Hi

Last week, VTEX hosted its annual meeting that lasted two days. As we decided to follow the company again (did it pre-IPO), we thought it would be of great value to share notes and takeaways.

✨Management was vocal on key messages: scale and innovation✨

VTEX is gaining international scale in operations and distribution by establishing partnerships with global players like AWS, Stripe, and Paypal. As a result, the developer activity has increased in the US (6.8k MAU for the US vs. 7.0k for Brazil).

On the innovation front, VTEX announced new features: 🛒i) VTEX Live Commerce - a solid match to the latest industry trends, and 📦ii) VTEX shipping network, where the company optimizes logistics cost/efficiency by acting as a carrier broker.

Also, during two days, different merchants and global industry players explained how VTEX adds value through its platform and numerous partnerships/collaborations.

On increased e-commerce penetration LatAm, several global and regional brands expressed optimism after the pandemic as new categories are transacted online, such as Mr. Galló, former 👗Renner’s CEO, Mr. Lebelson, 🍺ABInbev, and Mr. Diniz, Board Member at 🏪Carrefour Brasil.

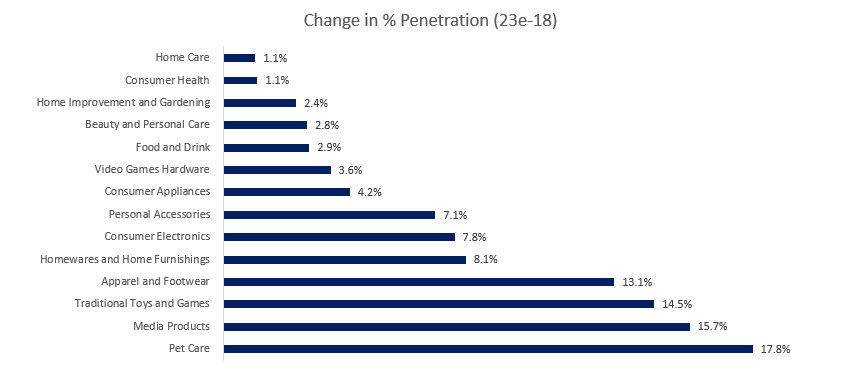

Indeed, we agree with management on that. According to our estimates, e-Commerce penetration should increase in the following years, especially in categories such as Pet Care, Apparel, and Footwear.

Also, frictions for e-commerce in Latam are rapidly diminishing, as demonstrated by the rapid adoption of digital payments (digital wallets or Pix in Brazil) and the continued improvement of regional logistics.

In the past couple of weeks, we released a couple of posts regarding exclusively on Pix. Make sure to read both (link and link) to get up to speed on the payment industry in Brazil.

About the increased market share in Latam ex-Brazil, VTEX's operations executives about many ways in which VTEX is rapidly expanding its reach throughout the region.

Progress on this front is often started on its own initiatives and from VTEX's customers in one country that use its platform to open stores in others.

At a country level, VTEX highlighted good traction in Colombia, with a strengthening ecosystem, wins of large logos, and government support to the industry (VAT free dates).

Meanwhile, in other countries like Mexico, Chile, and Argentina, VTEX also reported encouraging trends that correspond to Brazil and Colombia's earlier stages.

On the international expansion into developed markets, VTEX is making in-house efforts and establishing partnerships to raise brand awareness and broaden its operational and distribution reach.

Yet, as VTEX doesn’t have sufficient brand awareness in those countries, it relies on deepening relationships with strategic partners and investing in customer acquisition (using local agencies, for instance).

Beyond its prominent partnerships with global players like AWS (cloud, distribution) and Stripe (global payments), VTEX is also partnering with integrators and digital agencies on a worldwide (MacFadyen) and local scale.

The latter helped VTEX gain traction in Italy. In the beginning, a local system integrator helped liaise with domestic culture and practices to deliver robust results quickly (6 months to revenues).

Further, VTEX is now taking system integrators from LatAm into different countries to form partnerships with local agencies and expedite business development in new countries.

So far, VTEX has collected a few dividends from the recent partnerships, such as the partnership with Mazda to roll out stores across +20 European countries (link).

The initial rollout in the UK shows promising results (conversion almost doubled). It reflects the breadth of capabilities of VTEX's platforms by combining search with geolocation, all with enough customization to meet customer needs.

Further, VTEX's progress on the international front is evidenced by the numbers of developers from the US accessing the VTEX platform, which has grown to a similar level to those in Brazil (US 6.8k MAU, vs. Brazil 7.0k).

Finally, management will focus on culture and innovation beyond executing the three pillars mentioned above (increased e-commerce penetration in Latam, increased market share in Latam ex-Brazil, and continued progress on DM expansion).

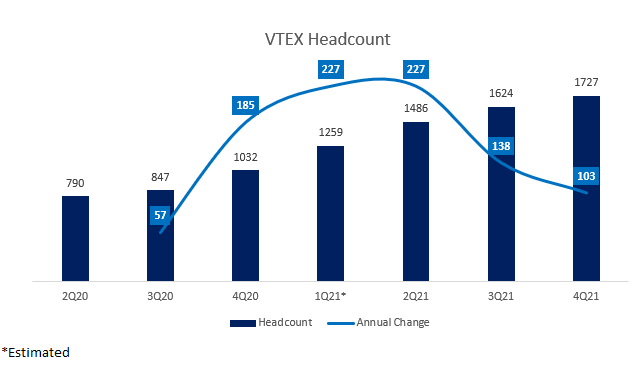

Over the past two years, the rapid pace of growth coincided with a rapid expansion in human talent that now incorporates senior industry executives from global technology firms.

As a result, the company will now focus on consolidating its culture, especially after two years of pandemics.

About it, we’re curious about how VTEX engages and retain employees. In the early days, the arbitration hiring Brazilian developers (weak currency) to develop solutions for developed countries (strong currency) was obvious.

However, the company has been expanding its footprint internationally to create brand awareness, which may impact its expenses in the following years.