Premium Post Pipeline

→ 05/28/2022: Stone Model Explained + Cheatsheet

In this post, I update the outlook for the Brazilian eCommerce market, the most relevant one in LatAm; Also, I take the opportunity to present more detail about the players that, in my opinion, will outperform in the following years.

Sea Limited (or “Shopee”) and MercadoLibre (or “Meli”) have been executing consistent strategies, though the friction between both is still not high.

Also, show another evidence to explain why I believe both can co-exist, even though local funds insist they’re locked horns with each other.

Again, In my opinion, local players have been focusing their channel check through IR teams from local companies, the same ones that mocked or called Meli a joke several times in the past.

“History Doesn't Repeat Itself, but It Often Rhymes” – Mark Twain.

Instead of talking to people that have been wrong for a decade, focus on the business. It’s not because their execution sucks that the industry is terrible.

Most companies don’t present critical KPIs because they are strategic. However, a sharp analyst could reasonably estimate most of them, just as I did withMeli’s marketplace operation and Sea’s.

As usual, the powerpoint presentation for this post can be located above the disclamer.

The Outline

- Retail Wrap-up

- Top Players Performance

- Sea Hit the Roof in Brazil

- Growth at what cost?

Retail Wrap-up

Although it was mostly expected, retail had a strong 1Q22, suggesting an upside risk for our estimates. According to IBGE, retail activities grew 14.3% YoY, boosted by office appliances, personal care, and home appliances.

Deflating the series, we would find a similar conclusion, with a 5.2% YoY real growth, which is strong growth for any 1Qs data.

However, most market participants were considering a stronger 1Q versus historical data due to retail reopening and more substantial consumer confidence, which hit the highest level since Aug of 2021.

Also, considering the seasonality for the 1Qs, the evidence suggests a 100bps upside risk for our previous expectations, primarily due to higher than expected inflationary pressure. So, we revised our expected growth for retail from 8.6% to 9.6%.

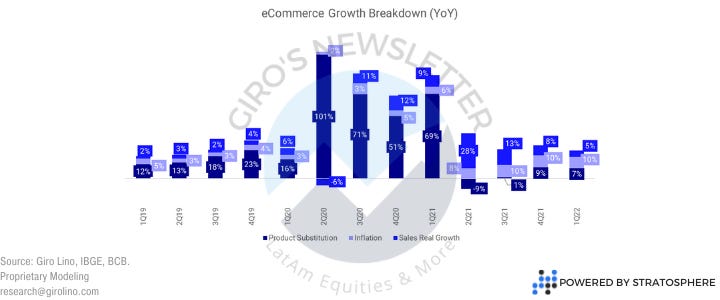

Meanwhile, eCommerce registered a 22.6% GMV growth in the 1Q22 YoY, boosted by an increase in its penetration percentage of retail sales.

As discussed in our last post about Meli, high-frequency categories stood out in the quarter, benefiting players such as Meli and Shopee (from Sea Limited).

Also, our thesis that macroeconomic conditions do not change for eCommerce penetration growth keeps proving itself for another quarter.

We strongly believe that the next five years are about execution. There are many low-hanging fruits in different categories. The challenge is to know which category to operate, how to do it, and why are you doing that.

Players Such as MercadoLibre and Shopee are gathering great results for strategies implemented years ago, not just a couple of quarters.

Meanwhile, Via Varejo, Americanas and Magalu are lagging for many reasons. For instance, Via Varejo raised capital in 2020 and bragged during the Covid outbreak that the company would outperform competitors.

However, the strategy was terrible. Via Varejo thought that to grow a marketplace operation, the only thing you needed was a financial incentive (read discounts).

We’re not going to explain many topics in this post, but the bottom line is that Via burnt a considerable amount of that cash in working capital, and it’s in big trouble.

Top Players Performance

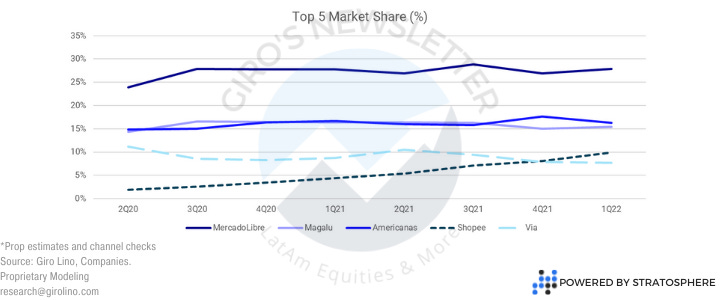

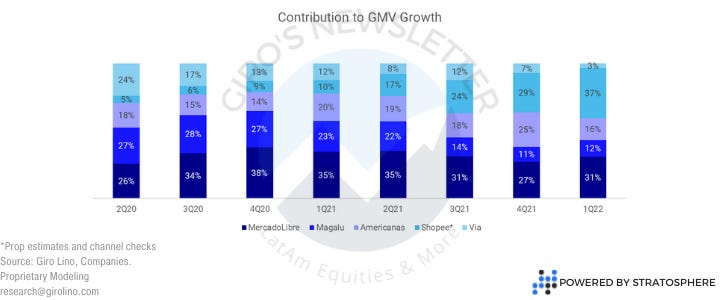

In the past 12 months, it’s hard to argue that MercadoLibre and Shopee were not the outperformers, leading the Brazilian eCommerce space.

On one side, there is MercadoLibre, executing nearly to perfection its strategy of expanding businesses around its Marketplace operation, enjoying improvements in sunk cost and network effect.

We spend a lot of time thinking about most decisions Meli’s management takes, especially if we dislike them. There is one, in particular, that was enough to prove the company has a systemic view of its business.

Very few buy-side and sell-side analysts noticed that. Still, when MercadoLibre was rolling out the wallet, all the resources from goods sales were redirected to the sellers’ wallets, affecting its financial result.

At first moment, we thought that was stupid. Forget about Meli for a second. Every eCommerce that operates a marketplace operation receives the cash and then transfers it to the seller.

While the transfer is liquidated, the cash is usually not booked in the balance sheet. Instead, it’s placed in a “Restricted Cash” bank account. Obviously, that cash isn’t Meli’s, so they don’t use it, though they profit from its interest.

Curiosity note: some companies book the restricted cash as a regular cash position, even though it's not. Obviously, this is a very aggressive and undesired accountancy practice.

So, instead of holding the cash in a bank account and profiting on interest, Meli transferred it to the seller’s wallet(!).

It took us a time to realize, but Meli did that simply because it was the best decision for the business going 10 years forward. Having the money in your wallet will increase the engagement, average ticket, and average sales per month.

According to our channel checks, the wallet itself is not profitable, but it does generate a positive (quantitative) output for the overall system.

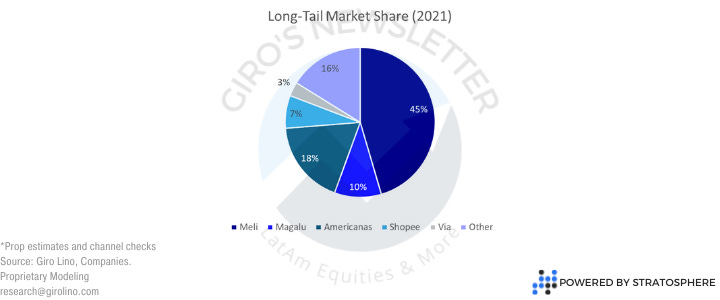

Meanwhile, we see Meli and Shopee as top Brazil eCommerce share gainers. For Shopee Brazil, launching its operations in the 2Q19, we estimate a 6% Brazil market share in 2021 and 15% in 2026E.

Our base case forecasts imply Shopee gains continued traction within the lower-ticket categories and younger / lower-income demographics where the company currently over-indexes, while logistics and fintech development remain barriers to a pivot to higher-ticket categories.

For the remaining top players, Magalu, Americanas, and Via, we forecast they’ll lose share in the aggregate between 2021 and 2026, especially Via.

While we believe current sellers overlap with Shopee remains low, these platforms are, on average, more exposed to the electronics category, where we see a more mature vertical and, therefore, lower eCommerce growth potential.

In one way, about the quarterly performance, we believe that Shopee hit the roof. We know this is controversial, but we only ask you to consider our standpoint.

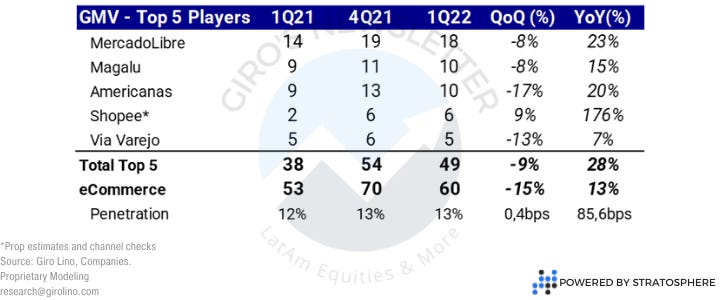

We estimate that Shopee grew 176% YoY, while Meli grew 23% for the same period. With that, Shopee became a more significant player than Via Varejo, which is actually shrinking after a disastrous operational performance.

Also, as we showed previously, we do not believe that Shopee is actually stealing shares. Except for Meli, most players focus on durable goods, a category the Shopee has shown little interest in.

Sea Hit the Roof in Brazil

We do not believe that Shopee “hit the roof” because they are not selling fridges. Scale matters here, and looking at the same information from a different perspective is crucial for not overestimating growth.

Growing 176% YoY from a R$2bn GMV is much easier than doing it when you already have an R$18bn GMV. So the way we look at it is focusing on the GMV increase, not its variation.

So, considering only the top players, in the 1Q22, Shopee’s growth represented 37% of the total GMV generated by them, which is, obviously, a lot.

Looking in the past 10 years, there were just a few specific moments when a player yielded a contribution over 40%, in a very different context, though.

The competition was immature, and the eCommerce penetration was below 5%, so any marginal increase in specific categories could generate tremendous growth in the GMV.

Does it mean that Shopee is doomed? Absolutely not. We’re just saying the company will not grow 200% in a year, 190% in the next one, and then 170%, and so on. Thit only happens in spreadsheets. Reality is different, though.

So, we believe Shopee will grow at a R$12bn GMV per year in Brazil, which is roughly US$2.5bn. However, we think that Shopee could start expanding to different locations, affecting its growth in Brazil.

In our opinion, there is a limited resource for funding a high-growth operation in Brazil and Mexico concomitantly. However, the market has been sending clear signs that high-growth companies with high cash burn funding are done.

We believe this is the reason Shopee anticipated most of its monetization plan, especially in Brazil, even though a US$2.5bn GMV is a lot.

Growth at what cost?

We believe that when a player capitalizes and enters a new market, we have to understand its motivations and capabilities.

By motivation, we mean funding. According to everything we have read in the earnings transcript and in our channel checks, Sea will burn cash to grow in Brazil. Therefore, it is a strategic investment for the company.

How much? According to our estimates, between US$2.5bn and US3.5bn. By the end of 2022, we estimate a US$2bn cash burn in Brazil.

Now, how capable is Sea’s management? At least, to increase GMV, highly competent. But, in addition, do not take for granted that burning cash is a guarantee of growth.

For instance, as we mentioned about Via, the company raised the exact amount we estimate Shopee burned last year, although their GMV shrank in the period.

At the same time, Shopee acquired US$2.7bn in GMV since it started operating in the country, proving a superior execution.

Still, there is another question we need to address. Meli has been capturing low-hanging fruits in long-tail categories for over a decade, with little or no competition in a few spots.

Suddenly, an outsider drops into its market and grabs almost 6% of the market share. Clearly, Shopee is exploring a place that even Meli hasn’t. Why?

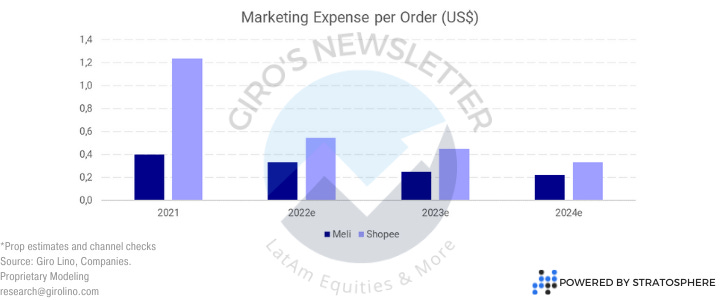

Even though we estimate a similar marketing expense per order for Meli and Shopee, we estimate that Shopee is spending much more money on active clients.

Considering Sea’s balance sheet, we doubt they’ll try to compete for the same spots against Meli in the foreseeable future. Instead, in our opinion, they’ll be focusing on gaining scale, diluting cost, and increasing engagement.

Unlike many analysts expect, Shopee has to be much bigger than Meli to match its cost of acquiring and maintaining clients. That is an arduous task.

Meli is a cash flow machine, generating per year in cash almost what Sea is actually burning in their operations in Brazil.

So, being repetitive, it does not make sense for Shopee to compete against Meli. Otherwise, they’ll get crushed. Instead, the promising future is through acquiring unattended customers and improving engagement.

On May 2nd Sea Limited was granted a license to operate as a payment institution (“IP”) in Brazil by the Brazilian Central Bank (“BCB”).

We believe the strategy for increasing engagement is in it. Sea’ll replicate SeaMoney strategy in Brazil. We pretend to comment about it when there is more information available.

Finally, even though the competitive landscape looks to be getting more challenging, Shopee and MercadoLibre are executing their strategy very well, while local peers have been facing problems related to execution.

We believe that both companies could co-exist in the same market. There is no example of a company that has kept the leadership without sharing the market with different players for a long time.

Usually, two or three players co-exist in the same market, with sustainable superior returns. Today, the existing evidence argues that Meli already has its spot granted.

The company generates a lot of cash, acquires customers cheaper than peers, and its execution is state of the art. The question we have is how Shopee will play the following chapters to consolidate itself as the second winner.