Today’s post is presented by Stratosphere:

Stratosphere makes it easy to get the financial data you want and to develop beautiful out-of-the-box graphs for your research process. No more complex user interfaces, no more limited historical data. You will get access to:

- 10 years of historical financial data & customizable views

- Stock idea generation & snapshots

- Company-specific metrics

- Beautiful data visualizations

Today’s outline

- CPI Looks Ugly

- Downside Risk Increased

- The Shape of a Recession

- Volatility Spikes

- New Regime, New Allocation?

- Banks for Funding…

- …Leverage on Oil

This Week Posts

- Stone - New Model, June 11th, 25 pages🌟

- The Narrative's Power, June 9th, 14 pages

- The Inflation-era Trade ($XXX), Jun 6th, 5 pages

Food for Thought #20, Jun 5th, 16 pages

Premium Posts in June 🌟

(Long-form only)

- Stone - New Model (Pinned), 25 pages

Milestone Watcher

→ 259 Pages, 30 issues, 86% Without a Paywall, 13h Channel-Check Calls in May.🔒

→ 90 Pages, 7 issues, 72% Without a Paywall, 4h Channel-Check Calls in June.

→ 1,197 Pages In 2022, 1,860+ Hours Researching, 107 Issues Published.

CPI Looks Ugly

May core CPI rose by 0.6% MoM, well above consensus and at the fastest pace since last June. We were a bit surprised by market action, though.

Even though the inflation swaps market was implying closer to an 8.5% YoY reading versus consensus at 8.3% YoY, the market still reacted significantly, with the curve flattening as front-end yields pushed to new cycle highs.

Obviously, due in part to the rebuilding of risk around larger than 50bps moves over the next meeting, but mainly to financial condition tightening, as inflation persists.

While a spike in airfares again contributed a tenth to the core, the composition was broadly strong as well, including autos and the fastest monthly pace of rent inflation since 1987.

The market reviewed the near-term path for CPI beyond what the surprise would have suggested, likely reflecting risks that some factors behind the May strength persist.

Looking at the curve, the consensus is anticipating hikes, now expecting the Fed to hike the fund rate by 50 bps in September (vs. +25bps previously), in addition to +50bps moves in June and July.

The terminal rate expected by consensus still is 3%-3.25%, pulling forward to 1Q23. That could raise the risk of downside surprises if inflation doesn't ease in the subsequent months.

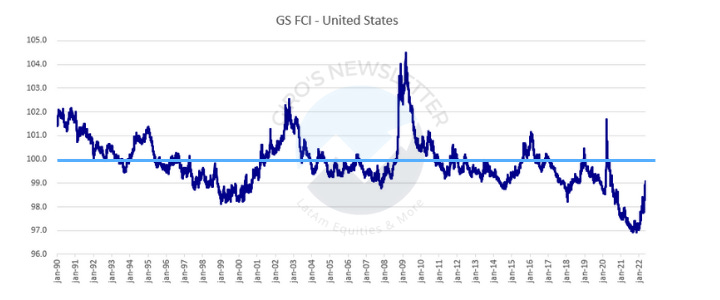

Meanwhile, the S&P 500 NTM P/E has fallen from 21x at the start of this year to 17x today alongside a significant tightening in financial condition.

Even though the US Financial Conditions Index (“FCI”) has tightened 203bps YTD, we should expect another 100bps contraction.

Again, if Powell is wrong on doubling down, we could face another 200bps contraction assuming an overshoot. Since the base case is priced, the risk is skewed.

To slow inflation, we believe the Fed is focused on managing financial conditions, meaning a significant market rally – which would ease the FCI – would likely be met with incremental hawkishness.

Powell doubled down in a bet based on recent economic data that suggested the outlook for equity valuations were improving. Instead, the economy appeared to be progressing toward a “soft landing.”

Unfortunately, this was a 0.5:1 bet. If not worse.

Downside Risk Increased

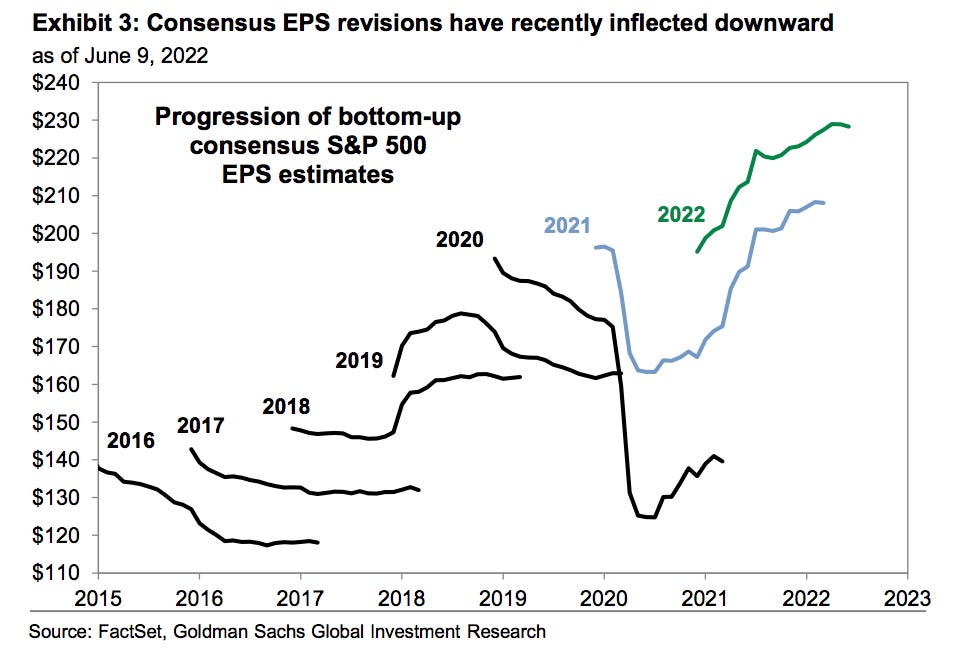

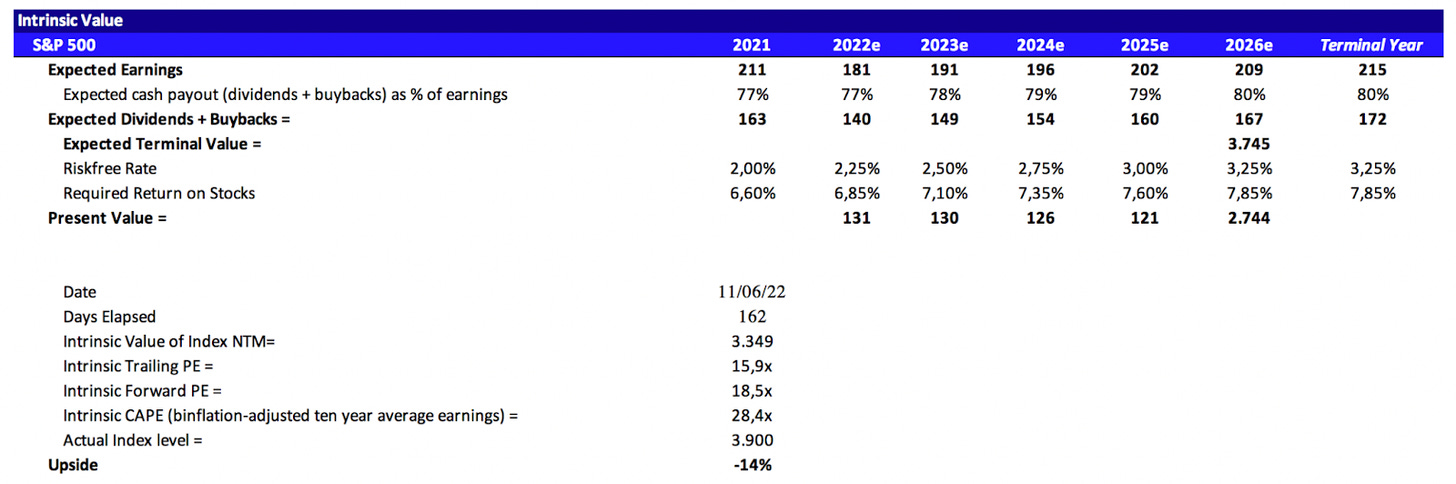

S&P 500 trades 19% below its all-time high, but equity valuations remain far from depressed. In our base case forecast, valuation remains roughly flat while earnings growth lifts the index to 4200 for the next twelve months.

Some analysts have recently trimmed EPS estimates, but the consensus profit outlook remains above our forecast. Prices move faster than analyst estimates.

If by year-end consensus, 2023 EPS estimates are moving towards our forecast of $234 and the P/E multiple remains constant at ~18x, the implied index level would be 4200.

In a recession, nevertheless, if the EPS estimate moves halfway to $191, a 16x P/E would bring the S&P 500 to 3350, in line with our previous bear case scenario based on rates sensitivity.

Valuations dominated investor focus in early 2022, but the recent discussions turned toward EPS performance, which we believe investors will give greater importance in the following quarters.

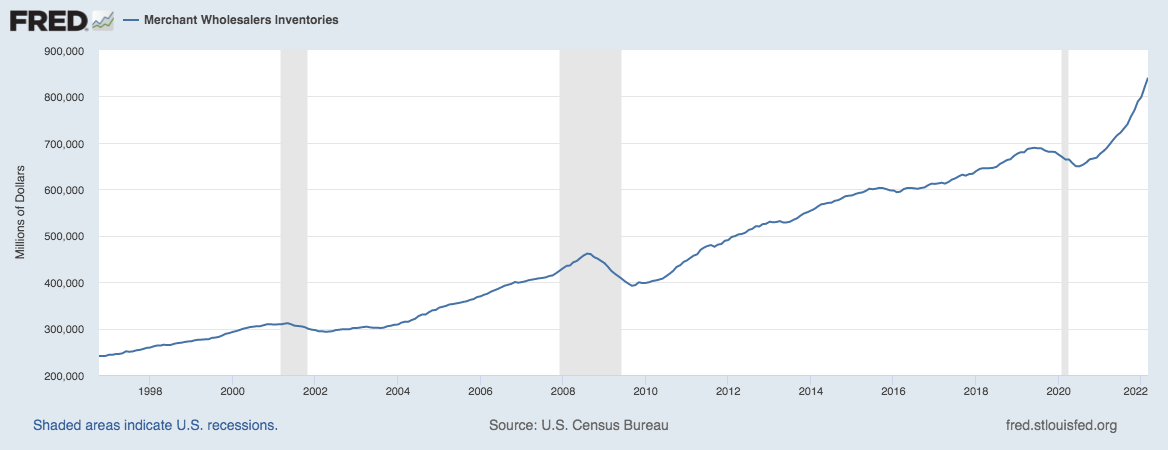

Company announcements have added to these concerns. Just weeks after shares fell by 25% on disappointing 1Q margins, Target cut margin guidance this week as it struggles to manage excess inventory — we'll come back to this.

Investors have also focused on a string of negative comments from tech companies. For example, recently, firms including Amazon, Microsoft, and Nvidia have signaled intentions to slow hiring.

Even though the overall message is disappointing, this development is positive in balancing the labor market, reflecting management anxiety about growth and inflation.

The Shape of a Recession

As savings are being depleted by spending and higher inflation, the first impact that is possible to observe is a deceleration in real consumer spending.

For companies, this is translated into inventories built, manufacturing production downshifts, fewer goods need to be transported, and transport company productivity declines.

As the density of transportation declines, it starts to be tougher to offset inflationary pressures, and price and yield increases become tougher to come by. In turn, profit margins eventually decline.

On average, it takes about 2-3 quarters for transportation companies to bottom, operationally, even though we recognize data is limited.

Since we have not yet experienced an extended industry-wide period of down volumes, coupled with erosion in operating margin, it's hard to predict the bottom.

Volatility Spikes

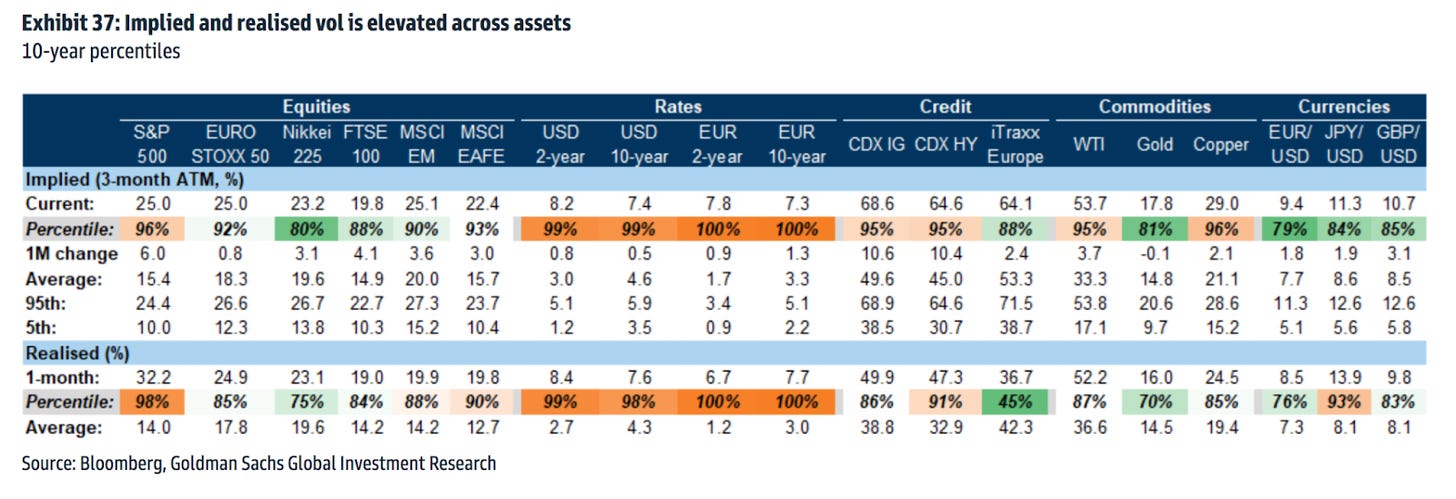

Implied vol remains elevated across assets, particularly for rates close to 10-year highs. After partially re-setting in March, equity and credit vol have spiked again.

The market narrative has shifted to stagflation with rising and sticky inflation and negative growth momentum, as well as lingering concerns about the Russia/Ukraine war and China lockdowns.

Accelerated monetary policy tightening and sharp increases in bond yields have weighed on risk appetite and fuelled investor concerns on US recession risk.

New Regime, New Allocation?

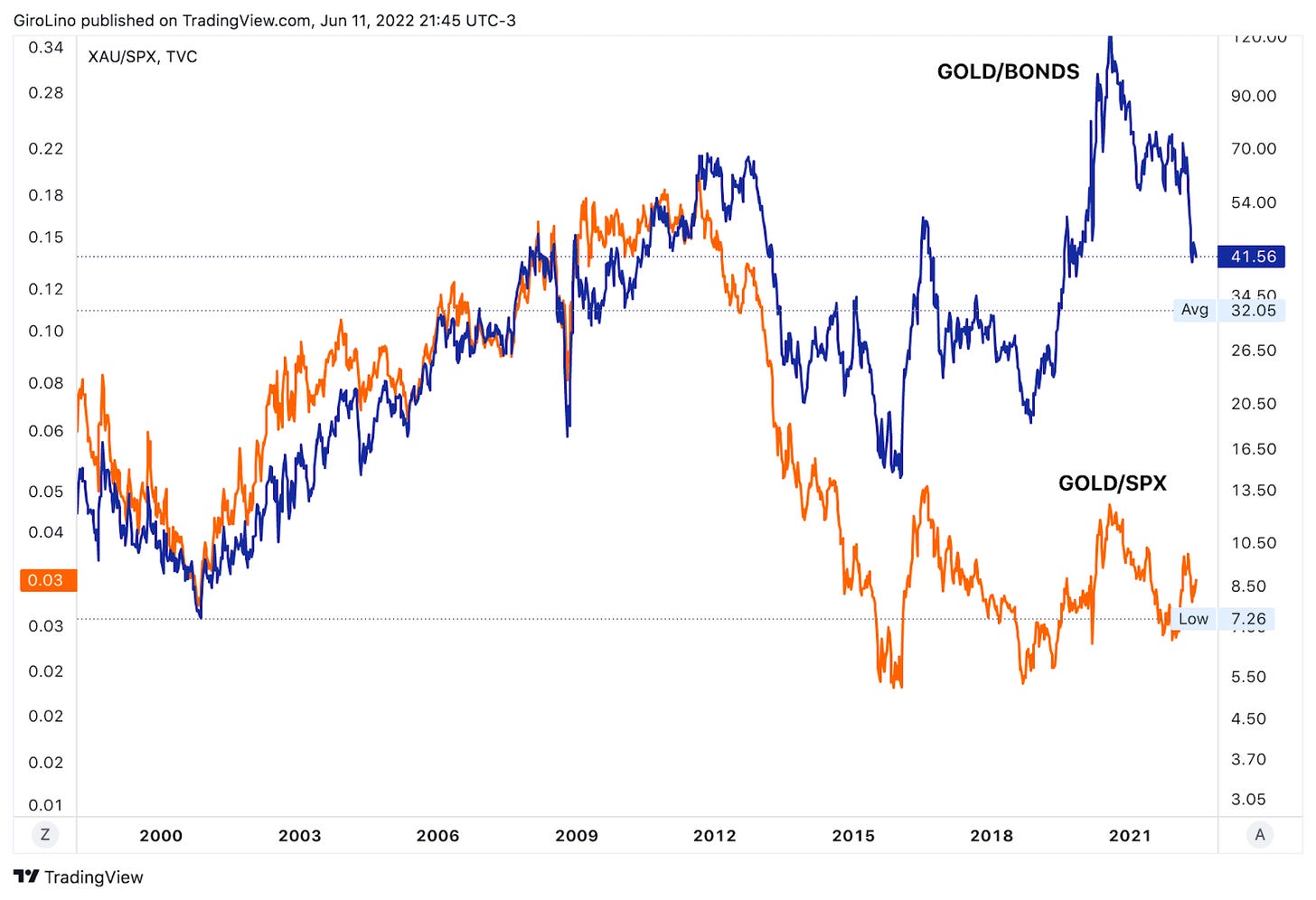

The gold-to-bonds ratio recently traded at an all-time high—above the critical 1980 and 2011 tops—and has historically often led the gold-to-stocks ratio higher.

The significant underperformance in many previous market leaders in tech, “growth” sectors, and the mega-cap platforms versus the “value” and commodity-related sectors is highly noteworthy.

This action suggests that global capital flows and investor asset preference appear to be urgently repositioning for sustained inflation—and possibly entrenched stagflation.

We believe that commodities such as ferrous metals, oil, gas, and gold would benefit from a reallocation to different asset classes.

Banks for Funding…

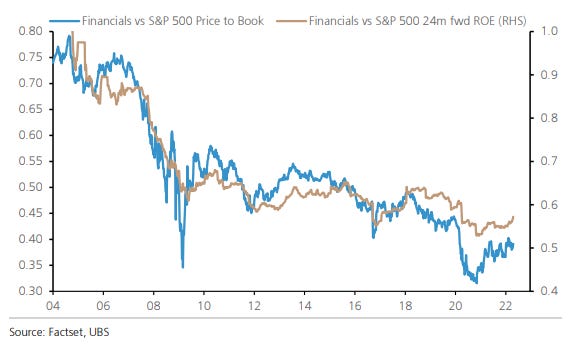

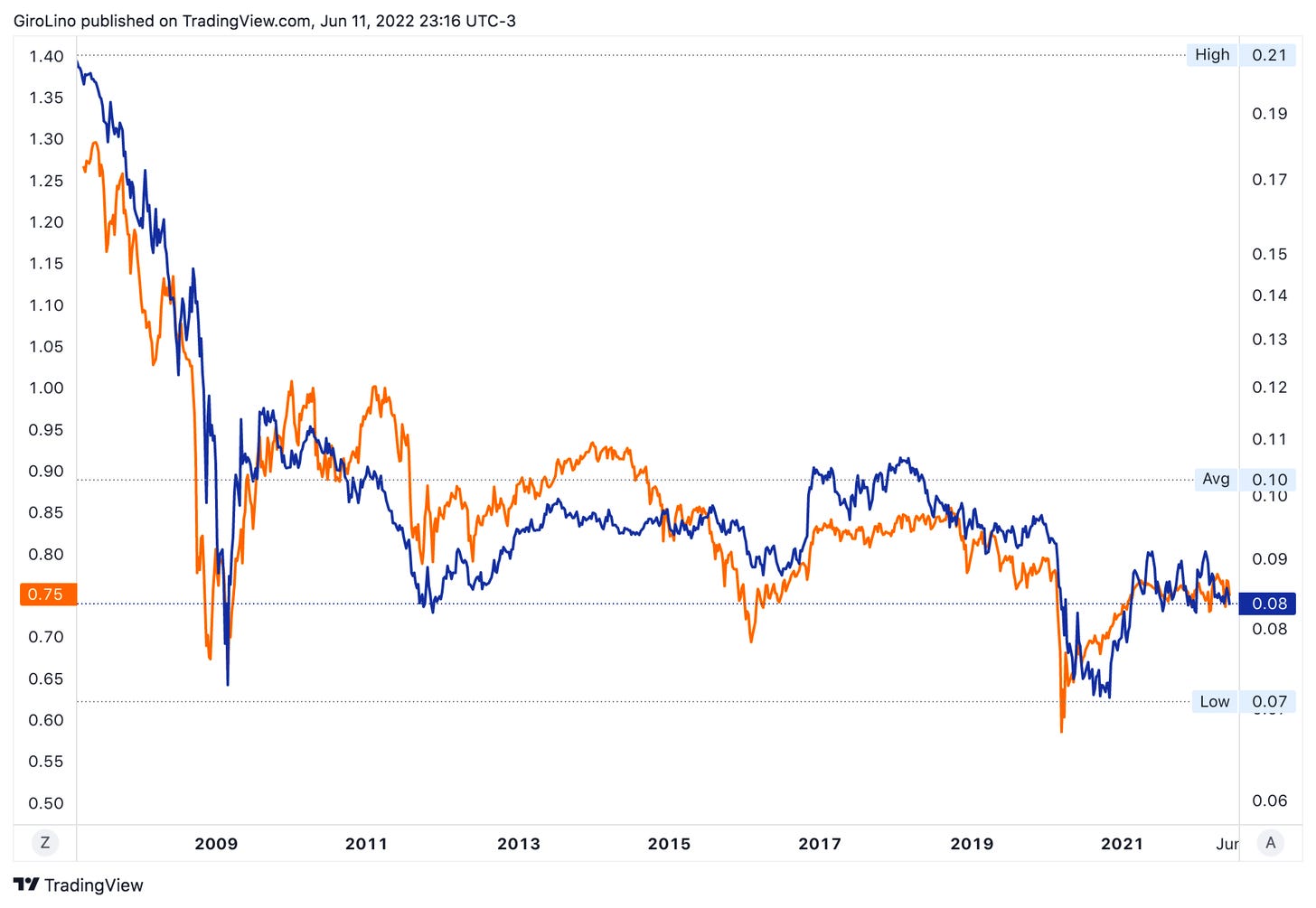

The bull case for banks is that their diverged from real yields and are now tracking the yield curve, leaving room for catch-up even if bonds recover.

Also, banks reported NIM sensitivity to Fed funds is double vs. the prior cycle. Relative Financials P/B is 20% below avg, with ROEs pointing to a 15% re-rating.

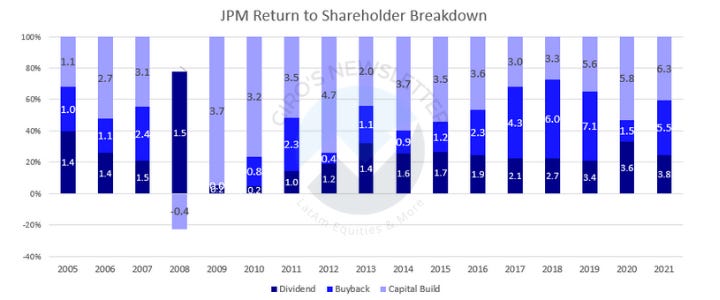

However, we respectfully disagree. If you go back, after the GFC, banks had to figure out a different way of generating value for shareholders.

They found out the best way was to boost buybacks and dividends, decreasing the capital build (difference between equity, YoY), and we agree with them.

Most are operating in consolidated industries, and clearly, increasing leverage wasn’t an intelligent way to figure this out.

The problem is that since the capital allocation structure change, so does profitability and valuation multiples. Therefore, we don’t believe using historical charts to label banks as cheap stocks make sense.

Let’s think about JP Morgan. From 2010 to 2016, the bank had a clockwork 10% ROE and invested most cash generated back into the operation.

By 2016, the company decided to improve its capital allocation by boosting buybacks. Thinking in financial engineering, why is that so smart?

Because if your stock is trading cheap to the relative value your operations generate, your ROE will go up, and, eventually, your stock will re-rate.

However, that doesn’t mean that banks are non-brainer buy decisions. This financial hack to improve profitability doesn’t change the fact that the industry is consolidated.

Therefore, the incremental return we should expect from total invested capital is not much different from its cost of capital.

Even though we agree that banks should perform relatively well, we’d rather keep looking for companies, or industries, facing multiple opportunities to deploy their capital other than just buy back stocks.

Finally, we understand that investors label banks as “Value” stocks, and, therefore, they should outperform the overall market.

However, we shall consider that inflation is harmless to banks only where there is growth. In a stagflation scenario, where asset quality deteriorates, banks will bleed.

…Leverage on Oil

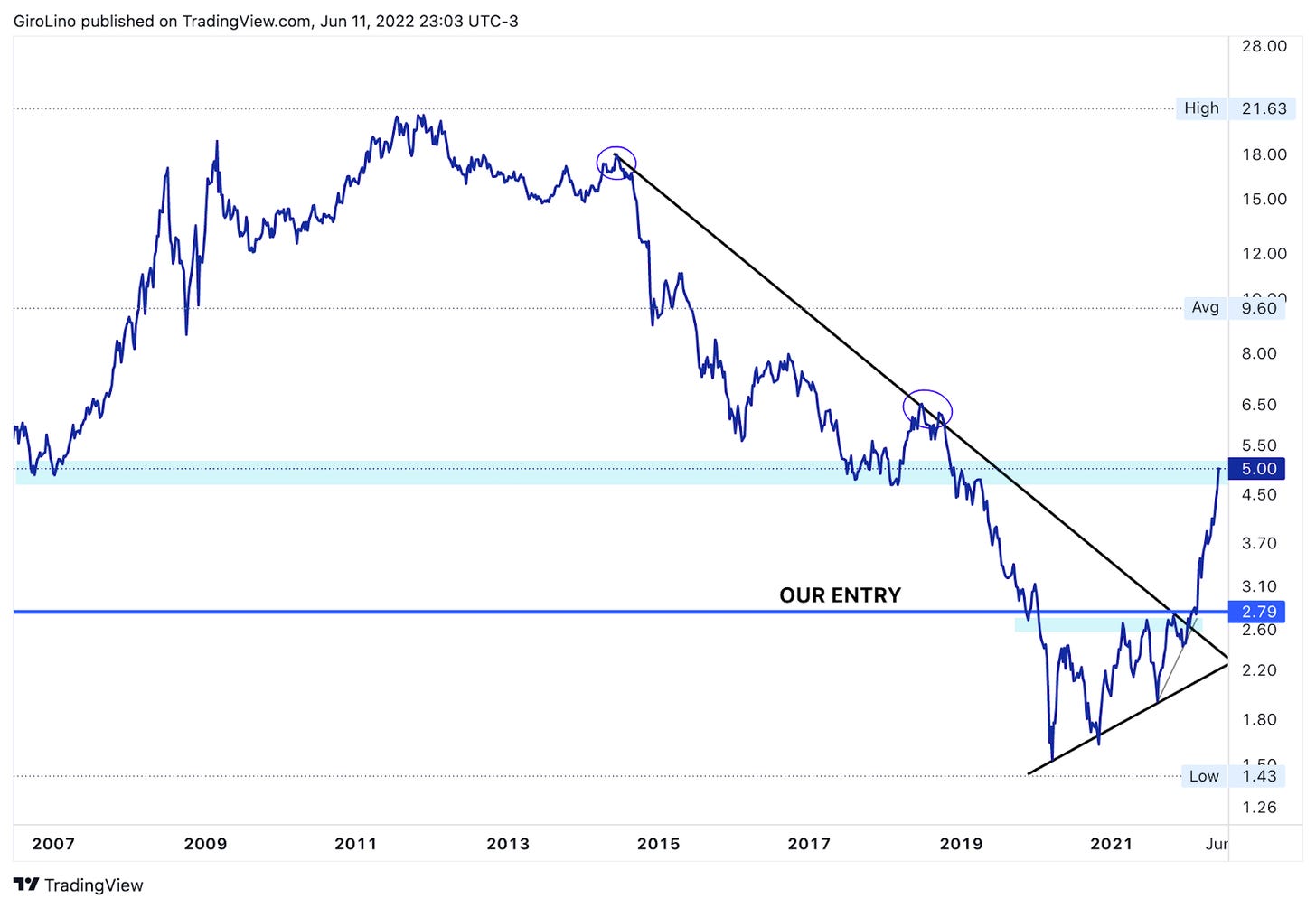

Since March, when we posted that we were long oil (XOP) and short financials (XLF), our trade has gone up almost 100%. Yet, we see a significant upside ahead.

Don't be biased, thinking, “oh, if it went up 100%, there is no upside anymore.” If you buy a 10-bagger and capture 80% of the overall return, it still is an outstanding financial performance.

Please, read our last update on oil.

When we entered the trade, we had no war and the sequence of the event. Also, we believe regulators are being extraordinarily stupid in releasing SPR to “surpass” demand as:

- Potential logistical bottlenecks to such an unprecedentedly large and long US SPR discharge could reduce its flow rate, with possible congestion on the Gulf Coast in getting to refiners or export terminals.

- The risks of slower shale growth are rising cost inflation and binding service bottlenecks. In addition, the US policy use of an SPR release, a potential deal with Iran, extreme price volatility, and the growing risk of a recession next year reduce producers’ incentive to expand.

- In fact, lower prices in 2022 support oil demand while slowing the acceleration in shale production, leaving, for now, a deficit in 2023 with an eventual need to refill the SPR. 🤡🤡🤡