Cielo

B3: CIEL3 and OTC NASDAQ: $CIOXY

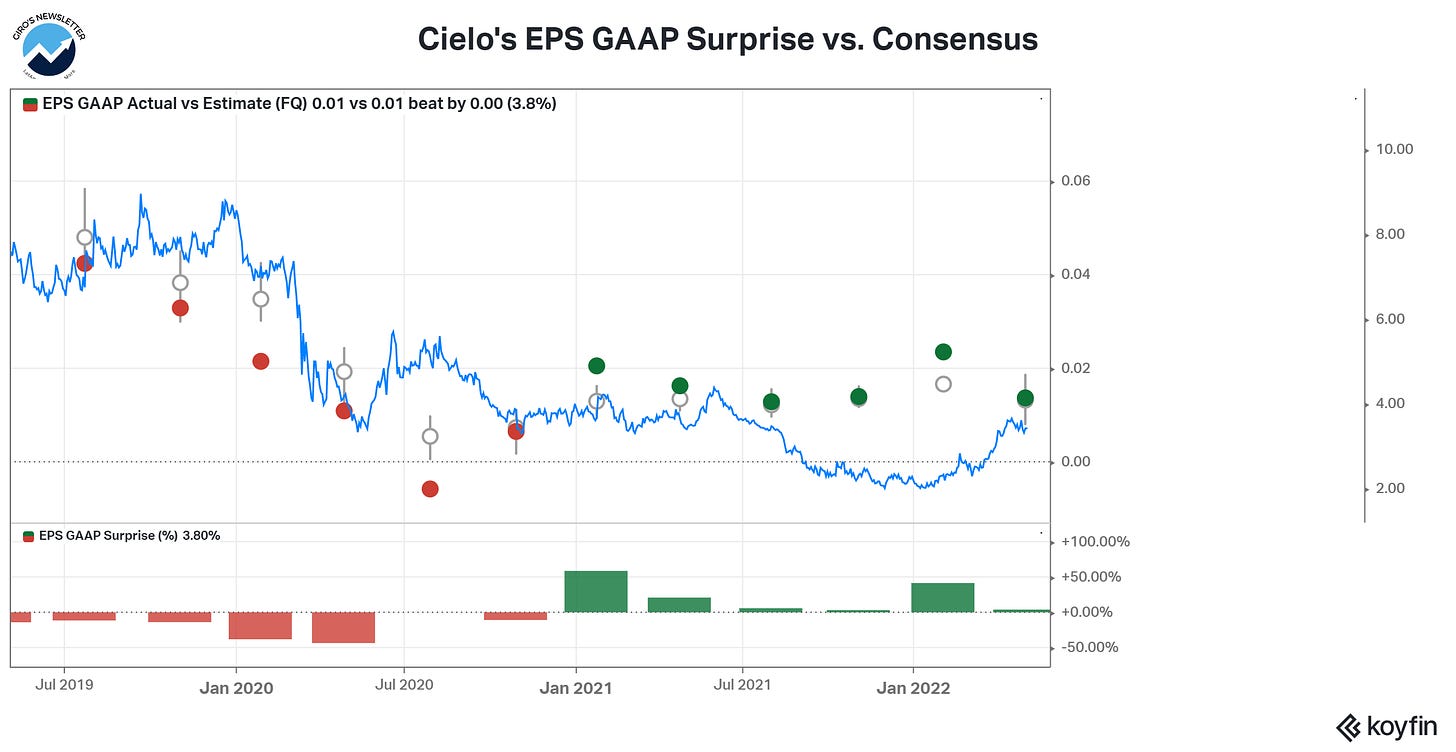

We were surprised by Cielo’s earnings, which was the 6th beat in a row to market consensus. In addition, Consolidated Net Income reached R$ 184.6mn in 1Q22 (+10% above Street), +35.9% YoY, due to excellent well cost control.

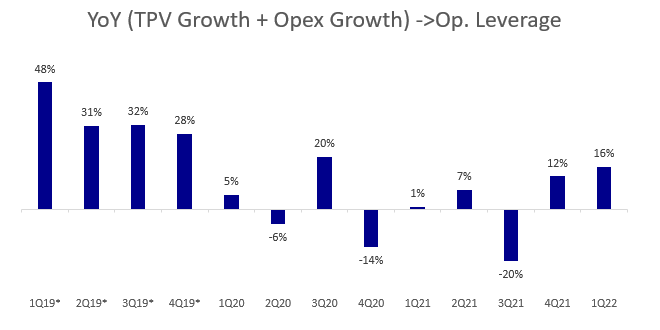

Costs and expenses were down 3.4% YoY. If extraordinary effects that reduced the expenditure base of 1Q21 were isolated, the decrease would have been 8.9%, reflecting:

- Nominal decrease in Cielo Brasil's normalized expenses, despite the inflation in the period, pressure on expenses from the substantial volume expansion, and investments in the transformation process;

- Expenses are under control in Cateno;

- Decrease in Other Subsidiaries expenses due to the sale of Multidisplay/M4U to Bemobi.

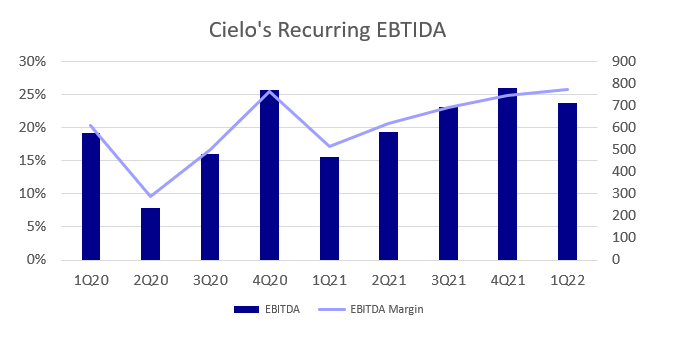

The consolidated recurring EBITDA recorded an expansion of 52.1% YoY, reflecting significant Cielo Brasil, Cateno, and excellent cost control growth.

Also, Cielo concluded its divestment agenda from non-core businesses. Although the business turnaround took much longer than expected, we recognize that cost-saving is better than expected.

After the end of the quarter, Cielo announced the closing of MerchantE Solutions sale, a payment company based in the United States.

The company received US$137 million for the deal at the closing date. With the announcement of the sale of MerchantE, the Cielo ends an important divestment cycle, totaling R$ 1.3 billion added to cash from January 2021 to April 2022.

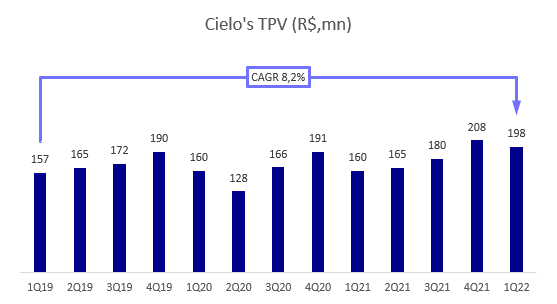

The TPV captured by Cielo Brasil was R$ 198.4 billion in 1Q22, the highest for a 1Q’, growing +23.9% YoY and -4.8% QoQ; despite that, historically, the 4Q seasonality had a more significant impact on the business.

Pre-payment volume totaled R$ 26 billion in volume, strong growth of 31% YoY, due to a 33.4% expansion in credit card TPV (vs. our 16% expectation).

We highlight that Cielo reported a substantial expansion of the acquisition of the receivables line, which reached 9.3%penetration, compared to 6.0% in 4Q21.

Also, the company reported a better card mix, as credit represented 60% of TPV (vs. 59% in 4Q and 56% in 1Q21). Consequently, Cielo is back on track for its operational momentum.

Finally, Cielo started to reprice its client base (mainly in the two-day payment modality) in January due to higher policy rates.

According to the company, card yield reached ~0.76% in the last week of Apr-22, vs. 0.67% in 1Q22. In the retail segment, the yield in the last week of April grew by 28bps vs. the previous week of March.

We’ll keep our expectation for card yield at 0.69% in 2Q22E. For 2022, we forecast TPV growth at +10.5%YoY, card yield at 0.69%, and recurring EPS growth of 6%YoY.