Today’s outline!

- Not Cool

- The Empty Breadbasket

- Add Fuel to the Fire

- A Fart in the Breeze

- Not Buying it

- In case you missed it (Sea Limited, Stone, Meli)

- Closed Ideas

This week Posts

- Friendly Fire in LatAm

- Schedule for April / Q&A

- PIX Surpasses Card

- Chairman Meeting Feedback

- Nubank - Part II

Not cool

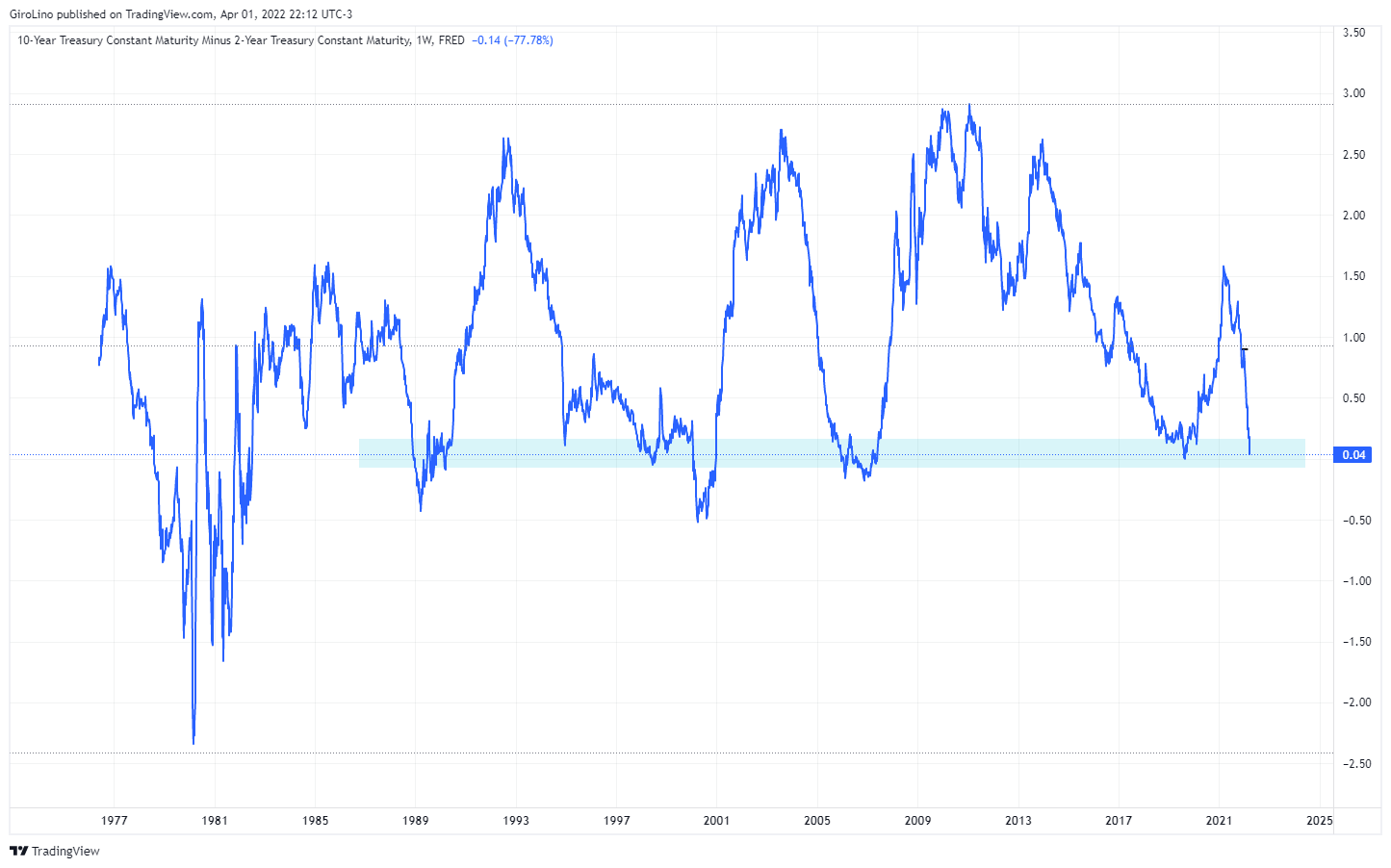

Since August 19th, the UST 2s10s curve has inverted for the first time. There have been nine instances of 2s10s yield curve inversion since 1965.

Despite these recent outsized moves, concerns are still high that more is to come as the Fed has embarked on its monetary tightening program.

Also, as commented in last week’s edition, the recent commentary from several Fed officials plans to be more aggressive on this front than previously expected, raising market expectations.

Over the past 30 years, rate expectations embedded into yields followed actual Fed policy rates.

So, if the Fed was hiking rates, rate expectations would rise. If the Fed was cutting rates, rate expectations would fall. More recently, rate expectations have risen well ahead of policy rates.

Even though markets are pricing a terminal rate a touch above 3%, don’t underestimate the current cycle. For example, Fed hikes in 1994 took the policy rate to 100-150bp above what was then.

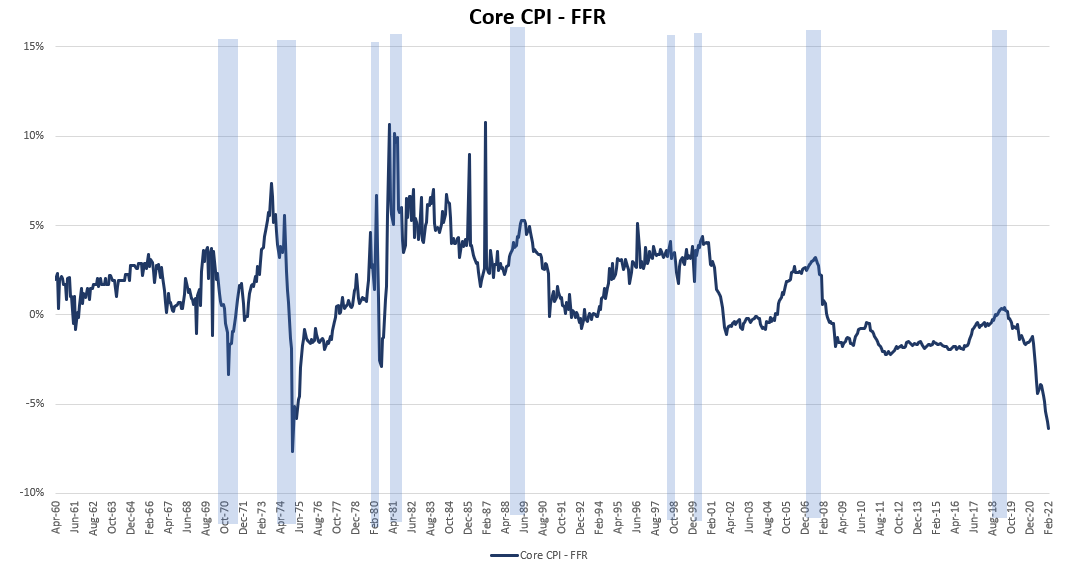

From an inflation perspective, the 1980s are also a precedent to remember. It is perceived that the aggressive tightening in the 1994 cycle under Fed Chair Greenspan was more about a pre-emptive strike to stem any possibility of rising inflation.

Inflation was a much more pressing concern in the early 1980s. Fed Chair Powell was reminded of the decisive actions of the Fed in the early 1980s under Chair Volcker - and Powell did not push back against the 1980s narrative. At that time, the Fed took policy 150-250bp restrictively.

Speaking freely — as I always will — in a scenario where the FED takes a restrictive policy above the neutral, the terminal rate could range between 3.5% and 5.0%, way above anyone’s expectations.

From the price perspective, since 1965, the 2s10s yield curve inverted a median of 20 months ahead of a recession. S&P 500 returns have typically been positive in the two years following yield curve inversion.

However, only on one occasion the 20 months forward returns were negative. You probably guessed this one; it’s 1980. And what is 1980 had different from all other samples? Yes, inflation shock.

The Empty Breadbasket

The crisis will likely have an immediate impact on grain exports from Ukraine and Russia. Most wheat and barley crops are harvested in the summer and exported during the fall.

Although it sounds scary, we might be walking into a humanitarian crisis. The war in Ukraine is devastating countries like Egypt, which generally gets 85% of its grain from Ukraine, and Lebanon, which got 81% in 2020 (96% considering Russia).

Ukraine and Russia produce 30% of the world’s wheat supply, 20% of its corn, and 75%-80% of the sunflower seed oil. Combined, both export ~36m tons every year.

Translating it to practical terms, ~12% of all calories consumed come from Russia and Ukraine. This is just the direct impact.

Globally only 48% of the world’s cereals are eaten by humans, 41% are used for animal feed, and 11% for biofuels. There will be a HUGE indirect impact from cattle, sheep, etc.

Tough choice for farmers. Whether he’ll less feed the sheep, that will create a supply problem, higher prices at the end of the supply chain, or more input costs passed down the supply chain.

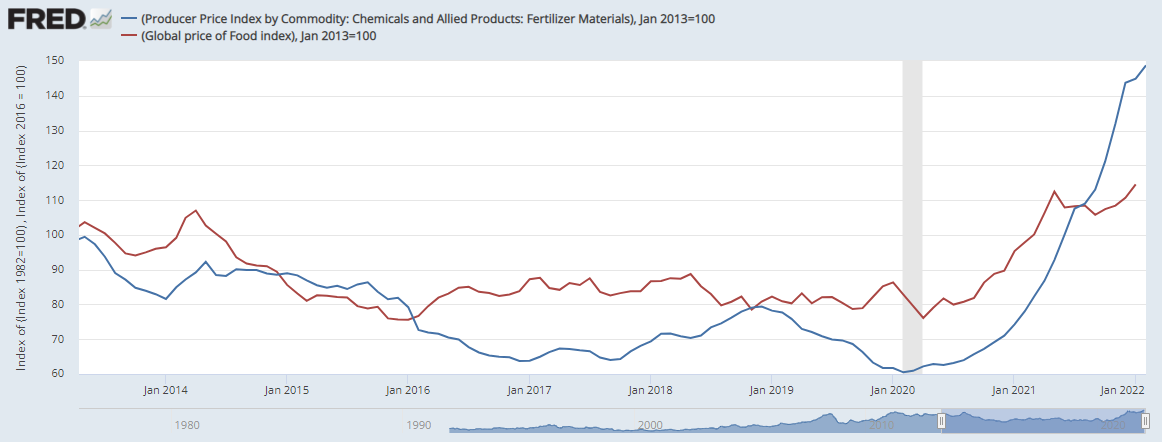

Farmers’ struggles began before the war. Last year, higher energy costs pushed up fertilizer prices, as did new curbs and export-licensing requirements by China, Turkey, Egypt, and Russia.

Food protectionism is spreading. Besides Russia, Indonesia, Algeria, Argentina, Hungary, Moldova, Turkey, Egypt, and Serbia are among a growing list of countries that are halting/curbing food exports.

Consider the case of Brazil, which imports 85% of its fertilizer—20% of which comes from Russia. However, due to high prices and unavailability, 72% of farmers in Brazil have not yet purchased fertilizer inputs for September.

The impact will be brutal. This chart shows it.

Add Fuel to the Fire

The US administration has confirmed a record large Strategic Petroleum Reserve (“SPR”) release of 180m bbl over the next six months, with the potential for other countries to release 30m to 50m bbl — ~1.2m bbl per day.

However, a release of inventories is not a persistent source of supply for the coming years, although it might accommodate Brent’s price in the following weeks.

In fact, lower prices in 2022 support oil demand while slowing the acceleration in shale production, leaving, for now, a deficit in 2023 with an eventual need to refill the SPR.

Upsides risks have not been resolved with today’s release:

- Potential logistical bottlenecks to such an unprecedentedly large and long US SPR discharge could reduce its flow rate, with potential congestion on the Gulf Coast in getting to refiners or export terminals.

- The risks of slower shale growth are due to rising cost inflation and binding service bottlenecks. In addition, the US policy use of an SPR release, a potential deal with Iran, extreme price volatility, and the growing risk of a recession next year, reduce producers’ incentive to expand.

A Fart in the Breeze

The Chinese Securities Regulatory Commission and other regulators are drafting a new framework that would allow most Chinese companies to keep their US listings, Bloomberg reported on Friday.

Beijing is set to give US regulators the auditing reports of most of the +200 Chinese companies listed in the US, though many should be delisted.

Admittedly, I’ve been carrying a positive view of Chinese Internet stocks in the past weeks, although price action is telling me to stay on watch.

Not buying it

A historical 25% run-up in home prices in the past couple of years, a recent surge in mortgage rates, and a 60% lower inventory of available homes are pushing an increasing number of buyers away.

While rates are still relatively low historically, the increase, coupled with higher home prices, is likely to worsen affordability.

This has been my best short this year. So few people realize that homebuilders are short commodities, labor, and long credit — huge beta. So you can get richer at the same pace you could go bankrupt.

In case you missed it (PIX, Rates in Brazil)

Sea Limited

Giro Lino @giro_lino$SE is leaving India, so they'll have space to focus in different regions, such as Brazil 🇧🇷 I wrote a couple of times about $SE, briefly commenting about their operation in Brazil and competition vs. $MELI. The truth is there are only a few ways for $SE to thrive 🧵🧵🧵⬇️⬇️⬇️

March 30th 20226 Retweets47 Likes

Stone

Giro Lino @giro_lino$STNE's Chairman, Mr. Street, and CEO, Mr. Piau have been meeting with the market in an attempt to clear the air. 💳💳💳 I'll talk to a friend who attended to a meeting. So, I'll write-up in tomorrow's Daily Crunch. 📔📓📒 Make sure to subscribe for 🆓 to read it (link in Bio)

March 31st 20221 Retweet22 Likes

Meli

Giro Lino @giro_linoHave you wondered why $MELI outperformed peers in 2021? Considering that most of them offered massive subsidies for sellers, we should have expected otherwise. Right? Let's see...🧵🧵🧵⬇️⬇️⬇️

March 31st 20222 Retweets19 Likes

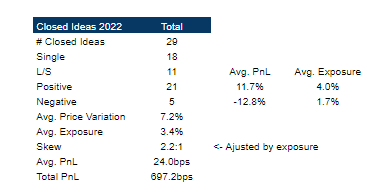

Closed Ideas

If you're a subscriber, don’t worry. I created a new section (“Trade Ideas”) to improve our communication. You can expect to receive all PRO content in your mailbox.

Also, all posts/ideas will be saved in this new section, so you can find any topic much more quickly from now on. : )