🇧🇷 Fading Momentum🔻

With interest rates potentially starting to point to a stabilization and strong FX appreciation, the environment for risk-taking is marginally improving from what we saw in late 2021.

Nevertheless, risks on the macro/political front may still prevent a more pronounced short-term rotation back to risk assets.

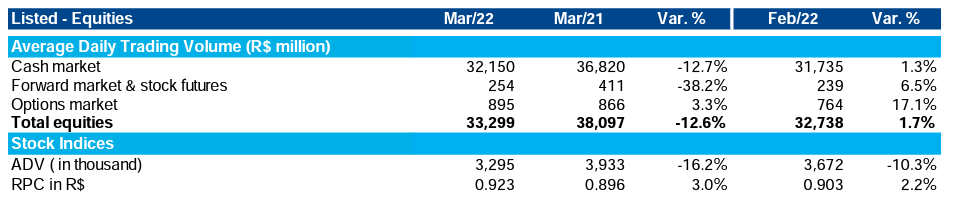

B3 (BVMF: B3SA3, OTC: BOLSY) has reported operating figures for March, with an equities Average Daily Traded Volume (”ADTV”) totaling R$33.3bn, flattish vs. R$32.7bn last month.

Meanwhile, derivatives posted 5.0mn ADV, above February’s 4.0mn print. As a result, for the entire quarter equities, ADTV totaled R$32.2bn, -1% QoQ, and -16% YoY. Turnover velocity remained at 173% in 1Q22 vs. 174% in 4Q21.

In January, the negative highlight comes from individual investors, registering stronger than expected outflow. Individuals’ savings reported R$40.8bn of outflow, much worse than R$16bn outflows recorded in January 2021.

There is a natural withdrawal for year-end consumption and an indication of a deterioration in household income and, therefore, demand. This is an unfortunate consequence of rising rates and higher-than-expected inflation.

Also, recent data shows large outflows from both Macro (R$-44.9bn YTD) and Equity funds (-R$19.5bn YTD). This is reflected in the secondary market, in which Brazilian Funds (aggregate) sold R$68.2bn YTD.

Though not surprisingly, foreigners have bought R$69.2bn in BZ equity YTD, the largest inflow quarter since at least 2008.

Last week’s newsletter explained why Brazilian equities might not outperform the market in the following 12 months. The attractive real rates in Brazil at 6.7% (10Y Bond at 12% - 10Y DAP) explain most foreign inflow.

This is short-term demand driven by hedge funds (”HFs”) investing in thematic baskets, such as high rates commodity exporter countries, in which Brazil is included.

Even though the EWZ is up almost +35% YTD, local the Brazilian Hedge Funds Index (IHFA) is performing only +6.7% for the same period, meaning that local investors have a lousy technical on the market.

For the 1H22, local HFs will not increase their risk, mainly because the annualized performance is above the benchmark. However, we should expect higher volatility in the 2H22.

Yellow Flag for Neobanks

Inter published its operational figures for 1Q22 (link here) and as expected credit origination was weak (up only 22% YoY) and asset quality deteriorated.

The bank's overall expansion was good with a client base achieving 18.6 m clients, net adds of ~2.3m (vs. 2.5m in Q421). On the other hand, the bank's NPL ratio moved up 50bps QoQ, reaching 3.3%.

This deterioration was even stronger in the case of the credit card business, as the ratio of overdue loans (90 days) achieved 6.6% (vs. 5.2% in Q421).

Note that before Covid-19, Inter’s NPLs were around ~4%. Investors could interpret this as a yellow flag for the entire sector, although we should wait for confirmation in subsequent operational figures.

Also, credit origination was weak achieving R$ 4.5 billion in Q122, a material decline vs Q421 when it originated at R$ 6.1 bn. The mix of loan origination also changed a bit, with SMEs achieving ~70% of total disbursements (mortgage and payroll got hit).

To foster the loan origination to individuals, Inter signed a partnership with Mercantil do Brasil with a focus on older customers (>50 years) - Inter should carry out credit assignments up to R$2bn in the next 18 months.

Finally, InterInvest showed weak QoQ active clients at 2.0m - it represents 10% of the bank's total clients vs. 12% in Q421. This is a meaningful deceleration, confirming the previous topic. Total AUC reached R$58.1 billion, +2% QoQ (+11% YoY).

All in all, investors should see this as a yellow flag for neobanks, especially because asset quality is worse than expected deterioration.