Today’s outline

- Edge of the chasm

- Two sides of the same coin

- Breakout week

- In case you missed it ($MELI, $STNE, $NU)

- Portfolio (PRO)

- Watchlist (PRO)

- Brazilian Banks ($BBD, $BDORY, $ITUB) (PRO)

- Making money with elections in Brazil (PRO)

- Short Populism (PRO)

Links to Interactive Models (PRO)

- Stone ($STNE), Petrobras ($PBR), 3R (BVMF: RRRP3), Sinqia (BVMF:SQIA3)

Edge of the chasm

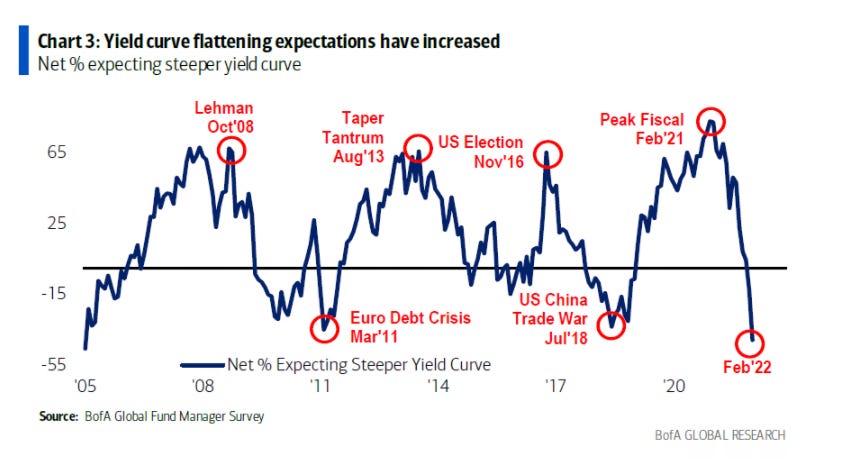

On Tuesday, BofA released its Global Fund Manager Survey, a claimed report for identifying market sentiment and global trends.

Investors continue to see hawkish central banks, inflation, and asset bubbles as their main concerns. In addition, they continue expecting EM equities and Oil to outperform in 2022.

Nevertheless, the chart above caught my attention, which shows yield curve flattening expectations have increased, reaching extreme levels seen only a few times in the past two decades.

A flat yield curve is an indication that investors are worried about the macroeconomic outlook. A few reasons the yield curve may flatten is market may be expecting inflation to decrease, lower growth, or the FED to raise the federal funds rate (“FFR”) in the near term.

Two sides of the same coin

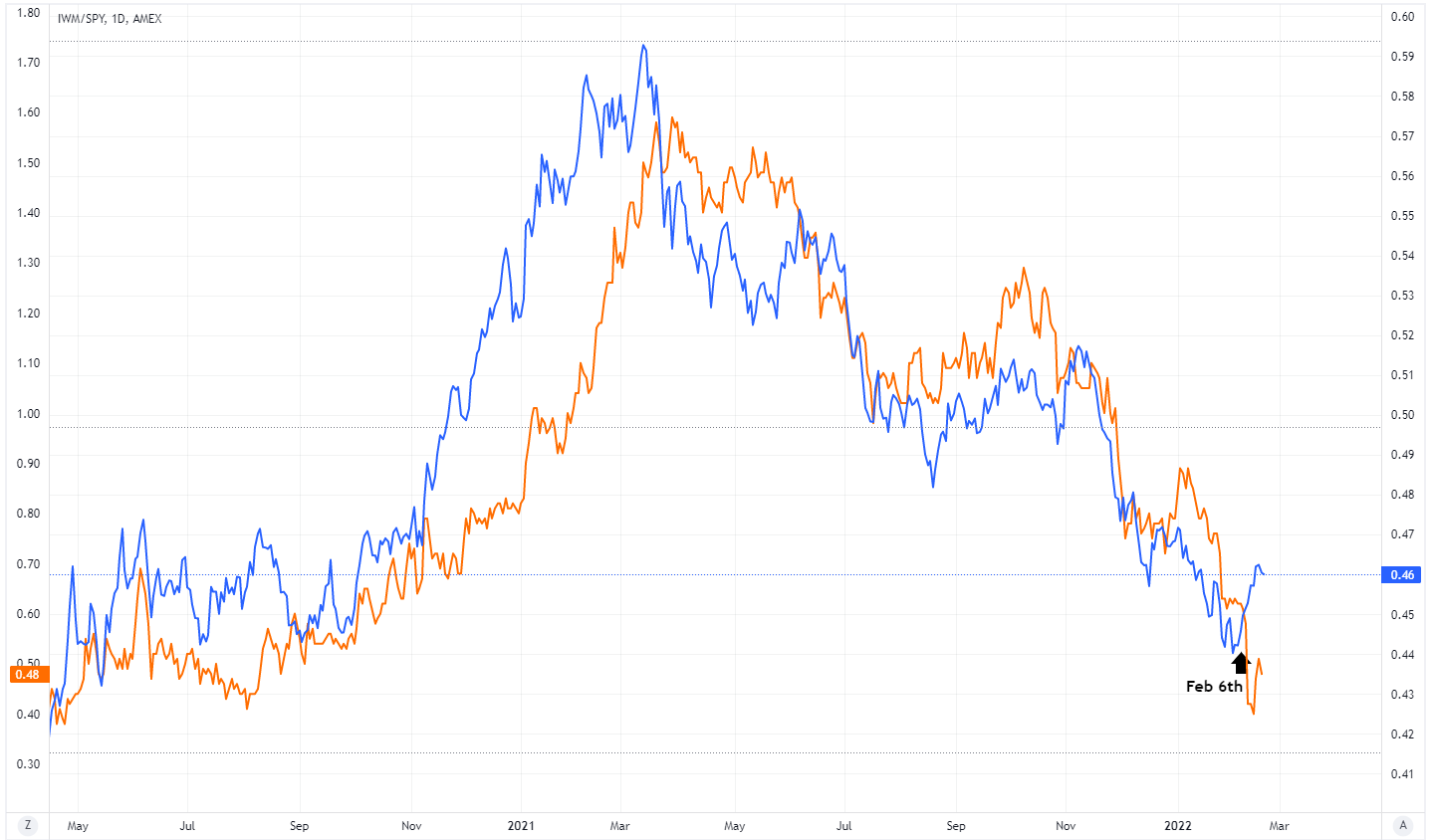

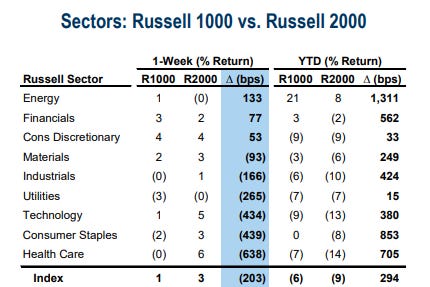

From a fundamental perspective, the Russel 2000 small-cap index is composed of cyclical small-cap companies and shows signs of growing weakness.

Since November, the bottom-up consensus forecast for Russell 2k profit margins dropped 4p.p. in 2022. Also, roughly a third of Russell 2k stocks should report negative net income over the next twelve months.

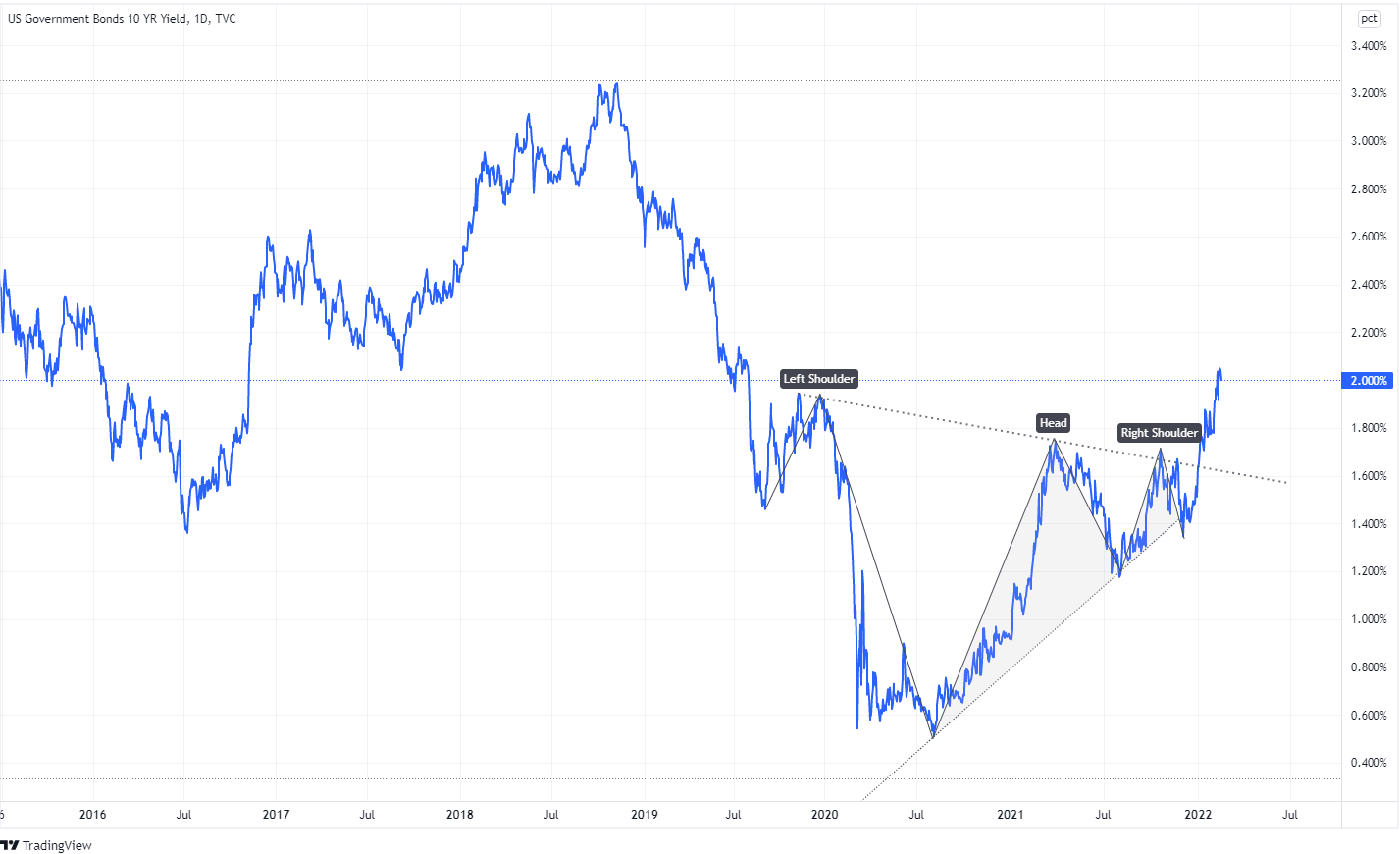

Also, the spread between 10yr and 2yrs maturity USTs has confirmed the lower growth environment trend, pricing lower growth ahead.

Affected by lower growth expectations, the Russell 2000 also contains stocks popular with US retail investors, which tend to hold tech and small-cap stocks, have been weakening breath since 2021.

Although sentiment toward commodity and other value companies has been increasing since September of 2021, the companies representing these sectors in the Russell 2000 have been lagging Large Caps.

Baskets with higher exposure from retail investors have been suffering inflationary pressure on valuations, lower growth expectations, and aggressive retail outflow from equities — tech allocation fell to the lowest level since August 2006. We like that.

Since you’ve been reading my stuff for more than a month, why don’t you redeem a free trial?

Breakout Week

I’ve been writing a lot about the steady advance in commodities sectors, and they may (continue) be the most critical development in the financial markets.

My favorite sector as a proxy for implicit inflation is metals and mining. Recent events, such as easing policies in China to stimulate demand and US data, might have led to the next leg-higher for the sector.

The second piece of evidence contributing to this thesis is the serial breakout in the bond markets (Japan, Germany, US,…) that soared through the past couple of weeks.

Finally, the last breakout of the week I’m using as evidence to my bull thesis on XME is Brent, who broke a 12-years falling wedge. Also, the bull thesis for Oil continues to play out, as we vastly discussed over the past weeks.

In case you missed it ($MELI, $STNE, $NU)

$MELI

Giro Lino @giro_lino1/n It's on the news today that $MELI has started to operate as a payment initiator. That means that if you wanna transfer money to your $MELI account from a different institution, u can issue the transfer from Pago's account! So, you don't have to leave $MELI's app anymore.

February 16th 20226 Retweets57 Likes

$STNE

Giro Lino @giro_lino1/n More awful news on $STNE. The company is looking for a buyer for a minority stake in TAG, its registrar company. I'll summarize how a receivable operation works and why this is a bad sign for $STNE.

February 16th 20221 Retweet16 Likes

$NU

Giro Lino @giro_lino1/n Well, I finished Bradesco's report on $NU. Before giving my opinion, let me tell you how I read sell-side reports. I don't care much about the writing, as they usually copy it from the prospectus. Instead, I focus on looking for mistakes in their estimates, which is typical

February 16th 20222 Retweets40 Likes

PRO Content

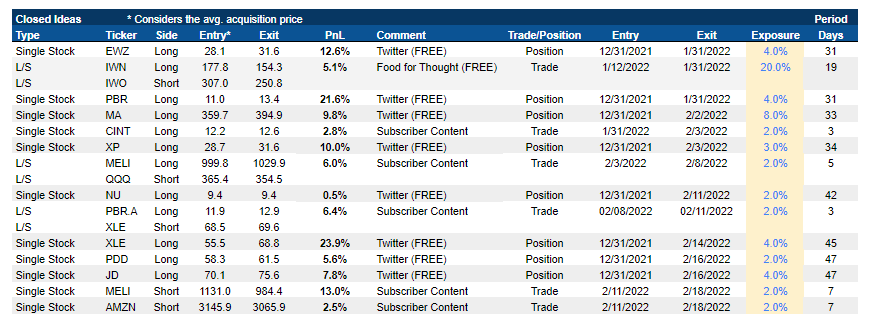

Closed Ideas in 2022

Research Schedule

I’ve been working hard on offering the best research to my readers. I truly believe that is possible, but I need your help.

Giving feedbacks is the best way you can help me to organize my schedule. So, it would be great if you help me answering this form.

Since I’m not collecting any personal information in this form, please, feel free to get in touch with me at [email protected].

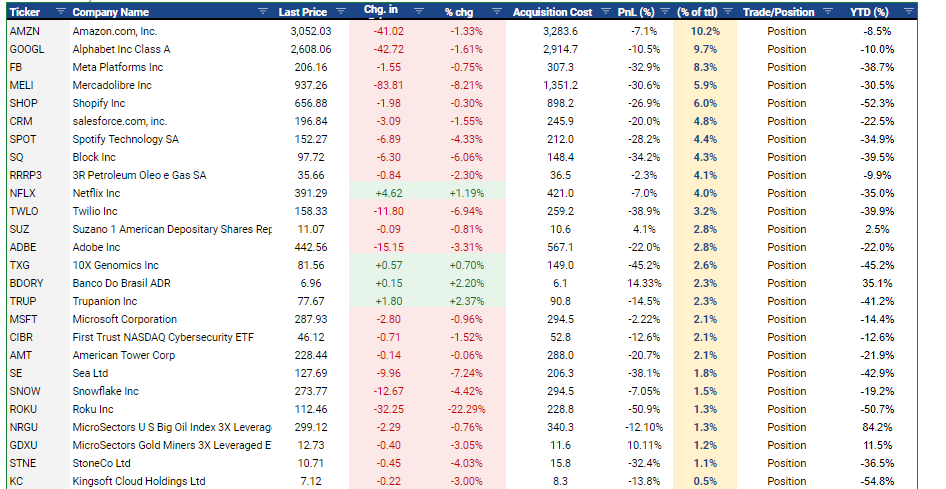

Portfolio

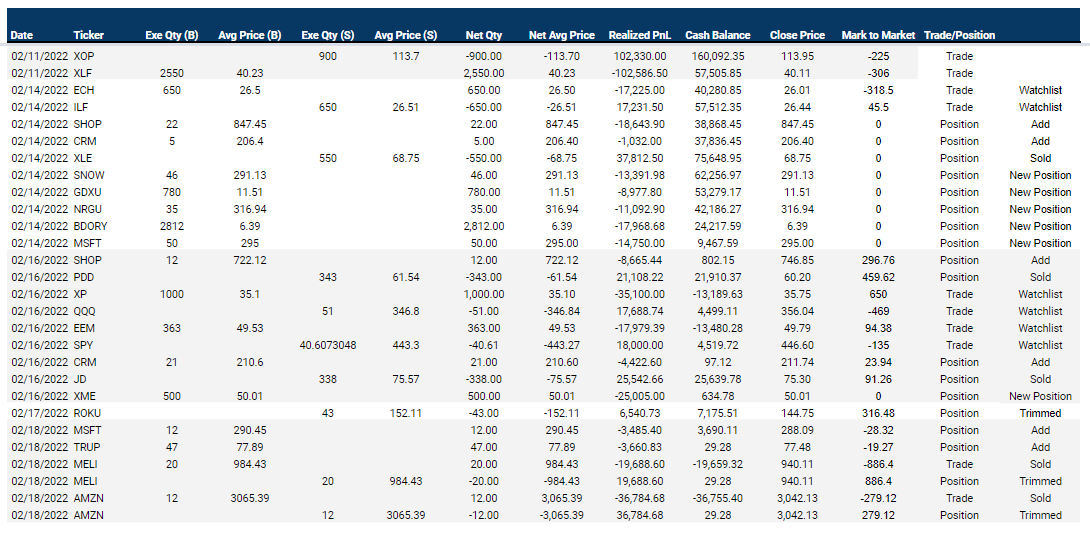

Trade Log

Position

New: i)$SNOW, ii) $GDXU, iii) $NRGU, iv) $BDORY, v) $XME and vi) $MSFT.

Add: i)$TRUP, ii)$CRM, iii) $SHOP

Trimmed: $ROKU

Sold: $JD, $PDD, $XLE

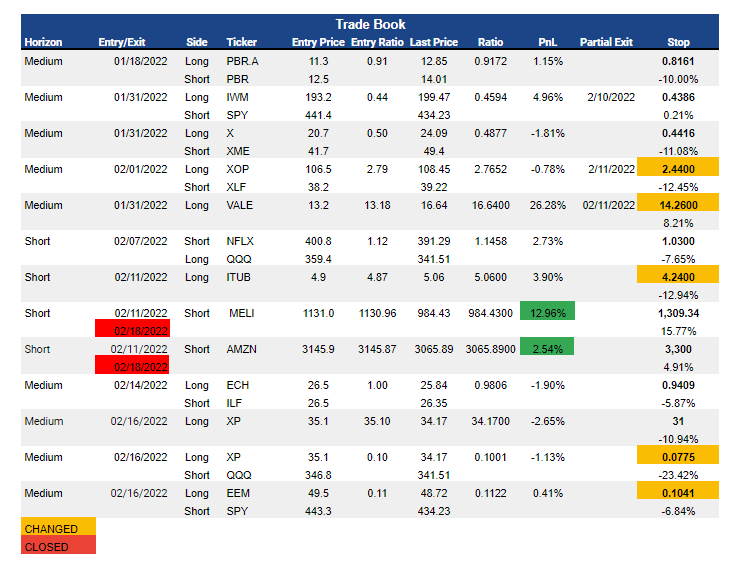

Trades

New: i) $ECH/$ILF, ii) $XP, iii) $XP/$QQQ, iv) $EEM/$SPY

Coverage short on $AMZN and $MELI.

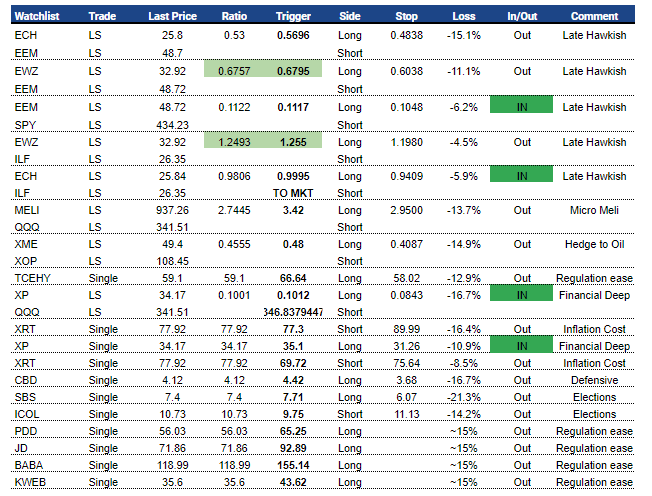

Watchlist

Links to Interactive Models

Stone ($STNE)

Password: STNE2022#

Sinqia (BVMF: SQIA3)

Password: SQIA2022#2

3R Petroleum (BVMF: RRRP3)

Password: RRRP2022#

Petrobras ($PBR)

Password: PBR2022#

Brazilian Banks ($BBD, $BDORY, $ITUB)

With both guidances in hand, Bradesco ($BBD) and Itaú ($ITUB) are suggesting that the level of loan growth in 2022 should remain robust (at low double digits), and top-line should maintain a decent expansion while asset quality is expected to present some deterioration in 2022.

Based on the midpoint of each guidance metric and considering a few more other assumptions, Itau Unibanco may deliver an earnings growth of 13% in 2022, while Bradesco of 7%.

As for Banco do Brasil ($BDORY), net interest income should improve both on the assets (volumes, mix, and repricing) and liabilities side (savings and judicial deposits). Meanwhile, the bank expects asset quality to remain under control, noting that coverage consumption could be from current high levels (325%).

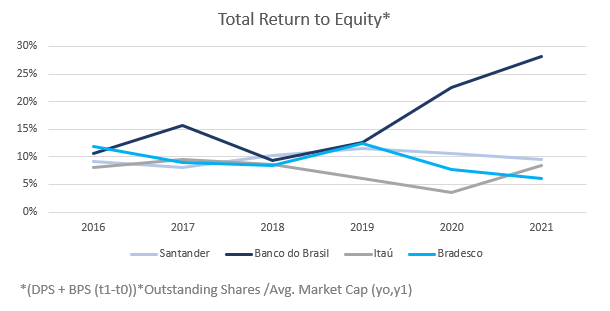

A metric I like to watch to assess return to equity is the change in the book value, dividends over the market capital. For me, this is the total return to equity the bank delivered over the year.

In the chart above, Banco do Brasil is the bank that has been delivering the most significant return to equity (equity + dividend), while Itaú has been showing a resilient operational track record, though stock trades with premium to peers. I’m holding both.

Making money with elections in Brazil

Nope. I’m not talking about Bolsonaro or Lula. Instead, it’s about Tarcísio “Truck” Freitas, the government Infrastructure minister running for Governor of São Paulo.

You might not know Tarcísio, but he is known for being one of the few Ministers who is doing a superb job. He is famous, open-minded, and loves privatization.

For that, a story that might gain traction in 2022 is Sabesp’s (NYSE: SBS) privatization, a water utility company owned by the State of São Paulo.

If the story gains momentum, as it did during elections in 2018, I’m talking about 70%-100% leg-up. So if the time comes, be ready.

Short Populism

Not talking about Brazil this time, but Colombia has elections happening in May. Many Colombians, tired of the country’s prolonged period of polarization, hoped this would be the year things changed. Ahead of presidential elections in May, efforts by erstwhile centrist rivals to unite behind a single candidate looked uniquely promising.

The Center Hope Coalition – an alliance of centrist and center-left politicians from different parties and independent movements formed last June – have touted their “strength through differences” and made rejecting the extremes a campaign platform.

But as quickly as hope came, it seemed to have evaporated. After two weeks of defections, recriminations, and infighting within the Coalition, unity in 2022 looks increasingly out of reach.

For that, populist candidates from far-right and left wings are gaining momentum. Just it happened in 2018. So if the time comes, be ready.

Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money.