One of my favorite duties as an analyst is meeting new people. As a curious person, it’s like a perfect excuse for asking a bunch of questions to strangers.

By the end of the day, the person believed that I did a good job, looked like someone really interested in the conversation, and even better because I learned a lot of new stuff.

The preparation for most meetings is massive, though. I go over where the person comes from, their culture, which university they went to, who is their boss, and most stuff related to their duties in the company.

Throughout these years, I took a lot of notes. I mean, a lot. There is something remarkable in them. For example, talking to managers, I always hear about strategy, goals, and planning.

There was probably no single conversation I didn’t hear about yearly targets, strategic meetings, target margin, etc.

Then, as my career advanced and I reached C-level executives, a contrast in communication shocked me.

Talking to C-level executives, you don’t hear many numbers about the company’s finance or most topics managers focus on. Of course, they care about it, but it isn't their priority.

High-performing companies have a great culture, and great culture is defined as the attributes that cause high performance.

In other words, when you ask someone if Amazon has a great corporate culture, they will tell you it does. (And it’s a highly successful company, so it does.)

But when we try to pinpoint which aspects of Amazon’s culture make it more successful than its peers and which would be predictive of success at other companies, we run into a complex problem.

The attributes we think are causal of success are the same ones we often deem causal of failure when company performance deteriorates.

Weird, right? This is what we call a paradox.

Strategy and planning are essential, indeed. But don’t be naive: “Everybody has a plan until they get punched in the mouth.”

Culture eats strategy for breakfast. Everybody enters the ring with a plan. There is a little competitive edge in doing so.

I remember an interview I heard last year from Shake Shack’s Founder Danny Meyer:

I finally realized, well, you’re darn right, it doesn’t feel the same anymore, and the culture isn’t the same anymore because culture is not something that wants to be contained or maintained. Culture is like a shark. It’s constantly moving, or it dies.

(My notes, so not quoted)

As a professional notetaker (a.k.a. analyst), I’ll summarize my knowledge of decision-making and dealing with highly unpredictable scenarios.

First, data and analytics. Without them, you can’t even diagnose what your company is going through. I can tell you that 100% of terrible C-level managers I met in life loved the gut feeling.

Second, build a signpost. Again, do not set a course, but consider the alternatives you can try. There is a fragile line here, though.

Good managers hate losing money, so their priority is avoiding risk. But, throughout the years, I noticed that sharp managers loved to have flexibility.

I noticed it through FP&A managers. It’s unbelievable the number of times a few of them have to review the entire budget repeatedly, and most changes are leaned toward flexibility (or diversification) and risk reduction.

Finally, management has to decide how much money to deploy and how to coordinate the entire team. Seriously, this is 100% soft skill.

So far, I found only three pieces of empirical evidence that helped me find those managers: at least two founding members in C-level positions, a 10yr track record for professional C-level managers, and former senior partners admiring the company after their departure.

Today’s outline

- Shortsighted Solution

- Worried About Zombies

- Financial and Physical Assets

- Meanwhile, in China…

- Stop Fighting It

This Week Posts

- You Heard This Lie Before, June 16th, 12 pages

- New Step in China ($XXX), June 13th, 5 pages 🌟

- Food for Thought #21, Jun 12th, 14 pages

Premium Posts in June 🌟

(Long-form only)

- Stone - New Model (Pinned), 25 pages

Milestone Watcher

→ 259 Pages, 30 issues, 86% Without a Paywall, 13h Channel-Check Calls in May.🔒

→ 121 Pages, 10 issues, 73% Without a Paywall, 7h Channel-Check Calls in June.

→ 1,228 Pages In 2022, 1,940+ Hours Researching, 110 Issues Published.

Shortsighted Solution

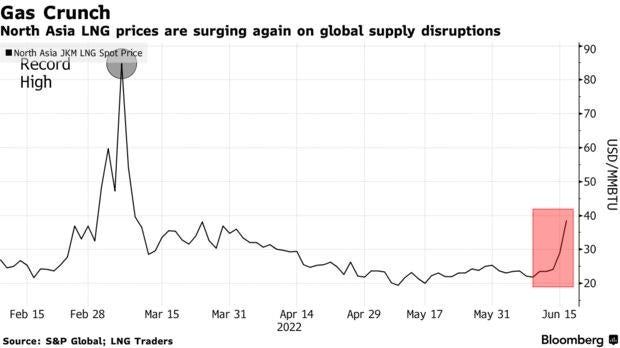

The cooperation between US/EU on LNG includes a wide range of measures to solve the short-term and long-term issues for the European demand.

Ultimately, we think that potential near-term measures will primarily focus on reallocating supply to Europe rather than actual increases in total US LNG export volumes.

For Europe, such measures would increase summer supply at the margin, helping take European storage to comfortable levels ahead of the following winter.

However, we found the short-term solution a joke, and just a couple of months later, we’ve seen its impacts on the market.

The United States has around 100 million tons of US LNG export capacity, with another 20 million tons under construction and expected to come online by 2025.

The problem is the US LNG export capacity is already fully utilized, and adding even a single export train in a brownfield project takes at least 2.5 years.

These short-term redirection measures are unlikely to prevent demand-destruction-type gas prices from re-occurring until global LNG supplies increase significantly from 2025.

The US has simply redirected its volume from Asia to Europe. That is it. Nevertheless, Asia has turned to Australia for incremental volume and new long-term contracts, so demand will keep increasing above expected. 🤡🤡🤡

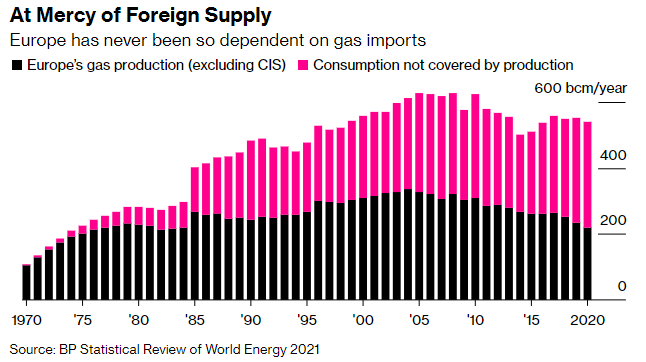

For Europe, this is a consequence they’ll have to face after scrutinizing the O&G industry for a decade, creating a significant regulatory burden that disabled new investments in infrastructure.

Worried About Zombies

When we think about the cost of capital, most of us believe the world is ruled by it, and there is no exception.

That is not true. If we were to set a rule, the most plausible one would be the inverse to be true. Most SME companies don't see them as sophisticated capital market investors. Forget about it.

For them, the measurement of specific metrics, such as the cost of capital, is non-existent. They're mom and pop shops trying to make their living, not stock analysts looking at complex long-term DCFs.

Personally, I had a company before my first job in the financial industry and knew nothing. But, as it happened to me, I believe most companies see their cost of debt as the financial cost of capital.

In an environment ruled by low inflation and low rates, most of these companies rely on debt to fulfill their obligations to suppliers and the workforce.

However, an excessively low rate environment has its dark side. Most businesses operating under an unsustainable model with sub-optimal profitability are dead-walking companies.

Their business exists due to lower debt costs when, in fact, their business model is not sustainable. Consequently, when the tide turns, many of these corpses should start showing up since they were not sustainable in the first place.

Recently, we posted on Twitter about a few dudes buying dozens of houses and using them as collateral for new mortgages.

However, since the spread between the capitalization rate and fixed mortgage rate never became negative, we believe they went to variable rates that were negative for a while.

This is a silly example, but many small mom-and-pop shops relied on cheap working capital for years. But, unfortunately, their time is over.

Financial and Physical Assets

Trading equities is different from commodities. The latter is about physical availability, even though volatility may distract most speculators. As we know, energy companies have been under siege for over a decade.

These policies impact physical markets in different ways. For example, the environmental policy restricts companies’ access to equity and bond markets, lowering their ability to make long-run Capex investments.

The rise of ESG investing has coincided with an imbalanced climate policy program focused on lowering hydrocarbon demand with little or no focus on managing the decline in hydrocarbon supply.

Without a clear policy around hydrocarbon supply, the market has taken responsibility for restricting access to capital for hydrocarbon companies — via ESG investing — to drive the transition.

This is another hammer/nail situation. Overshadowing a problem doesn’t mean the issue isn’t there anymore. This is stupid.

However, with energy companies facing a declining long-run demand profile, there is little incentive to grow long-run supply capacity, even though millions of jobs rely indirectly on oil.

As a result, capital restrictions and asymmetric policy have prematurely lowered the supply of hydrocarbons and forced prices and physical inflation.

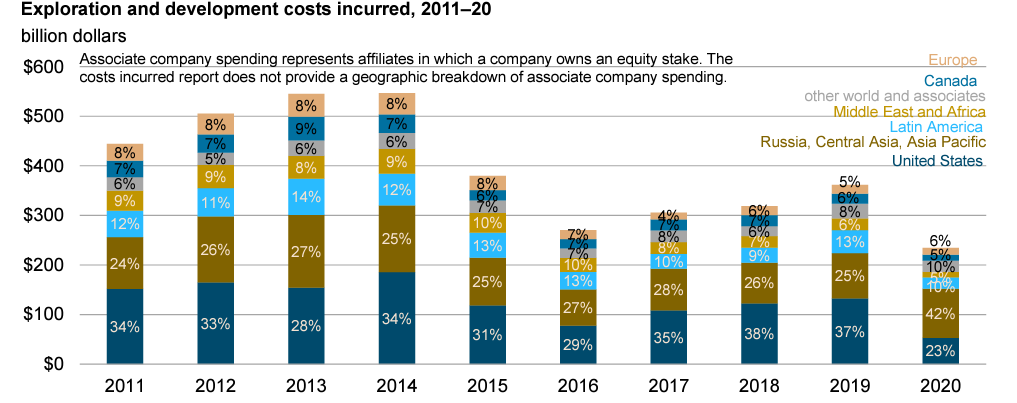

From 2014 to 2019, the global oil and gas upstream capital spending fell 36%, and Capex commitments in long-cycle oil and gas projects have been cut by more than half, while today, physical inflation in the Eurozone years to correct.

Finally, there is the risk of a concentration of investment in new E&P projects in different regions, leading to an energy dependence for a few areas.

For instance, from 2011 to 2020, the investment in exploration development in Europe shrank by almost half, creating a situation where the countries might rely on external supply, such as Russia. 🤡🤡🤡

Stop Fighting It

It’s no secret that 2022 has been a soft year for LNG purchases in China, with imports falling every month since December, and the first four months of the year also saw declines from the same month in 2021.

What has happened is that Chinese utilities have largely withdrawn from the spot market and are taking only their contracted volumes.

High spot prices undoubtedly play a part in the reluctance to buy cargoes. Still, it's also worth noting that domestic coal output has been at record levels this year as Beijing prioritizes ramping up coal-fired power generation.

China is one of the most prominent investors in wind and solar, but leaders called for more coal-fired power after economic growth plunged last year and shortages caused blackouts and factory shutdowns.

Russia's attack on Ukraine added to the anxiety that foreign oil and coal supplies might be disrupted. That is, energy security is a crucial concern for the party, regardless of the climate cost.

This year, some Asian buyers were unwilling or unable to procure LNG at current spot rates, instead choosing to wait for prices to come down before refilling inventories.

That risks leaving buyers short in extreme weather or other significant disruptions. Thankfully for importers, the country cut back spot purchases this year after virus restrictions eased usage.

While demand is seen recovering by winter, China’s LNG importers don’t want to buy spot shipments at current prices since they would lose when the fuel is sold into the much cheaper domestic gas market.

Unlike the West, though, China is getting ready for its next decade of growth, prioritizing its five-years plan.

For instance, recently, we saw the state-owned China National Petroleum Corp. and Sinopec negotiating to invest in Qatar’s $29 billion North Field East project.

The companies are looking to procure LNG under long-term contracts, two people familiar with the matter said. Reuters earlier reported the news.

Turn to China, Dude

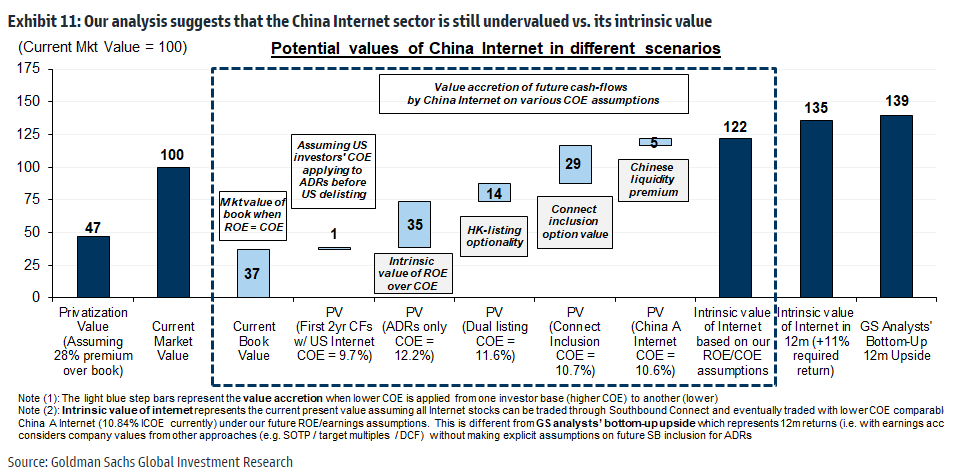

I know many of you dislike the idea of investing in China, even though I can’t understand why investing in LatAm, on the other hand.

In my recent interview with my friend Conor, I highlighted the misconception about investing in LatAm and China.

In my opinion, the biggest misconception I often see is that it’s safer to invest in LatAm than in China. I’m not commenting about China, but LatAm is one of the most hostile regions in the world if you’re an entrepreneur.

China has its particularities — true —but since you understand how the party communicates matters more than how often they do it, your life investing in Asian stocks will improve.

In general, Asian countries value and respect tradition, so announcements in the highly regarded events, though they might be short, send invaluable information.

Chinese policy put option has been activated as communicated in some high-profile Party and government meetings (Vice Premier Liu He's statement on March 16, the statement from the Politburo on April 29, and Premier Li's teleconference on May 25) in recent months.

I’ve heard for a decade, “Don’t fight the FED, stupid.” But, contrary to the rest of the world, which is going through harsh monetary tightening, China is launching an unprecedented easing cycle that will last years.

Finally, Chinese equities seem to price in a perpetual bear cycle. Even among the optimistic, their assumptions are so conservative that it makes me wonder if investors understand the underlying upside in Chinese equities.

I’d like to highlight a slight imprecision in the above methodology. Even though we recognize the importance of avoiding risk, I find the analysis overly conservative.

First, the ROE/COE assumptions are based on short-term estimates, which may not be adequate for internet companies, as I know that many surpass short-term results as Opex expects superior returns in the future.

Second, we checked for each company under GS coverage, and analysts are using a COE between 12%-16%, which doesn’t match the 11% from the top-down modeling.

Assuming a 15 years duration for Chinese internet companies, which is reasonable considering how mature those companies are, there would be a substantial upside risk for these estimates.