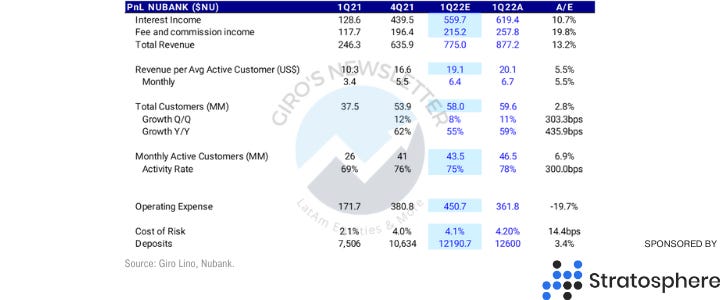

Nubank reported a $45mn net loss vs. the company-provided consensus of a $77mn loss. Similar NPL rises to the incumbent consumer segment, but without payroll and mortgage to smooth the hit.

We see the quarter with solid credit balance growth. Specifically, total loans rose 122% YoY. In addition, consumer loans, an investor focus, rose to $2bn and now represent 23% of total loans vs. 21% in 4Q21.

Card TPV rose to $15.9bn, up ~112% YoY and ahead of GIROe's $14.8bn. Interchange revenues increased 127%, with flattish yields at 1.19%.

Significantly, asset quality did not erode as most buy-side analysts expected, with 90-day NPLs up 70bps QoQ vs. Bradesco’s consumer segment’s 60bps and Itau’s 30bps, although this comparison tells only half true (keep reading).

While fast loan growth helps NPLs, we see Nubank’s figures as substantially better than other neobanks. Provisions rose 287% YoY, driven by loan growth. Overall, Nu presented a strong beat vs. our expectations.

Nu presented a substantial beat to our estimates due to credit portfolio growth. According to the management:

“We continued to see significant opportunities to grow and gain share in the unsecured credit market in Brazil, the largest available market in financial services in Latin America. Our credit portfolio, with credit cards and personal loans, grew significantly above market, at 126% YoY, to a total of U$$8.8 billion, while maintaining healthy credit levels and strong unit economics”. (David Vélez)

Asset Quality

Many local investors were calling for an explosive worsening in asset quality and using it as an argument for shorting the stock.

We’d like to highlight that investors should stop looking at short-term multiples. This is noise and means nothing for Nubank’s business performance. First, growth drives an increase in credit loss provisioning.

Under IFRS9, Nubank has to front-load the recognition of credit loss provisioning whenever a loan is booked. So, the faster Nubank grows the credit book, the more short-term pressure it brings to our gross profit margin.

Second, we must consider how interest on cash balance hurts the short-term PnL. As interest rates go up, Nubank earns more money on our large pool of cash balance, even if it is partially or wholly offset by higher funding expenses.

But it drives our revenue up and leaves our gross profit essentially unchanged. This pushes down our gross profit margin as it enlarges the denominator of the gross profit formula.

We ran a few tests assuming stable growth (only to offset churn) and rates at 6%-8% and found a 55%-65% range for gross profit (versus the actual 34% in the 1Q22).

Therefore, we believe our long-term estimates for Nubank are conservative and should be reviewed upward, as the company confirms the higher profitability trend in the following quarters.

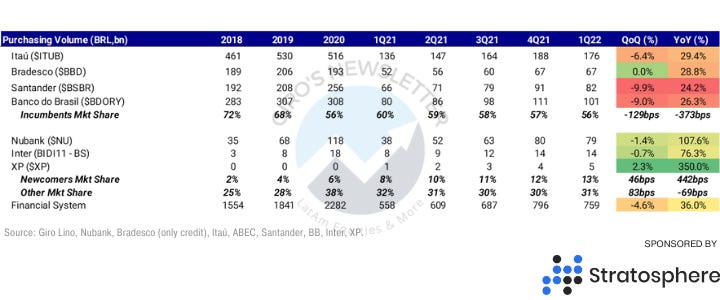

Purchasing Volume

Card TPV rose to $15.9bn, up ~112% YoY and ahead of GIROe's $14.8bn. Interchange revenues increased 127%, with flattish yields at 1.19%. Nevertheless, we remember that the trend for this yield is downward.

According to ABECS, in the 1Q22, payments grew 36% YoY (FXN). We highlight the outstanding performance for the credit cards of 42.4%, with the increase in penetration.

Most of the QoQ contraction was led by debit cards (-10% QoQ, +15% YoY), which, in our opinion, was affected by Pix transactions and losing total share to pre-paid cards.

Also, we highlight that the 1Q is a weak quarter due to seasonality, and the 4.6% QoQ contraction was one of the best registered, meaning that credit card penetration should keep picking up in 2022.

With that said, we highlight the consolidated figures for purchase spending in the 1Q22. Undoubtedly, newcomers are leading a true financial revolution, enabling more people to access financial products.

Operational Leverage

The sustained growth of deposit franchise. Deposits increased 68% YoY, reaching $12.6 billion in the 1Q22, mainly due to continued growth in Nubank’s customer base, its activity ratio, and increase of primary bank relationships’ share.

Considering that active users grew by 80%, the deposits/active user decreased YoY. Nevertheless, we highlight this is not bad news. On the contrary, actually.

We estimate that Nubank could capture 600bps in operational leverage throughout the following year diluting transactional and customer service costs by increasing total deposits.

Customer

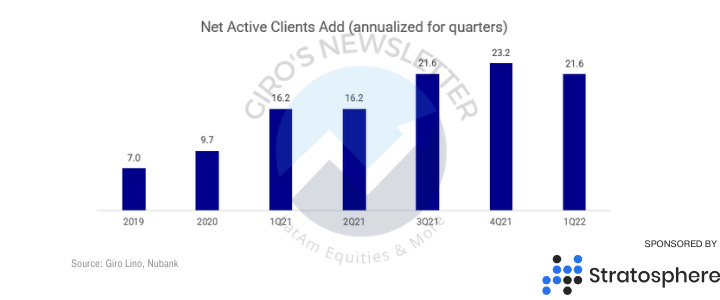

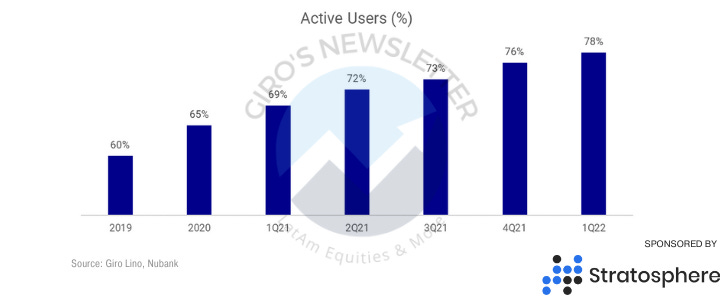

Growing and engaged customers. Nubank ended 1Q22 with a record 59.6 million customers, reaching historical highs for retail customers and SMEs.

Brazilian customers increased 55% YoY to 57.3 million, representing 33% of the country’s adult population. Moreover, Nubank has become the primary bank for over 54% of the MAU (!) who have been with the Company for over a year.

However, the annualized quarterly active new users showed a deceleration for the first time, from 23.2mn in the 4Q21 to 21.6mn in the 1Q22.

Considering that we do not have enough evidence, this could happen due to the seasonal effect, but after reaching 78% of active users, it became more challenging for Nubank to beat the previous quarters.

In Mexico, Nubank’s customer base increased 950% YoY to 2.1mn, consolidating the Company’s position as the #1 new issuer in the country.

There is something new that we were not expecting. As it happened in Brazil, in the new geographies that Nubank is expanding, the actual active users are higher than in mature locations.

Consequently, the active users hit levels only seen when Nubank had only 5mn clients. This powerful message shows that the product has shown good acceptance in the new locations.

New Products

NuPay

During the quarter, Nubank launched NuPay, a payment solution for online purchases integrated with e-commerce checkout or made in installments.

Nu launched NuPay to strengthen its position at the intersection of commerce and payments in the region.

NuPay is a more convenient and secure way for Nubank customers to pay for their online purchases with just a few clicks on the Nu App.

Customers can choose to pay now, using their Nubank account balance, or pay later in interest-free installments, leveraging incremental credit limits.

For merchants, in our view, the objective improvement is that clients’ purchasing power increase if they enable the tool.

Also, we believe Nubank will offer a superior checkout experience/conversion and higher approval rates compared to traditional payment methods like a credit card.

Nucripto

the Company launched an initial rollout of Nucripto, which allows crypto trading starting from R$1 (US$0.2). Consistent with its mission, Nu aims to democratize crypto in Brazil and in the rest of LatAm.

Paypal, MercadoPago, and Nubank allow crypto transactions on their respective platforms. The product roll-out is due on June/22.

Also, Nu has a partnership agreement with Paxos, a regulated blockchain infrastructure platform responsible for executing orders and custody.

According to Nubank, the company will invest 1% of its equity in Bitcoin. Therefore, in our opinion, Nubank is matching the expected deposit the company will have in crypto to avoid balance sheet risk.

Dont forget it… End of lock-up today

On May 2nd, Nu published a notice to the market informing that it has agreed to modify the final lock-up release terms, setting the end of the lock-up for May 17th.

Under the previous lock-up conditions, the end of the lock-up was expected for June 7th (the 181st day after the IPO).