On Friday, Beijing held a symposium on the heels of the Politburo meeting, sending a clear message the clampdown is over since everybody keeps following the rules.

The country’s major Big Tech players, including Alibaba, Tencent, Meituan, and TikTok owner ByteDance, were present.

A joint regulatory meeting is also set to take place this weekend to put all regulators on the same page regarding Beijing’s new decision to ease aggressive actions.

In the last 18 months, regulatory hostility has been one of China's tech stocks' most significant investment risks, wiping out trillions of dollars in market value across New York and Hong Kong while deterring venture funding for Chinese tech start-ups.

Last Friday, the Politburo statement was issued in the early afternoon, breaking Beijing’s tradition of releasing reports outside market hours.

As a result, Alibaba rose 15.7%, Tencent gained 11.1%, while Meituan advanced 15.5% during the trading session.

Since January, we’ve been calling investors’ attention to the regulatory developments in China. Particularly last week, we wrote extensively about it.

Politburo Highlights

➡️ Economic Growth

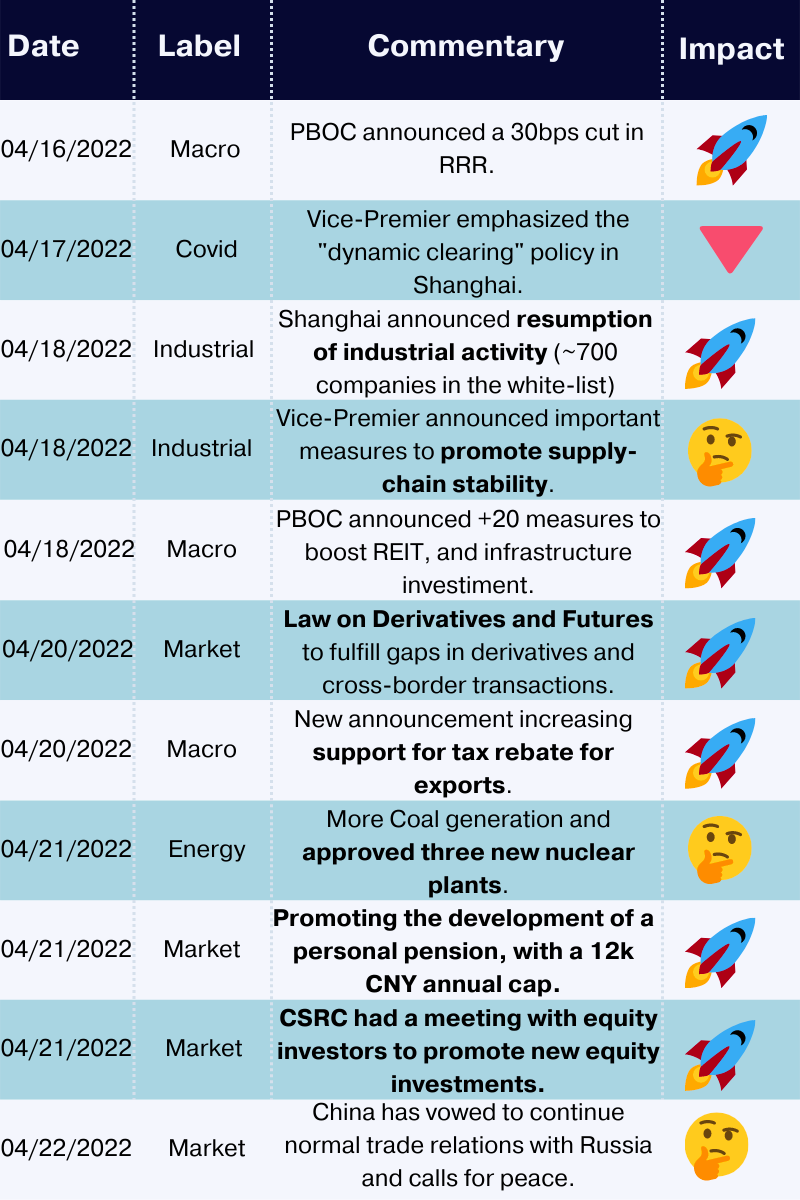

Policymakers highlighted "increased uncertainties due to Covid outbreak and Russia-Ukraine conflict." However, they reiterated they would "step up policy support, work hard to achieve economic growth and maintain growth within a reasonable range."

They also highlighted the need to "accelerate the implementation of supportive measures already announced, prepare additional easing measures, and properly handle policy intensity and relative magnitude under the guidance of economic targets."

You could read it like: “Dude, QE is coming.”

➡️ Investment and consumption

They noted expanding domestic demand and pushing for "comprehensive acceleration of infrastructure investment."

Policymakers would roll out a relief program for SMEs and industries hit by Covid and facilitate consumption growth. In addition, the statement mentioned "stabilize and expand employment" and "ensure normal operation of supply chains for key industries."

➡️ Platform companies

As mentioned before, the Politburo meetings sent positive signals by stating to complete targeted inspections of these companies and even to roll out measures to support the healthy development of these companies, as long as they play accordingly. Policymakers understand that platforms support the common good by boosting local economies.

➡️ Property market

The broad statement follows recent communications. "Housing is for living not for speculation" was reiterated.

➡️Zero Covid policy

No signs of policy fine-tuning on this front. Like President Xi emphasized in late March, policymakers continued to emphasize "people first, lives first," stick with "dynamic zero-Covid" while minimizing the economic costs of anti-pandemic measures.

Reiterating the View

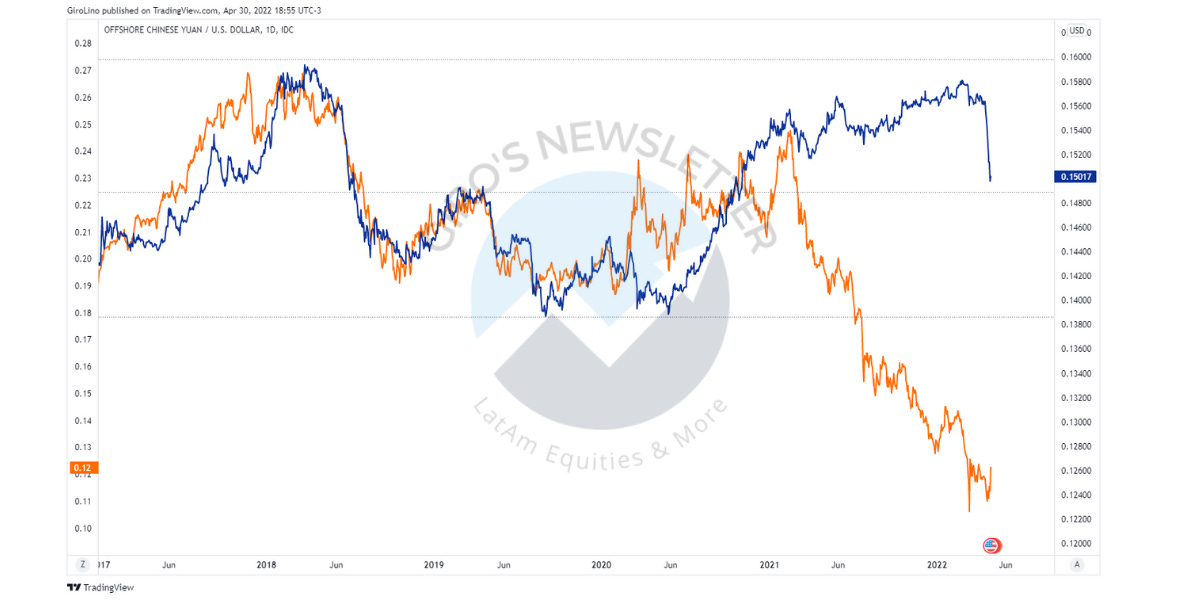

For as long as it takes, we’ll reiterate the Chinese stocks hit bottom on March 16th, when the policymaker hit its circuit breaker.

On March 16th, Vice Premier Liu He chaired the Financial Stability and Development Committee meeting. He responded to key market concerns on a macro policy stance, property risks, ADR, and platform company regulation.

Over the past several weeks, the policymaker understood the rapidly worsening Covid-19 situation and weak credit indicators.

They don’t only need firm policy easing measures but also support from platforms that are supplying the lockdown population and supporting local communities. So a month later, they started a series of supportive measures.

Thank you for reading Giro's Newsletter. This post is public so feel free to share it. Also, consider becoming a free or paid supporter.💙💙💙