The Outline

How Ecology Emplains Pix

War Table

Monetization

…Complementary Research…

P2P (Peer-to-Peer)

- Appealing Value Proposition

- Mobile First

- Enablers

P2B (Peer-to-Business)

- Compulsory Adoption

- The Middle Man

- Channel Check Flags Bypass as a Risk

This post will conclude our series about the Brazilian Instant Payment, Pix. Hopefully, after Part I, and Part II, readers will have understood Pix works and its functionalities.

So, yeah, I’ve got a few messages, crew…

The first one is that — hopefully — next week, I’ll write an update on Stone, presenting the new top-down model for the payment business I built and updating a few estimates.

It took me a lot of time to collect data, though the outcome was pretty cool. I’m sure you’ll enjoy it as much as I did.

Second, I’d like to share a quick thought about companies in LatAm. Many investors admire Stone because Buffett and ARK hold a position on it. Still, companies such as XP Inc. and Nubank give much more leverage to the Brazilian/LatAm financial system than Stone does.

We wrote extensively about Nubank on these posts (Part I, Part II), and, to my surprise, most comments received by email were questions about… Stone.🙃

LatAm has much more companies to offer than just Stone, even though I admire what the company has accomplished so far.

For instance, according to my estimates, the new entrants (Pago, Nu, XP, BTG, Stone, Pags, Inter, and DLO) will go from 7% of the profit pool to ~15% in 2025e.

In the model, Stone will gain roughly 50bps market share in the profit pool, and the others the remaining 650bps market share gain. So again, even though I’m a shareholder, there are much more good companies in LatAm.

Finally, I’m changing a little bit the writing about LatAm companies. I expect to write “short deep-dive” and post about specific topics. I loved the feedback about Meli’s post about its marketplace and the outlook for the marketplace in LatAm.

However, it’s essential to hear the critics. It’s fair that people ask about its interactive model and speed up things.

So, it sounds reasonable to write a short post (~20 pages) to attend a stake of the audience, then goes for our crazy Part I, II, III, IV,… write-ups. It makes sense, and everyone ends up happy.

Even though we began our writings in February, we’re approaching the 100th post.💙 So, I get why people ask me to write about topics I already did. The best way to solve this is to organize the stuff.

Probably, in a couple of weeks, I should have a “Content” post organizing all the stuff. Steady and slowly, but we’ll get there. Don’t worry.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber. 💙

How Ecology Emplains Pix

To understand why and where Pix will disrupt the payment industry, we should briefly consider externalities and their consequences.

Externalities it is first helpful to consider second-order consequences. Whenever we interact with a system, we need to ask, “And then what? What will the wider repercussions of our actions be?”

An exciting book called Living Within Limits, written by the American ecologist Garrett Hardin, explains why Pix is so successful.

In his research, Hardin established three common laws of nature that rule the world. The first helps us quite a lot in understanding Pix, and it states: "We can never do merely one thing."

Hardin was referring to externalities and their impacts on our actions, and that externalities can drive outcomes, even though we might have the perception of control over them.

“The amount of stress which an ecosystem can absorb before it is driven to collapse is also a result of its various interconnections and their relative speeds of response. The more complex the ecosystem, the more successfully it can resist a stress. … Most ecosystems are so complex that the cycles are not simple circular paths, but are crisscrossed with branches to form a network or a fabric of interconnections. Like a net, in which each knot is connected to others by several strands, such a fabric can resist collapse better than a simple, unbranched circle of threads—which if cut anywhere breaks down as a whole”.

Perhaps, the Global Financial Crisis (“GFC”) opened economists’ eyes that we should reflect on Too Big to Fail (“TBF”) institutions. There is bound to be at least one externality.

Economies of scale underlie the growth of industrial and financial firms to sizes that may be both too large to manage and losses too significant to bear.

This is the case for banks such as Itaú, Bradesco, Banco do Brasil, and Santander, which have grown to bear the risk with systemic consequences.

However, the risk they’re dealing with is different from American banks. Most Brazilian banks are controlled by an economic group — usually a few families.

So, they usually don’t have excessive leverage since the long-term goal is to perpetuate the business, not to enrich management, as happens in most US banks.

The understated externality Brazilian banks have regards innovation — or its lack. Considering that, for almost two decades, a few players owned 80%+ of all financial assets, it’s no surprise they never cared about its customer.

If a firm’s negative externalities are not compensated by its positive externalities or appropriately regulated, its social risks can be substantial.

Incumbents never thought about helping or creating better products for their customers and also have a considerable stake of the blame, creating headwinds for the bancarization process.

The Brazilian TBF has contributed to an immense negative externality—costs experienced by the public. In this sense, markets with appreciable negative externalities are no longer efficient, even if we have perfect competition.

We believe this allowed newcomers and new products to emerge and threaten markets that — theoretically — were operating in a perfect competition environment.

With that said, our job is to understand how much externalities influence competition and to conservatively estimate its economic impact on companies.

Let’s set our war table…

War Table

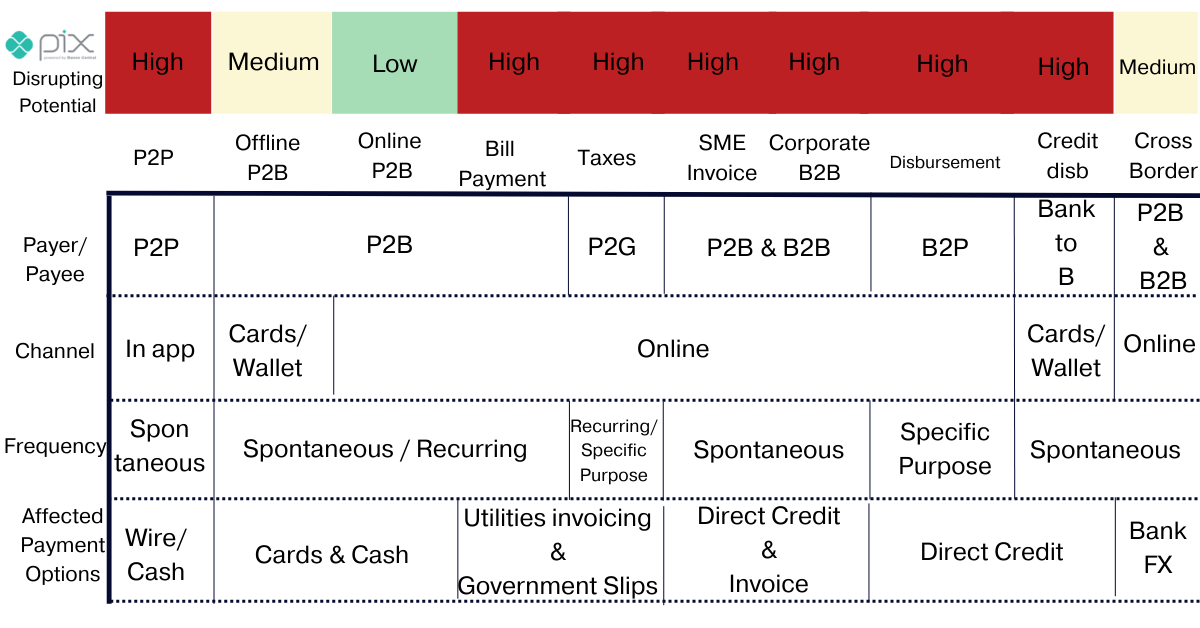

According to our proprietary research and expert channel checks, instant payments can affect many use cases involving merchants and consumers.

In the past month, we heard over a dozen CFOs and Senior Product Managers trying to map where instant payment schemes could offer a threat to profit.

Our perception is that C-level management doesn’t see Pix as a core, and Product Executives are solely focused on implementation.

Even though we agree they should focus on their respective roles, we missed more granularity about the economic impact of Pix.

So, illustrated below, we set our war table for estimating where and by how much Pix and probably most instant payment schemes should affect profit pools.

We built this table based on the available evidence, gathering and processing all data since Pix was launched in the 3Q20 and in our new top-down model for payment companies.

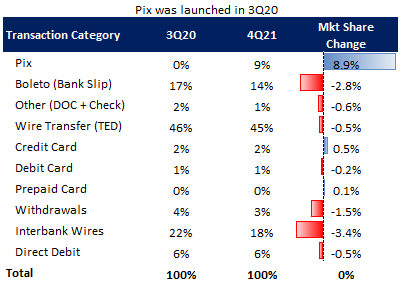

The first evidence we highlight is the transaction market share. By the 4Q21, Pix had gained an 8.9% market share. Also, it’s worth mentioning that credit cards gained market share during the period.

As the following illustration shows, bank slips, wire transfers, and withdrawals (cash) were the main losers.

However, based on historical growth, we observed that Debit and Prepaid Card growth decelerated since Pix was launched, raising the question of whether Pix isn’t stealing the incremental volume directed to Debit.

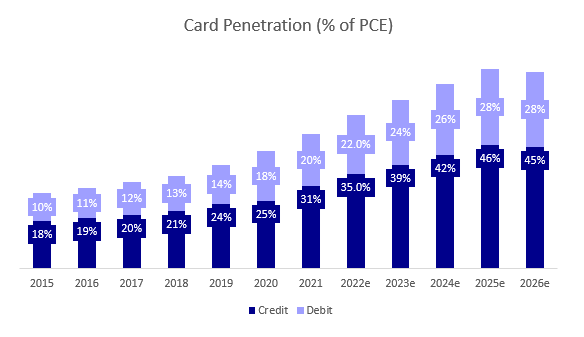

If that is the case, and the argument sounds reasonable, Debit card penetration should slow in the following years.

On the other hand, we see evidence of accelerating credit card adoption since Pix was launched. After deep research, we concluded there is a different external factor for such acceleration.

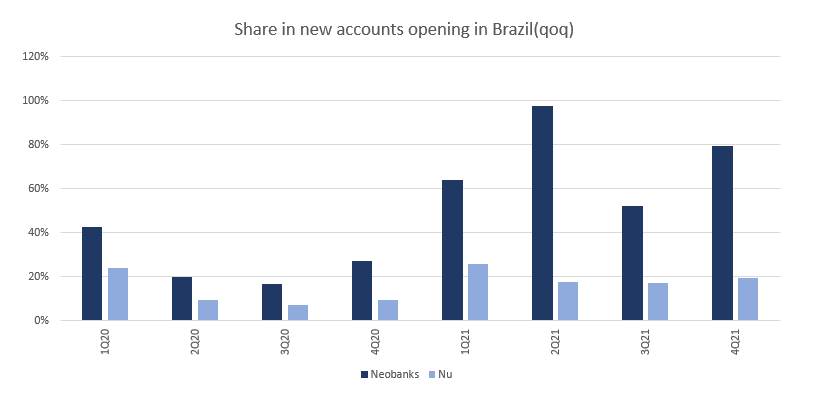

Breaking down all the data related to new accounts opened, Neobanks’ new accounts had gained momentum and represented ~60% of all new accounts opened in Brazil. Nu accounted for 20% of all new accounts in financial institutions in Brazil.

Remarkably, the new issuance of credit cards, even though with meager credit limits, will support the improvement of the credit penetration in Brazil.

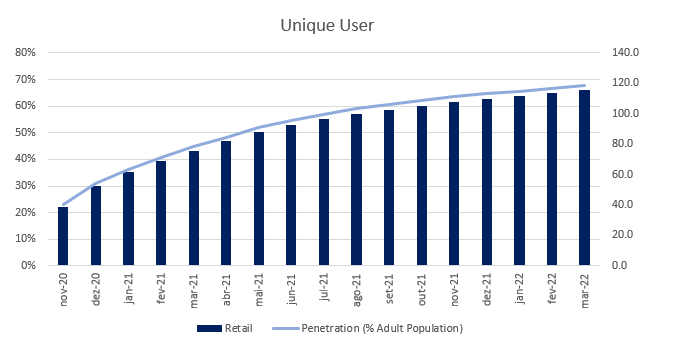

For estimating credit card penetration, we found out that another driver for its acceptance it’s mobile penetration. So, we used neobanks account opening and mobile penetration as leading indicators in our model, illustrated below.

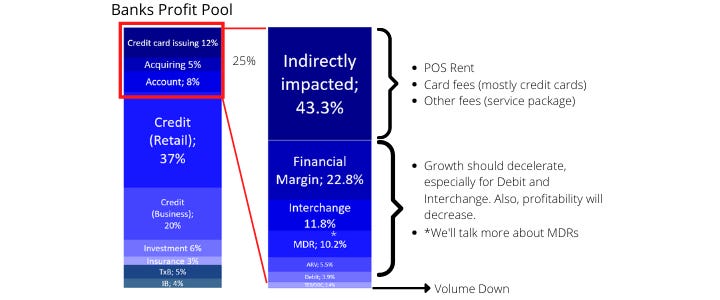

With that in mind, we gathered data provided by financial institutions and estimated a $22bn profit pool for the Brazilian banks, breaking it down by business segment.

According to our estimate, Pix will impact 25% of banks’ profit pool, 43.3% through an indirect impact, and 56.7% directly, as the illustration below shows.

Even though a few of those impacts are hard to measure, such as financial margin, POS rent, and service fee, segments like interchange and MDRs are much more manageable when comparing the available products and their value proposition.

Monetization

For merchant acquirers, we continue to see a mixed feeling. On the bull side, they can monetize all transactions through PIX (except P2P transfers), and they benefit from Pix disruption of cash and higher financial inclusion, new business opportunities, and cross-selling.

Merchant acquirers can charge transactional fees. Contrary to what some investors believe, companies like Stone and Pagseguro can monetize P2B, B2B, and B2P transactions.

In addition, it is essential to know that Pix prices are not regulated; in fact, competition has resulted in efficient pricing and healthy returns, arguably similar to debit cards, wire transfers, and bank slips.

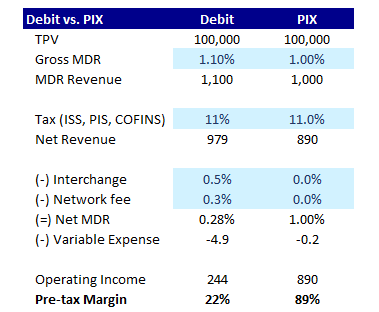

P2B gross profit returns are better compared to debit cards. Merchant acquirers in the SME segment earn an average debit net MDR of 0.3%. This is the gross debit MDR of 1.1% minus the interchange fee of 0.5% and the card flag fees of 0.3%.

In contrast, Pix prices for this segment are close to 0.4%; however, the cost of processing a Pix transaction is close to zero, so the net yield is the same.

However, this is not sustainable. Honestly, take a deep breath, and answer yourself if acquirers may make a 90% margin for a product with ZERO barriers to entry, almost zero maintenance cost, and nearly zero variable cost.

If the word “commodity” came to your mind, you nailed it. Pix is a commodity business. Let me give you a bit of context here.

When acquirers wanted to boost their merchant base a decade ago, they announced a 5/10bps discount in MDRs. A decade ago, they made as much money as Pix today, but competition eventually destroyed their margins.

“History Does Not Repeat Itself, But It Rhymes” (Mark Twain)

We actually know a few industry members spreading the competition is rationalized, and the industry will not go back into that destructive loop.

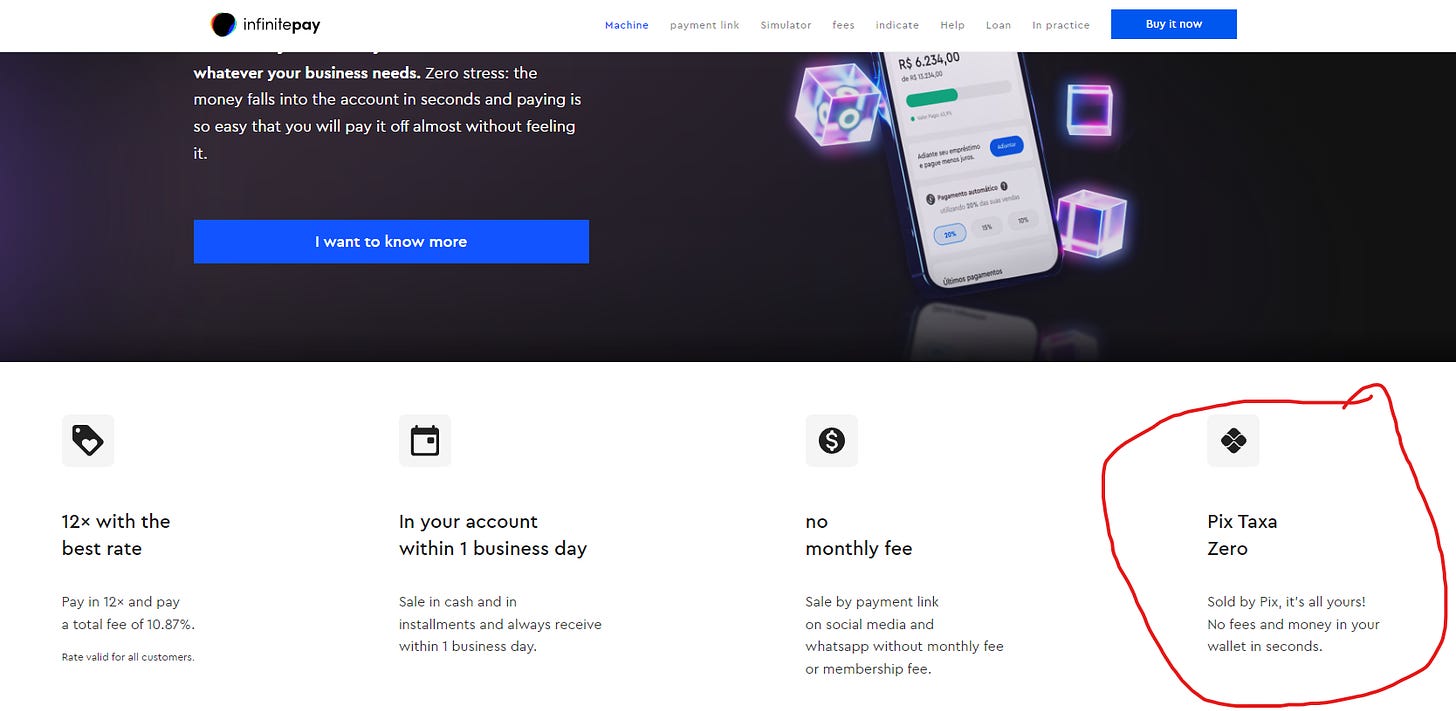

Nevertheless, since February, a new acquirer has been offering Pix for FREE for P2B and B2B transactions to acquire customers.

Let us tell you what will happen: competitors lower their respective MDR, or InfinitePay will steal their share until the day they decide to reduce the market share.

That is it. Pix is a fantastic product for businesses because the infrastructure cost is zero. It shouldn’t be treated as an opportunity, though.

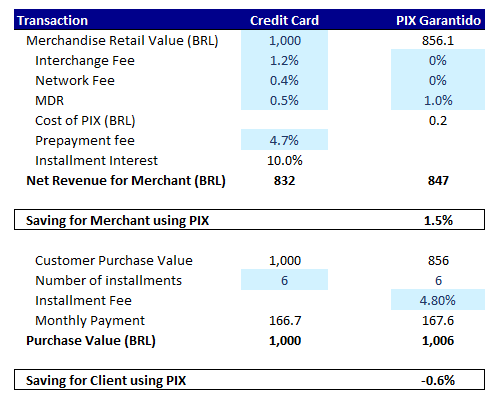

Also, we do not believe that Pix offers a better credit solution than the existing one. A new product has a disruptive potential if it has i) massive adoption and ii) superior value.

Pix Credit (“Pix Garantido”) is a credit transaction. However, unlike credit cards, it doesn’t offer a series of conveniences, such as i) wide acceptability, ii) convenience, and iii) rewards (cashback).

In the illustration below, we show that based on market fees. Even though the seller improves its revenue by 1.5% at the current costs, there would be a 0.6% price increase for customers.

Therefore, we do not see enough evidence to believe that Pix Garatido will disrupt the credit card industry. Also, unlike many market participants think, Pix Garantido is a credit operation.

Finally, is it possible to leverage sales on Pix? Yes. Mercado Pago and Infinite Pay have been doing an excellent job.

For instance, as mentioned, Infinity Pay is growing its customer base exponentially by showing how much each market participant is charging them for P2B transactions. Effective.

Mercado Pago has been using Pix's offering to leverage its marketplace business. They created a bunch of new credit offerings for their customers to capture growth in both financial and marketplace business, as we noted in our comment about its earnings.

P2P (Peer-to-Peer)

In this section, we present our expectations for P2P transactions and the evidence supporting them: i)speediness, ii)lower cost of acceptance, iii)visibility, iv)free, v)mobile-first, vi)enablers.

Appealing Value Proposition

One of the most significant advantages of Pix is its transactions’ speediness. And it is fast even before the transaction is initiated.

Instead of asking for information regarding the beneficiary’s account and/or personal data, the payer just asks for the Pix alias or scans a QR code (static or dynamic) to start a Pix funds transfer at any day and time.

Pix tends to have a lower acceptance cost because its transactional framework has fewer intermediaries than traditional payment methods.

Also, Pix access must be visible and up-front, on the home screen or after the login screen, displaying the Pix name or logo with the same emphasis as other payment services.

Finally, the BCB demanded that incumbents offer Pix P2P transactions for free, creating an asymmetrical value proposition that WILL disrupt the prior.

Mobile-first

We believe that mobile likely will be the dominant software development platform, providing primary end-point distribution and productivity benefits.

So, this is another advantage for Pix. Since it was built to promote inclusion, the BCB did an outstanding job focusing on offering a Mobile solution.

Although Pix works on computation manufacturers, the user experience is much better transferring funds through the app, as shown in Part I.

There is evidence supporting this statement. First, in 2020, Mobile represented more than 50% of all transactions in Brazil for the first time.

Specifically for P2P, in my estimates, this number is superior to 60% and should keep gaining share throughout the following years.

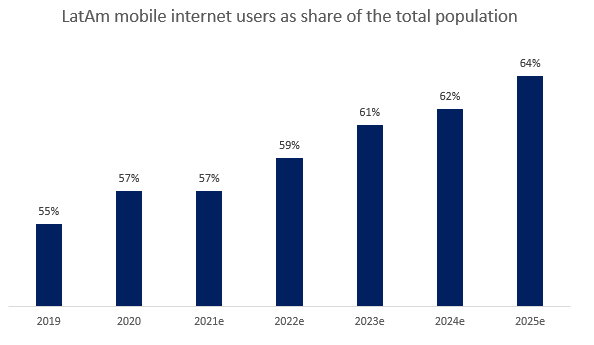

Second, the technological developments in the financial and banking sectors will keep allowing more and more people to access their bank accounts and finalize banking operations from their devices and apps, as mobile internet users will keep gaining traction.

Therefore, considering that individuals are migrating to Mobile devices to transfer their funds and that its penetration of the overall population is increasing, acquiring customers through mobile devices is cheaper than any other category since institutions are enjoying a considerable tailwind to do so.

Enablers

We didn’t see the term “enabler” anywhere, so let us explain it. An enabler is a feature that diminishes the friction for new adopters.

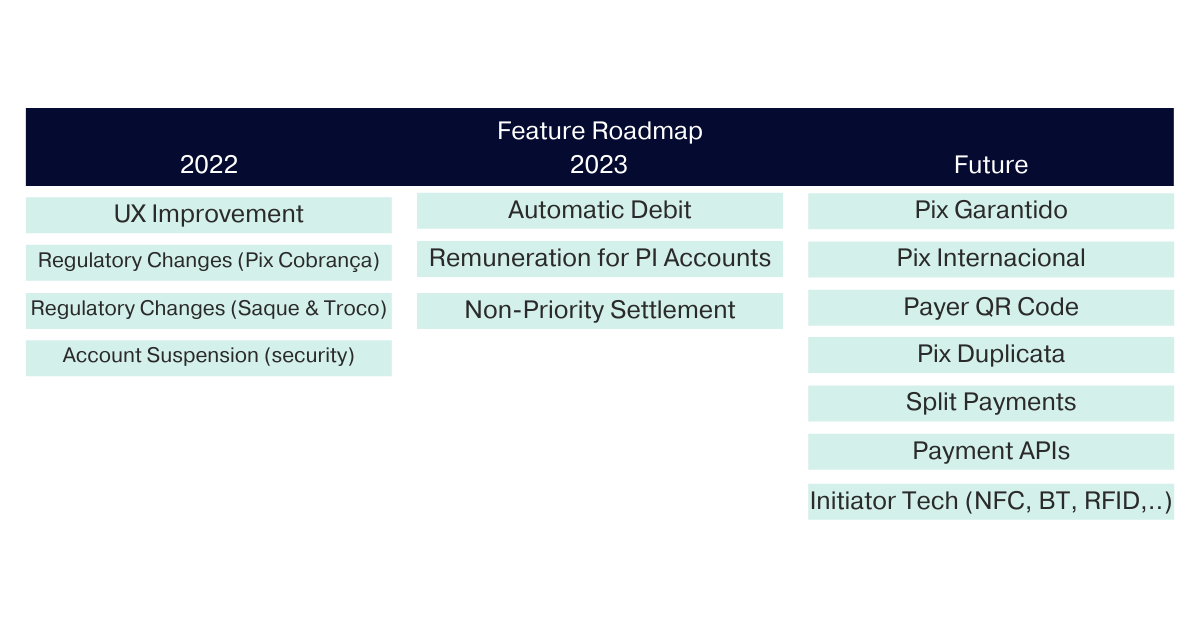

So, even though Pix is a superior product compared to wire transfers, it lacks features to reduce its cost of adoption. For instance, the BCB plans to allow Near Field Communication (NFC) technology in 2023.

Also, Pix could be initiated like any other: click, verify using biometrics and select PIX Pay or PIX Receive. This would be a massive game-changer for the industry.

The payer or the recipient could enter the amount, automatically requesting confirmation on the other person’s smartphone. This would eliminate the need to insert or scan more data — no more IDs or QR Codes (!).

Going forward, BCB’s roadmap for Pix is a “top priority,” according to the regulator, so Pix’s agenda is on fire.

P2B

Compulsory Adoption

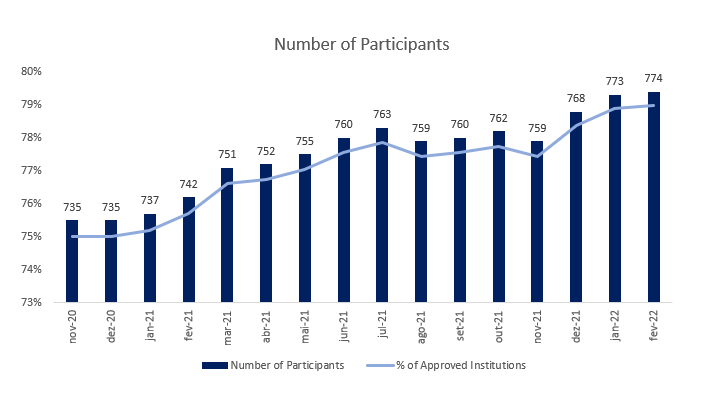

If you have a Payment Institution (“IP”) and a decent back-office operation, you could run Pix. For instance, according to our estimates, almost 80% of all applications to join the SPI were approved.

Some institutions have to offer Pix on a mandatory basis. This was a game-changer since the BCB obligated incumbents to participate and set that Pix access must be visible and up-front.

Smart move from the BCB. They made the Pix logo available to everyone, which obligated the 34 big institutions that had to participate to explain the product to their clients.

Also, it was great for the neobanks since the big boys were doing the heavy — you can read expensive — job of awareness, and they only had to deal with branding, which is incredibly cheaper.

Finally, the other financial institutions and payment institutions, including payment institutions that are not subject to authorization by the BCB, may offer the service on an optional basis, as long as they subscribe to Pix.

In these cases, they will be considered a part of the Brazilian Payments System (SPB) and subject to a minimum regulation from the moment they request to join Pix.

The Middle Man

Most POS devices offered in Brazil can already display QR codes, and those that don’t print the QR code or send the code link via email or text message.

For instance, customers could enter their mobile phone numbers into a POS device and receive text messages with the link. But, of course, all the devices will need updated software to fully onboard PIX.

An alternative for low-end POS devices is to display the QR code through a smart device (mobile phone or tablet), using the payment service provider's app instead of the POS.

Pix requires a payment initiator agent, so today, it’s hard for a few acquirers to accept Pix due to the point of sale hardware.

Although the BCB plans to launch a new QR code functionality for vendors, today, the POS machine should be a quasi-smartphone with a camera and internet connection to access all features offered.

However, a few acquirers figured this out using their creativity. For instance, if you’re using a Pago’s POS and have a smartphone, you could easily target that transaction directly to your smartphone.

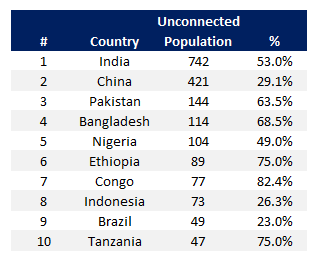

Owning smartphones isn’t an issue in Brazil According to Kepios, in 2021, 62.5% of the world population had access to the internet, versus 47% in India and 77% in Brazil.

In absolute terms, Brazil is one of the countries with the largest connected population globally, with over 150 million people connected.

Also, the Brazilian population is incredibly connected, which simplifies the adoption of the mobile-native application.

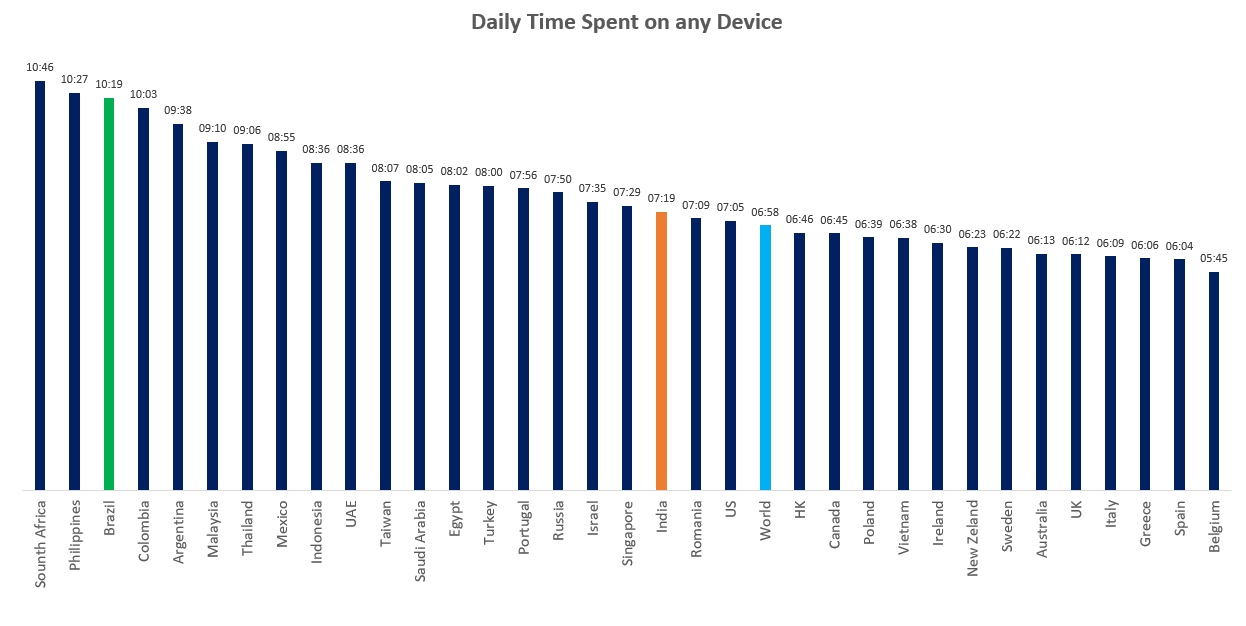

According to GWI, the world’s daily time spent on any device is 6m58s. Meanwhile, the average daily time spent on any device in Brazil is 10m19s.

Finally, the security software provider is a concern. In the multiple checks we conducted, most service providers are non-regulated companies.

So, we don’t know who is to blame if the service provider suffers an attack and deviates from the client’s fund. We went through the regulatory framework and didn’t see anything that addressed that matter.

So, we believe the BCB should improve the regulatory framework in dealing with this sort of problem.

Channel Check Flags Bypass as a Risk

It doesn’t take much to see that merchants are circumventing cards and Pix fees by utilizing personal accounts under the free P2P modality.

We visited a few locations (including malls), and merchants constantly offered discounts between 5% and 10% if we agreed to a P2P transaction instead of a P2B.

Even though the financial amount on the overall result should not be representative, we heard this sort of offer for spending going from $2 to $2,500.

Although merchants are circumventing cards, larger merchants may have incentives to operate as a business, including offering benefits to employees, business accounts, lower income taxes, and buying business services from acquirers and banks.

As we have argued in this report, cards are not being disrupted by Pix, so the impact on merchants acquiring revenues from merchants bypassing Pix should be marginal and hard to supervise.

For instance, it’s nearly impossible to monitor a merchant with multiple business accounts since he may not notice any transaction in a specific corporate account.

Finally, another argument supports our thesis that Pix MDR will go to zero over time. There are incentives and means for merchants to bypass P2B transactions.