Permanent Impairment of Capital

I’ll never forget when I read Mr. Piau’s comment about acquiring the 5% of Banco Inter. My first concern was the funding, so I started asking the street, and Stone was issuing its first bond. I was amazed.

“our investment in Banco Inter and the commercial pa that we intend to build will be very accretive in terms of learning and new experiences.”

The order book was multiple times oversubscribed, and the management wrote a material fact writing this was an evidence of the company’s ability to access multiple funding sources to support its growth.

For a moment, I thought Stone and Inter would merge, even though Inter had bought Granito (an acquirer), so that would be weird. But, on the other hand, I was excited because that would be a great movement.

Perhaps they were talking about a deal, but the window for new offers closed in the following months. So, who knows… The fact is, after a year, what a poor capital allocation decision that decision proved to be.

I’d like to highlight a passage from yesterday’s earnings release:

During 2Q22, we have sold 21.5% of our stake in Banco Inter through the cash-out option offered in their corporate restructuring. As a result of such transaction, we decided, from 2Q22 onwards, to stop adjusting in our Adjusted Statement of Profit or Loss the financial expenses related to our bond, which was raised to fully fund the acquisition of our stake in Banco Inter.

Considering the carry and the bond’s interest, Stone is running at 85% losses on the R$2.5 billion invested in Banco Inter. What management just told you in this beautiful paragraph is they realized a R$459mn loss (~US$100mn).

They managed to lose more money trading stocks than in their credit portfolio. The best part: as this is not a core business, they reported it as “other” and presented an adjusted EBT for shareholders… C’mon…

Even though management wrote beautiful paragraphs about their incredible performance, equity value per share is shrinking, CAC is soaring, and they realize ~20% of an investment incurring a 90% loss. So yeah… everything is fine.

The truth is the credit card industry is doing fantastic! We presented it in our macroeconomic model for the credit card industry in Brazil.

However, Stone has been executing poorly in the past couple of years. They are gaining market share because the industry is expanding faster than the competition.

This is a piece of good information and an excellent prospect for the industry, but not for Stone. Keep that in mind. Day after day, it’s urging the necessity of improving execution.

Thoughts About Restructuring

Edu (Stone’s co-founder) announced the intention to convert his Class B shares into A-shares; thus, surrendering control, Stone announced this morning that it will submit to the Brazilian Central Bank a request for change of control.

Following the recent departure of Edu from the BoD and his desire to covert his Class B super voting shares into Class A shares, the two co-founders would then collectively (and individually) have less than 50% voting power.

Street will remain a reference shareholder, although surrendering his control as per the material fact. Street remains Chairman and reference shareholder, but not the controller shareholder.

In Brazil, any change of control for a regulated institution must be approved by the regulator, so that will take a little time to be effective.

Until now, Stone was controlled by HR Holdings (with an 11% stake). And due to its large amount of B shares (which have 10x more votes than A shares), it holds the majority of voting rights, with a 51% stake.

Street stated in the press release that Stone has made continued efforts in recent months to enhance governance and implement business improvements, onboarding industry veterans into the management team and Board, and raising the percentage of independent members, as commented before.

Honestly, if Stone sells any more shares from Inter in the next quarter, the company is for sale and with a potential buyer.

Holding an indirect investment in a licensed bank would make the deal much harder from a regulatory perspective than if they just dump their position.

Right now, Stone called their cash-out option as liquidity is terrible and probably to not raise any flag from curious people.

Also, management populated the board with experienced veterans with close relationships to different financial institutions (BTG, mostly), and it’s simplifying its report — for those with sharp eyes, you probably remember that Stone released 10 different adjustments in 2020/21 for its PnL.

It’s worth mentioning the new stock option plan. Stone approved a new incentive plan pool, composed of 19.2mn Restricted Stock (~6% dilution), 30% vesting in 3 years, and 70% in 5 years.

One could argue that stock price is depressed, and they need to hold critical employees. On the other hand, a liquidity event ( M&A) could trigger the call. Who knows… right?

When the bride is fully dressed, they could simply announce a block trade and close the deal in a second moment. Finally, if any agreement happens in 2022, I'd be surprised, with the stock trading below US$20/sh.

Operating Figures

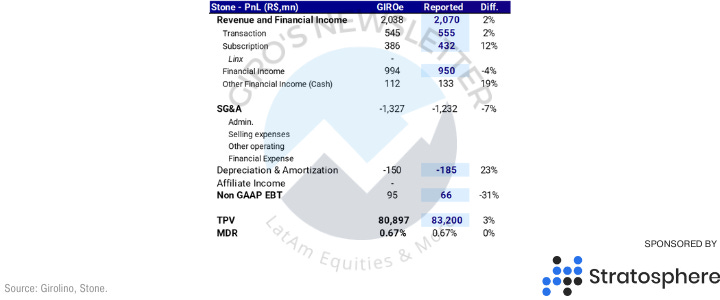

Hopefully, you read the 1Q22 preview. Results were extraordinarily in-line with our expectations, except for depreciation, which we’ll comment on soon.

Broadly in line 1Q22 and guidance for 2Q22. Stone reported 1Q22 figures, with its adjusted EBT of R$163mn, coming in slightly above the guidance provided for the quarter of R$140mn, even though it came below ours.

Also, the company announced its guidance for 2Q22, expecting EBT without adjustments +R$90mn, vs. R$82.5mn in 1Q22, pointing to EBT of R$350-R$400mn for the 2022 full-year.

After the 1Q22, our EBT for 2022 is R$369mn, versus R$670mn from the sell-side consensus. As we flagged almost a dozen times, consensus will have to lower their expectations for Stone’s earnings.

We’d like to recall that in November of 2021, we presented our R$500mn EBT for 2022, flagging a downside risk for our expectations due to downside surprise in rates, while the market had over R$1.2bn.

We feel confident about Stone’s earnings dynamics and do not expect any abrupt changes in estimates, limiting downside risk for its core operation.

The Last Puzzle

As you may have noticed, we’re almost obsessive when figuring out how things work. There is an aspect in Stone’s earnings we’re still trying to solve.

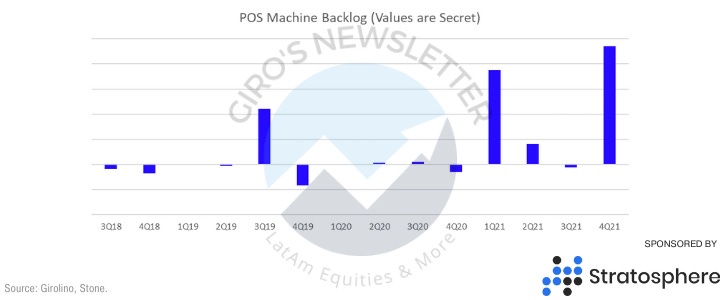

Theoretically, when depreciation rises, you could relate it to growth in sales since Stone would be investing in more POS hardware and, therefore, in sales.

So, we cross-checked with a few POS suppliers and through a simple depreciation waterfall to build a backlog for Stone’s POS hardware.

Personally, I doubt you’ve ever seen this chart before.

We use it to figure out the quarterly increase in merchants and, therefore, Stone’s market share gain or loss and anticipate new Capex plans.

However, Stone continued to show sequentially higher operating expenses, impacted by soaring selling expenses on the back of higher personnel (related to hubs) costs, reaching R$384mn (vs. R$318mn in 1Q21).

That means that churn will increase, as we previously expected, so we’ll lose reliability in our churn estimates. We’ve been using a specific rate collected through channel-checking, but the sample is biased.

We realized the check with formers that worked at Stone during easing cycles, and we’re inclined to believe until proved otherwise that customer behavior changes with the market conditions.

So, until we have more visibility on how bad churn looks, we’ll avoid significant changes in Capex estimates for POS hardware.