Hi.

As previously anticipated, this week, we wrote about Pix. However, we decided to break it down into a few posts considering its length.

By the end of all posts, the goal is to offer a complete, sizeable and comprehensive handbook about Pix to be used as a reference for evaluating any further national instant payment or estimating financial impact in specific companies.

In this week’s post, we assumed that nobody knows what Pix is, leaving from ground zero and explaining the most trivial aspects of Pix. This post has 11 pages, so probably is 20 minutes of reading. Enjoy it.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Pix 101

- One-page Synopsis

- What is Pix?

- How does Pix work?

How do Brazilians access and use Pix?

- A practical example of using Nubank

In the subsequent post, we’ll talk about the infrastructure behind Pix. Then, about Pix impacts on P2P, P2B, threats to banks, acquirers, and other market participants.

One-page Synopsis

- Brazilian Central Bank (“BCB”) created Pix, the Brazilian IP scheme within the Brazilian instant payment ecosystem. Pix enables its users — people, companies, and governmental entities — to send or receive payment transfers in a few seconds, including on non-business days.

- Unlike what I heard a few times, Pix doesn’t use blockchain, though it’s safe. Instead, Pix has a centralized architecture consisting of messaging communication among the various participants and the BCB. All transactions occur through digitally signed messages that travel in encrypted form, over a protected network, separated from the Internet — this means that your personal data is transmitted through a centralized structure.

- One of the most significant advantages of Pix is its transactions’ speediness. And it is fast even before the transaction is initiated. Instead of asking for information regarding the beneficiary’s account and/or personal data, the payer just asks for the Pix alias or scans a QR code (static or dynamic) to start a Pix funds transfer at any day and time.

- Pix will be another element in the payment instruments available in the Brazilian retail payments system. Traditional payment instruments, such as TED, DOC, and Boletos (bank slips), will continue to be offered; the same holds for credit and debit cards. Therefore, it is the end user’s discretion to choose the best payment instrument for the occasion.

- Pix access must be visible and up-front, on the home screen or after the login screen, displaying the Pix name or logo with the same emphasis as other payment services.

- To send money or pay a bill, users can search and select the ID of the recipient. Then, they can scan a QR code, which will have the recipient information encoded in the graphic. Or they can manually input the information of the recipient.

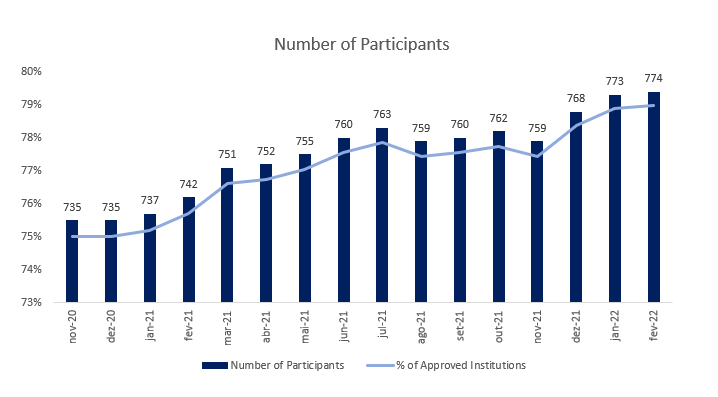

- The BCB proposal is to embrace a large chunk of market participants, setting a low bar for new participants to participate in Pix. If you have a Payment Institution (“IP”) and a decent back-office operation, you could run Pix. For instance, according to our estimates, almost 80% of all applications to join the SPI were approved.

- Some institutions have to offer Pix on a mandatory basis. This was a game-changer since the BCB obligated incumbents to participate and set that Pix access must be visible and up-front. They are financial institutions or payment institutions authorized by the BCB with more than 500k active customer accounts (considering current deposit accounts, savings accounts, and prepaid payment accounts).

The modalities of participation in Pix are as follows: i) transactional account provider (a financial or payment institution that provides a current deposit account), ii) government entity (National Treasury Secretariat, with the sole purpose of making collections and payments), iii) special settlement agent (a financial or payment institution authorized to operate by the BCB to provide settlement services), and the iv) payment initiation service providers (financial institutions authorized to operate by the BCB that have the exclusive purpose of providing payment transaction initiation services).

Pix 101

What is Pix?

Brazilian Central Bank (“BCB”) created Pix, the Brazilian IP scheme within the Brazilian instant payment ecosystem.

Pix enables its users — people, companies, and governmental entities — to send or receive payment transfers in a few seconds, including on non-business days.

By transferring funds between transactional accounts — demand, savings, and prepaid payment accounts — Pix is a payment method that tends to have a lower acceptance cost because its framework works with few intermediaries.

In addition to increasing convenience for the users making payments, Pix promotes:

- Lower financial costs increased security and improved customer experience

- Digitization of the retail payments market

- Higher market competition and efficiency

- Financial inclusion

- Gap-filling of retail payment instruments available to the population.

Unlike what I heard a few times, Pix doesn’t use blockchain, though it’s safe. Instead, Pix has a centralized architecture consisting of messaging communication among the various participants and the BCB.

All transactions occur through digitally signed messages that travel in encrypted form, over a protected network, separated from the Internet — this means that your personal data is transmitted in Pix transactions.

In addition, user information is also encrypted and protected by mechanisms that prevent scans of personal information in the single and centralized proxy database (“DICT”). This addressing database stores information on Pix keys.

How does Pix work?

One of the most significant advantages of Pix is its transactions’ speediness. And it is fast even before the transaction is initiated.

Instead of asking for information regarding the beneficiary’s account and/or personal data, the payer just asks for the Pix alias or scans a QR code (static or dynamic) to start a Pix funds transfer at any day and time.

Additionally, Pix tends to have a lower acceptance cost for merchants and businesses because its transactional framework has fewer intermediaries than traditional payment methods.

Once started, Pix transactions are irrevocable and processed individually in a few seconds. In addition, Pix will promptly notify the end-users (both payer and payee) of the transaction’s conclusion.

With the payment confirmation, the payer has certainty that the payment was received and funds are available for the beneficiary.

It must be emphasized that the Pix alias is only used to facilitate initiating a Pix transaction. Therefore, to pay with Pix, it is unnecessary to register a Pix alias.

Pix will be another element in the payment instruments available in the Brazilian retail payments system.

Traditional payment instruments, such as TED, DOC, and Boletos (bank slips), will continue to be offered; the same holds for credit and debit cards.

Therefore, it is the end user’s discretion to choose the best payment instrument for the occasion.

How do Brazilians access and use PIX?

The instant payment instruments are available in multiple distribution channels of payment service providers, but smartphone apps are likely the most common point of access.

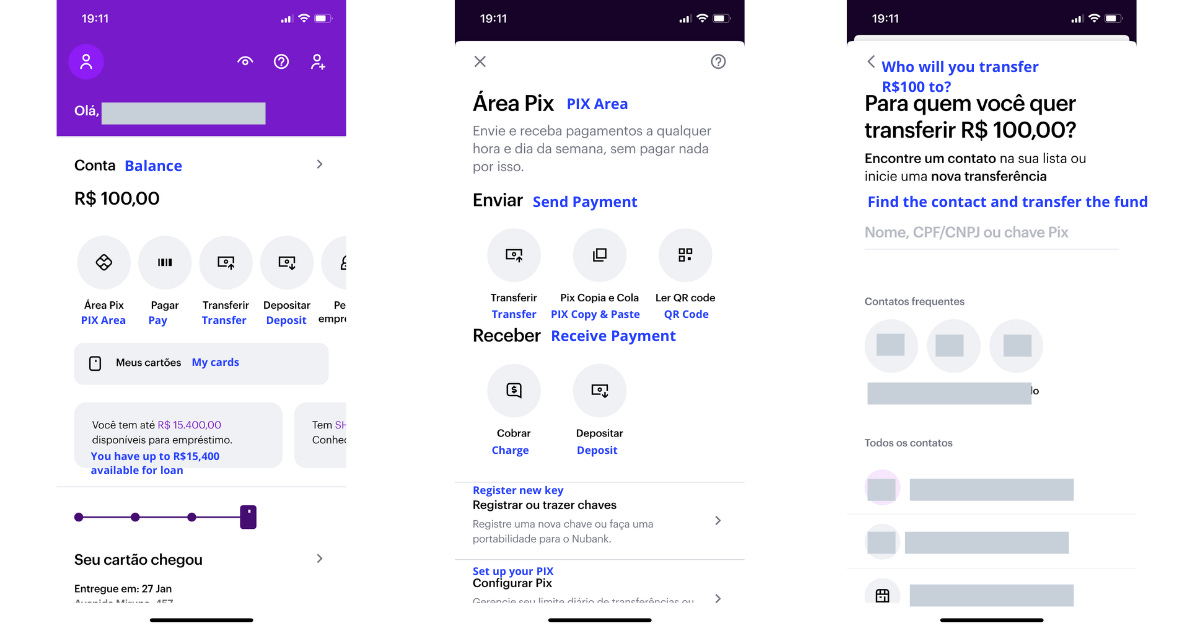

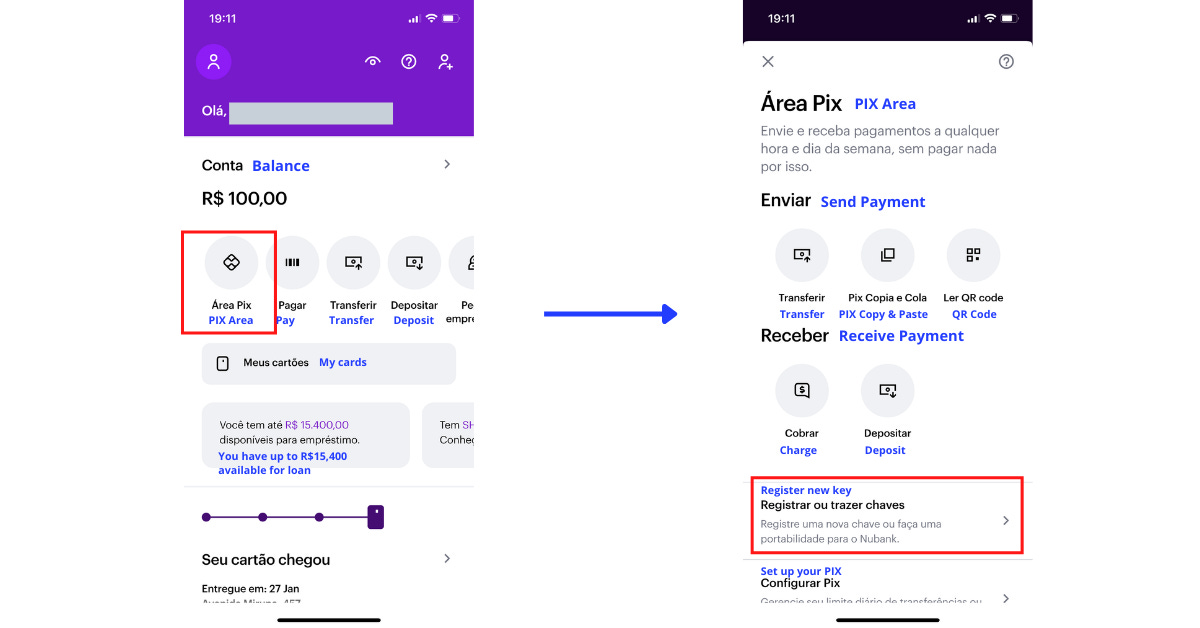

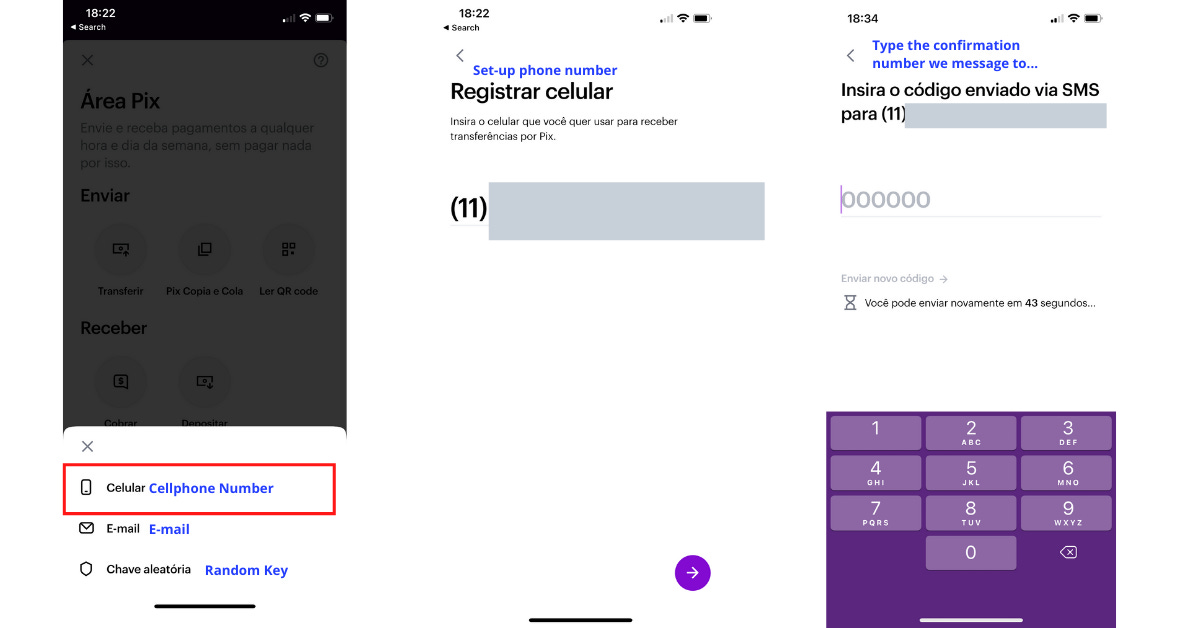

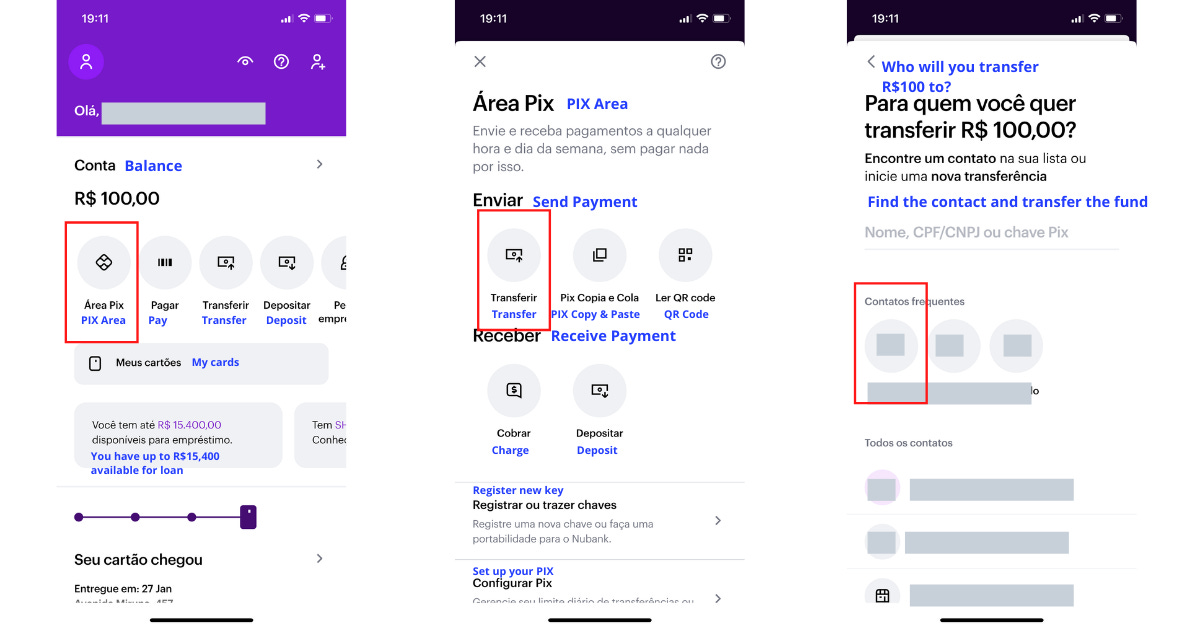

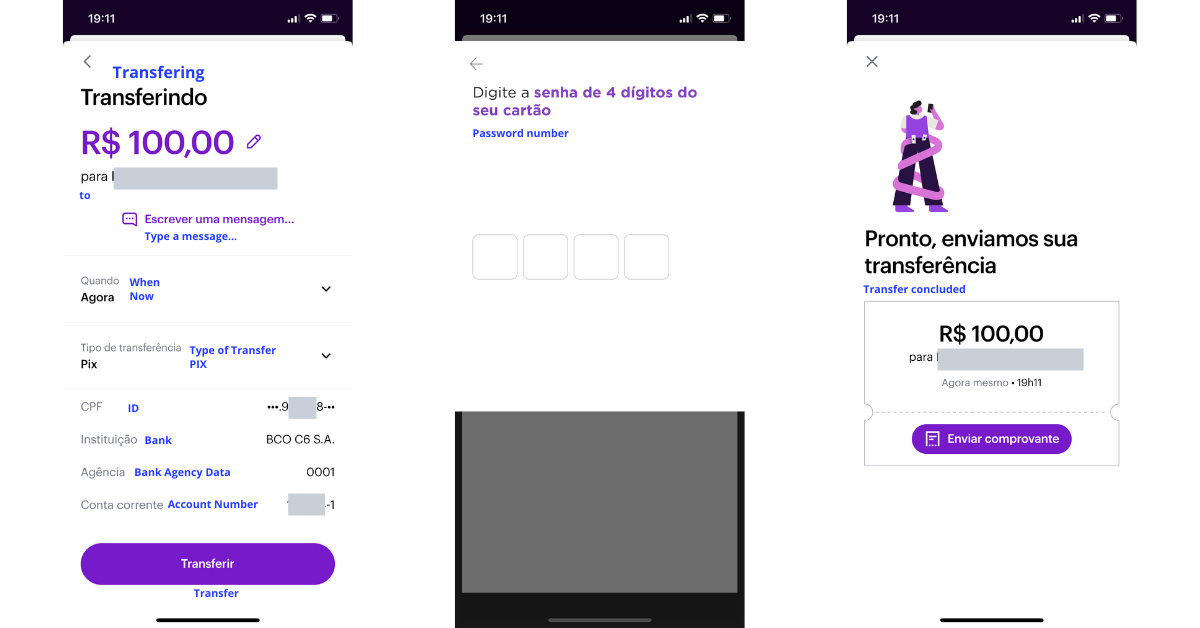

To better understand how PIX works, I took a series of screenshots from my screens (translation written in blue), so we could follow the process. Then, since Nubank offers the best user experience, I used its app.

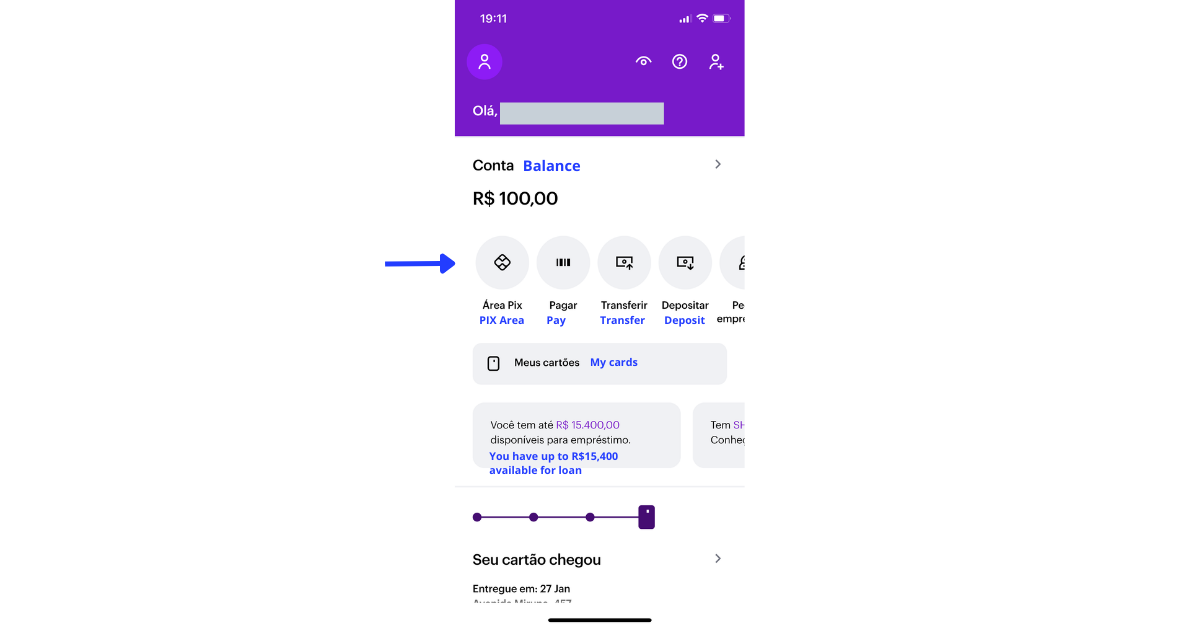

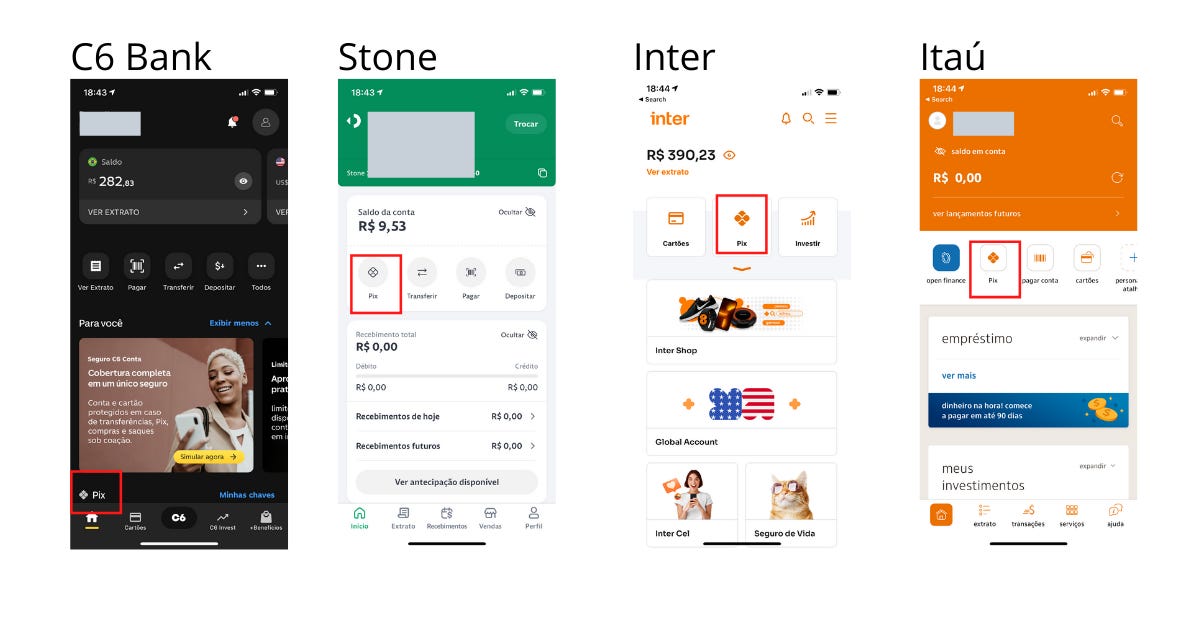

I) Pix access must be visible and up-front, on the home screen or after the login screen, displaying the Pix name or logo with the same emphasis as other payment services.

To make sure that everybody understood: Pix access must be visible and up-front. As a result, most banks highlight the feature, though a few try to hide it.

II) User authentication should be seamless, not generating more actions than those required for other payment services.

III) To begin, users must set up at least one ID. The IDs are used to identify checking, savings, or prepaid payment account held at financial institutions or payment companies.

IV) There are four types of IDs: mobile number, taxpayer ID (CPF/CNPJ), email address, or virtual payment address (EVP).

V) Then, users can initiate a payment. To send money or pay a bill, users can search and select the ID of the recipient. Then, they can scan a QR code, which will have the recipient information encoded in the graphic. Or they can manually input the information of the recipient.

VI) PIX will verify the ID and settle the transaction. IDs are stored and confirmed in the proxy database (DICT). After verifying the ID, the money will be transferred between the accounts without the need for any intermediary.

Participants

The BCB proposal is to embrace a large chunk of market participants, setting a low bar for new participants to participate in Pix:

- adhere to the rules, conditions, and procedures established in the Regulation;

- possess technical and operational capacity to comply with the duties and obligations specified in Regulation;

- have a signed contract with an accountable participant; and

- demonstrate to have paid in and to be able to maintain at least R$ 1,000,000.00 (one million reais – R$) of capital.

If you have a Payment Institution (“IP”) and a decent back-office operation, you could run Pix. For instance, according to our estimates, almost 80% of all applications to join the SPI were approved.

Some institutions have to offer Pix on a mandatory basis. This was a game-changer since the BCB obligated incumbents to participate and set that Pix access must be visible and up-front.

They are financial institutions or payment institutions authorized by the BCB with more than 500k active customer accounts (considering current deposit accounts, savings accounts, and prepaid payment accounts).

The other financial institutions and payment institutions, including payment institutions that are not subject to authorization by the BCB, may offer the service on an optional basis, as long as they subscribe to Pix.

In these cases, they will be considered a part of the Brazilian Payments System (SPB) and subject to a minimum regulation from the moment they request to join Pix.

In addition, the National Treasury Secretariat is allowed to join Pix in its role as a government entity.

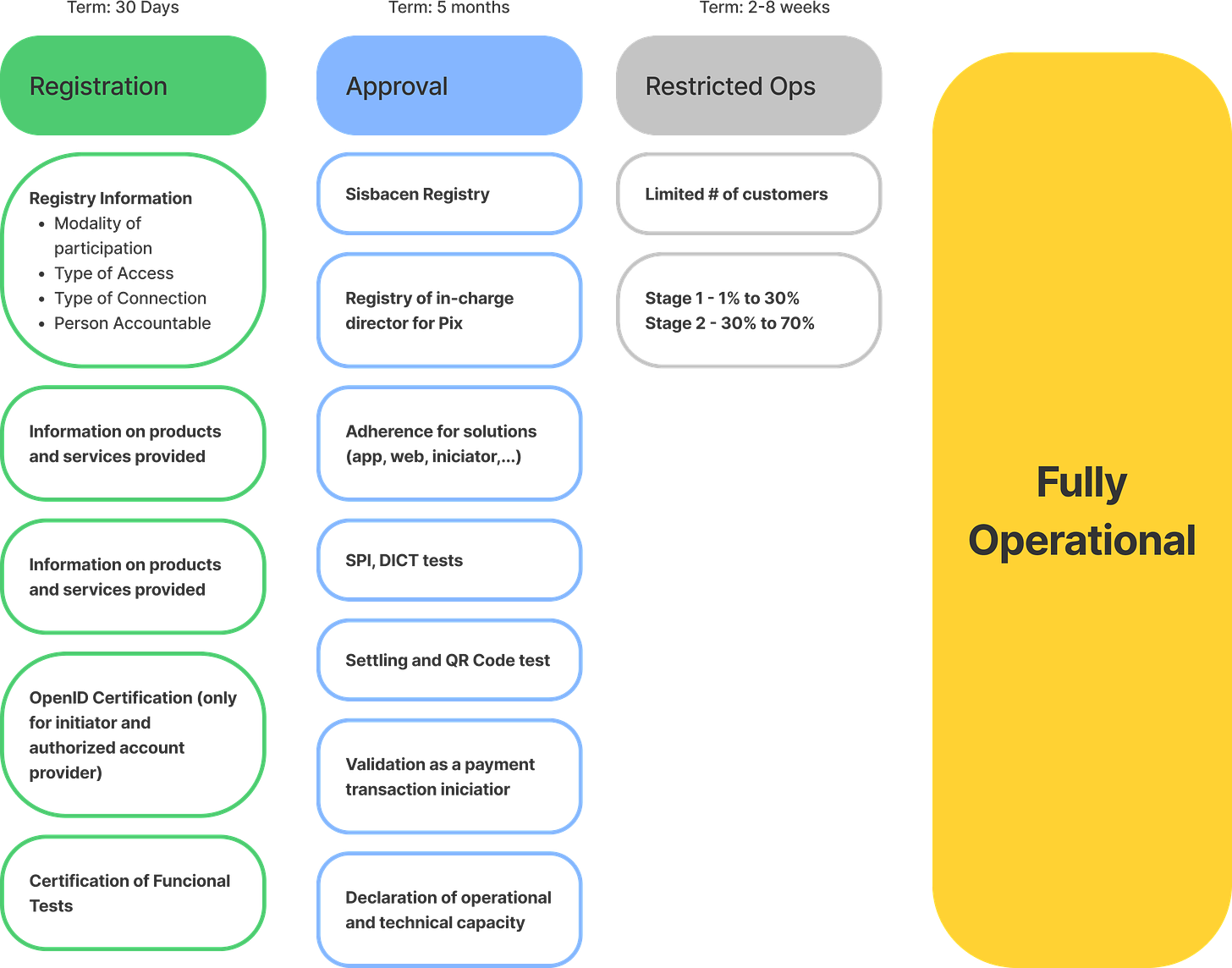

The admission procedure consists of three stages, highlighted below as a summary schematic of the processes:

The modalities of participation in Pix are as follows:

Transactional account provider: a financial or payment institution that provides a current deposit account, savings account, or prepaid payment account to the end-user to pay or receive a Pix.

Government entity: the National Treasury Secretariat, with the sole purpose of making collections and payments related to its typical activities.

Special settlement agent: a financial or payment institution authorized to operate by the BCB to provide settlement services to other participants.

The special settlement agent must also observe the requirements to act as a settlement participant in the SPI.

The special settlement agent does not have to meet the requirement for mandatory participation in Pix and does not send or receive a Pix from end-users.

Payment initiation service providers (“PISP” ): financial institutions, payment institutions, and other institutions authorized to operate by the BCB that, within the scope of Pix, have the exclusive purpose of providing payment transaction initiation services.

Once the PISP has initiated the payment, the account provider (direct or indirect) will move the funds through the SPI to credit the receiver’s account instantly.