Hi.

Before talking about Mercado Libre (“Meli”), let me explain a few things. First, I don’t believe that readers will enjoy reading a post longer than 20 pages — this one has 21. So, I decided the best solution was to split the post.

This week, I approached Meli from a qualitative perspective, telling the reader company’s history, the services, any possible conflict of interest, and many more.

In the next post, I’ll go into financials. Thanks to my idea of splitting the post, I’ll have plenty of space to go deeper into financials, approaching not only the traditional DCF but much more.

For those who are not paid subscribers, I encourage you to enjoy the special offer going monthly and check it for yourself.

The outline

Introduction

When the Going Gets Tough, the Tough Get Going

- Winner Corporate Culture

Business Model

- Marketplace

- Mercado Pago

- Mercado Envio

- Mercado Classified

- Mercado Ads

- Mercado Shops

How does Meli make money?

- Commerce

- Fintech

- Management Compensation

Introduction

As disclosed last week in Food for Thought, I’ve been working on writing my opinion about Mercado Libre. It’s pretty fun writing about a company that I’ve been a customer of for many years.

The evolution of my orders in Mercado Libre is remarkable, from 3 orders in 2013 to 56 in 2021. From those, I had my order canceled by the seller twice, got scammed once, and received my package with delay three times.

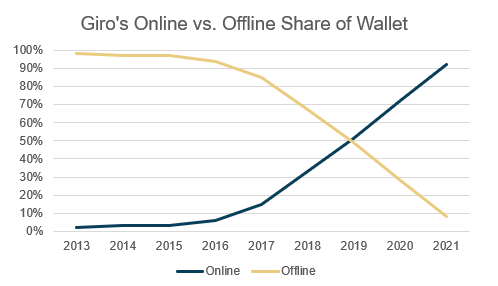

Unfortunately, I changed my bank account over these years and couldn’t recompose my share of my wallet in different marketplaces, direct-to-customer channels, and offline purchases.

However, I can confidently estimate my share of my wallet for online and offline purchases for discretionary and nondiscretionary items (excl. restaurants). Last year, Mercado Libre represented 40% of this value.

A few observations: i) I’m an outlier, and I know that; ii) since 2017, when I started researching internet companies, I forced myself to migrate all my habits to the online world to compare experience; iii) last year, I almost hit 1,000 orders for a single year, so I’m a biased heavy user, so be aware of that.

Every year, there are questions I revisit. For example:

- What has driven a customer to spend almost half of his spending in one marketplace?

- How did MELI increase the assortment increasing service level as well?

- How did MELI scale its operation in an impoverished country (US’s GDP per capita is 10x higher than Brazil’s), generating cash and gaining market share?

These are questions discussed in the post.

Since you’ve been reading my stuff for more than a month, why don’t you redeem a free trial?

When the Going Gets Tough, the Tough Get Going

Mr. Galperin probably is one of the lowest-profile businessmen in LatAm. Many employees at Mercado Livre wouldn’t recognize his face. No glamorous annual showups to employees, nor motivational speaks.

"I see many entrepreneurs who use their company as a platform to be famous.”

He was born in Buenos Aires, from a wealthy family, went to study finance at the University of Pennsylvania. Then, he returned to Argentina and spent three years working at YPF (the largest O&G company in Argentina).

In 1997, interested in technology, he applied to Stanford University in California’s Silicon Valley. After studying eBay, he developed his version for a company that would thrive in LatAm.

"For us, it's exactly the opposite, we want the company to be famous. The lower our personal profile, the better."

Unlike e-commerces which were starting to thrive in developed countries, Mr. Galperin focused on simplifying the lives of LatAm users, adapting the service to their financial condition, infrastructure, internet access, and regulation.

In 1999, John Muse, a Private Equity owner (HM Capital,) made a speech to MBA students at Stanford, and Mr. Galperin volunteered to drive Mr. Muse back to the airport. On the way, he pitched his idea and got his seed money.

In November of 1999, Mercado Libre raised $7,6M in a Venture Round. Mercado Libre received $46,5M in a Series B in the following year, led by HM Capital, GS, GE Equity, Flatiron Partners, Chase Capital (JP Morgan), and Capital Riesgo. But, of course, the luck was there since the last deal was made right before the tech bubble burst.

The early days were challenging, with the company facing additional financing issues, hiring people in LatAm, and the competitive landscape evolving fast.

About the latter, DeRemate.com was offering pressure in Argentina, Lokau in Brazil, and a foreign competitor entrance was imminent (Yahoo! and eBay).

An ivy league educated founded Lokau. Knowing that the market was small for many players, their communication strategy was very aggressive. DeRemate.com was no different, receiving a $45m fund to invest in customer acquisition. By no means Mercado Libre was off the hook.

However, Mercado Libre differentiated from DeRemate.com in its operations. Meli offered an open forum where buyers and sellers could find each other, negotiate and make deals based on trust.

As more deals were made, the seller was considered more reliable inside the forum. What made the model of open space forum thrive was that, different from the offline world, the bigger the marketplace became, the easier it was to identify the best seller to make a deal with.

In 2001, eBay became the biggest shareholder of Mercado Libre, holding a 19,5% stake in the company. The deal also allowed Mercado Libre to incorporate iBazar Como, eBay’s subsidiary in Brazil, access capital, and eBay pledged not to enter LatAm for at least five years. Eventually, in 2016, eBay divested from its stake.

One of the most remarkable contributions from eBay to Meli was the “Feedback tool,” where customers were able to evaluate the seller, leaving comments about the purchase. It had a massive impact on the traction that Meli was growing.

Before, the only evidence the buyer had was the volume of deals. The Feedback enabled buyers to evaluate sellers using different qualitative metrics, such as shipping, quality of the product, contact with the seller, and so on.

Then, in 2004, Meli came up with Mercado Pago, offering a definitive solution for transaction problems in the marketplace.

If customers were skeptical about buying and negotiating the payment process with an online seller, Mercado Pago standardized the payment process internally, so clients would have to trust Meli, not the seller.

For instance, the seller receives the payment only after the buyer receives the order. If there is any problem, the buyer could open a dispute with Meli as the intermediary to get his money back.

In 2007, after a corporate round of $27,8M led by Tiger, Mercado Libre went to market, raising almost $50M in its IPO. eBay divested from Meli in 2016.

In 2011, the company transitioned its platform to open source technology. The transitions allowed APIs to expand the platform solutions. Two years later, they created the Meli Fund, private equity inside Mercado Libre focused on investing in disruptive companies that could boost the API platform solution.

Winner corporate culture

Let’s go back to Meli Fund for a moment.

Let’s take a moment on Meli Fund. Just a sheer of investors notices, Meli Fund is such an entrepreneurial characteristic that resembles Mercado Libre.

After returning to Argentina, Mr. Galperin faced hardships looking for people with the right fit to work at Mercado Libre. He brought back from Stanford to Buenos Aires a few of his colleagues: Mr. Pedro Arnt, current CFO, Osvaldo Giménez, current Fintech President, and Mr. Hernan Kazah.

Also, it’s essential to highlight Mr. Nicolas Szekasy, CFO from 2000 to 2009. Mr. Szekasy and Mr. Kazah left Mercado Libre to found Kaszek in 2011, one of the most successful Venture Capital companies in Latin America.

In their unbelievable track record, they invested in Nubank ($NU) since the seed round, QuintoAndar (Series E), Nuvemshop (Series E), Konfio (Series E), Loggi (Series D), Warren (Series C), and so on.

More recently, in October of 2021, Mercado Libre and Kaszek created a SPAC called MEKA (MELI Kaszek Pioneer Corp), raising $287M to invest in innovative companies.

Kaszek’s and Mercado Libre’s track record teaches us their unique ability to find outstanding teams and understand the market’s demand for products. That is the most important competitive advantage Mercado Libre has: its culture.

Since it was founded, Mercado Libre invested and bought almost 50 companies (35 under Meli Funds). I’m not saying that those were successful acquisitions, but on both sides (bidder and offer), the probability of greater alignment was higher than in many other companies.

Also, it reflected in better recruiting and retention. Mercado Libre gives employees plenty of freedom to develop solutions they think would serve better clients, attracting people focused on developing the best solution into a company that offers fewer constraints as possible.

Business Model

The company offers an ecosystem of six integrated e-commerce and digital payments services: Mercado Libre Marketplace, Mercado Pago Fintech, Mercado Envios (logistic service), Mercado Libre Ads, Mercado Libre Classifieds, and Mercado Shops (online storefront solution).

Marketplace

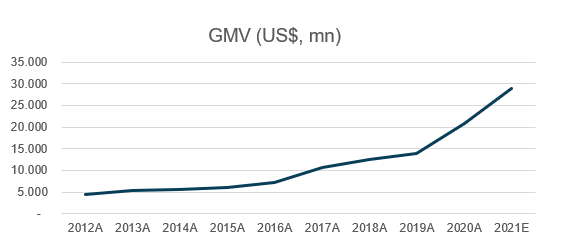

The product is a fully automated online commerce platform, connecting sellers with buyers, transacting a Gross Merchandise Value (GMV) of $7,3B in the last quarter, selling over 250M items, and almost achieving the milestone of 1 billion items sold in 12 months.

The marketplace benefits buyers and sellers by offering them access to product and geographic markets larger than they would reach offline. Mercado Libre attracts buyers offering variety, value, and convenience, and sellers by providing access to the broader market, efficient marketing, distribution, and ultimately higher profits.

Both experience reduction in search and selling cost, with a better experience. For instance, recently, Mercado Libre launched its loyalty program. The buyer accumulates points for the amount spent on the platform, receiving a discount on shipping and free access to streaming services.

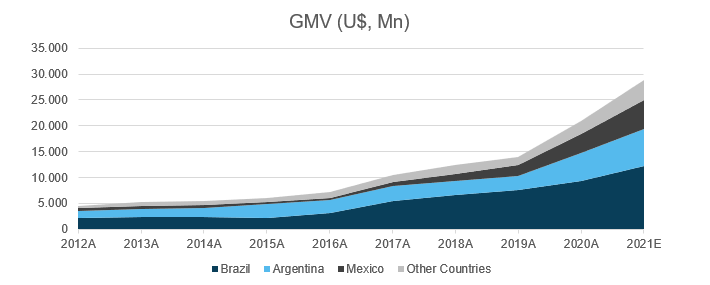

Meli operates in 18 countries, but almost 90% of its GMV comes from Brazil, Argentina, and Mexico (in U$ based).

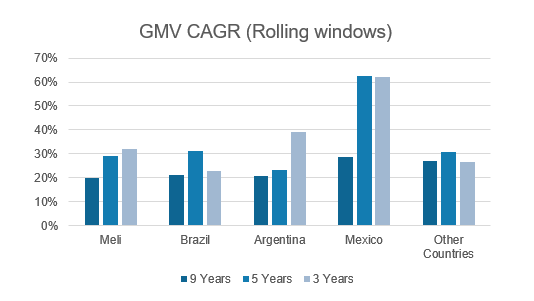

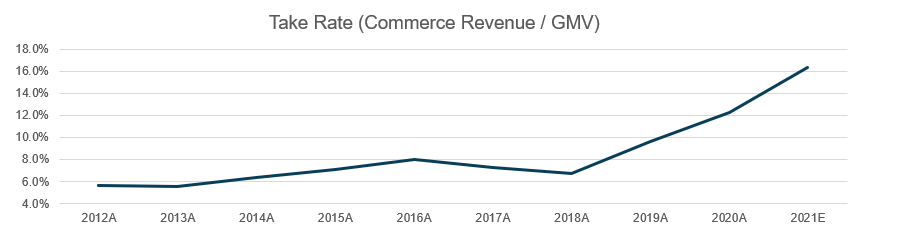

Looking in different rolling windows, Meli’s GMV has been growing above 20%, gaining momentum in the last three years, primarily because of the Covid-19 movement restrictions that moved offline users to the online world.

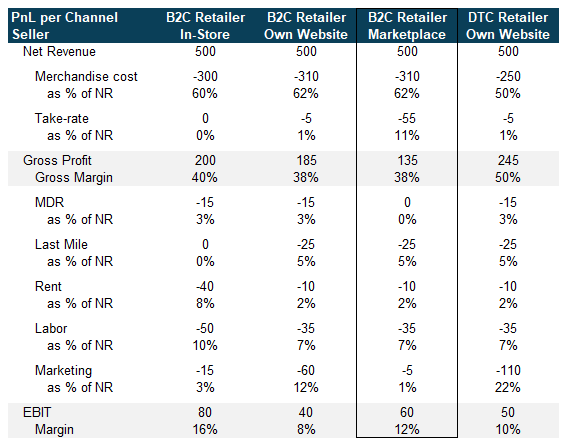

For the seller, the most significant advantage is access to more customers. Also, Meli offers delivery, funding, and inventory solutions. As a result, the service provides higher margins than different online channels from the profit and losses perspective.

The image above estimates retailers’ operational performance based on their selling channel. Marketplace offers a good value proposition when customers focus solely on volumes.

Furthermore, channel checks suggest that one of the most important advantages for sellers is not necessarily higher sales. Instead, more significant sales volumes are translated into better conditions financing operations and suppliers, boosting cash flow.

Most sellers rely on Mercado Libre to access financial and operational conditions that enable better operational performances.

Mercado Pago

The company created Mercado Pago in 2004 to offer online payments solutions designed to facilitate transactions both within and outside of the marketplace product.

Mercado Pago operated similar to Paypal when it was launched, offering a digital wallet. Customers could add their payments after linking a valid credit/debit card or depositing the fund in the account.

However, Mercado Pago developed into a stand-alone payment platform, offering services to receive payments done not only through Mercado Pago but also from any service provider, meaning that Mercado Pago is not only a payment processing company.

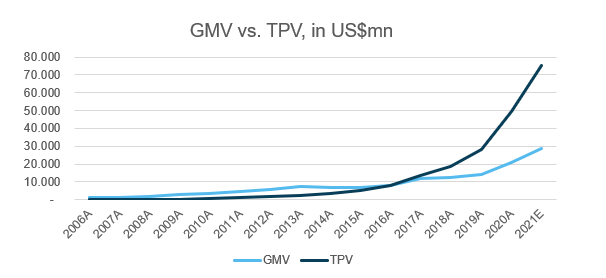

Recently, Mercado Pago’s transactions became more relevant than the marketplace’s GMV, given the greater scalability of the business.

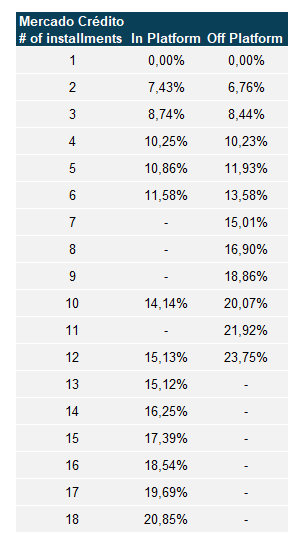

For instance, Mercado Pago offered POS to offline sellers and launched the Mercado Credito, also offering credit solutions to customers, evaluating credit scores in its proprietary solution, with over 400 variables.

An edge Mercado Pago has over its competitors is that they have been gathering and processing data since 2004. It means that the company could grow its loan portfolio without taking unexpected losses. But, again, I suggest reading about Stone for more on the topic.

Besides, if the client is also Marketplace’s client, the credit scoring process is superior because Mercado Libre can track clients’ cash flow, inventory, receivables, and so on. So it’s excellent for a banking or payment processor solution, offering a more competitive price and accretive risk management.

Therefore, Mercado Pago has a massive hole in Meli’s success since the business is more significant than the marketplace given its scalability and ability to connect buyers with sellers and merchants, in or off the platform.

Mercado Envio

Meli shines out in logistics. Suppose you’re selling in Meli’s marketplace. In that case, there are two options: first, you can take advantage of Mercado Envios Full (“MEF”), a comprehensive fulfillment service, such as Fulfillment by Amazon (“FBA”), allowing the seller to store the items in Meli’s warehouses, where they handle the entire process.

The second option is through Mercado Envios Diretos (“MED”). The seller is responsible for storing the item and for the delivery processing, hiring, or realizing the delivery to the client.

A condition to hire MEF’s or MED’s services is that the seller must be connected in the marketplace, register the invoice for each order, and fit the accepted dimensions. Meli had a liability with sellers dealing without invoices in the past, though they solved the problem many years ago.

Going deeper in MEF, the fully integrated service has no cost seller, and it’s collected by the Mercado Coletas, managed by Meli then.

The constrain for sellers is the coverage area. Again, MEF is a no-brainer, but the coverage area is limited to certain areas, established according to the distance between the seller and the distribution center (“DC”).

Quantitatively, Meli has fewer DCs than all of its competitors, but this isn’t entirely true from a qualitative standpoint. For example, Magazine Luiza, Americanas, and Via are older companies, and not all their DCs enable fulfillment service.

Via, for instance, recently launched its first fulfillment center to sellers, although they have the most significant number of DCs. Older DCs have lower productivity sorting items and more significant recurring Capex, though many companies don’t repair properly.

The process of opening new DCs is highly reliable on data. First, they gather and process a vast amount of data, turning then into analytics. Second, an analysis of areas with sufficient demand.

Third, Meli partnered with a company specializing in DC to execute the project (including Capex) in exchange for a long-term leasing contract. It's genius. They don’t have Capex investing in new DCs, minimizing the risk.

Beyond that, Meli launched an initiative to offer logistics as a service (“LAAS”), setting its first partnership with Pão de Açúcar ($CBD), which operates over 5,000 SKUs.

Meli can offer same-day delivery for 10 million items, from electronics to supermarkets, with no additional cost to the buyer.

The shipping policy is the same, with free shipping for purchases at R$79. Currently, the company can deliver on the same day for almost 25% of all zip codes in Brazil.

More recently, Meli launched an app called Mercado Envios Extra, connecting self-employed delivery drivers to the e-commerce platform, similarly to delivery apps, such as Rappi and iFood.

The driver can define deliveries pick-up locations in the app and notify the buyer that the package is on the way. Drivers are paid weekly through Mercado Pago.

Meli has over 600 enveloped vans, 10,000 third-party vans, four planes, 600 trailers, and 51 electric vehicles for the last mile.

According to Gustavo Pompeo, Logistic’s Director, Meli delivers 90% of its orders in less than 48 hours. Out of those, 75% are delivered within 24h.

MercadoLibre Classified

It’s the service where sellers can list and buy motor vehicles, aircraft, real estate, and so on. The service is irrelevant compared to the marketplace and differs because the seller pays the fee upfront, not the usual take rate.

MercadoLibre Advertising

The service enables sellers and large advertisers (not necessarily sold on the marketplace) to display ads on a CPC (cost-per-click) basis.

It won’t surprise me if Meli adopts Alibaba's same strategy to replace the standard take rate for advertising revenue. Then, of course, there would be a discussion regarding scale and investment in clicks, but this is something to keep in mind if the commerce take rate starts reducing more aggressively somewhere in the future.

Last year, in LatAm, 7 of 10 searches for products began in a marketplace, so they became a mandatory media for agencies and companies.

Using analytics tools, Meli offers performance marketing for brands and products. Unlike Mercado Envios, customers grom Advertising don’t have to sell on the platform necessarily.

MercadoShops

MercadoShops (“Shops”) was the last initiative launched by Meli, designed to offer SMEs and longtail to create their website inside Meli’s environment, integrated with Meli’s universe of services.

The first thing that comes to my mind is Amazon Webstore. For those who don’t remember, in 2010, Amazon launched its own web service company, called Amazon Webstore (“Webstore”).

However, Webstore was a complete failure. After five years of operating, Amazon decided to shut down the operation, suggesting that clients migrate to Shopify.

In my opinion, the product was horrible. First, Amazon charged $79/m for an interface identical to Amazon’s website (competitors were charging ~$30/m). Initially, Webstore was much cheaper (under $40/m), but Amazon hiked prices quickly.

Second, the value proposition was worse. Besides being more expensive and less customizable, Webstore charged sellers 2,1% to 3% to process payments.

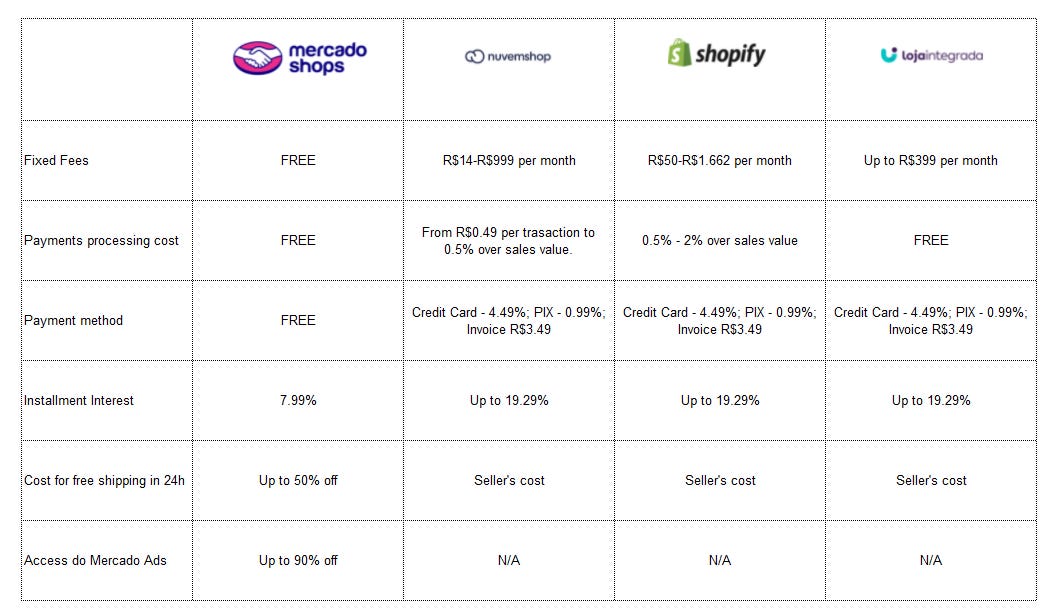

On the other side, Shops offers a considerable value proposition to customers using their scale to offer most services for free or at a very competitive fee.

Shop’s strategy is to attract SMEs and longtail. In the layer behind, Meli is boarding clients in its ecosystem for a low CAC (Customer Acquisition Cost) to offer different financial and logistic services.

How does Meli make money?

In its public filing, Meli identifies two main revenue streams: revenue linked to the marketplace operation and non-marketplace operations, where the company offers different services to clients.

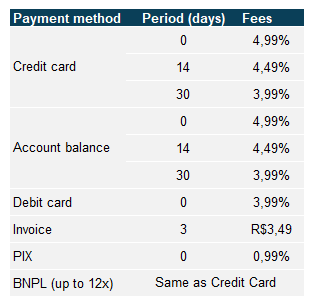

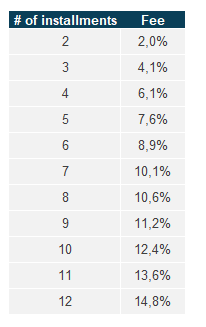

- The commerce business is comprised of revenue streams that are mainly generated from marketplace fees that include final i) value fees and flat fees for transactions below a specific merchandise value, ii) shipping fees net of third-party carrier costs (when we act as an agent), iii) classifieds fees, iv) ad sales up-front fees; v)sales of goods and vi) fees from other ancillary businesses.

1) The fintech business is comprised of revenue streams that come from the Mercado Pago business. Concerning Mercado Pago, fees are attributable to commissions that are charged to sellers representing a percentage of the processed payment volume in connection with off-Marketplace transactions;

2) Commissions from additional fees are charged when a buyer selects to pay in installments through the Mercado Pago platform for transactions that occur either on or off-platform;

3) Commissions from additional fees are charged when sellers elect to withdraw cash, cash advances, fees from the merchant and consumer credits granted under the Mercado Credito solution, and revenues from the sale of MPOS products.

Management compensation

Probably management’s long-term alignment is one of the most undervalued elements in a company.

However, one of the best ways of verifying your thought about the company’s focus is looking where compensations are coming from.

A heuristic that has been working fine to me is that a company whose management doesn’t have skin in the game is doomed to a failure somewhere in the future.

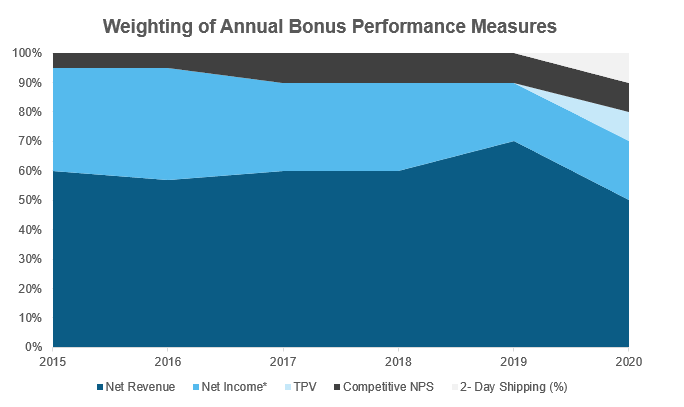

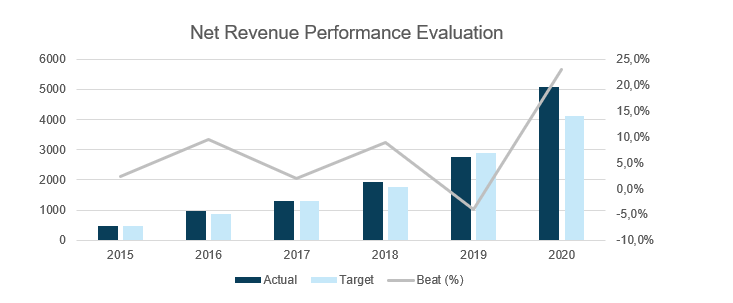

From 2011 to 2017, Meli’s compensation and performance measuring looked much like a commerce company, with a greater focus on revenue growth and net income.

In 2018, Meli hired Mercer Consulting to establish better compensation peers and draw better weighting performance measures.

The relevant highlights are the inclusion of “2-Day Shipping (%),” “TPV,” and changing “Net Income” criteria to Operational Income.

There is a circular reference from “2-Day Shipping (%)” to NPS and from “TPV” to Net Revenue, meaning that Meli kept Net Revenue importance unchanged, increasing the priority for better “NPS” using an operational metric, instead of a subjective metric. NPS has an inherent problem because it is affected by external factors that management might not interfere with.

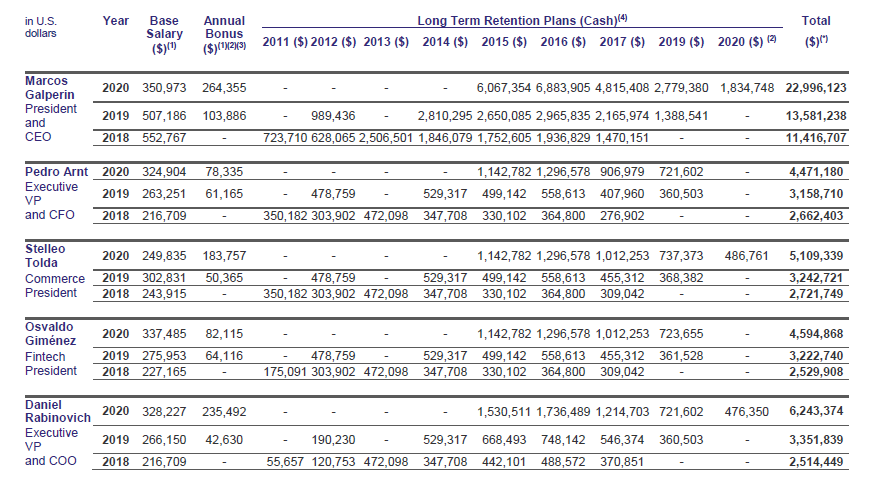

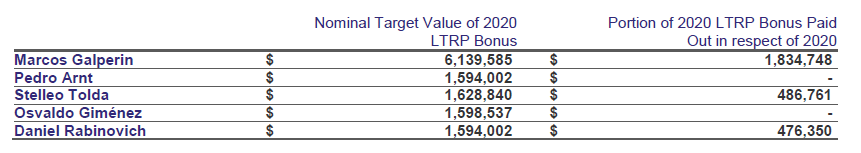

In 2020, 98.5% of our chief executive officer’s total target direct compensation for our 2020 fiscal year was performance-based, and 93.8% of our other named executive officers’ average total direct target compensation was performance-based.

The vesting for the Long Term Retention Plans (LTRP) is six years, meaning that every year management receives 16,67% of the nominal target value for the LTRP if there is any. Historically, Meli’s management beats its operational targets year over year, receiving greater LTRP.

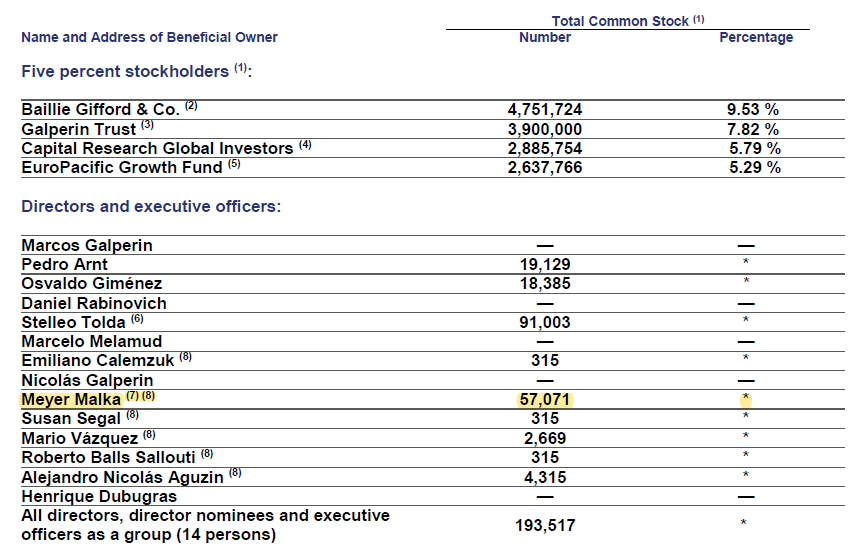

Also, the Chairman of the Compensation Committee is Mr. Meyer Malka (“Micky”), who has been on Meli’s board since 2013 and founded Ribbit Capital, a Venture Capital company focused on Fintech companies.

The ultimate evidence that Micky has no conflict of interest with other stockholders is that he is a stakeholder, having more shares than most directors.

Final words

In this week’s post, my objective was to prove that Meli is a fantastic company from a qualitative standpoint.

Mr. Galperin founded Meli to create the best solution for connecting buyers and sellers, changing how people buy and sell in LatAm.

I’m a proud shareholder for everything the company builds and its culture, which attracts the best-talented people across LatAm. Meli’s entrepreneurial characteristic sets a terrific way for the company. One I would be proud to ride with.

In the next post, I’m going deeper into financials, peers, valuation, and customer value proposition.