Today’s outline!

- Latest Posts

- Don’t hesitate

- Pill hard to swallow

- Oil tumbles

- What charts are telling us?

- In case you missed it (Rates in Brazil, Oil)

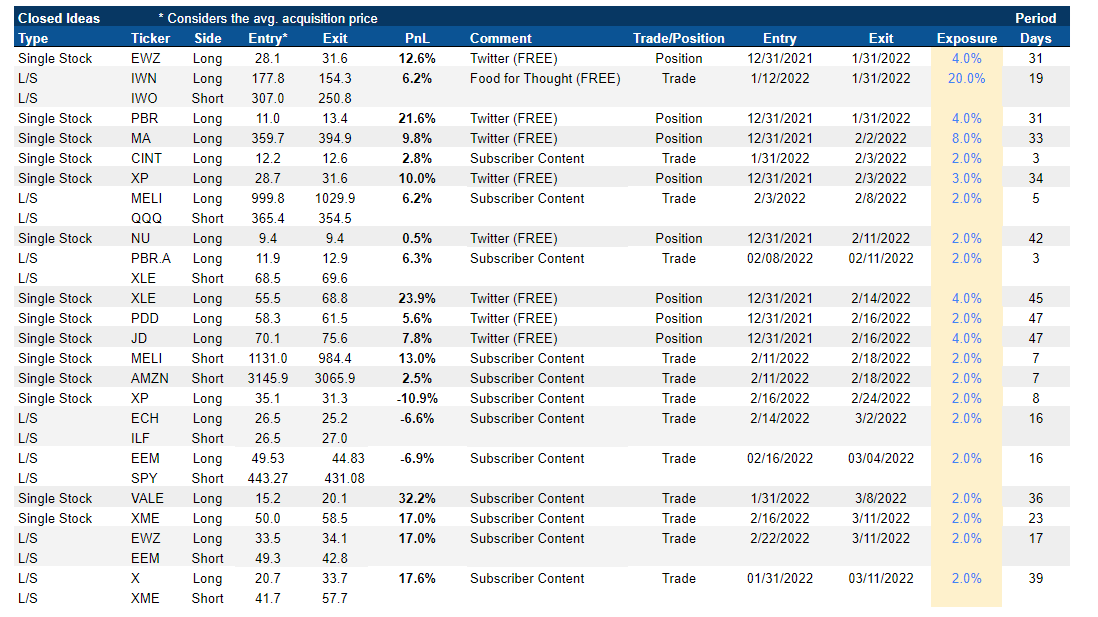

Closed Ideas

Latest Posts

- Delisting Risk

- Watch Over #1 - Updating the shopping list

- New guideline for Fintechs in Brazil

- PBR - Change in management (again)?

- Stone 4Q21

- Trading Diary #3

Don’t hesitate

The difference between a good analyst and a money manager is how they deal with hard times. People have capabilities of coping mechanisms that work fine when everything is running well, but it doesn’t work when the market collapses.

Going through tough times, analysts focus on knowing everything, trying to make sure they have all the possible alternatives computed to improve odds.

That is not humanly possible, so good analysts start hesitating instead of taking decisions. Money managers, on the other hand, deal with the lack of information, or its absence.

There is a remarkable asymmetry between the ways our mind treats available information and information we don’t have.

The mind has an associative machine that represents ideas/information we already possess, and (unconsciously) ignores what we don’t know.

“The unwarranted confidence which is produced by a good fit between the predicted outcome and the input information may be called the illusion of validity. This illusion persists even when the judge is aware of the factors that limit the accuracy of his predictions.”

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The commodity upward cycle should persist and the strong correction in non-profitable companies is likely finished, with a liquidity overshoot that drove 60-90% drawdowns.

Also, the geopolitical risk seems to be reduced from previous weeks, and a deal in a few weeks looks likely.

The risk for many EM markets (especially China) and small caps (suffered on lower liquidity) seems to price a multi-year recession, which is not on the radar.

So, I’ve been adjusting a few positions in the past couple of weeks to increase my exposure to companies I’ve admired from a distance for years.

Pill hard to swallow

Recently, I've been receiving thousands of Alibaba ("BABA") charts pointing that the actual “stock price is below its IPO's in 2014”. Sure. But this is an observation, a piece of evidence that means nothing if you can’t connect with something else.

— Sure, but I’m a long-term investor, how does it affect me?

I’ll let Mr. Gartman answer you:

“Capital comes in two varieties: Mental and that which is in your pocket or account. Of the two types of capital, the mental is the more important and expensive of the two. Holding to losing positions costs measurable sums of actual capital, but it costs immeasurable sums of mental capital”.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

It doesn’t matter if the investor is an individual or a professional, they will ultimately make money if the price goes up, or lose if it goes down. Illogic often reigns and markets are enormously inefficient despite what the analysts believe

For instance, let’s say that you’re an insider in BABA. You know the company, disclosed and undisclosed information about its finances, so you can perform the best valuation ever.

The stock was trading at US$300 per share, and according to your estimates, the implied IRR (return p.a.) is 10% over the next decade.

After a year, prices go down to US$80 per share, so it would have to go up ~30% every year for the remaining decade to achieve the initial 10% return. So whether you like it or not, you were wrong.

If you’re right about the company, but wrong on timing, you’re ultimatelly wrong.

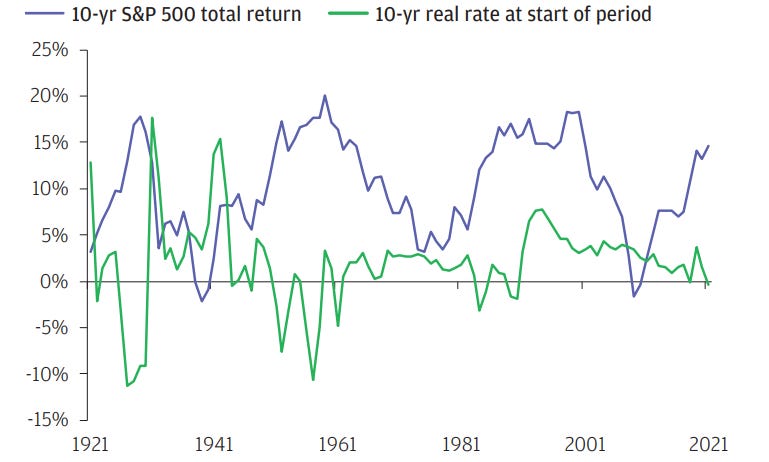

Since 1921, the 10YR return investing in the S&P 500 ranges from 0% p.a. to 20% p.a., so let’s say that you invested in BABA estimating the average market return from the past century — this is pretty good, actually.

Simple base rates here, but you went from market average return expectations to abnormal return expectations over a year. Again, you were wrong.

So far in this news, you should have noticed that being good at valuation doesn’t make you a good investor. Let me tell you about me.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

I spend less than 5% of my time on valuation since I consider it just an observation. Understanding the business, strategy, competition, and management is far more important if you’re a long-term investor.

Ultimately, the trajectory the company is heading is far more important than a DCF valuation. It’s impossible to have earnings visibility beyond three years ahead, so it’s worthless to spend time thinking about the company’s earnings in 2032.

Also, in those cases, the value is given by the value beyond the fifth year, which is most certainly wrong. Believe me, adding wrong information (long-term) to good information (short-term forecasting) doesn’t produce good information.

Therefore, it’s important to enhance the investment process, not depending entirely on DCF Valuations. And, of course, it’s important to keep learnings from mistakes.

Oil tumbles

Brent prices retreated to below $100/bbl, having shed more than $30/bbl in little more than a week. Oil’s rally sharply turned around amid a resumption of Russian seaborne oil flows, renewed hopes of an Iran nuclear deal, and a resurgence of Covid lockdowns in China which raise the alarm that containment measures could dent demand.

It all serves as a reminder that geopolitical premiums can deflate just as easily as they escalate, especially when S&D fundamentals remain in inconstancy.

I don’t know, but it’s likely that Brent trades above US$90/bbl for longer. Although the market has been lowering its production forecast for Russia, there are signs that Russian seaborne commodity exports have resumed.

Large quantities of Russian oil continue to be boycotted by Western refiners, but there are indications that price-sensitive buyers are willing to take more oil offered at steep discounts to Brent — Russian crude already trades at a ~US$30/bbl discount to Brent.

It’s been reported that the Russian producer Surgutneftegaz was able to sell its ESPO blend crude to Chinese buyers by skipping the guarantee known as letters of credit (LC) in order to bypass Western sanctions.

Also, India, the world’s third-biggest importer of oil, is also reportedly looking to buy more Russian crude offered at a steep discount. According to an Indian Government Official: “Russia is offering oil and other commodities at a heavy discount. We will be happy to take that.”

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

This week, state-run Indian Oil Corp and Hindustan Petroleum, the country's top refiners, bought 5mn barrels of Russian Urals for May delivery at a discount of $20-25/bbl to Brent.

Nevertheless, even considering a moderation for consensus GDP forecasts, the market is trading even tighter than it was before the war considering that:

- Consensus is overly pessimistic for non-jet fuel demand, considering full-year demand below the annualized 4Q21 demand (which happened in 20% of the previous 15 years);

- Recent data shows that the market is operating at a supply/demand deficit, suggesting that demand might be running above the expected;

- Although soften GDP hits fuel consumption, mobility indicators continue to show that driving is pointing to a steeper recovery.

All in, inventory data suggests that consensus has been repeatedly underestimating demand, while the supply side has been getting, even more, tighten than it was before.

Therefore, the oil market still looks tightened on the supply side, and oil prices should trade in the upper range in the foreseeable future. Recently, I posted an update in my shopping list, containing a few names I’d like to hold in my portfolio.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

What charts are telling us?

As commented before, the geopolitical risk seems to be reduced from previous weeks, and a deal in a few weeks looks likely, while valuation has hit multidecade lows, even for severe crisis periods.

MSCI China is trading over a decade support/resistance region, hitting a 55% drawdown, the worst since the index inception.

The ETF rebounded after China’s State Council urged for concrete measures to boost the economy. If geopolitics improve in the following weeks, Chinese stocks could have hit the bottom.

The Jan-Feb shift in macro policy showed up in reported data this week with macro data for 2H22 showing broad-based upside surprises including a strong uptick in industrial production (+7,5% YoY) and a notable acceleration in fixed asset investment growth which rose 12,2% YoY in Jan-Feb vs 2,0% YoY in Dec.

China Internet printed good online goods retail sales growth +12,3%, fastest since mid-2021. Jan-Feb 2022 online goods retail sales growth reaccelerated to 12,3% YoY (2yr CAGR 21%), up from 5%/1% YoY in Nov/Dec (9%/4% 2-year CAGR), triggering a strong rebound for Chinese Internet Stocks ETF (KWEB).

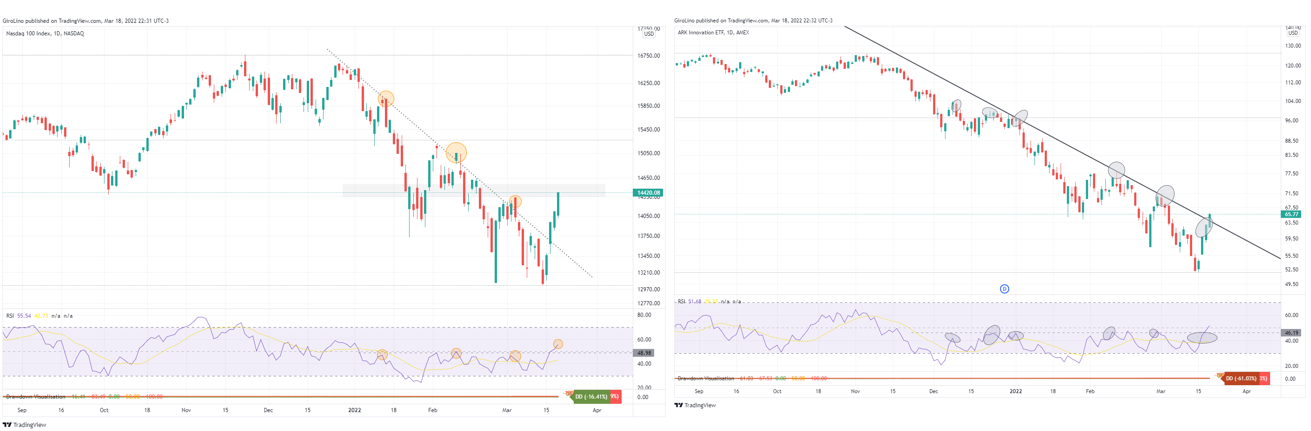

The FOMC hiked the federal funds rate by 25 bp to 0.25-0.5%. The rate hike was in-line, but the guidance in the statement was more important.

Though the median dot in '22 came in at 1.875%, consistent with seven 25bp rate hikes in 22', seven policymakers (out of 16) placed their dots >1.875%, with one dot as high as 3.125% at the end of the year.

The FOMC also postponed the QT, cheering tech investors. It’s the first time since November that tech stocks have had a significant improvement in their price action, though macro headwinds persist.

However, zooming out, and watching the same chart in a relative base (over SPY), ARKK and NDR are still not off the hook. Short-seller might increase their positions in this range. Personally, I’d not be short any tech stock at the current valuation.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

As previously commented, it’s tough arguing with prices. The O&G producers are trading close to a resistance area. Different from previous years, momentum is playing along with brent, meaning we could see a relevant breakout throughout the following weeks.

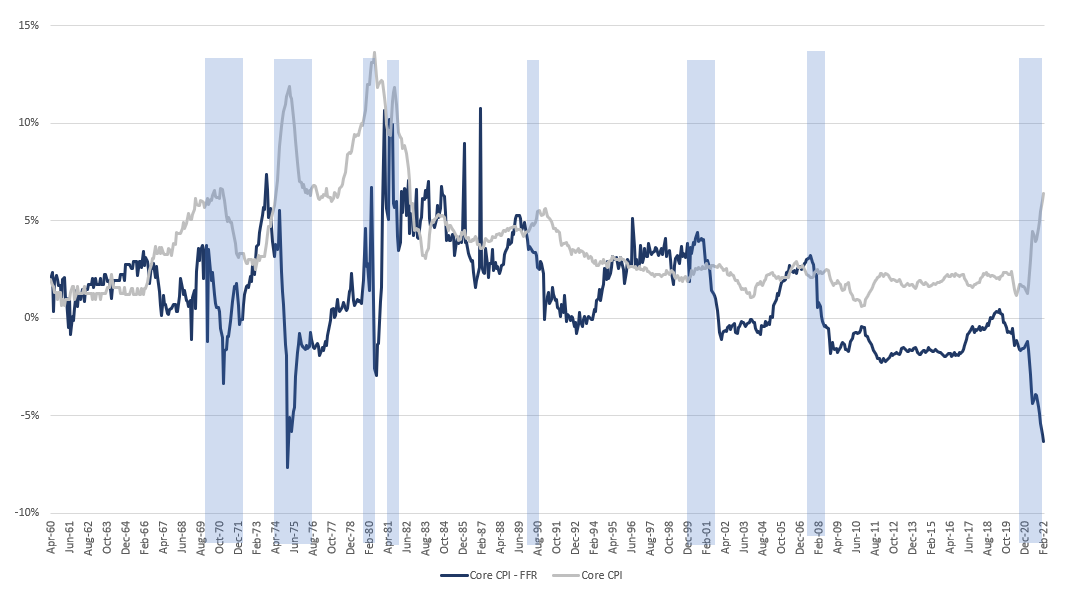

Though the FOMC hiked only 25bps, the price action has been suggesting they’re wildly behind the curve. So I recently posted an update on my shopping list, disclosing how I’m taking advantage of the current environment to find good trades.

Finally, just as the oil shock in the 70s, the gap between Core CPI and Fed Funds minus Core CPI is hitting alarming spreads (17p.p in the 70s versus 12p.p. in 2022). Yeah… “transitory inflation”.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

In case you missed it (Rates in Brazil, Oil, FED)

Rates in Brazil

Giro Lino @giro_linoYesterday, the BCB raised Selic (FFR) by 100bps to 11,75%p.a. The move was largely in line, and the BCB indicated another 100bps increase in May. Also, the BCB revised its inflation expectation to 7,1% (vs. 5,4%). Largely expected for those reading Food for Thought. $EWZ

March 17th 20221 Like

Giro Lino @giro_lino1/n Since Dec, LT rates in Brazil have gone up 200bps, and many companies have been de-rating quickly. There are many discussions regarding the cost of capital, and I'd like to contribute by telling how Prof. Greenwald changed my view about the valuation process.

March 14th 20222 Retweets16 Likes

Oil

Giro Lino @giro_linoMarket players have been reviewing targets for Oil prices given even tighter supply conditions with the situation in Ukraine. Though this was expected, stocks are pricing Brent <$75/bbl. I'll write about it this weekend, so make sure to subscribe for free 🙂#Oil #StockMarket

March 17th 20224 Likes

Closed Ideas 2022