EBIT Margin Growth, Mercado Pago's Impact, and Credit Portfolio Strategy

Welcome to our latest analysis of MELI's impressive performance throughout 2022. In this post, we'll delve into the key drivers behind their success, explore the challenges they've faced, and discuss their strategic approach in managing their credit portfolio. Stay with us as we unravel the intricacies of this e-commerce giant's journey, and don't forget to subscribe to our blog for future insights and updates. Let's dive in!

Summary

- On Apr 30th and June 25th, we presented our first estimates for MELI's marketplace and Mercado Pago businesses, respectively. Our predictions were mostly accurate, with the company delivering a strong 2022, achieving an EBIT margin of 9.8% ahead of schedule. MELI's top line met expectations, while operational margins exceeded them.

- Management expressed optimism about future GMV growth and market share gains, possibly due to Americana's bankruptcy. Plans to increase the proportion of 1P in 2023 were confirmed as MELI has refined its capabilities and profitability. In 2022, the take rate for Commerce's 3P operation rose to 14.5%, driven by higher ad revenues, shipping fees, and seller final value fees. Although the contribution from fulfillment monetization is growing, the company remains focused on expanding fulfillment penetration in Brazil and other markets. The steady growth in ad revenues suggests a significant opportunity to further enhance take-rate and profits.

- In 2022, MELI's profitability significantly exceeded expectations, with EBIT margin expanding by 3.6 percentage points year over year to 9.8%. The main drivers were a 649 basis point expansion in gross margin due to a lower contribution from the 1P business and a reduction in provisions due to halted credit portfolio growth amid deteriorating macro conditions. This resulted in a US$410 million increase in EBIT, reaching US$1 billion. Operational leverage in selling, marketing, and general administrative expenses was observed, in line with management's focus on cost management during uncertain times. The company also benefited from more effective promotional spending during holiday seasons, leading to higher GMV.

- MELI's credit portfolio growth has been limited due to various factors. Despite overall strong performance, macroeconomic conditions, tighter lending standards, regional disparities, and increased competition within the credit market have contributed to stagnation in the credit portfolio's growth. In 4Q22, MELI's over-90-day NPL ratio increased, while early NPLs decreased. The gross loan portfolio grew modestly, with credit cards comprising 22% of the loan book. Provisioning expenses declined, and interest margin after losses improved. To stimulate credit portfolio growth, MELI may need to explore new strategies, markets, or credit products while balancing risk and opportunity.

- Mercado Pago's conservative approach to credit portfolio growth is influenced by its accounting practices under IFRS 9 and the need to manage credit risk. The company has seen a mixed performance in its NPL ratios, with short-term NPLs remaining stable, while long-term NPLs continue to rise. This warrants caution in expanding the credit portfolio amid a challenging lending environment. Mercado Pago's extensive credit data and understanding of economic scenarios allow it to navigate the credit landscape effectively, prioritizing stability. This conservative stance is expected to restrain growth until conditions improve, ensuring a healthy credit portfolio in the long run.

Overall Picture

On Apr 30th, we presented our first estimates for MELI’s marketplace business, followed by Mercado Pago on June 25th. Even though we had only a quarter or two to estimate the full picture of 2022, we did a decent job. Overall, most sell-side and buy-side analysts were expecting null earnings due to MELI’s credit business and still accelerated growth for commerce.

Since our first post, we explicitly said that Mercado Pago was the jewel of the crown. In 2021, the consensus estimate for the company TPV 2022 was barely above US$100 billion, which was absurd. Our take was that, by that time, most of MELI’s analysts were specialists in retail, so they were excessively conservative in estimating its financial business, or there was a lack of knowledge on how they should do so.

MELI delivered a strong 2022, with an EBIT margin that we believe exceeded even more optimistic expectations and brought the full-year 2022 margin to 9.8%, in line with the level we had projected MELI to achieve only by 2Q23. Overall, MELI’s top line was in-line with our expectations, with a strong beat in operational margins, which we’ll go through over the post.

During the call, management expressed optimism regarding future GMV growth and market share gains, likely due to the bankruptcy of Americana, a top-four player. In line with previous discussions, management indicated plans to raise the proportion of 1P in 2023, having fine-tuned capabilities and profitability to a point where the opportunity set becomes more appealing for MELI.

In 2022, the take rate for Commerce's 3P operation grew by 86 basis points year over year to 14.5%, fueled by increased penetration of ad revenues as well as higher shipping and seller final value fees. Management emphasized the growing contribution from fulfillment monetization but also noted that the increase would be gradual since the company still prioritizes higher levels of fulfillment penetration in Brazil and other markets.

We were reassured by the consistent, incremental growth in the contribution from ad revenues (1.4% vs. 1.3% in 3Q22), even amidst robust GMV growth. We continue to envision a significant opportunity to boost additional take-rate and profits, as key components of the ad tech platform are now in place or being implemented.

Where did we miss?

In 2022, profitability was the main highlight. EBIT margin expanded by an impressive 3.6 percentage points year over year to 9.8%. This marked a considerable beat compared to the consensus (6.6%) estimates. The primary driver was a 649 basis point year-over-year expansion in gross margin (versus our 360 basis points), resulting from a lower contribution from 1P (approximately 3.5% of GMV vs. around 3.9% in 2021), which led to a US$307 million increase in EBIT.

Additionally, the credit portfolio growth miss resulted in a miss in provisions. As macro conditions rapidly deteriorated, management halted credit portfolio growth. Provisions for doubtful accounts were US$1.06 billion (versus our US$1.2 billion), leading to a US$103 million increase in EBIT.

Taking into account both gross margin expansion due to the lower contribution from the 1P business and lower provisions due to reduced credit portfolio growth, our EBIT would increase by US$410 million to US$1 billion, slightly below the reported earnings due to higher revenue growth than expected.

We also continued to see operational leverage for selling and marketing expenses, excluding provisioning and general and administrative expenses, consistent with management's previous statements about managing costs in a context of uncertainty. The company also highlighted more effective promotional spending during the holiday seasons, which supported higher GMV than expected.

Credit Yet to Shine

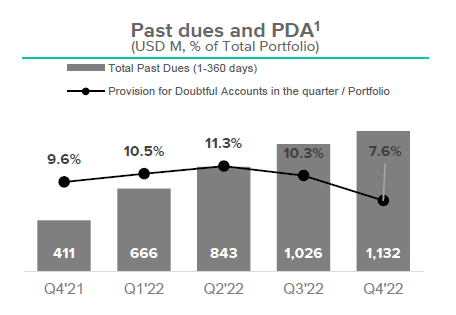

Non-performing loans (NPLs) increased but were in line with our expectations, which were based on the anticipated aging of the portfolio and data from credit receivable funds in Brazil (FIDCs). In 4Q22, MELI's over-90-day ratio rose to 30% (from 24% in 3Q22) due to the ongoing maturation of previous vintages and a slower pace of originations, particularly in the credit card book in Brazil.

Early NPLs decreased by 300 basis points quarter over quarter, registering at 10% in 4Q22. We also observe that the most recent data from the FIDCs (from January 2023) indicates a stabilization of the over-90 NPL ratio at this 30% level and a consistent improvement in the early NPL ratio.

The gross loan portfolio grew a modest 2% quarter over quarter to US$2.8 billion (+68% year over year), in line with our projection and solely due to expected 4Q seasonality, as the company maintained stricter lending standards. Management also mentioned that lower origination in Brazil was compensated by growth in the book in Argentina and Mexico.

Credit cards represented 22% of the loan book in 4Q22, up from 17% a year earlier but relatively unchanged compared to 3Q22 (21%). Nevertheless, profitability was supported by an adjustment of annual percentage rates (APRs) and lower new provisioning levels, driven by reduced exposure to higher-risk segments and overall improved asset quality.

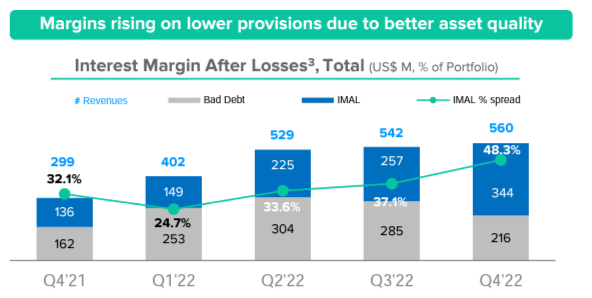

Provisioning expenses (as a percentage of lending revenues) significantly declined both quarter over quarter (by 14 percentage points) and year over year (by 16 percentage points). Interest margin after losses (IMAL) was 48% in 4Q22, up from 37% in 3Q22 and 32% in 4Q21, partially due to a combination of mix effects, repricing, lower provisioning for new cohorts, and better-than-expected collection campaigns. The funding mix reportedly remained stable quarter over quarter.

Despite the overall strong performance of MELI , the lack of growth in the credit portfolio was below our expectations, though we agree with the management strategy. Several factors have contributed to this stagnation, impacting MELI's ability to expand its credit offerings and capitalize on potential opportunities in the market.

Firstly, macroeconomic conditions have played a significant role in limiting the growth of MELI's credit portfolio. As economic uncertainties persist, the company has adopted a more cautious approach to extending credit to minimize potential risks. This conservative strategy has led to a slowdown in the credit portfolio's expansion, as MELI focuses on maintaining the quality of its assets and controlling exposure to high-risk segments.

Secondly, tighter lending standards have been implemented by MELI to ensure that its credit portfolio remains robust in the face of economic challenges. While this approach helps maintain the quality of the loan book and reduces the likelihood of non-performing loans, it also contributes to slower growth in the credit portfolio.

In addition, MELI's credit business has experienced a varying degree of growth across different geographical markets. While there has been a decrease in credit origination in Brazil, this has been offset by growth in other countries such as Argentina and Mexico. However, the mixed performance across regions has led to an overall stagnation in the credit portfolio's growth.

Furthermore, the competition within the credit market has also played a role in the lack of growth in MELI's credit portfolio. With the emergence of new financial technology companies and traditional banks expanding their digital offerings, MELI faces increased competition for market share, making it more challenging to grow its credit portfolio.

In conclusion, the lack of growth in MELI's credit portfolio can be attributed to macroeconomic conditions, tighter lending standards, regional disparities, and increased competition within the credit market. To reinvigorate growth in this area, MELI may need to explore new strategies, markets, or credit products while maintaining a balance between risk and opportunity.

Quality Over Quantity

It is essential to understand Mercado Pago's credit business within a broader context when evaluating its conservative approach toward credit portfolio growth. This is because the company adopts different accounting practices compared to Brazilian banks, which influences its provisioning methods.

Brazilian banks typically operate under accounting practices authorized by the Central Bank and report losses under IAS 39. This standard requires loans to be classified into nine categories based on risk level, and minimum allowances are determined by applying specific percentages to each category. However, Mercado Pago reports under IFRS 9, which uses Expected Credit Losses (ECL) – an entirely different method.

IFRS 9 requires impairment allowances for all exposures from the time a loan is originated, based on the deterioration of credit risk since initial recognition. This standard calls for a forward-looking approach and the use of multiple macroeconomic and workout scenarios to estimate expected credit losses, in contrast to the historical estimate approach of IAS 39.

Mercado Pago's quantitative approach has been developed through gathering and processing data since 2004, giving the company a wealth of credit information at its disposal. This advantage allows Mercado Pago to better understand how default rates behave under different economic scenarios in countries like Argentina and Brazil – an edge that would take years for other players to replicate.

The company's short non-performing loans (NPLs) have been impacted by a product mix change, with credit cards accounting for 22% of the credit portfolio in the last quarter, up from 1% in 2021. This shift underscores the need for a conservative approach in managing credit risk.

Furthermore, Mercado Libre ($MELI) remains cautious about expanding its credit portfolio, primarily due to the ongoing challenges highlighted by the company's recent NPL performance. While the short-term NPL ratio (<90 days) has been relatively stable year-on-year and fell to 10.3%, thanks to improved asset quality and successful risk containment measures implemented in mid-2022, there are still concerns that warrant a conservative approach.

The long-term NPL ratio (>90 days) continues to rise, driven by the accumulation of prior period bad debts until they are written off at 360 days. This trend is compounded by a credit portfolio with a duration of 2-3 months and slower growth in originations compared to the previous year. Although the provision for Q4'22 was equivalent to 7.6% of the portfolio – a lower level than the previous quarter – due to lower overall risk and improved asset quality, the ongoing increase in long-term NPLs signals that challenges persist.

Additionally, the company maintains a more than 100% provision for its > 30-day past due portfolio, reflecting its commitment to managing credit risk and ensuring the stability of its financial operations. This conservative stance allows MELI to focus on strengthening its existing credit portfolio and closely monitoring the performance of its loans.

MELI's reluctance to aggressively expand its credit portfolio stems from the mixed performance of its NPL ratios and the need to manage risk in a challenging lending environment. As economic conditions improve and the company continues to enhance its credit risk assessment and asset quality, MELI may become more comfortable with the prospect of expanding its credit portfolio to capitalize on new growth opportunities.

Honestly, we praise Mercado Pago's conservative approach to its credit portfolio is driven by the accounting practices it follows and the need to manage credit risk in a forward-looking manner. By leveraging its extensive credit data and understanding of economic scenarios, Mercado Pago can effectively navigate the credit landscape and prioritize stability. This conservative stance is expected to subdue growth until conditions improve, ensuring that the company maintains a healthy credit portfolio in the long run.

In short…

MELI delivered a solid performance throughout 2022, with remarkable profitability and EBIT margin expansion. The company's cautious approach to credit portfolio growth, driven by its accounting practices and economic conditions, demonstrates its commitment to maintaining stability and managing risk. As MELI continues to adapt and capitalize on growth opportunities, it will be fascinating to observe the company's evolution in the coming years.

Stay tuned for our next post about MELI , where we'll not only dive deeper into MELI's strategies and explore potential opportunities for expansion and innovation but also share our expectations for the company's performance in 2023. Be sure to subscribe to our updates to stay informed and gain valuable insights into the ever-evolving world of e-commerce and fintech.