Rising Covid-19 cases in China raised concerns about a global economic slowdown, but Blue Chip stocks reversed losses in afternoon trading as tech names gained.

The stock market had already been frightened by rising Treasury bond yields and the potential for much higher interest rates as the FED seeks to tame high inflation, at 8.5%.

On Monday, it decided to worry about the impact of rising Covid cases in China, too, as Shanghai saw thousands of new cases on Sunday. A China going into shutdown mode means U.S. companies will have trouble accessing supplies for goods and services.

That could raise costs and pressure profit margins, but demand could also be hit if companies keep raising prices for consumers.

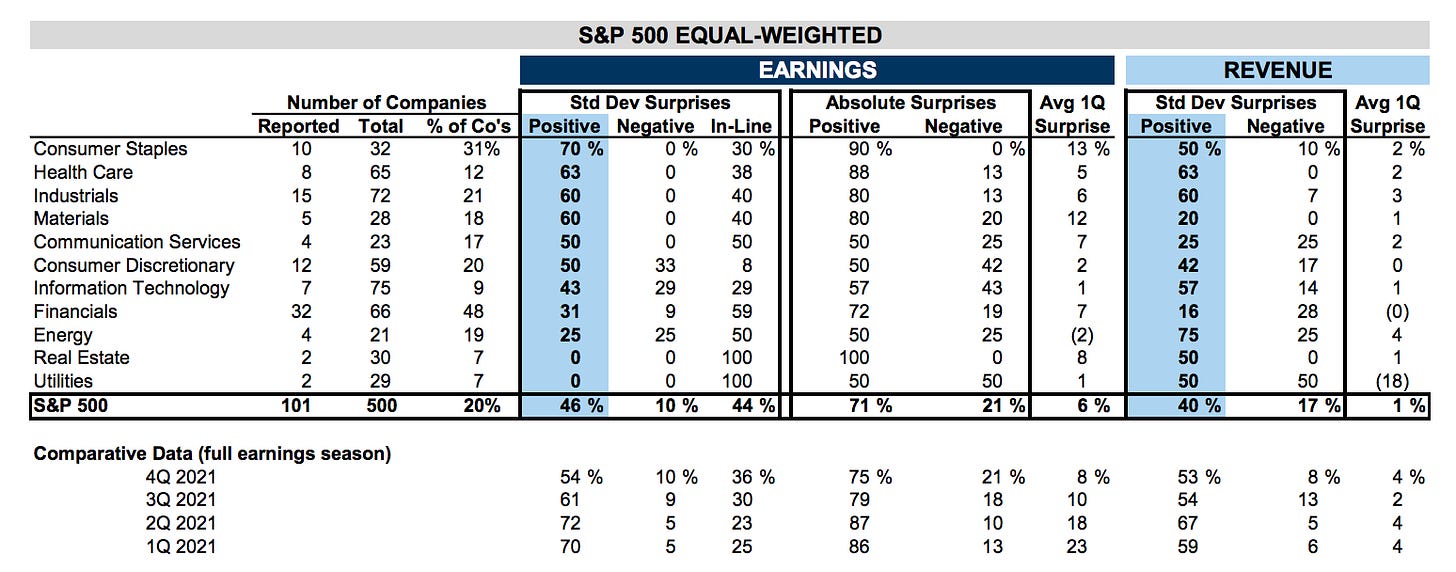

The hope is that a solid earnings season can help arrest the market’s decline. Around 25% of the S&P 500 companies are scheduled to report this week, including MSFT, AMZN, AAPL, and GOOGL.

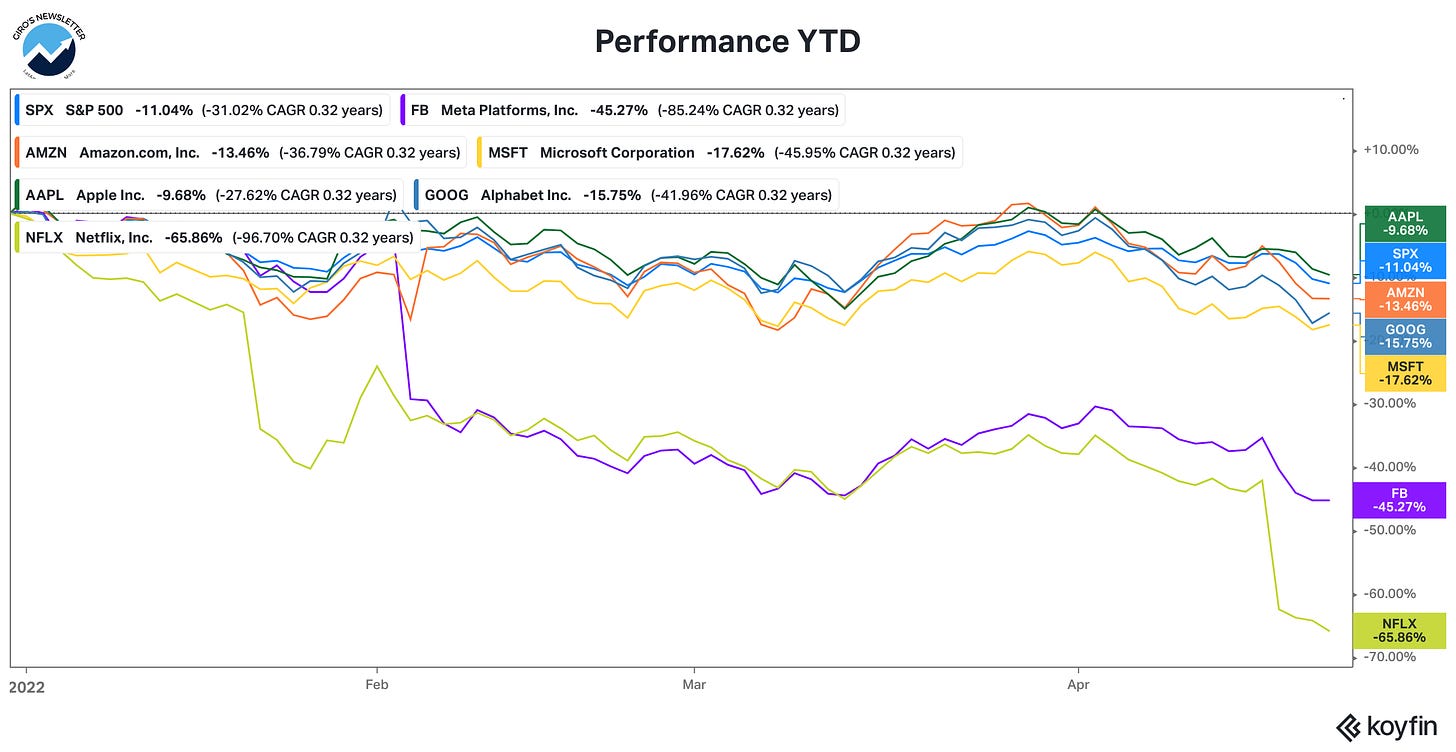

AAPL is the last FAANG standing—and its earnings report this coming week could go a long way toward determining if the stock market bounces back or slides even further.

As bad as this year has been for the stock market, it’s been even worse for the original FAANGs. While the S&P 500 has fallen 11.0% in 2022, FB has slumped 45.3%, AMZN has dropped 13.5%, NFLX has tumbled 65.9%, and GOOGL has fallen 15.8%.

The expanded FAANMGs haven’t done much better, with MSFT falling 17.6% and only AAPL—down 9.7% in 2022—outperforming the S&P 500.

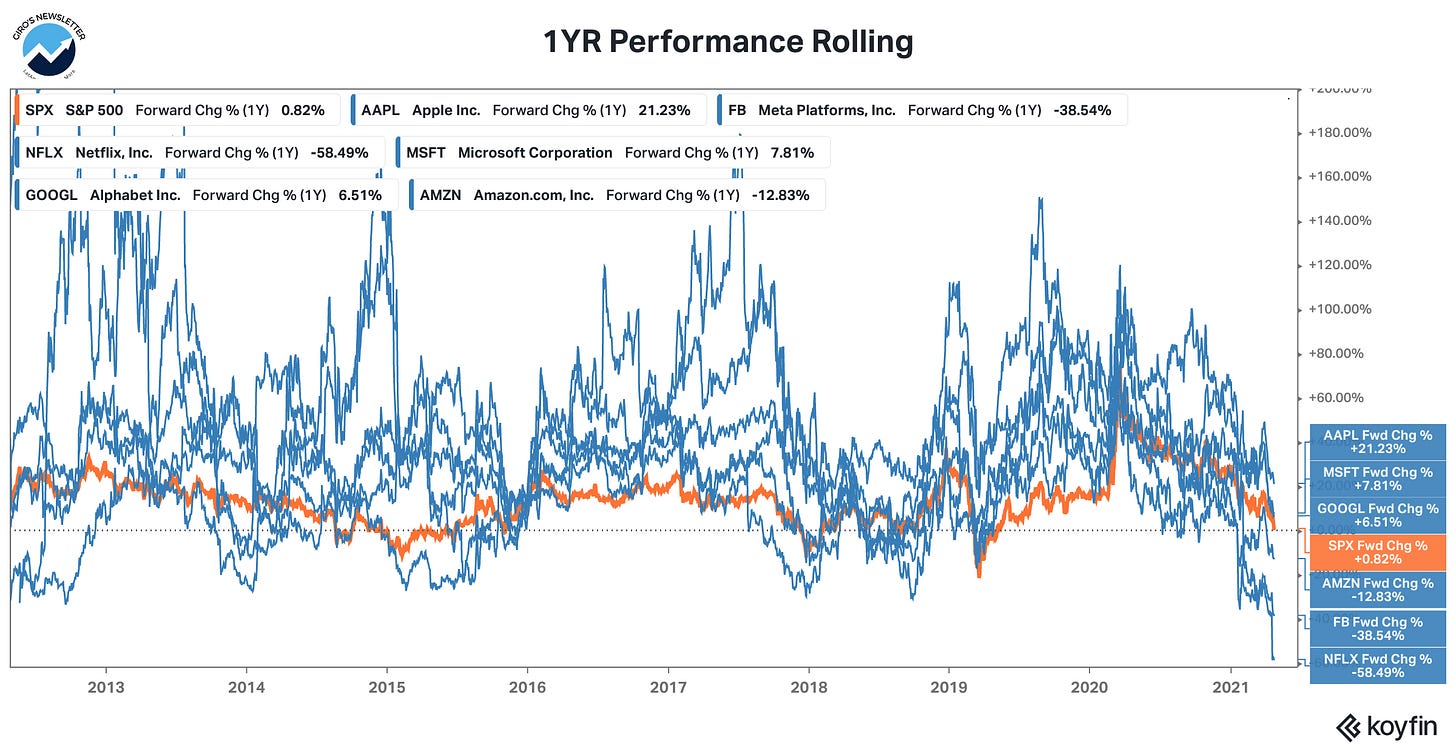

To say this is terrible news for the stock market is an understatement. Most major tech stocks added more to the S&P 500’s returns than their index weight would imply in the past decade.

Concern that Fed tightening will trigger a recession has recently been a significant focus of market participants, especially after Fed policymakers have doubled down on the message that policy tightening will be front-loaded.

However, they note that monetary policy soft landings are historically rare and have described the outlook for the Fed as a “hard path.”

The S&P 500 has fallen by a median of ~20% from peak to trough during 12 recessions since WWII, a drawdown magnitude that would bring the index to 3650.

Finally, we believe that market participants will carefully follow all major tech companies to balance overall expectations.

In the same way that subsequent positive surprises triggered tech stocks to outperform and contribute to the overall index performance, negative surprises would be a catalyst.