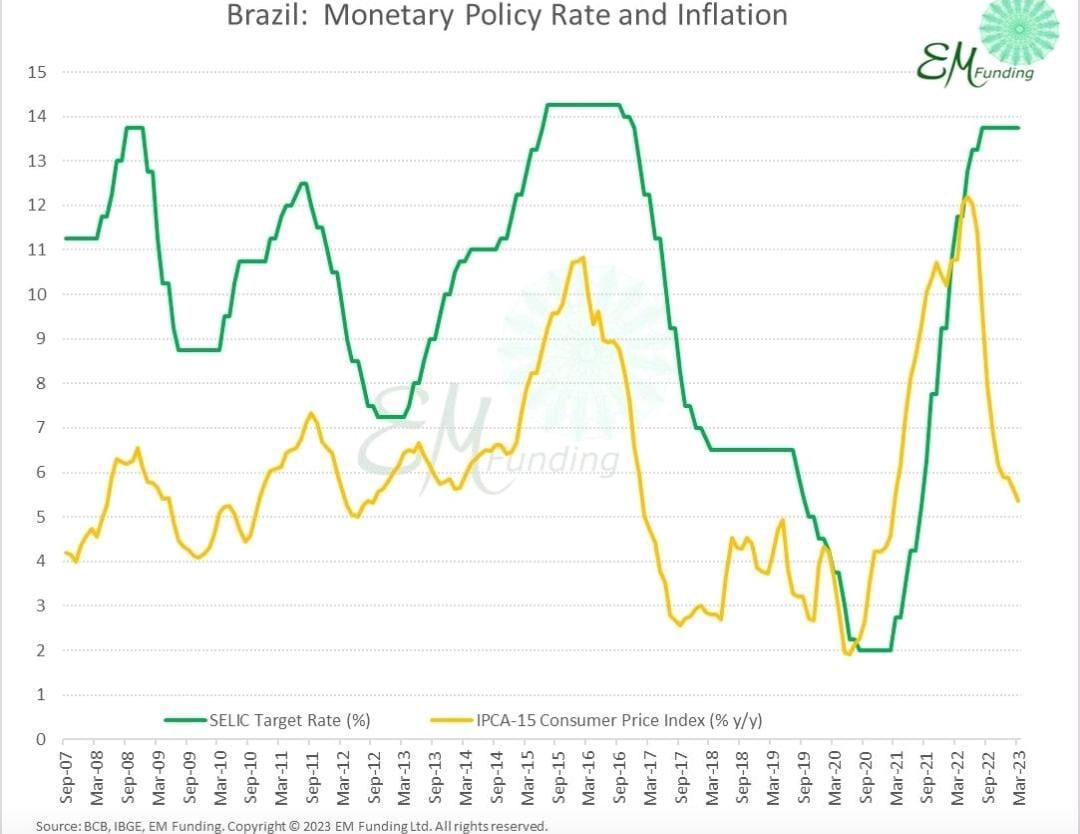

Given that the Brazilian Federal Funds ("Selic") increased from 2% to 13.75%, it was challenging to envision equities outperforming bonds in the following twelve months.

More Structural

Looking ahead, we anticipate falling interest rates to be the catalyst for a new bull cycle in Brazil. Firstly, we do not foresee a risk appetite or short-term rally.

When analyzing the short-term Z-Score for Brazilian equities, there is no significant premium in current equity prices to suggest a short-term rally.

With the lack of triggers and a constant downward revision in earnings, Ibovespa has been trading in a stable range in the past twelve months.

In contrast, recent weeks have shown a moderate easing in inflationary pressure, sparking discussions about potential short-term rate cuts and a growth rebound, which could provide a supportive environment for Brazilian assets.

The Triggers

Despite the Brazilian Central Bank's (BCB) reluctance to soften its statements and its persistence in maintaining a hawkish view, we believe this will eventually result in a more significant rate decrease, fostering a favorable environment for equities.

On one hand, the BCB has outlined several factors in their releases that support maintaining higher rates for an extended period. On the other hand, historically, market forces have pressured the BCB, with future curves suggesting 300 basis point cuts in the coming years.

The reality is that both the BCB and the market are correct. The evidence for keeping rates elevated for a more extended period is valid, but Brazil presents exceptionally high rates for global investors looking for carry. As inflation starts to ease, the money flow pressuring the curves is likely to continue.

Among "inexpensive" assets, Brazilian equities (especially those outside the commodity sector) appear to be the most appealing. Given the link between commodity equities and physical commodity prices, as well as concerns in Brazil regarding state-owned enterprise governance, we prefer domestic equities.

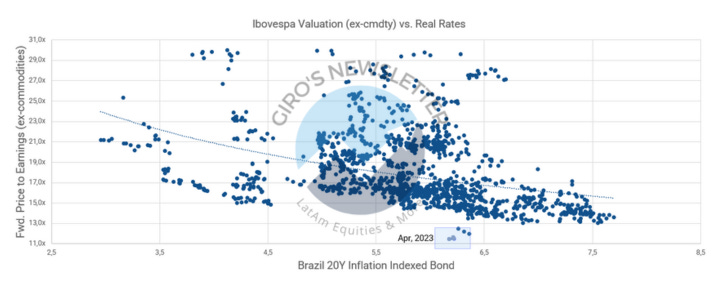

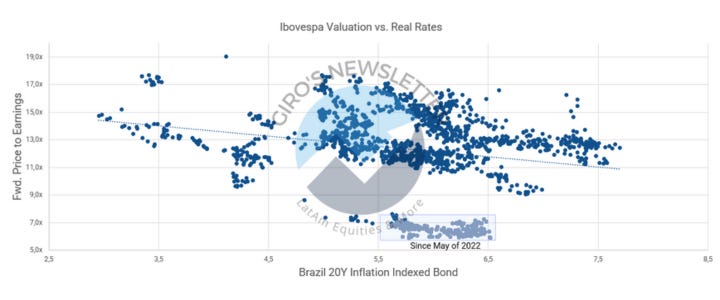

From a valuation perspective, a close relationship exists between equity valuation and local real interest rates.

The current 11x P/E multiple for Brazil's non-commodity sector (including retail, financials, and utilities) seems more in line with real rates around 9% (compared to the present 6.2%). Assuming rates do not increase, equity valuation would need to rise by approximately 27% to 14x to be considered "fair."

For historical context, Brazilian equity multiples hovered around 11x during the 2013 taper tantrum's nadir (when real rates were ~6%, implying that equities were undervalued) – and the market re-rated to 12x by mid-2014, with real rates staying relatively stable. It is essential to note that Brazil experienced a deep recession during this period, suggesting that a 14x P/E is rather conservative.

I would like to emphasize that the beginning of April represents the lowest valuation level for our basket in the past decade. In terms of market cycles, this is also the most inexpensive level we've seen.

Recently, global markets have primarily focused on the US financial system (and, to a lesser degree, Europe), allowing most emerging market assets to remain outside the global spotlight. However, Brazil has encountered a comparatively turbulent trading environment.

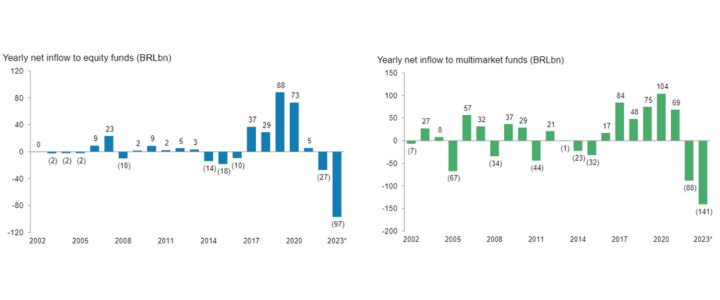

Compounding the situation, the Brazilian Fund Industry faces increasing pressure. While 2022 was the worst year in terms of money flow, 2023 is expected to be even more challenging, resulting in a surge of forced sellers in the market.

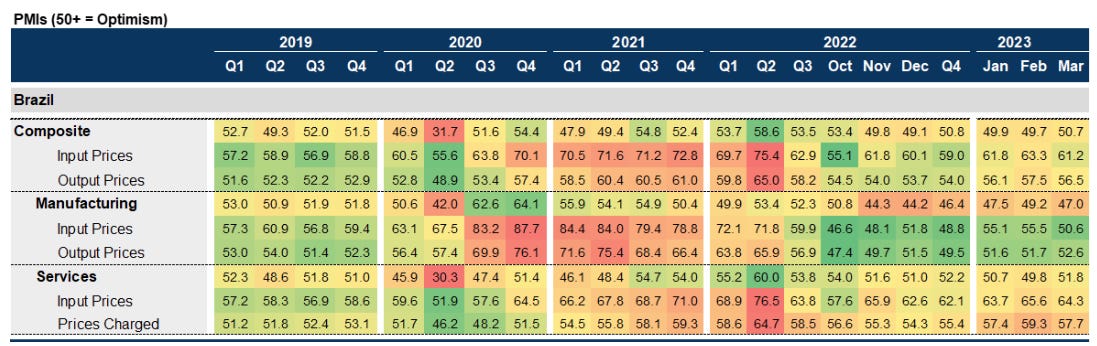

Moreover, since January's end, the Ibovespa index has declined by 10% due to weak growth (Composite PMIs below 50 since October) and concerns surrounding fiscal and monetary policies, leading to historically low equity valuations.

Although it is impossible to determine if the worst is behind us, we believe we are nearing the bottom. Despite intensifying headwinds in the manufacturing sector in March (the PMI contracted again, at a faster pace than in February), the Services PMI rebounded into positive territory, with new orders and employment components also returning to positive ground. As a result, the composite index has risen above 50 and may have reached its lowest point.

Consequently, over the past year, we have observed one of the most aggressive de-ratings of the Brazilian Stock Exchange, trading at 7x forward earnings compared to a 12.5x historical average—an inexpensive multiple given the real rates.

As previously mentioned, local rates in Brazil have performed well (as they have globally due to US rate easing), but the recent equity-centric sell-off has raised questions about emerging value in that asset class. The sell-off has been quite severe.

As the curves flattened, the risk premium shifted from bonds to equities, presenting a double-edged sword: I) Equities are extraordinarily cheap, and investors should expect a rebound in prices; II) Rates are expensive, and investors should view them as a hedge.

In our opinion, we believe that investors should consider increasing their exposure to Brazilian equities, particularly domestic companies. As the BCB begins to adopt a more lenient policy, a new structural bull market is likely to emerge, presenting attractive opportunities for discerning investors.

Trade Idea

2023-04-07 BUY EWZS at $11.5, with a stop-loss at $9.7 and gain at $16.0 (2.5:1)