Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money.

.

Today’s outline

- Latest Posts ($NU, PIX)

- Tightening Condition

- Calibrating estimates

- What charts are telling us?

- In case you missed it ($PBR, Oil, GDP)

- Closed Ideas

Latest Posts

Giro’s NewsletterNubank ($NU)Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money. (Reading time 39 minutes) Hi. This week, I approached Nu Holdings Ltd. (“Nu”) from a qualitative perspective, telling the reader company’s history, the services, any possible conflict of interest, and many more…Read morea month ago · 1 like · Giro LinoGiro’s NewsletterSantander launches PIX ParceladoHi Santander (NYSE: BSBR, BVMF: SANB11) announced a new product, the "PIX Parcelado," a new solution for the Brazilian Instant Scheme ("PIX"). Within the Brazilian instant payment (IP) ecosystem, Banco Central do Brasil (BCB) created Pix, the Brazilian IP scheme that enables its users — people, companies, and governmental entities — to send or receive pay…Read more2 months ago · 1 like · Giro Lino

Tightening Condition

In the past couple of weeks, the sell-side started reviewing its expectations, which is a challenge amid the uncertainty of war and disruptive geopolitics.

The consensus is that commodities are the primary channel for inflation and growth — though we cannot discard the odd of a shock related to recent events, such as the US banning oil import from Russia and the European Commission proposing a sharp cutback on gas import.

However, I don’t think the EU could reach energy independence any time soon. Much has been said about acceleration on the run for alternative energy sources. I partially agree.

One of the primary components in renewable energy is scarce and expensive base metals, such as Nickel. Therefore, I would not expect any short-term changes.

In my opinion, the consensus baseline for Brent and European natural gas are still behind the curve, in US$100-110/bbl and €100-120/MHw.

Higher energy prices and upward pressure on foods prices (wheat, corn, and so on) should generate a material impact on inflation, kicking the annualized inflation for 1H22 for a multi-decade high (>7%).

Although the threat to global growth comes from a drop-off in consumption, weakening job growth, and tightening financial conditions, sentiment in the US still booming given the excess savings cushions (wealth is up almost 15% vs. pre-pandemic). Nevertheless, the US growth will eventually suffer from conditions that keep deteriorating.

Also, the economic consequences of the invasion of Ukraine are spread wide. Still, a major theme driving EM assets recently is weaker growth and higher inflation, or stagflation.

There is a fairly consistent historical pattern of commodity producers’ countries outperforming large commodity importing countries’ markets in Asia.

Brazil and other commodities producers offer tactical protection against the concerning mix of weaker growth and higher inflation impulses across EM equities.

We recently enjoyed a nice outperformance from a trade long EWZ and short EEM (see Closed Ideas). The EM Index is a composition of 60% Asia, 12% India (fiscal is deteriorating fast), and 28% RoW (rest of the world).

Nevertheless, stagflationary periods are rare in recent history, and the conditions surrounding episodes of weaker growth with higher inflation have been reasonably differentiated from period to period.

For instance, Brazilian equities underperformed the market during late-cycle slowdowns (‘07/’15), resulting in more significant drawdowns.

It seems the trade works better during mid-cycle slowdowns (‘02/’04/’10/’19), where commodities prices perform well while the risk premium sustains the outperformance.

I recently left the trades (long EWZ, short EEM/SPY) because it’s hard to identify if this is just a mid-cycle movement or a late one.

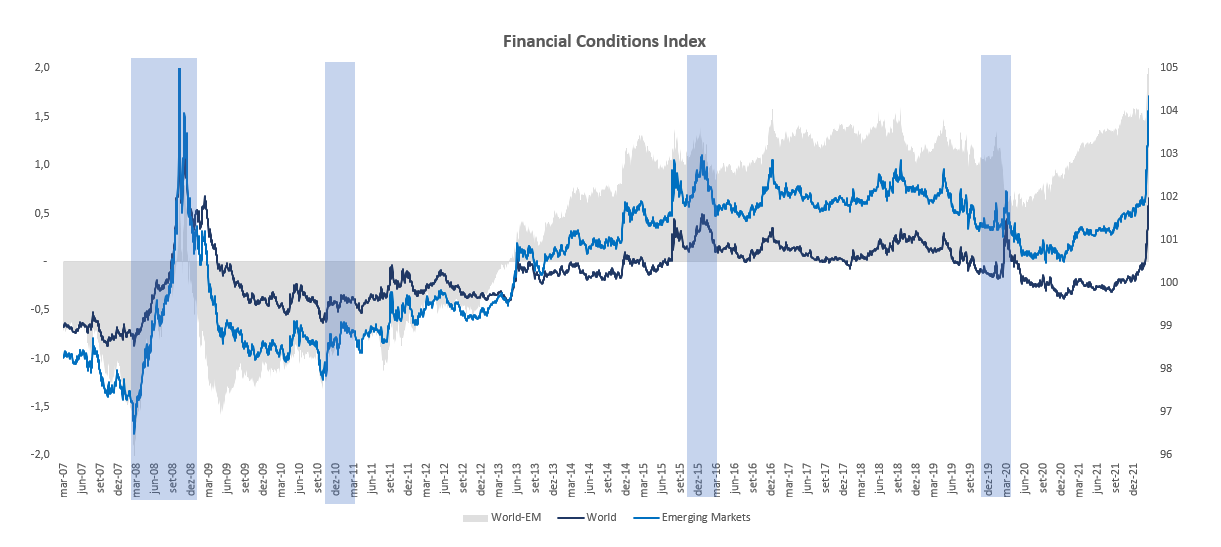

Historically, more abrupt changes in financial conditions (“FCI”) usually come with an exogenous shock (such as a war) and indicate a late-cycle movement.

“FCI is defined as a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP” (GS).

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Also, all the commodities producers (such as Brazil and South Africa) are trading in resistance regions, with is a second signal that pulls me out of the trade.

Calibrating estimates

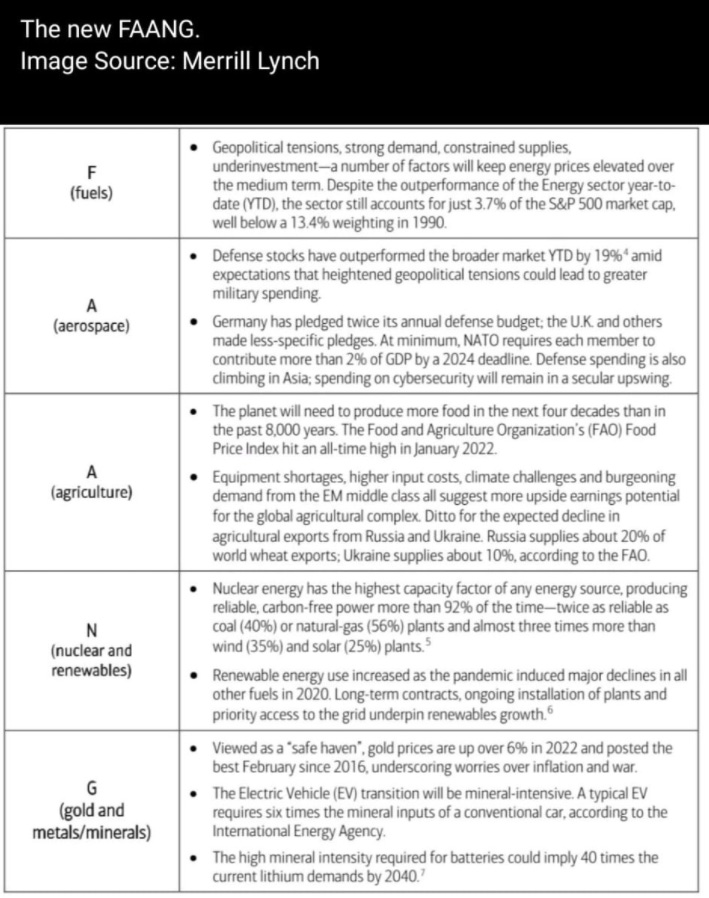

The Bank of America (“BofA”) published a report (which I did not have access to) with the image below, which suggests that the bank is bull with value plays and assets that benefit from geo conflicts.

Paid subscribers know that I’ve been carrying these names in my portfolio, but I’d like high highlight the “aerospace” assets. Though the situation might not escalate to a direct conflict, countries — such as Germany — should increase their budget to Defense.

Bundeskanzler Olaf Scholz @BundeskanzlerEs ist Krieg in Europa. Mein Wunsch ist es, dass die Europäische Union ihre Kraft entfaltet und weiter geschlossen handelt, um dafür zu sorgen, dass der Frieden in Europa eine gute Perspektive hat. Darum geht es jetzt, auch beim Gipfel in Versailles.

March 10th 2022486 Retweets6,629 Likes

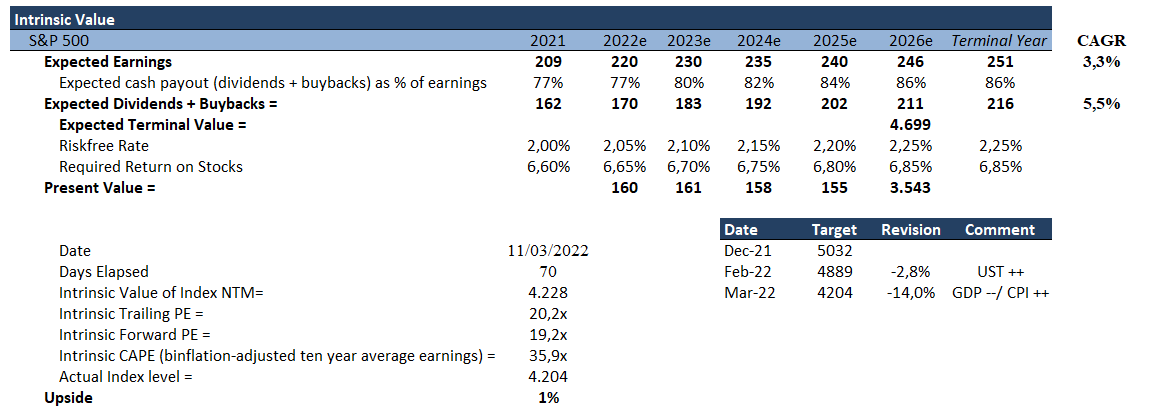

Also, lower growth, higher inflation, and geopolitical conflicts only benefit a few asset classes, but it huts sales and earnings growth for most. Consequently, I reviewed my estimate for the S&P 500.

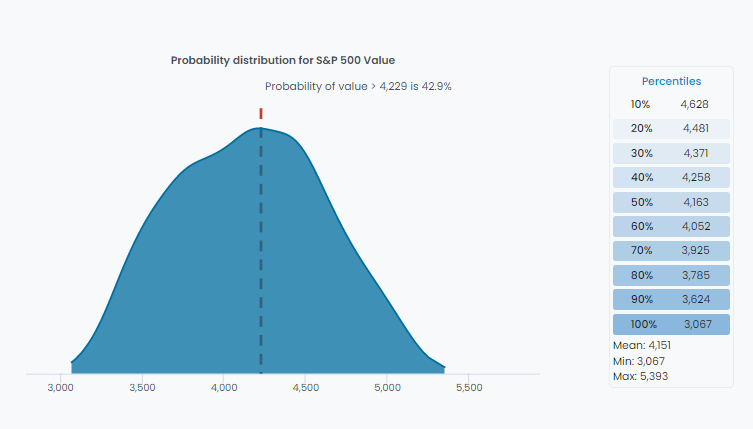

Estimated earnings growth is 3-10% lower than consensus, maintaining other metrics unchanged (for now). Consequently, the new target for 22YE for the S&P500 is 4.200, in line with market prices.

Remember, the output means little. But, nevertheless, the valuable information is that value is going down with prices. Be smart. Go easy on risk.

Ah… Access the interactive model if you’d like to have fun estimating and keeping your own targets for yourself. Have fun.

What charts are telling us?

I posted on Food for Thought #6 that Tech was near a support area, and we should await confirmation for taking the next step.

Well, we had several new breakout attempts throughout the week in the Tech space. I believe the most representative is ARKK.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

For me, ARK Innovation is much more a liquidity indicator than a proxy for Tech. Nevertheless, different Tech companies’ ETFs are telling us the same message.

Also, taking a step back and looking from a cycle perspective, the most meaningful breakouts this week were Tech stocks relative to Oil E&P companies and Metals & Mining companies.

Although big techs represent an important weight in the S&P 500 (~25%), we’ve also seen a meaningful breakout versus the index.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Finally, If we’re going through a bull market for commodities and this period will be different from 2014 to 2020, any retrace should be interpreted as an opportunity to add on weakness.

From Twitter ($MELI, $PBR, Oil, Stagflation)

$MELI

Giro Lino @giro_lino$MELI filed a document about a cyberattack: "data from approximately 300k users was accessed ... we have not found any evidence that our infrastructure systems have been compromised or that any users’ passwords, balances,... or credit card information were obtained."

March 7th 20223 Retweets13 Likes

$PBR

Giro Lino @giro_linoYesterday, PBR announced a new price increase — 18.8% for gasoline and 24.9% for diesel in refineries, and 16% for LPG. Also, the Senate approved two law projects aimed at reducing fuel price volatility. Comment about both on the blog (link in Bio). $PBR $EWZ $EEM

March 11th 20222 Retweets6 Likes

Oil

Giro Lino @giro_linoSanctions continue to severely disrupt Russian seaborne oil exports. Loading data remains volatile, but we'd been talking about a 3 mb/d decline in Russian crude and petroleum product seaborne exports, the fifth-largest one-month disruption since WWII(!!!) #stagflation

March 9th 20222 Retweets6 Likes

Stagflation

Giro Lino @giro_lino$JPM updated its forecasts and now see global growth slowing to a trend-like pace of 2.6% in 1H22 versus a forecast for 4.9% growth just three weeks ago. In addition, global inflation is now expected to run nearly a percentage point higher, at 4.6%. #stagflation 🔥

March 8th 20221 Retweet5 Likes

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Closed Ideas in 2022

If you’re paid subscriber, don’t worry. I created a new section (“Trade Ideas”) to improve our communication. You can expect to receive all PRO content in your mailbox.

Also, all posts/ideas will be saved in this new section, so you can find any topic much more quickly from now on. : )