Today’s outline

- Double Down

- Earnings Season

- Bear For Longer

- Financial Condition

- Buy Banks?

- Chinese Logistic Reported 1Q22

This Week Posts

- Pix Handbook - Part III, May 7th, 22 pages

- MELI 1Q22: In a League of Its Own, May 6th, 8 pages

- Cielo & 3R 1Q22 Earnings Digest, May 5th, 9 pages

- XP 1Q22 Earnings Digest, May 4th, 6 pages

- What Really Happened to AMZN?🌟May 3rd, 13 pages

- Finding Alpha ($), May 2nd, 4 pages

- Food for Thought #15, May 1st, 13 pages

- MercadoLibre ($MELI) (Last Deep Dive, Pinned), 29 pages

→ 104 Pages, 89% Without a Paywall, 8h Expert Channel-Check Calls in May.

→ 902 Pages In 2022, 800+ Hours Researching, 78 Issues Published.

Double Down

The week's most significant event was the FOMC decision to increase the Fed Funds Rate (“FFR”) by 50bps. Also, Powell said that 50bp increases in the FFR should be on the table at the next couple of meetings.

The market already expected a second 50bp hike in June. Market prices suggest they revisit their Fed forecast to include a third 50bp hike at the July meeting (vs. 25bp previously).

In response to a question, Powell said that a “75bp increase is not something the committee is actively considering,” which was taken as a dovish statement.

Also, the curve indicates that the odds for a fourth 50bp rate hike are possible in September, but we believe odds should stay at 25bps until there are additional data.

While some Fed officials might see the FOMC’s 2.25-2.5% neutral rate estimate as a possible point to transition from 50bp to 25bp hikes, implying a fourth 50bp hike in September.

The market is maintaining its 3-3.25% forecast but anticipating the FOMC will reach that rate by 2Q23 (vs. 3Q23 previously).

In our opinion, Powell doubled down at the call that inflation has peaked, even though the evidence suggests otherwise.

The stake placed at risk is high. On one side, if he’s right and inflation peaked, that's fine. On the other side, if Mr. Chairman is wrong, they’ll be so behind the curve they’ll cause a huge demand shock adjusting the FFR.

We believe that he’s wrong and that market conditions should tighten even more. We’ll go back to this topic in a minute.

Earnings Season

Investor concerns about Fed tightening, surging interest rates, and the risk of recession have outweighed the 1Q earnings reports. So far, almost 90% of the S&P 500 reported earnings.

As always, results exceed the sell-side expectations leading to the so-called “upward revision” for the remainder of the year and possibly for the following.

However, analysts don’t tell you that the aggregate earnings surprise was 5.1%, though it was reported that 77.7% of the companies presented a positive earnings surprise.

Furthermore, the market expected a mild 2.5% earnings growth (YoY), which should be translated into a contraction in real terms.

The actual aggregate earnings growth (YoY) is 7.6% and considering an 8% inflation, the S&P earnings are contracting (YoY). A few sectors, such as Financials and Discretionary, slumped.

Bear For Longer

Indeed, results have exceeded expectations and prompted modest upward revisions to estimates for the remainder of 2022 and 2023, mainly driven by the Energy sector.

However, boosting revisions should not be enough to offset managers’ fears. It’s worth noting that our base case modeling for the S&P 500 doesn’t consider an overshooting scenario.

We maintain our base case 4,200 target for the S&P 500, introducing a new bear scenario, where Powell’s bet fails, and Financial Condition Index (keep reading) overshoots in 100bps, with a 3,300/3,600 target.

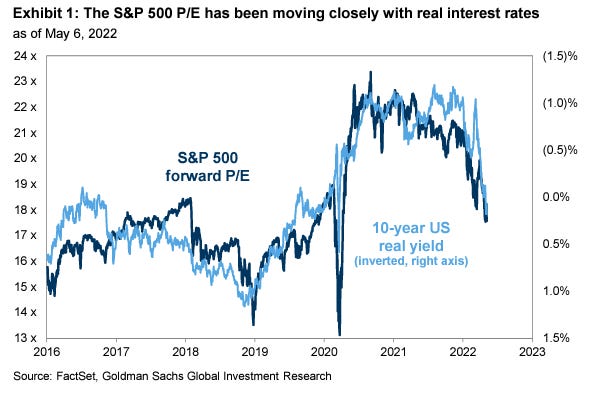

Currently, a combination of higher real rates, slower growth, and a tightening policy outlook led to a valuation compression that has driven the 13% YTD S&P 500 decline.

The consensus forward P/E multiple has declined by 16% from 21x at the start of 2022 to 17x today, tracking the rise in real interest rates closely. The real 10Y Treasury yield has surged from -1.0% to +0.25% during just the last two months.

And here is why Powell's double-down on lower inflation is too risky. If he’s wrong, we shall see an overshooting in real rates and possibly a compression in the S&P multiples to 14-16x.

Financial Condition

In this volatile macroeconomic environment, you can expect: slowing growth and tightening financial conditions. In our base-case scenario, GDP and earnings continue to grow, albeit slower than in 2021. In real terms, we expect null expansion for EPS.

The consensus expects annual average US real GDP growth to slow from 6% in 2021 to 3.1% in 2022 and 2.1% in 2023.

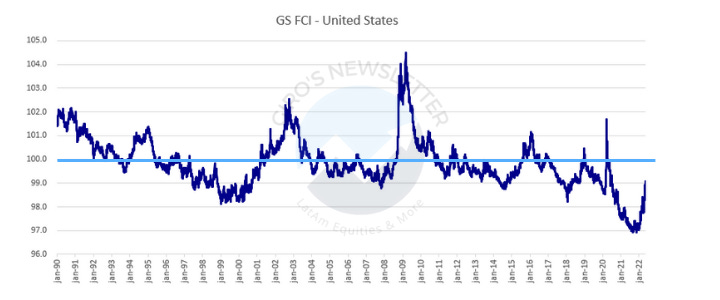

One contributor to this expected economic deceleration is the ongoing tightening in financial conditions engineered by the Fed to fight inflation.

Even though the US Financial Conditions Index (“FCI”) has tightened 203bps YTD, we should expect another 100bps contraction.

Again, if Powell is wrong on doubling down, we could face another 200bps contraction assuming an overshoot. Since the base case is priced, the risk is skewed.

Buy Banks?

We’ve been avoiding writing about oil in the past weeks. This is because we exhausted most topics related to it and looked for different industries.

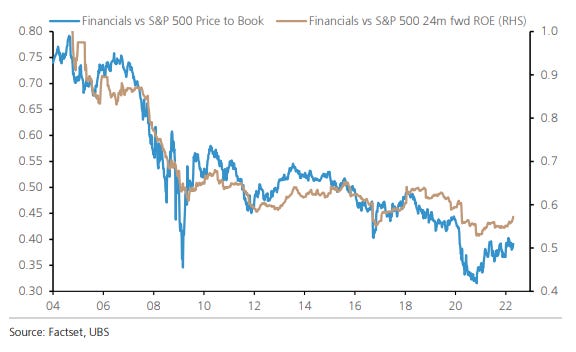

We’ve been hearing a lot of bull pitches inside the Financial industry. The bull case is that bank performance has diverged from real yields and is now tracking the yield curve, leaving room for catch-up even if bonds recover.

Also, banks reported NIM sensitivity to Fed funds is double vs. the prior cycle. Relative Financials P/B is 20% below avg, with ROEs pointing to a 15% re-rating.

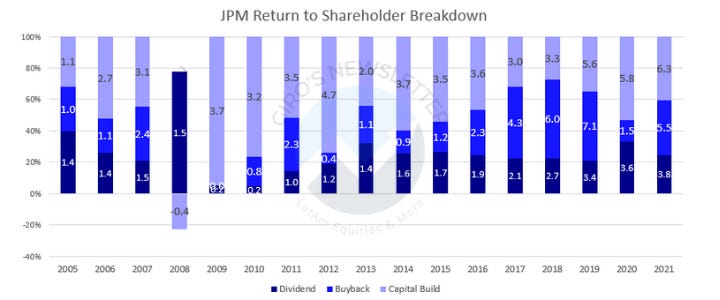

However, we respectfully disagree. If you go back, after the GFC, banks had to figure out a different way of generating value for shareholders.

They found out the best way was to boost buybacks and dividends, decreasing the capital build (difference between equity, YoY), and we agree with them.

Most are operating in consolidated industries, and clearly, increasing leverage wasn’t an intelligent way to figure this out.

The problem is that since the capital allocation structure change, so does profitability and valuation multiples. Therefore, we don’t believe it makes sense to use historical discount charts to explain banks are cheap.

Let’s think about JP Morgan. From 2010 to 2016, the bank had a clockwork 10% ROE and invested most cash generated back into the operation.

By the end of 2016, the company decided to improve its capital allocation by boosting buybacks.

Thinking in financial engineering, why is that so smart?

Because if your stock is trading cheap to the relative value your operations generate, your ROE will go up, and, eventually, your stock will re-rate.

However, that doesn’t mean that banks are non-brainer buy decisions. This financial hack to improve profitability doesn’t change the fact that the industry is consolidated.

Therefore, the incremental return we should expect from total invested capital is not much different from its capital cost.

Even though we agree that banks should perform relatively well, we’d rather keep looking for companies, or industries, facing multiple opportunities to deploy their capital other than just buy back stocks.

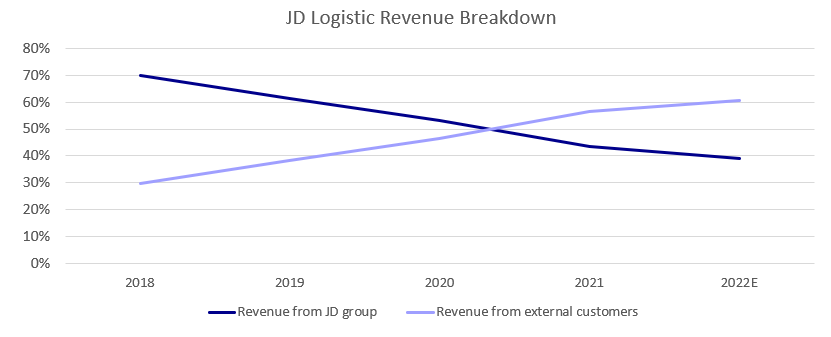

Chinese Logistic Reported 1Q22

It’s curious how the increasing relevance of networking in supply chains alters the perception of corporate risk and its measurement and management.

On one side, the supply chains expand the business opportunities that companies face in reaching a specific location, improving competition density, globalization, operational risk, dealing with externalities, etc.

However, supply chains have also contributed to an increase in risks. As a result, managers have an essential role in appraising corporate managers about identifying the incremental bottlenecks, how to measure the financial burden, and finding a balance considering upsides and downsides.

Between April 26-30, YTO Express, JD Logistics, ZTO, and Yunda express delivery A-shares reported 2021 annual and 1Q22.

The results and management commentaries have trended largely in line with our previous comments, where volume growth moderated due to covid, pricing stabilized, and top players gained further share with sequentially better unit profitability.

However, we flag that margin visibility is increasingly blurred. For example, even though outsourced logistics has ~44% in China and fully integrated players, such as JDL, see their clients growing +50% YoY, headwinds are outpacing operational leverage.

The industry landscape has been changing quite significantly. Amid the industry slowdown, the express delivery market is becoming more dependent on the supply side.

We believe the future competitive landscape depends more on companies’ ability to differentiate their products in the medium to long term as the effects of economies of scale are waning.

For MercadoLibre, this is such extraordinary news. There is no logistic operator in the country that nearly matches the value proposition Meli is offering to clients.

We’re still figuring out the outsourced line-haul/trucking costs, especially the FTL (Full-Truck-Load) dilution, for Meli, but the marketplace PnL inspires confidence.