Introduction

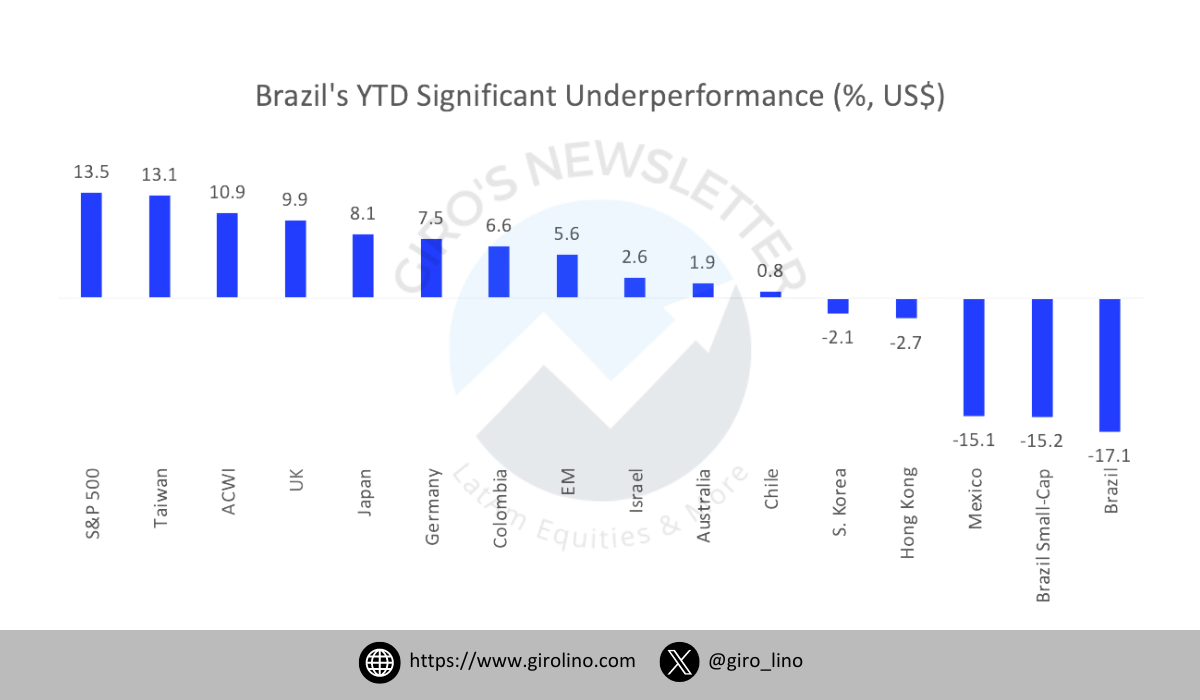

In 2024, the Brazilian stock market faced significant challenges, emerging as the worst performer globally with a YTD return of -17.1%. Several setbacks have marked this year, including fiscal concerns, government intervention, sluggish economic growth, and a challenging monetary policy environment. Despite these issues, opportunities still exist for savvy investors. One such opportunity lies in Brazilian Small Caps, particularly through the iShares MSCI Brazil Small-Cap ETF (EWZS).

Brazil’s economic landscape is complex, shaped by many internal and external factors that dampen investor sentiment. The government's expansive fiscal policies, frequent interventions in various sectors, and sluggish economic growth have all contributed to the market’s downturn. The Central Bank's aggressive measures to combat inflation and external pressures, such as global economic slowdowns and trade disruptions, have further exacerbated the situation.

However, Brazilian Small Caps offer a unique investment proposition within this challenging environment. These smaller companies often have greater growth potential than their larger counterparts and can be more agile in adapting to changing market conditions. The iShares MSCI Brazil Small-Cap ETF (EWZS) provides diversified exposure to this market segment, making it an attractive option for investors looking to capitalize on potential rebounds.

The image shows the Year-to-Date (YTD) returns of various regional ETFs in 2024, highlighting Brazil's significant underperformance. While the S&P 500 has gained 13.5% and other markets like Taiwan and the UK have also posted strong returns, Brazil has struggled with a steep decline. This stark contrast underscores the unique challenges faced by the Brazilian market this year.

Brazil's fiscal landscape has been a major point of concern. The government's expansive fiscal policies have led to increased budget deficits and public debt, raising questions about long-term fiscal sustainability. Frequent government interventions in various sectors have created an unpredictable regulatory environment, unsettling investors and deterring foreign investment.

Economic growth in Brazil has been sluggish, trailing behind other emerging markets and causing concern among investors. This stagnation is rooted in several structural issues, including low productivity, inadequate infrastructure, and a cumbersome regulatory environment. Despite these challenges, certain sectors have shown resilience, and there are modest growth prospects on the horizon.

Fiscal Concerns and Government Intervention

In 2024, Brazil's fiscal landscape has been a significant concern for domestic and international investors. The government's expansive fiscal policies, aimed at stimulating economic growth, have led to increased budget deficits and soaring public debt. This situation has raised alarms about the long-term sustainability of Brazil’s fiscal health and has contributed to the overall market downturn.

The Brazilian government's approach to fiscal policy in recent years has been characterized by increased public spending on social programs and infrastructure projects. While these initiatives aim to boost economic activity and improve living standards, they have also led to a substantial increase in the budget deficit. The government's inability to balance spending with revenue generation has resulted in a growing public debt burden. As of 2024, Brazil's public debt stands at a record high, prompting concerns about the country’s ability to meet its future obligations without resorting to severe austerity measures or significant tax hikes.

Frequent government intervention in various sectors has further unsettled investors. To control inflation and protect consumers, the government has recently adopted new measures, such as importing rice and selling it at lower prices to mitigate rising costs. While well-intentioned, these measures have disrupted market dynamics, leading to unintended consequences.

The government's decision to import rice and sell it at cheaper prices aims to prevent inflationary pressures on a staple food item. However, this intervention has affected local rice producers, who now face increased competition from imported rice sold at lower prices. This has squeezed profit margins for domestic farmers and could potentially deter future investment in the local agriculture sector.

Additionally, regulatory changes in key industries such as energy, mining, and telecommunications have created an unpredictable business environment. The government’s interventionist policies, including sudden changes in tax regimes and regulatory standards, have increased investors' perceived risk. This uncertainty has led to a decline in foreign direct investment as businesses seek more stable environments for their capital.

The issue of long-term fiscal sustainability is critical. Brazil's public debt-to-GDP ratio has reached levels that many economists consider unsustainable. Without significant fiscal reforms, the country risks a downward spiral of increasing debt costs and reduced investor confidence. The government’s current trajectory suggests that more borrowing will be necessary to finance ongoing deficits, further exacerbating the debt problem.

To address these issues, the Brazilian government must implement comprehensive fiscal reforms to reduce the deficit and stabilize debt levels. Potential measures include curbing public spending, improving tax collection efficiency, and fostering a more business-friendly environment to stimulate private investment. However, these reforms are politically challenging and require strong political will and public support.

Economic Growth Projections

The Brazilian economic growth has been sluggish in 2024, trailing behind other emerging markets and causing investors' concerns. This stagnation is rooted in several structural issues, including low productivity, inadequate infrastructure, and a cumbersome regulatory environment. Despite these challenges, certain sectors have shown resilience, and modest growth prospects are on the horizon. Understanding the nuances of Brazil's economic landscape is essential for identifying potential investment opportunities, particularly in small-cap companies.

Brazil’s economic performance has been underwhelming in recent years. The country’s GDP growth rates have lagged significantly behind other emerging economies, reflecting deep-seated structural problems. Persistent issues such as low productivity, a complex and burdensome regulatory environment, and insufficient infrastructure investment have hampered economic expansion.

External economic pressures, including global supply chain disruptions and fluctuating commodity prices, have compounded these issues in 2024. These factors have further strained Brazil's economy, leading to a contraction in industrial output and weakened consumer confidence. However, not all sectors have been equally affected, with some showing signs of resilience amidst the broader economic slowdown.

While the overall economic picture has been bleak, certain sectors within the Brazilian economy have performed relatively well. The agriculture sector, for instance, continues to be a significant contributor to GDP growth. Driven by strong global demand for commodities like soybeans, coffee, and beef, the agricultural sector has remained robust, providing steady export revenues.

In contrast, the manufacturing and services sectors have faced more substantial challenges. The manufacturing sector has struggled with high production costs and decreased domestic and international competitiveness. Meanwhile, the services sector, which includes key areas such as retail, tourism, and financial services, has been hit hard by subdued consumer spending and investment.

Looking ahead, Brazil's economic growth prospects are mixed. On the one hand, the government is trying to implement structural reforms to improve the business environment and boost productivity. These reforms include initiatives to simplify the tax system, reduce bureaucratic red tape, and invest in critical infrastructure projects. If successfully implemented, these measures could lay the groundwork for more sustainable economic growth in the long term.

However, in the short term, growth is expected to remain modest. Economic forecasts suggest that Brazil's GDP growth will hover around 1-2% annually, significantly lower than the growth rates required to reduce unemployment and improve living standards meaningfully. External factors, such as global economic conditions and commodity price volatility, will continue to play a significant role in shaping Brazil’s economic trajectory.

Understanding Brazil's economic growth projections is crucial for investors to make informed decisions. While the overall economic outlook remains cautious, opportunities exist, particularly in sectors more exposed to the broader economy's structural issues. Small-cap companies, deeply intertwined with the broad economy, often face more challenges but can present attractive investment opportunities when the economy stabilizes or improves. Their higher exposure to economic fluctuations means they can benefit significantly from economic rebounds, making them a compelling option for investors willing to navigate short-term volatility.

Labor Market and Wage Dynamics

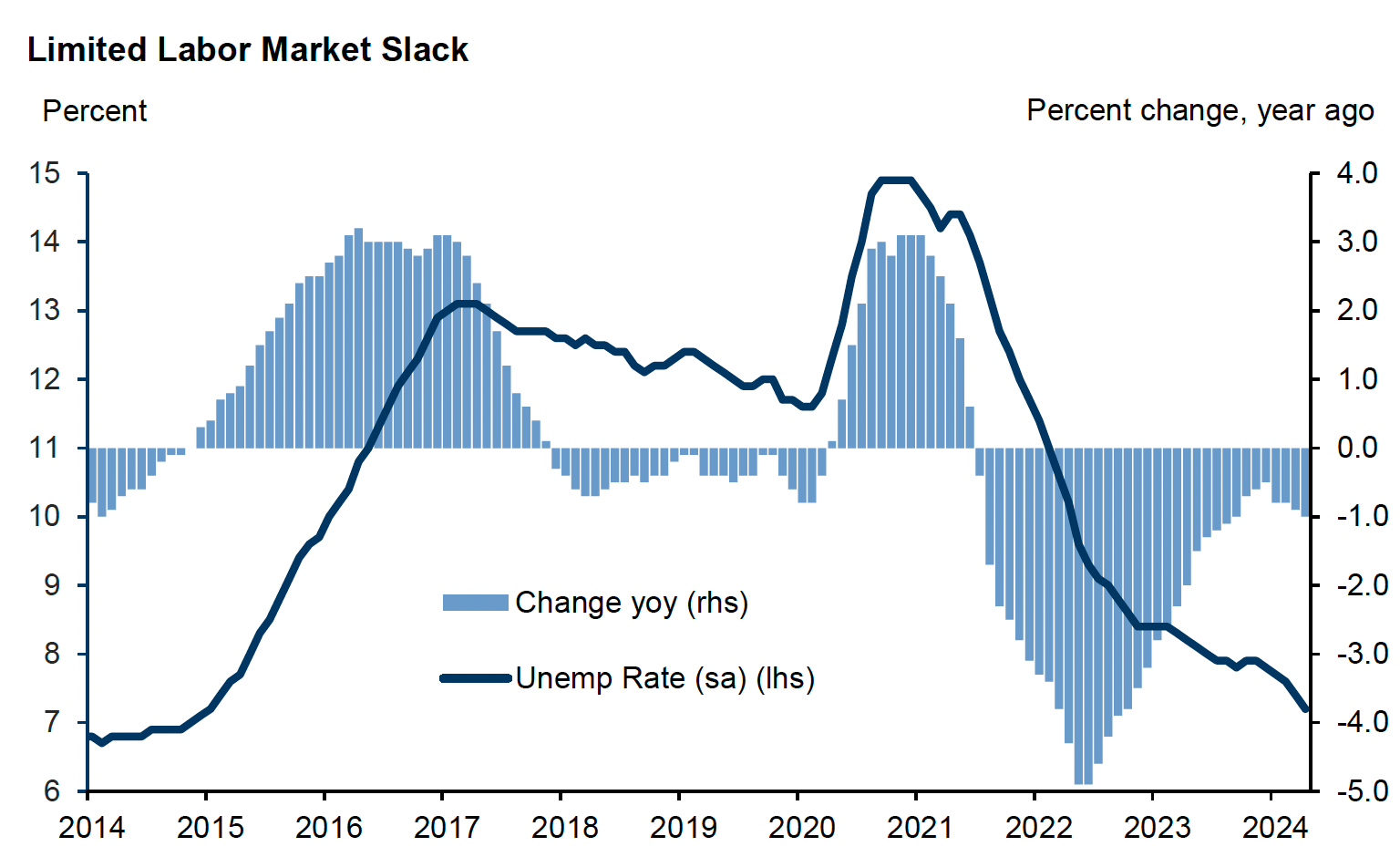

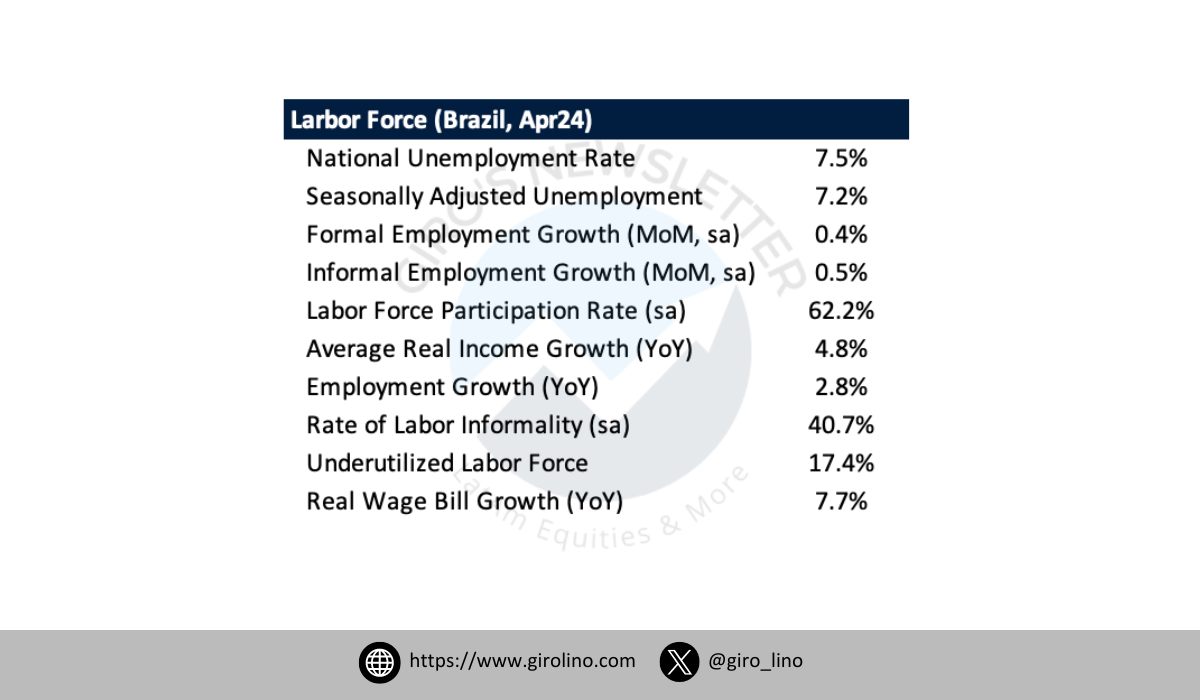

The Brazilian labor market has shown some resilience amidst these economic challenges. The national unemployment rate printed at 7.5% in April 2024, lower than the consensus forecast of 7.7%. Seasonally adjusted, the unemployment rate declined to 7.2%, the lower end of the Non-Accelerating Inflation Rate of Unemployment (NAIRU) range. This indicates a relatively tight labor market, with formal employment rising by 0.4% month-over-month (sa) and informal sector employment increasing by 0.5% month-over-month (sa). The labor force participation rate also saw a slight uptick to 62.2% (sa), although it remains below the pre-pandemic peak of 63.0%.

Average real income for employed workers accelerated to 4.8% year-over-year (yoy) in April, up from 4.0% yoy in March. This increase in real wages reflects both the strong labor market and the inflationary pressures driving up nominal wages. Employment growth also accelerated to 2.8% yoy, indicating a robust demand for labor despite the economic headwinds.

However, the rate of labor informality remained high at 40.7% (sa), and nearly one-fifth of the active labor force is still underutilized. This includes those unemployed but actively looking for a job, partially unemployed, or too discouraged to look for work. Despite the rise in real wages, the significant portion of the workforce in informal employment and underutilization suggests structural issues in the labor market that could affect long-term economic stability.

Overall, the economy's real wage bill increased 7.7% year-over-year in April, compared to 6.5% in March. This indicates substantial wage growth but also underscores the challenges of inflationary economic pressures. The number of discouraged workers outside the labor force stood at 3.5 million, representing 3.2% of the active labor force, while 20.1 million workers remain underutilized, accounting for 11.4% of the working-age population and 18.5% of the economically active labor force.

Monetary Policy and Inflation: A Complex Landscape in 2024

The year 2024 began with high hopes for Brazil. Investors were optimistic as the country seemed poised for recovery, buoyed by favorable economic indicators and a stable fiscal outlook. However, the picture became increasingly complicated as the months progressed, casting a shadow over the initial optimism.

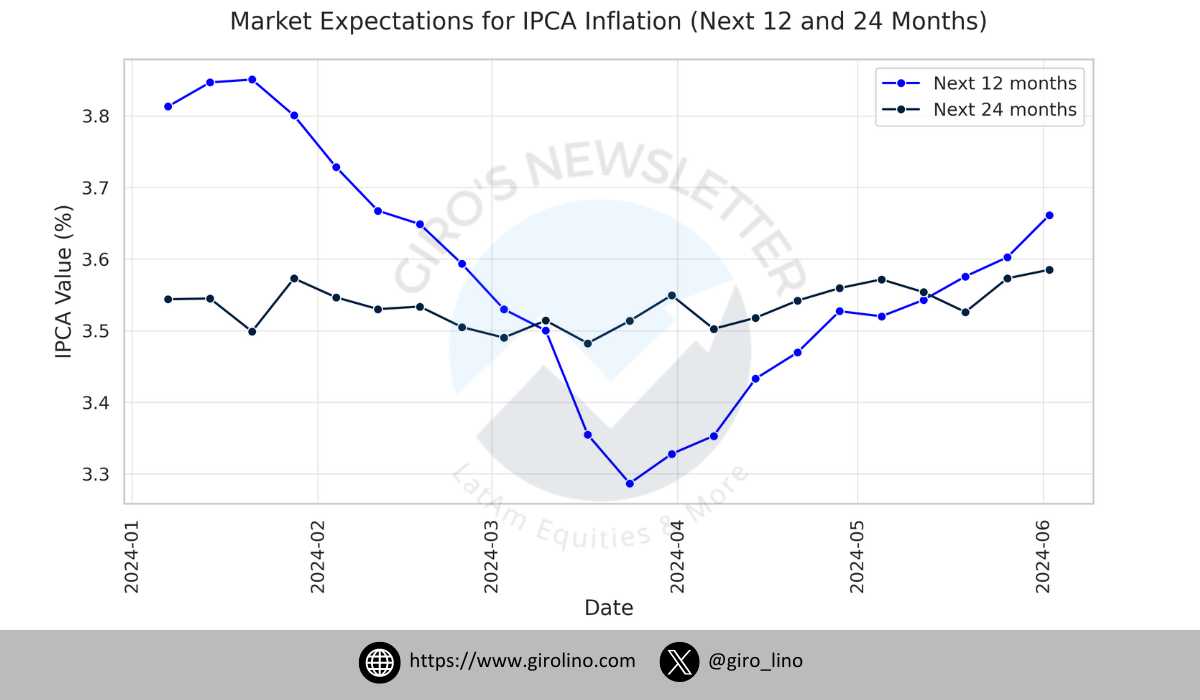

At the heart of Brazil's economic challenges lies the issue of inflation. Early in the year, inflationary pressures were already significant, driven by domestic and international factors. Supply chain disruptions, higher global commodity prices, and currency depreciation increased prices.

As seen in the chart above, market expectations for IPCA inflation over the next 12 and 24 months began to rise sharply, reflecting growing concerns about inflation's persistence. This increase in expected inflation posed a critical challenge for the Brazilian Central Bank (BCB), Banco Central do Brasil.

In response, the BCB took decisive action. The Central Bank initially reduced the Selic rate to stimulate economic activity, making borrowing cheaper and encouraging spending. However, as inflationary pressures continued to build, the BCB shifted its strategy.

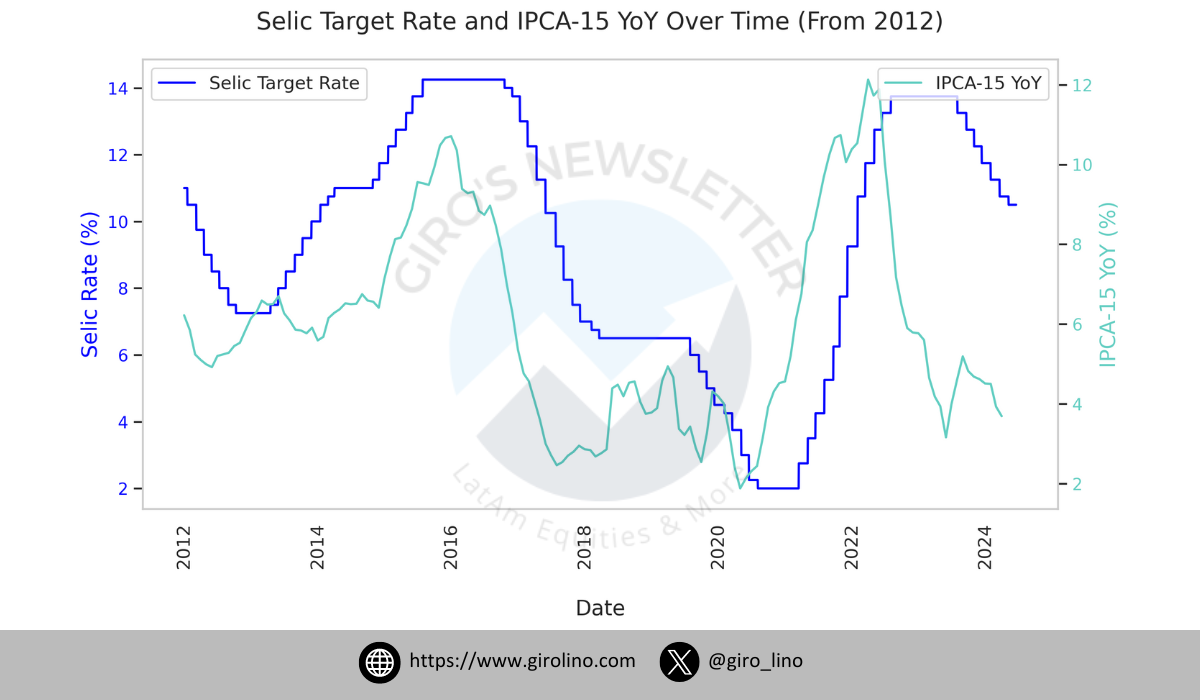

The chart above illustrates the fluctuations of the Selic rate over the years, showing the recent cuts aimed at boosting the economy. By mid-2024, however, it became evident that these measures were insufficient to curb inflation. The BCB had to struggle, balancing the need to support economic growth with the imperative to control rising prices.

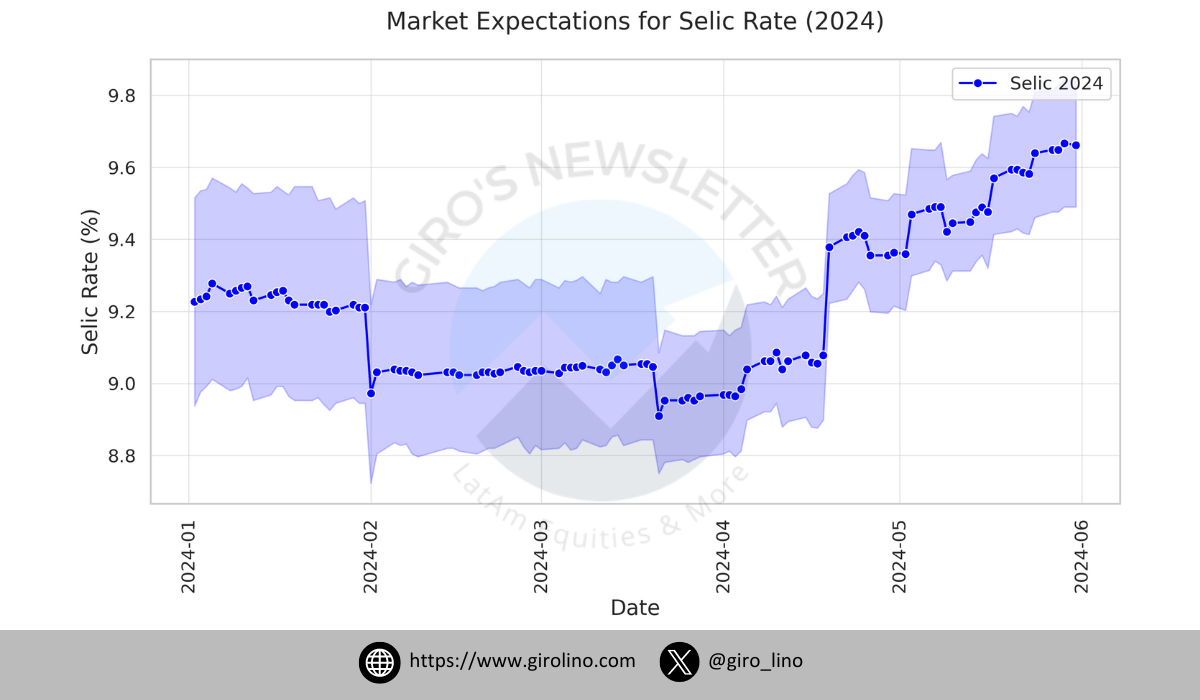

As inflation expectations climbed, the market began anticipating future Selic rate adjustments. This shift in sentiment was captured in the next chart, which shows the evolving expectations for the Selic rate throughout 2024.

Here, we see that the anticipated Selic rate for 2024 increased significantly, reflecting market skepticism about the Central Bank's ability to keep inflation in check with its current policies. Investors began to brace for further rate hikes, which pressured the stock market.

Adding to the complexity, despite persistent global inflation, local inflation in Brazil worsened due to expansive fiscal policies and uncertainties regarding fiscal policy. The Brazilian government's increased spending and lack of clarity on future fiscal measures have further fueled inflationary pressures, complicating the BCB's task.

As the year progressed, these dynamics created a challenging environment for policymakers and investors. Fiscal concerns and government interventions further complicated the BCB's efforts to manage inflation through monetary policy adjustments.

For example, to mitigate the impact of rising food prices, the government decided to import rice and sell it at lower prices. This measure aimed to protect consumers but disrupted local market dynamics, putting pressure on domestic producers who struggled to compete with cheaper imports.

The complexities of managing inflation, fiscal policies, and market expectations made for a volatile economic landscape. The interplay between these factors is perhaps best illustrated by the following chart, which correlates the Selic rate with the year-on-year IPCA-15 inflation rate.

This chart provides a clear view of how inflation and monetary policy have interacted over time, highlighting the challenges faced by the BCB in its efforts to stabilize the economy.

In conclusion, 2024 has been a year of economic turbulence for Brazil. The initial optimism gave way to a more complex reality as inflationary pressures, fiscal concerns, and government interventions shaped the economic landscape. The Brazilian Central Bank's monetary policy adjustments, while necessary, have had mixed effects, underscoring the delicate balance required to navigate such a challenging environment. As Brazil moves forward, the lessons of 2024 will undoubtedly influence its approach to balancing growth and stability in the future.

Market Sentiment: Improving Globally, Worsening Locally

In recent weeks, the relationship between emerging market (EM) currencies and U.S. yields has intensified, making the responses of EM central banks to U.S. monetary policy increasingly important for foreign exchange (FX) markets. Several EM central banks have adopted more cautious stances: Bank Indonesia raised rates, Bank of Mexico held rates steady, and the Brazilian Central Bank (BCB) slowed its rate cuts to 25 basis points (bps) earlier this week.

However, the 25bps cut was already anticipated by the market. The significant impact came from the closely split vote (4 out of 9 directors favored a 50bps cut), causing the BRL and Brazilian rates to underperform. Earlier this year, the BRL had been one of the more resilient Latin American currencies amidst domestic rate cuts, showing limited impact from monetary policy decisions, unlike the Chilean peso (CLP). This dynamic has shifted.

The chart above shows the decoupling of Brazilian 10-year government bond yields from the U.S. curve (in orange), highlighting how local conditions have worsened. Despite initially moving with the U.S. yield curve, local factors have caused Brazilian yields to diverge significantly. The dissenting votes for a larger cut came from directors appointed by the Lula administration, with the governor’s term ending in December. This raises the potential for a dovish shift in the BCB’s policy approach, particularly in a context of fiscal loosening, which will likely be a key focus for the currency moving forward.

Broadly, updating our cyclical ‘fair value’ model for the BRL, we observe that global factors have supported the currency since the USD/BRL peaked a few weeks ago. Despite recent domestic volatility, there has been no significant underperformance relative to these global factors in the short term. Key global drivers include the reversal of recent increases in U.S. yields, a recovery in equities, and marginal improvements in Brazil’s terms of trade.

As shown before, market expectations for the Selic rate in 2024 underscore the growing concerns among investors. Despite the BCB's efforts, the market is reflecting skepticism about the effectiveness of current policies in curbing inflation. This expectation of rising Selic rates in response to persistent inflation further pressures Brazilian financial markets and investor sentiment.

In conclusion, while global factors have supported the BRL, local economic conditions, driven by fiscal policy decisions and inflationary pressures, have increased market volatility. Investors are closely watching the BCB’s policy moves and the broader fiscal landscape, making domestic issues a central concern in the near term.

Final Thoughts: Investment Opportunity in EWZS

As 2024 progresses, the Brazilian market faces a complex and evolving landscape. Despite initial optimism, local conditions have deteriorated due to expansive fiscal policies and uncertainties regarding future fiscal measures. However, this challenging environment has also created significant investment opportunities, particularly in Brazilian small caps.

The relationship between emerging market (EM) currencies and U.S. yields has intensified, making the responses of EM central banks increasingly important for foreign exchange (FX) markets. In recent weeks, several EM central banks have adopted more cautious stances. The Brazilian Central Bank (BCB) slowed its rate cuts to 25 basis points (bps), a move already anticipated by the market. However, the close split vote (4 out of 9 directors favored a 50bps cut) caused the BRL and Brazilian rates to underperform.

Earlier this year, the BRL was resilient amidst domestic rate cuts, but this dynamic has shifted. The divergence in yields indicates significant local economic challenges. Directors appointed by the Lula administration favored larger cuts, suggesting a potential dovish shift in the BCB's policy approach, particularly in a context of fiscal loosening.

Broadly, global factors have supported the BRL since the USD/BRL peaked a few weeks ago. Despite recent domestic volatility, there has been no significant underperformance relative to these global factors. Key drivers include the reversal of recent increases in U.S. yields, a recovery in equities, and marginal improvements in Brazil’s terms of trade.

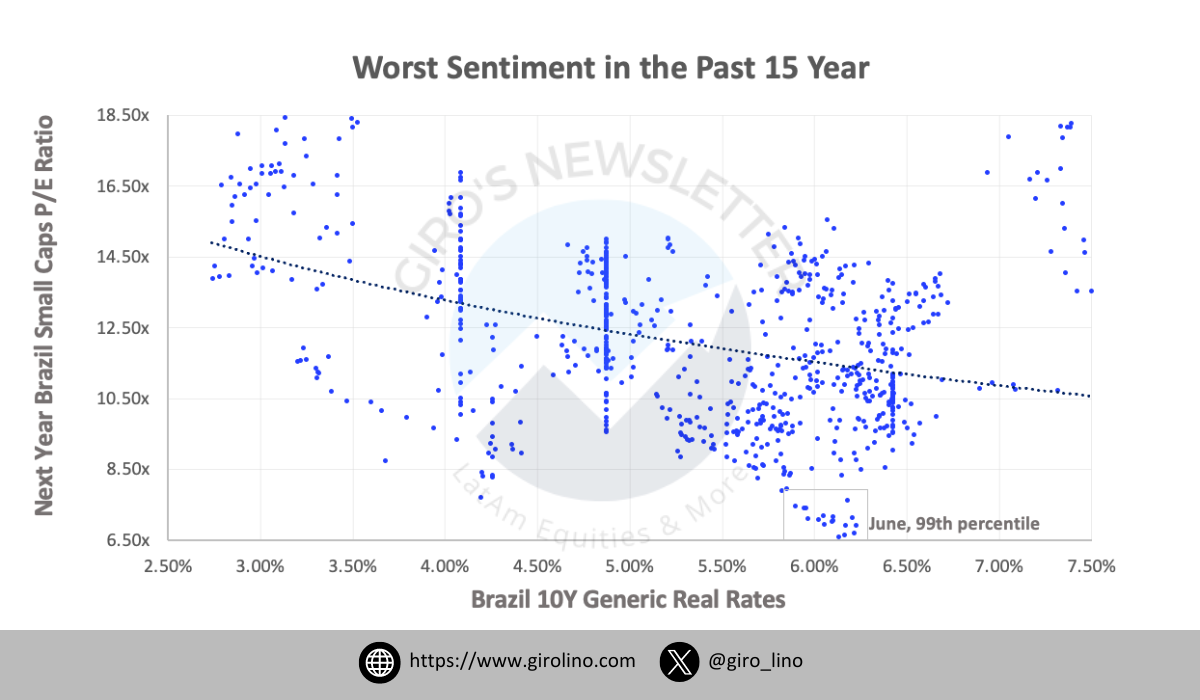

The relative valuation of Brazil's 10Y Generic Real Rates with the Next Year Brazil Small Caps P/E Ratio chart indicates that June sentiment hit the 99th percentile in the past 15 years, signaling extremely low valuations.

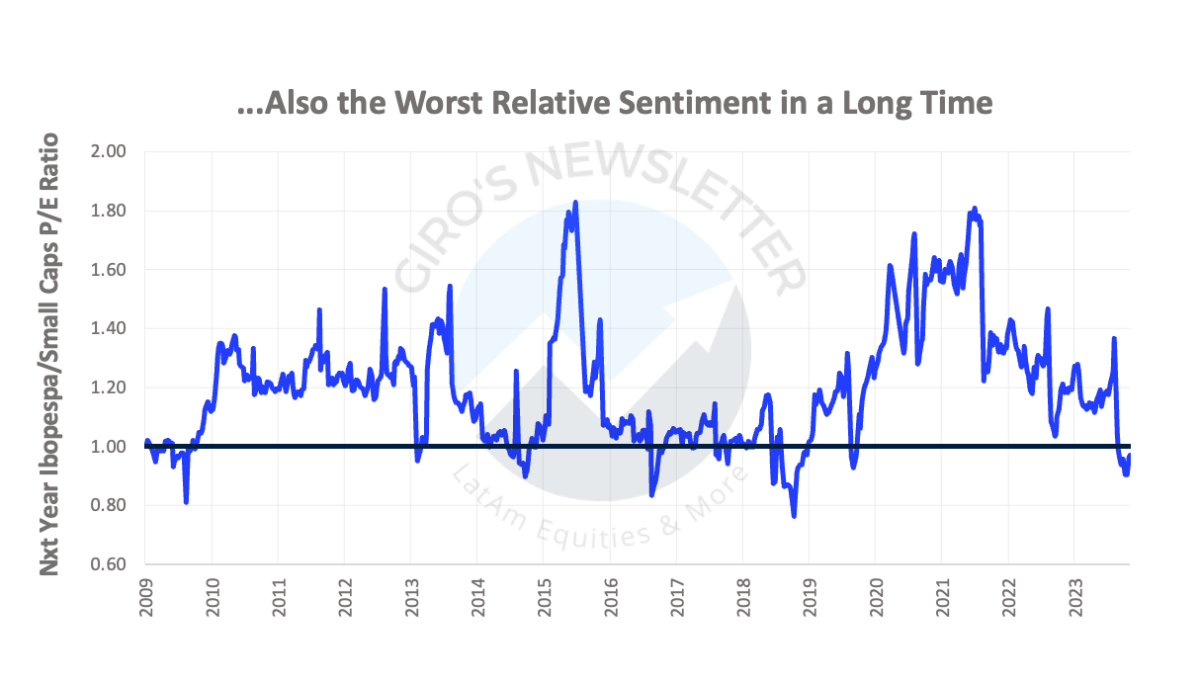

Similarly, the Ibovespa/Small Caps P/E Ratio chart highlights the worst relative sentiment in a long time, emphasizing the significant underperformance of small caps since 2009. This presents a unique opportunity for investors, as small caps are now more than priced in.

Given these conditions, Brazilian small caps are undervalued both in absolute terms and relative to broader indices like the Ibovespa and real rates. The iShares MSCI Brazil Small-Cap ETF (EWZS) offers a diversified way to gain exposure to these undervalued assets. Trading around 7x earnings for 2025, the EWZS presents substantial upside potential, making it an attractive option for investors looking to capitalize on potential rebounds as market conditions stabilize.

In conclusion, while the Brazilian market faces significant challenges, these very challenges have created a ripe environment for savvy investors. The historical context and current valuation levels of Brazilian small caps suggest that now may be the time to consider EWZS for a diversified investment portfolio. By understanding the interplay of global and local factors, investors can make informed decisions and potentially benefit from the eventual market recovery.