In no other region of the world does populism and its debate have such a long and rich political and socioeconomic history as in Latin America, even if the rural Russian and North American cases preceded it.

In the past two decades, the coming to office of a series of center-left governments (such as Lula in Brazil, the Kirchners in Argentina, or Rafael Correa in Ecuador) has given new space (and meaning) to the term.

When we think about populism, there are several varied explanations ranging from classical sociology, Gramscianism, and Bonapartism to theories of electoral realignment.

Perhaps, one of my favorite thoughts about the topic comes from Bonner and Rajiva, authors of Mobs, Messiahs, and Markets.

Bonner argues that populism thrives because none of us really likes honesty. On the contrary, we prefer deception —but only when it is unabashedly flattering or artfully camouflaged.

“They need heroes, however fraudulent. People ask actors who play doctors on television what they should do for their ailments, although they know perfectly well that the actors are just playing a role. Studies show that people are more likely to accept the opinion of a confident con man than the cautious view of someone who actually knows what he is talking about. And professionals who form overconfident opinions on the basis of incorrect readings of the facts are more likely to succeed than their more competent peers who display greater doubt”.

This passage is fascinating and illustrates what Brazilians have witnessed in the past decades. Sounds right, and being confident is actually more important than being right.

It’s tragic but funny to watch Brazilian politicians in public debates. They create data and virtuous explanations for explaining poverty, corruption, and how they could quickly solve all problems.

American and European politicians refer to a problem and how they would take care of it —even though they may be wrong. Instead, Latin American leaders create a desaturated narrative to give context to the current situation feeding its people with lies and misguidance.

In short, populists are a plague in Latin America because when the person doing the deceiving is fool enough to be deceived, too, that is, when he believes his own lies.

That is why incompetent leaders—who are naive enough to fall for their own guff—are dangerous to civilized life. If they are modern leaders, they must delude themselves into thinking they know how to make the world a better place.

The problem is that, ultimately, reality will come to light and claim its price. Then, the population will be disappointed and waiting for its new Messiah to come.

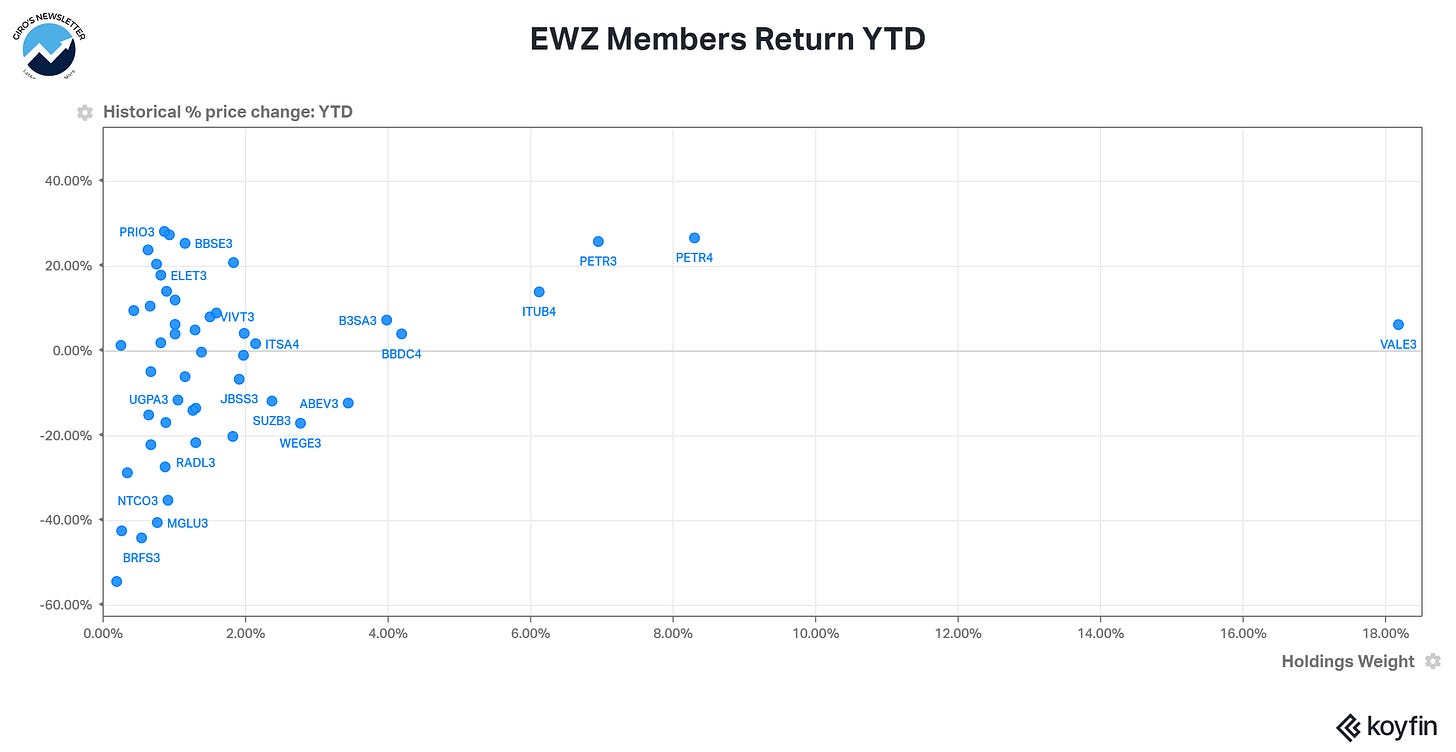

After a solid start to the year and the recent sell-off, Brazilian stocks tumbled 10%, while the EWZ stumbled 14% in April — ended the month +16% YTD, though.

Historically, Brazil’s big banks have an outstanding track record of going through crises with modest operational performance. Benchmarking with global peers, Brazilian banks deliver excellent performance.

As commented in our last wrap:

“As commented a few weeks ago, while higher interest rates tend to benefit NIMs for most banks, there are risks from weaker GDP growth and high inflation, which can pressure loan growth and deteriorate asset quality.

However, Brazilian banks have been among the worst-performing banks globally. On the other hand, most banks globally have risen in the last 12 months, with only Turkish banks declining more than LatAm banks.”

Also, the global commodity rally was benefiting the Brazilian Index, considering that more than 1/3 of the Brazilian Stock Exchange is composed of commodities companies, such as Vale, Petrobras, and Gerdau.

We believe that Latin America in general and Brazil are well-positioned in the current challenging geopolitical backdrop.

There are many reasons for this: i) geographic and economic insulation from Russia’s War; ii) considerable commodities exposure (grain, oil, and iron ore); and iii) attractive valuation entry points.

The fact that most of the flows into Brazilian equities this year are coming from foreigners is also driving increased demand for more oversized caps and more liquid stocks.

As a result, Itaú, B3, Bradesco, Petrobras, and Vale are among the most liquid and best-performing stocks in the index, supporting the extraordinary YTD performance.

However, we’ve been flagging the increasing risk in the region and wrote on Apr 10th that the Brazilian Stocks would not outperform the global market in the following months.

Even though the EWZ is down 20% since we flagged these risks, there is much more risk for deterioration. There is an understanding that BRL is cheap because the carry is high.

Nevertheless, if you simply observe the LTM inflation and the average Selic, you’re losing money(!). Simply can’t agree with the trade.

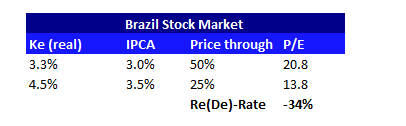

Also, we believe that higher long-term rates in Brazil should lead to a de-rating in the Brazilian Stock Market. In 2021, our base case for real rater was 3.25%, with a 3.0% and moderate pricing power for Brazilian companies.

Considering the recent deterioration in the local markets, we raised our base-case assumptions. As a result, we consider a 4.5% real rate (vs. actual 5.7%), 3.5% long-term CPI (vs. actual 11.3%), and household income destruction leading to pricing power loss.

With that in mind, we estimate that Brazil Stock Exchange should suffer a 35% de-rate versus previous trading multiples.

Also, as the Brazilian Federal Funds (“Selic”) continue to skyrocket, today at 12.75%, with no clear signal if the tightening policy cycle peaked or not. The BCB communication is terrible.

Just like the FED, the BCB doubled down (a few times) through its policy rate administration, leading to several shocks in the rates and FX market. Considering its last catastrophic bet, we might see the Selic rate above 14% in a long time.

Also, the local equity funds suffer sequential redemption, leading to forced selling in stocks with lower liquidity amidst a market with low liquidity and sequential sell-offs in specific names.

Even though stocks may look cheap, we need to consider the greater context. We have populist candidates running for elections in Brazil, surging public spending, and a global crisis on our hands.

Finally, we heard a lot that Brazil is trading at 10x earnings, 1-st.dev below the 10yr average, so it’s trading cheap. Again, we disagree.

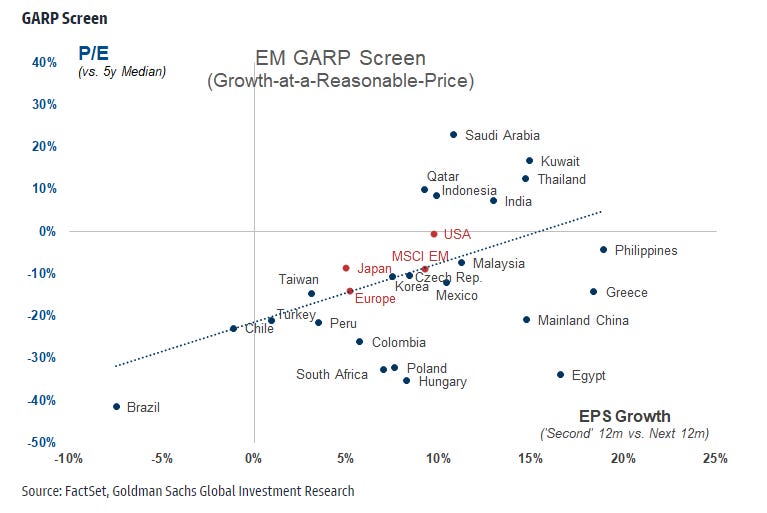

We stick to our thesis that most investors are short-sighted and pay little attention to macro headwinds, such as inflation. Goldman illustrated that very well in the chart below.

Considering the ‘Second’ 12m earnings growth, actually, Brazil is one of the worst places to be invested in. That happens because the country is a commodity play — as we insistently point out.

Inflation will vanish any remaining growth in 2023. So, owning any LatAm ETF while extraordinary companies are trading at reasonable valuation is a waste of time.