Hi 👋

We've got good news if you’re a Free Subscriber and wish to have access to paid posts without actually paying.

In the next few days, we’ll launch our referral program, in which we’ll offer a range of rewards based on your number of referrals.

We’ll bring more news soon.

GOOG

I'd expect the market to have a mixed reaction to the GOOG 1Q22 earnings report, as it showed two trajectories: better than expected Search results and weaker than expected YouTube revenues.

Actuals vs. Estimates: GOOG reported Q1 gross revenues of $68.01bn (vs.Consensus $68.06bn), or +23% YoY. Q1 GAAP Operating Income was $20.09bn (Consensus $19.74bn) for a 29.5% GAAP Operating Income margin.

Based on multiple channel checks intra-quarter, the direct response advertising environment (especially search) had remained robust as the tailwinds of post-pandemic recovery and new categories penetration increased, such as autos.

Concerning YouTube, I need more time to understand engagement trends, the mix of short-form vs. long-form video, and the overall brand advertising environment to better establish the drivers of the reported results.

About the Cloud biz, GOOG reported revenue growth ~ in line with the market (+44% YoY growth) and sustained high op. losses vs. 21' – questions on the mix of sustained growth, backlog, and path to eventual operating profits are likely to dominate the debates about Cloud.

For equity returns, I see GOOGL’s $13.3bn of Q1 share repurchases and an increased $70bn repurchase authorization as another step to sustain a multi-year trend of improved shareholder returns.

Overall, the $GOOG long-term trend seems intact, though I'd expect more negative prices on share prices due to video dynamics and Covid-related headwinds on search.

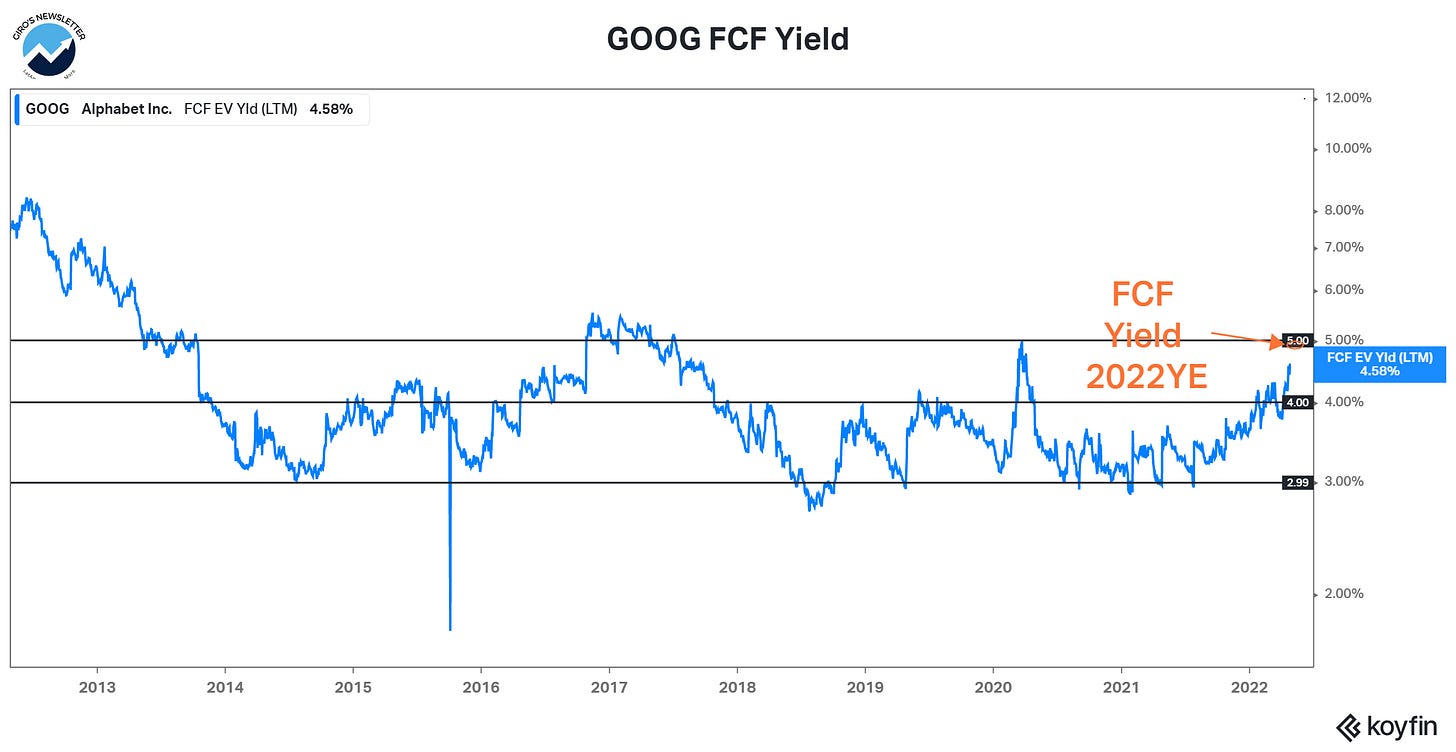

Nevertheless, we’d highlight its valuation, which looks depressed. After considering the 1Q22 earnings, our model still suggests an FCF Yield of 5% for 2022, a substantial premium to long-term Treasury Yields.

If GOOG’s market multiple is fair, the stock appreciation should be represented by its earnings growth, buyback, and dividends.

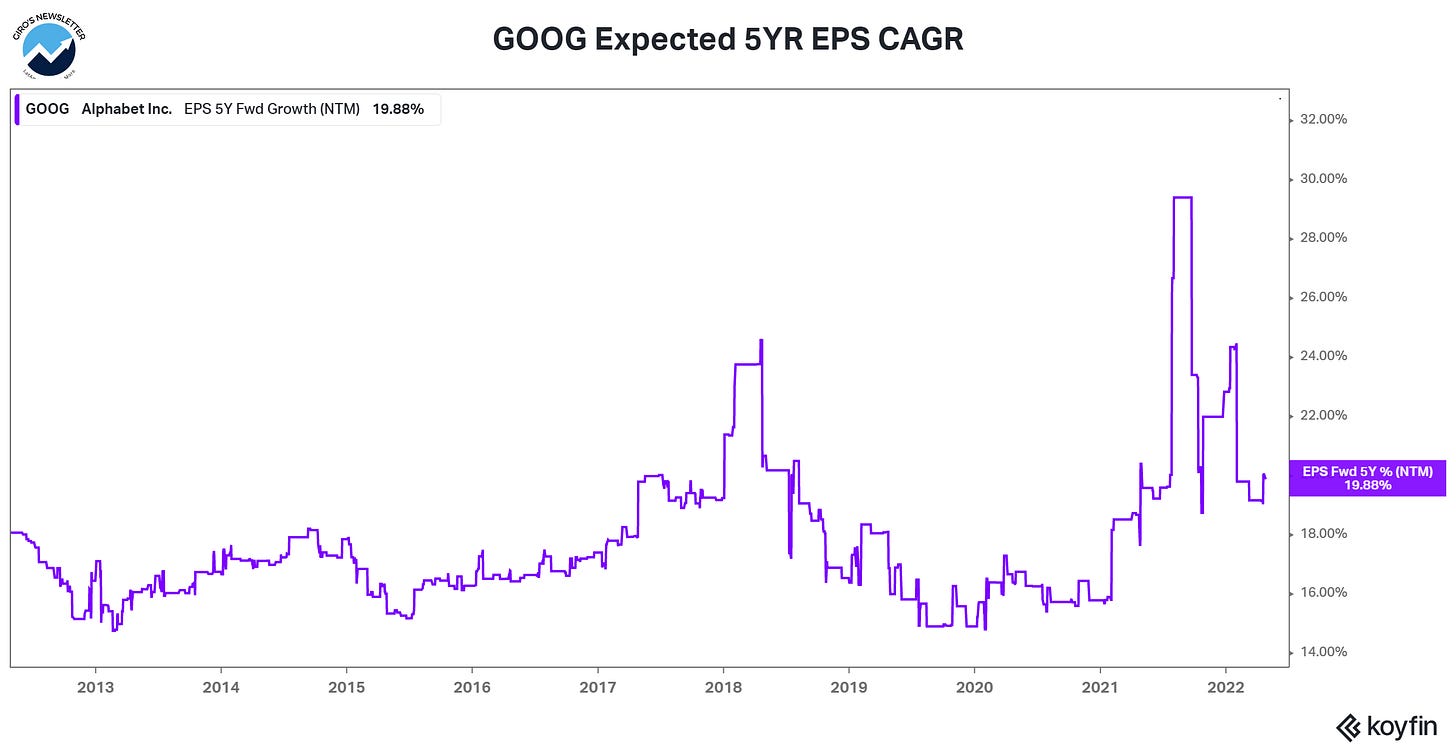

Considering only the earnings growth, the market expects a 20% EPS CAGR for the following five years, meaning that GOOG’s stock prices should yield this return. This is a considerable internal rate of return.

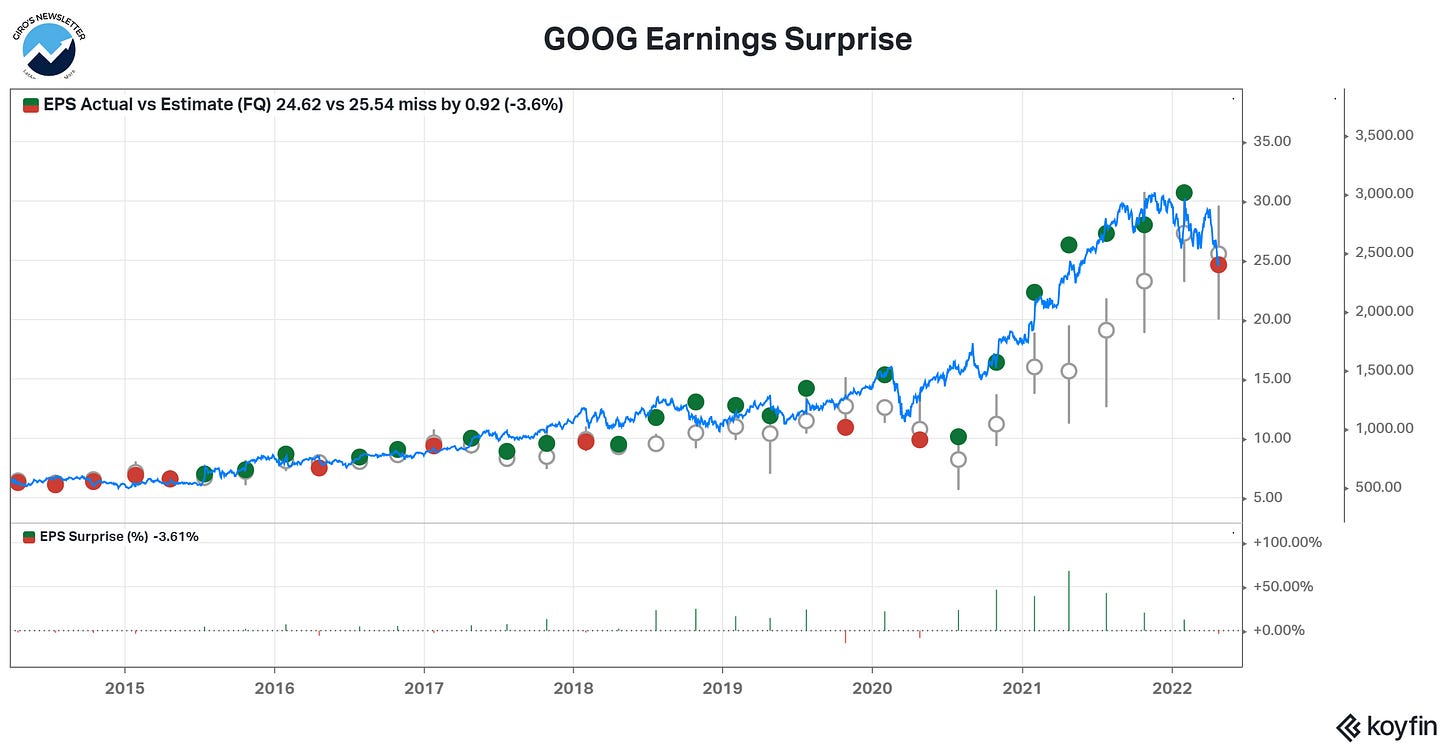

However, for a realistic scenario, we should be considering the average earnings surprise versus the consensus estimate and discounting it.

Looking at the all-time data, our sample captures 33 earnings releases, in which 33% of them presented an average of 4.3% negative earnings surprises.

Assuming a 50% negative earnings surprise and in-line for the other half, our bear case for GOOG would be a 17.5% internal rate of return, assuming no multiple re-rate, no buybacks, and no dividends.

We recently posted on Twitter, but we’ll stick to our simplicity thesis for buying exceptional businesses at a reasonable valuation. This is what GOOG looks like.

MSFT

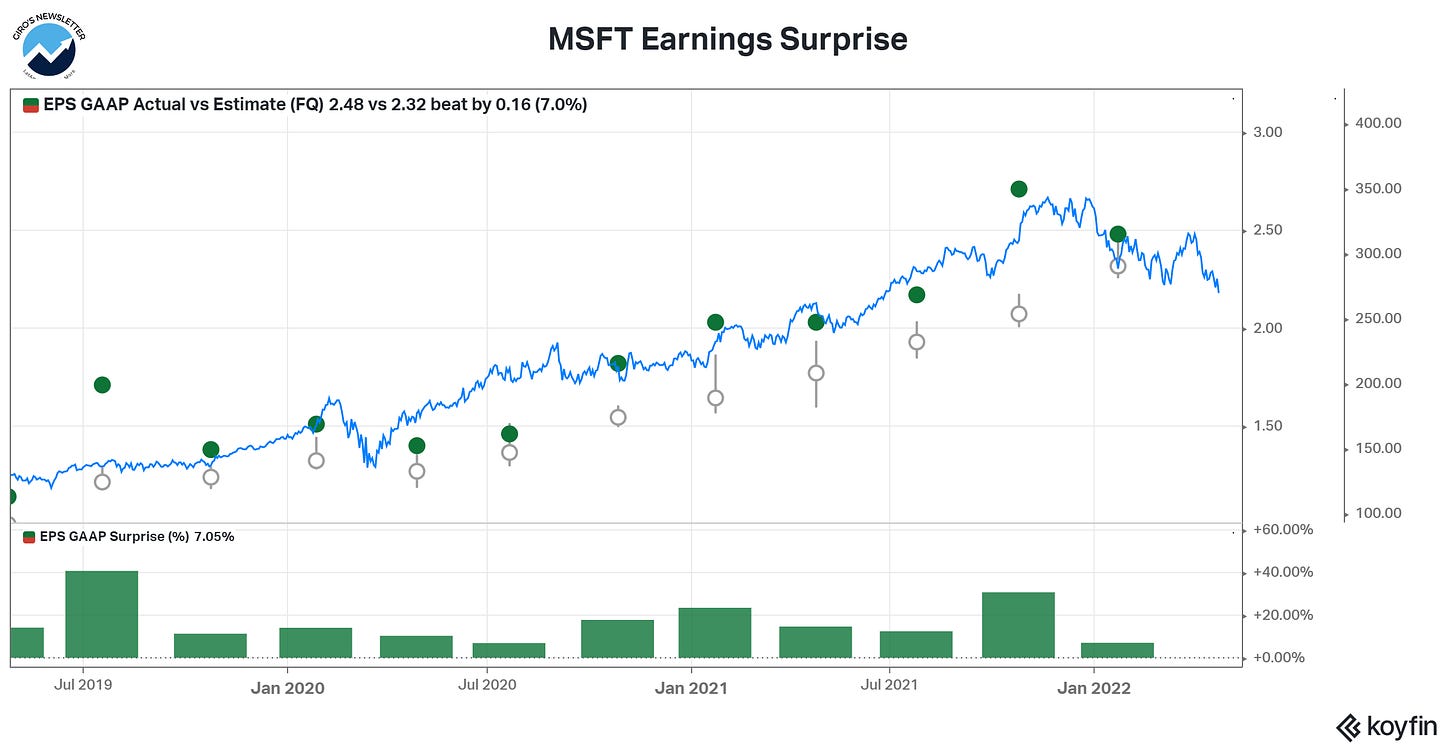

Unlike $GOOG, $MSFT showed a strong performance in its earnings, pretty much in every biz. $MSFT is indicated flat AH after reporting 1Q22 results that were relatively in line, with a slight beat in revenue of ~70 bps.

We acknowledge that the magnitude of the company's non-GAAP EPS of $2.22 (vs. Street expectations of $2.19) was weaker than in historical prints.

Looking deeper, we were encouraged by MSFT's performance across the following key metrics that are critical in identifying the overall health of the company:

- Commercial cloud bookings grew +35% YoY, vs. 37% in 2Q22, despite a 26pp more challenging comp.

- Re-acceleration in Azure's growth rate to 49% (vs. 46% in 2Q22), with an ARR of ~$45bn. This compares to Google Cloud's reported growth of ~44% YoY on a base of ~$23bn.

- Sustained mid-single-digit growth in Server products. As one of Microsoft's most economically-sensitive business offerings, ongoing spending is a strong indicator of the wider IT environment.

We also note the strength in the commercial PC market and the close of its Nuance acquisition on Mar 4 as drivers of revenue growth.

Overall, $MSFT reported strong figures, especially under more challenging comps. Moreover, we see the third company's third consecutive quarter of +20% y/y growth rate as considerably solid given Microsoft's +$200bn ARR business.

A decade from now, Satya Nadella will be recognized as one of the best CEOs ever. Even though MSFT has a look of criticism for its “buy and kill” strategy, it delivered a tremendous value to shareholders.

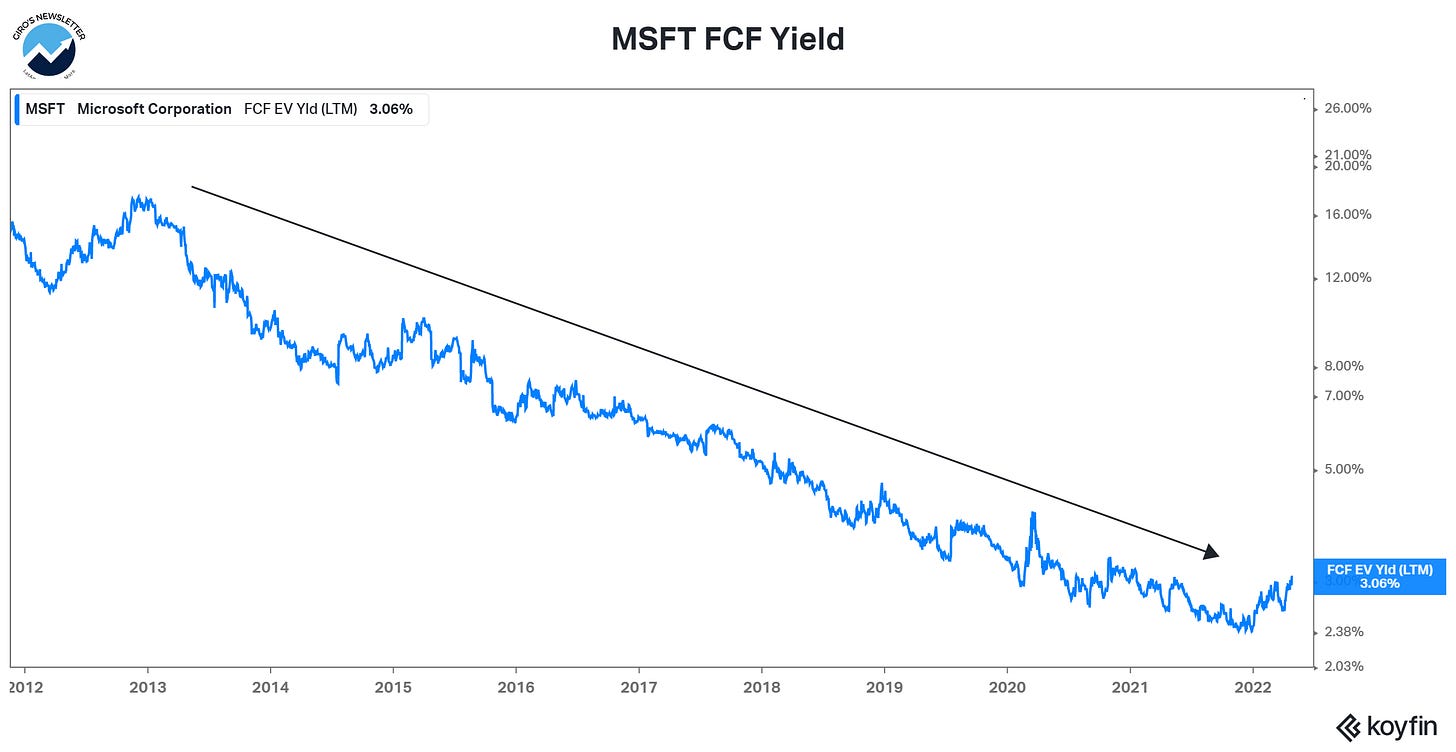

More importantly, Satya created an unparalleled earnings recurring machine. One of the most underestimated characteristics in most businesses is cash flow durability.