Strong May

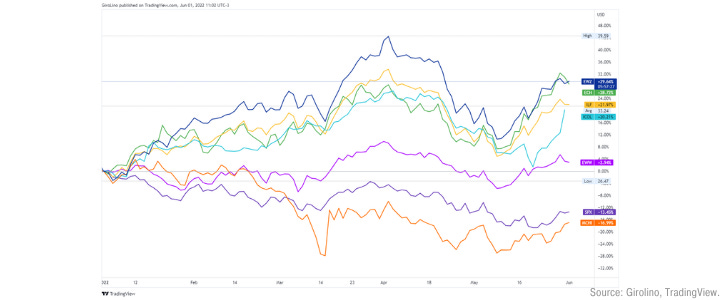

After a weak performance in April, the Brazilian Stock Exchange (“Ibovespa,” “Ibov”) was back in positive territory in May (up 3.2% in BRL and 7.8% in USD), remaining one of the top-performing equities.

Considering Ibovespa’s relative performance in the year, mainly to local peers in LatAm, we checked the market consensus and evaluated what was priced.

First, though, we’re over the 1Q22 earnings season, which is particularly strong for LatAm. Nevertheless, we highlight that most countries did well due to local currency performance, not local economic performance.

Earnings Season

1Q22 earnings season in LatAm was strong despite the disparity versus consensus estimates: 38% of companies beat the consensus(historical avg. is 27%) while 29% missed (vs. historical avg of 31%).

The net income expanded by 70% YoY in USD with robust numbers led by Brazil, Mexico, and Colombia, boosted by FX gains, while sales and Ebitda increased by 25% YoY.

Good numbers were supported by higher commodity prices. This season's highlights were Energy and Telecom, beating estimates by 64%, while Tech, Healthcare, Discretionary, and Staples missed by 50%.

We saw a clear reflection of this strong earnings season, coupled with currency appreciation, on consensus earnings expectation which stood at +18% for LatAm (from +10%) and increased significantly for Brazil at +16% (from +7%) due to stronger than expected currency performance.

Despite several companies reporting below consensus expectations, local currency performance leads to upward earnings revisions in the region.

In Brazil, 41% of companies beat and 37% missed consensus numbers. Ebitda for energy jumped by 56%, and materials fell by 19%. Only discretionary saw a contraction in net income YoY.

Despite the upward revisions, operational performance in local currency has weakened in relevant industries, such as retail and banks, leading us to believe that currency was the only upside surprise in the season.

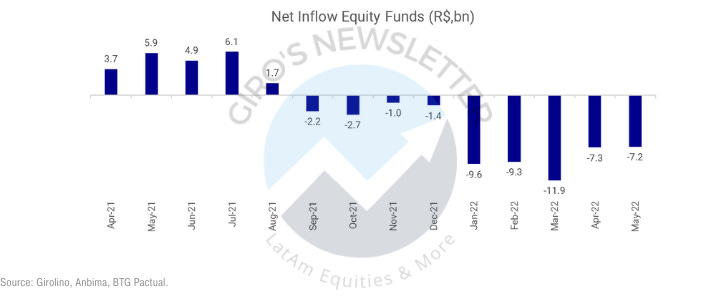

Net Flow Equity Funds

Local equity funds suffered a sequential month of redemption, leading to forced selling in stocks with lower liquidity amidst a market with low liquidity and sequential sell-offs in specific names.

Put yourself in the context. In Brazil, you could buy a bond issued by a top-tier bank, such as Bradesco, paying 15% p.a. in local currency. The risk-adjusted return for fixed income products is superior, so why bother holding the equity?

Even though stocks may look cheap, we need to consider the greater context. We have populist candidates running for elections in Brazil, surging public spending, and a global crisis on our hands.

Context is Important

At a glance, Ibovespa looks like the cheapest exchange in the world, trading today at 112k, with the sell-side estimating a YE Target of 140k, implying a juicy 25% upside.

Looking at multiples, the Ibovespa is negotiating at 6.9x price to earnings for the next twelve months, a 2-st deviation below the 10yr average, which sounds like a screaming buy opportunity.

However, in our opinion, investors should consider the context:

- 33% of the Brazilian Exchange is composed of commodities companies, trading at contracted multiples due to higher commodity prices;

- Looking forward, the sell-side expects a contraction in earnings growth, assuming earnings normalization;

- Brazil is going through tough elections in 2022 that could change the entire space in the subsequent four years;

- By the end of May, real long-term rates in Brazil were trading at 5.7% versus a yield barely above 0% in the US, suggesting that something isn’t right.

Even though we understand the thesis that Brazil is partially shielded against a monetary tightening in the US, and a challenging geopolitical environment, for being a commodity exporter, that is partly true.

The above statement would be entirely accurate if Brazil was a rich country. However, Brazilians are eating less year after year, creating a fragile social condition to be dealt with.

For instance, from 2011 to 2018, the expenditure on food per capita dropped from US$3.4k to almost US$400 per year. In the same period, the household income collapsed from US$13.2k to US$9.2k.

Also, this is not useful only for Brazil. Most emerging countries face the same situation, with expenditure on food as a high percentage of household income.

That Matter

A reasonable question would be: why does it matter? The answer also explains the current valuation. As flagged in the previous section, real long-term rates in Brazil are at 5.7%.

First, Brazil is a populist country. Politicians are always waiting for their time to urge miraculous, though impossible, solutions and to blame someone for that.

Second, Brazil lived with higher than expected inflation in the past decade. So because public spending is misallocated and the productivity deteriorates year after year, we have a country with low growth and higher inflation.

Consequently, investors require a higher premium for financing the public treasury. So, do not believe that rates in Brazil are a non-brainer because the country exports commodities.

We’re not sure if the 2006 supercycle should happen again. But unfortunately, former President (and inmate) Lula wasted Brazil's most significant opportunity to increase public spending, create new companies, and subsidize companies that approved his government.

So, Brazil not only spent a relevant stake from the surplus, but also the poverty, corruption, and bureaucracy worsened during the period.

Perhaps, a new commodity cycle gives more oxygen to the Brazilian economy, though its effect should not last long.

Skeptical on Valuation

In our view, LT real interest rates at 5.7% imply significant political and fiscal risks. As most economists have advocated, there is room for improvement in the LT real rates.

That would take someone to win elections and commit to fiscal discipline. So naturally, falling LT interest rates are the critical trigger for stock prices in Brazil.

We constantly ask ourselves “why”. So, it's no different when we go over the sell-side consensus estimating almost 30% upside for the leading stock market in 2022.

Their pitch sounds good, but the math is entirely wrong. First, according to most sell-side analysts bull in Brazilian equities, the stocks look cheap, so we agree with them.

Second, they use a historical price-to-earnings chart with a 10-year average to demonstrate their point. This is a huge bias, but we could overwatch this.

Third, they imply a return to average, supporting their view that the market expects a 15%-20% ROE for the Ibovespa in 2022, trading below the 10x price to earnings multiple, so it’s cheap. This analysis is wrong.

They’re perpetuating a 20% ROE in a commodity peak cycle, which is stupid. Sorry, but that’s the word. This is ridiculously aggressive.

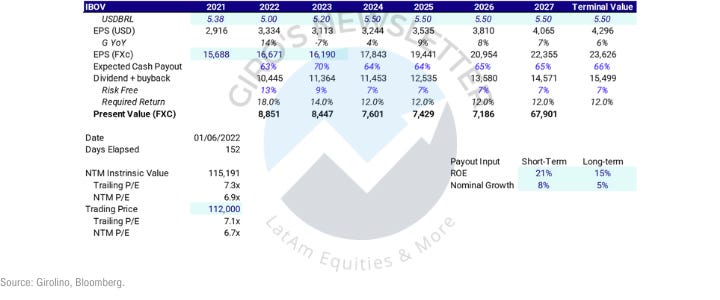

How to Value the Ibovespa?

In our opinion, the conservative approach to evaluating the Ibovespa is not considering a re-rating. This is important because we do not know who will win the elections this year.

As mentioned, we do not take sides in politics. Instead, we examine the evidence, giving our best assessment of the situation. So, no comments about election odds or anything like that.

In the sell-side modeling, they are considering real rates 270bps below where it stands today. This is aggressive.

So, we built a comprehensive model for the Ibovespa, valuing only dividends and not considering multiple expansions, reaching 115k for the next twelve months.

We also estimated a few scenarios:

No re-rating

- Bear (95k): commodities rally is over in 2022, and Brazil replicates historical growth and inflation figures;

- Base (115k): the image above;

- Bull (126k): commodity still rallying in 2023 and partially in 2024, with a higher long-term ROE and payout.

Considering re(de)-rating

- Bear (117k): The same scenario, considering 200bps compression in real rates;

- Base (140k): The same scenario, considering 250bps compression in real rates;

- Bull (167k): The same scenario, considering 250bps compression in real rates;

Why not shorting Ibovespa? Easy. Check our bear case, considering the re-rating. Even though we’re pessimistic on fundamentals, we lose if the market gets optimistic for any reason.

If you’re shorting the Exchange in local currency, there is a 0.5:1 skew in this trade, which doesn’t sound good. However, we’ll likely sell coverage calls for our positions if the market goes up.

Finally — in the first person —I don’t want to spook the bull case for Brazilian equities in the first person. I’m not a sell-side analyst with no cash invested in equities and trying to sell you a pitch, looking for angles to justify my opinion.

Many Brazilians criticize my job for not being “buy” in Brazil. I couldn’t care less, honestly. I’m in the business of making money, not writing bs…