Hi.

This month, China has been adopting new policies that we believe will materially affect the landscape in the 2H22, especially after years of facing regulatory constraints.

A few events might affect asset pricing and the economy more than most people realize, even though the media has been ignoring the matter. So, we decided to prioritize our resources in researching and curating the best content.

Since December of 2021, new policies have triggered significant concerns about ADR delisting risk and the broader risk of US-China decoupling in the capital markets, leading to a renewed selloff in Chinese ADRs.

Also, China recorded 19,000 new daily Covid cases on average over the past week, surpassing the previous peak in early 2020.

Since the first official case was identified on Dec 8, 2019, in Wuhan, China has logged 340,000+ total Covid cases, of which 3/4 were reported in the past 6 weeks.

We believe 2Q could disappoint vs. current market expectations due to the scale of Covid lockdowns but will mark a bottoming-out of growth quarters.

The velocity with which the Chinese government announces and roll-out its policies is remarkable. Also, from a fiscal perspective, the country has vast flexibility to boost liquidity and growth.

Therefore, we'll present the available evidence to sustain our thesis that China might face an inflection point in the 2Q22, offering a significant long-term opportunity for investors.

This newsletter is only possible thanks to paid supporters. Access to a great deal of my content is free, but if you like what you see, please consider becoming a supporter!

Think about it. If you make just one good decision per year because of something you learn here — or risk you avoided —it’ll pay your subscription for multiple years and you'll be supporting me to keep generating good inputs for you.

Today’s outline

- Standstill

- Assault on Markets

- Block the Road

- Growth Lackluster

- Optionalities

- Set the Ground

- QE is Coming

- Policy Summary

Summary

- Inflection Point

- Valuation

- Investability

- Regulation

- Closed Ideas

Standstill

On Thursday, Shanghai extended a standstill order throughout the city to April 26, tightening its stranglehold on a lockdown entering its fourth week to track down every Omicron case in one of China’s largest population centers.

City authorities have extended their “static management” measures until next Tuesday to plug the loopholes around unguarded compounds, where infections have flared up again after lying dormant.

In China, daily new Covid cases surged and reached the highest level since early 2020, and multiple provinces imposed restrictive measures in response to Covid cases.

To date, 5 cities are under harsh lockdowns (6% of the nation's GDP and 4% of the population), and 19 are in partial lockdowns (8% of GDP and 7% of population).

Also, industrial areas are being affected indirectly, pushing the percentage of the GDP affected even higher.

Assault on Markets

In the past week, US SEC added another 17 Chinese companies to the list of CIIs (40 in total). Didi set a shareholder meeting on May 23 to vote on its US delisting plan.💣

On Dec 2, Didi, a Chinese ride-hailing company that floated its shares on the NYSE on June 30, 2021, announced that it would file for delisting its American Depositary Shares (ADS) from the exchange and start work on a Hong Kong share sale. 🤡🤡🤡

In March, the SEC announced that 5 Chinese stocks had been identified as CII (Commission Identified Issuer), triggering a ~30% drawdown of Chinese ADRs in a week — roughly a 5-sigma move.

Before that, on Dec 1, Chinese authorities reportedly discussed plans to ban companies from going public abroad through the VIE structure due to data security concerns.

Under a variable interest entity (VIE) structure, a Chinese company sets up an offshore entity for overseas listing purposes that allows foreign investors to buy into the stock.

Existing VIEs may have to provide more transparency, according to the report. However, later on the same day, the CSRC denied such an intention, and on Dec 3, China Daily reported that regulations are expected soon for “orderly overseas listings.”

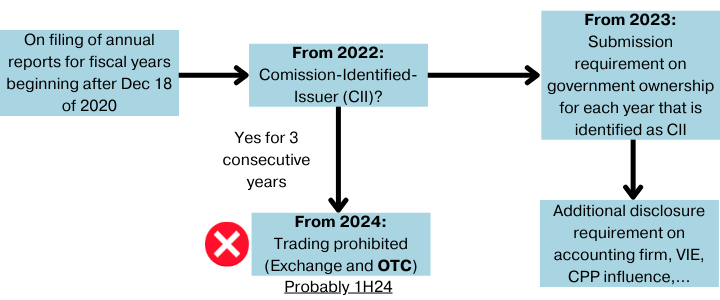

On Dec 2, the SEC in the US adopted amendments to finalize rules relating to the Holding Foreign Companies Accountable Act (“HFCAA”). The HFCAA was passed by Congress and signed into law by then-President Trump in Dec 2020.

It permits the SEC to ban (foreign) companies from trading and delist them from US exchanges if the US Public Company Accounting Oversight Board (PCAOB) cannot audit requested reports for three consecutive years.💣💣💣

The Commission will identify CIIs for fiscal years beginning after Dec 18, 2020, suggesting that the first batch of CII will be added to the provisional list by the SEC as early as in 1H22 (20-F Form will be due). If no agreement is reached, the timing for delisting would be from 1H23 to 1H24.

In the case of delisting, which is not our base case, those are the options we're considering after reading the Consultation Conclusions to the HKEx:

- Investors will have ten days to sell the stock (before the last ADR trading day) after filing Form 25 with the SEC.

- Investors could continue trading the shares on the OTC market under a sponsored level I ADS program, such as Luckin Coffee and Guangshen Railway.

- They could return their ADS to the custodian and withdraw the equivalent deposited security (in the HKEx).

- Investors could wait to receive the net proceeds upon the termination of the ADR program.

Another invaluable help that actually costs you nothing is sharing my content. I'm primarily relying on word of mouth to spread my content, so I'd deeply appreciate it.

Block on the Road

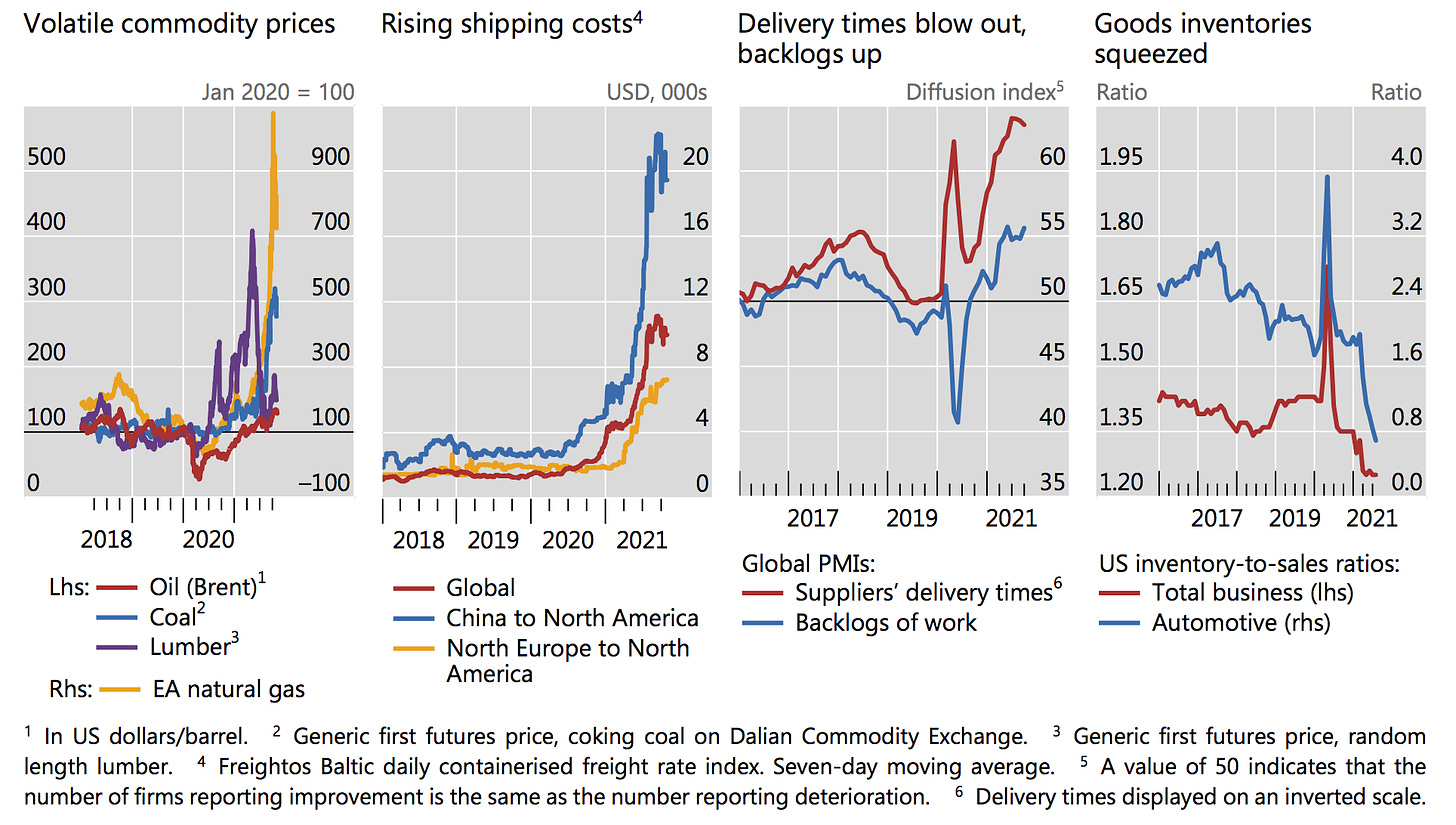

As the global recovery gains traction, demand for critical raw materials, intermediate inputs, and logistical services has outstripped available supply, leading to rising and volatile prices and delivery delays.

The resulting mismatches have put supply chains under pressure, causing bottlenecks when the demand for an upstream production input suddenly and significantly exceeds the maximum amount produced and delivered.

Current bottlenecks have persisted longer than anticipated, weighed on output growth, and helped to raise global inflation.

According to BIS, on supply chains for exports, manufacturing of computer and communication equipment appears most affected, with restrictions in Guangdong being the most disruptive.

Several cities in China's southern province, Guangdong, a central manufacturing hub, have asked the industry to curb power use by suspending operations for hours or even days as high factory use combined with hot weather strain the region's power system.

The power restrictions are a double-whammy for manufacturers who have already been forced to lower production due to a recent surge in raw material prices, including steel, aluminum, glass, and paper.

These bottlenecks have had knock-on effects through production networks. Unable to secure inputs, firms slowed or stopped production, causing order backlogs and blowing out delivery times.

At the retail level, goods inventories have sunk to historic lows, particularly for durable items such as cars and furniture with high transport costs (fourth panel).

Energy inventories are also at record lows in several countries, leading to blackouts and rationing. These, in turn, have weighed on the production of raw materials and manufactured goods, intensifying bottlenecks further.

Also, structural vulnerabilities across the information and communications technology (“ICT”) supply chains have presented several risks that have become more apparent due to disruptions caused by the COVID-19 pandemic.

These include the lack of a domestic ecosystem for many segments of ICT production, overreliance on single-source and single-region suppliers, and the difficulty in maintaining product integrity due to complex supply chains.

These vulnerabilities increase the potential for supply chain disruptions and complicate product and supply chain security efforts.

Growth Lackluster

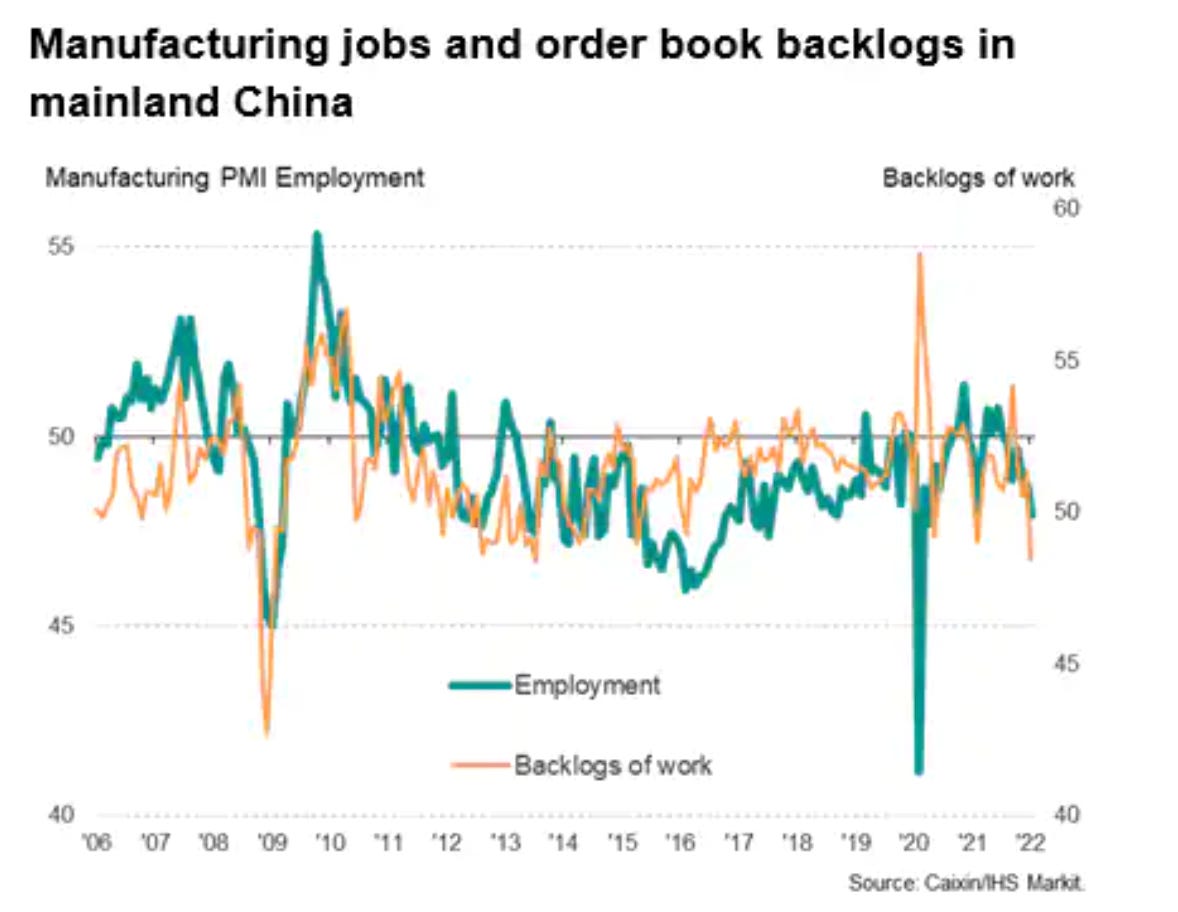

According to PMI survey data produced for Caixin by IHS Markit, manufacturing production in mainland China fell in January as the Omicron wave disrupted business activity.

The survey data had shown output growth accelerating in December ahead of the Omicron outbreak, rising at the fastest rate for two years, as business revived from the Delta wave, linked to output falling between August and October.

However, reimposed restrictions against COVID-19 spread in several regions during January were reported to have curbed factory production and inhibited demand.

The drop in production in January was the third-largest recorded since the onset of the pandemic, though far weaker than the downturn recorded during the first lockdowns.

New orders likewise fell back into decline amid the January Omicron restrictions, fueled by the most significant drop in export orders recorded by the survey for 20 months.

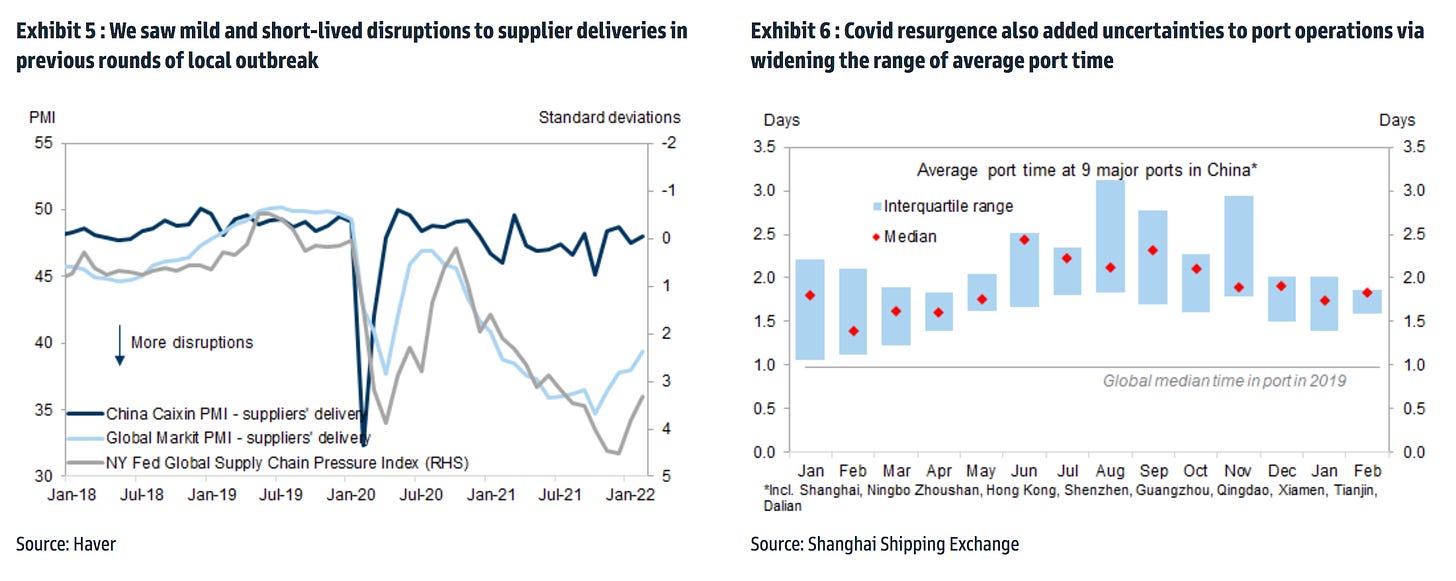

The local outbreak also appeared to affect key transportation points such as ports. For example, in June 2021, when a local outbreak affected Guangdong, we saw an increase in average port time.

Meanwhile, in August 2021, when adverse weather conditions and local Covid outbreaks affected Jiangsu and Zhejiang, the median of the average port time in 9 major ports in China had little changed in August.

Thanks to some diversions, the interquartile range widened notably, suggesting logistical issues at select ports, not the entire system.

Admittedly, with surging new cases, this wave of local Covid outbreaks appeared to be the most severe since early 2020. Thus, disruptions to logistics and ports could be worse than those in early 2021 and last summer.

Considering the need to keep draconian Covid-containment policies in place given the political capital President Xi Jinping has spent on them, in light of his presumed assumption of a precedent-breaking third term at the helm later this year.

We believe that the stringent Covid containment policies will remain until the 4Q22, for the 20th National Party Congress, which will likely be held in the 4Q22.

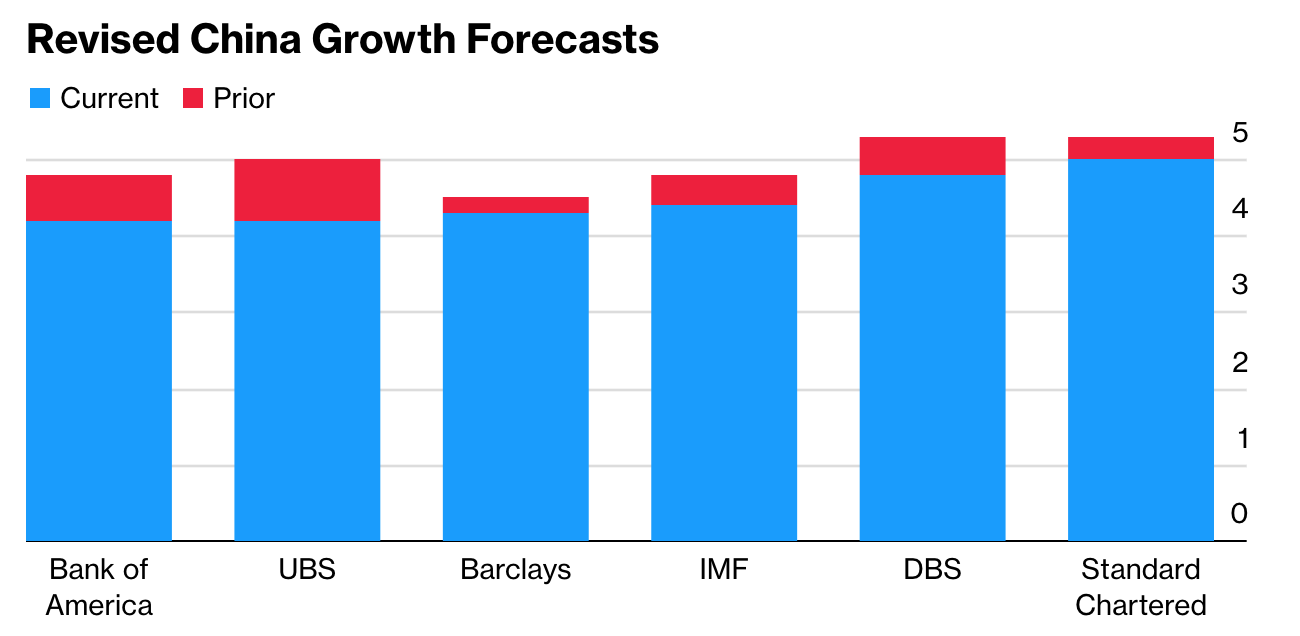

Economists have been reducing 2022 growth expectations to a sub-5% level, almost a percentage point below the government’s 5.5% target.

Optionalities

China’s growth estimates for 2022 have been revised downward by a percentage point or more below the government’s target of 5.5%.

As we mentioned a few weeks ago, the US growth estimates have been cut to 3% for the year.

As a result, several economists say that a recession may not be avoided. Instead, the Fed needs to raise rates much more forcefully to bring down inflation, with a higher risk of leading the country to a stagflation period.

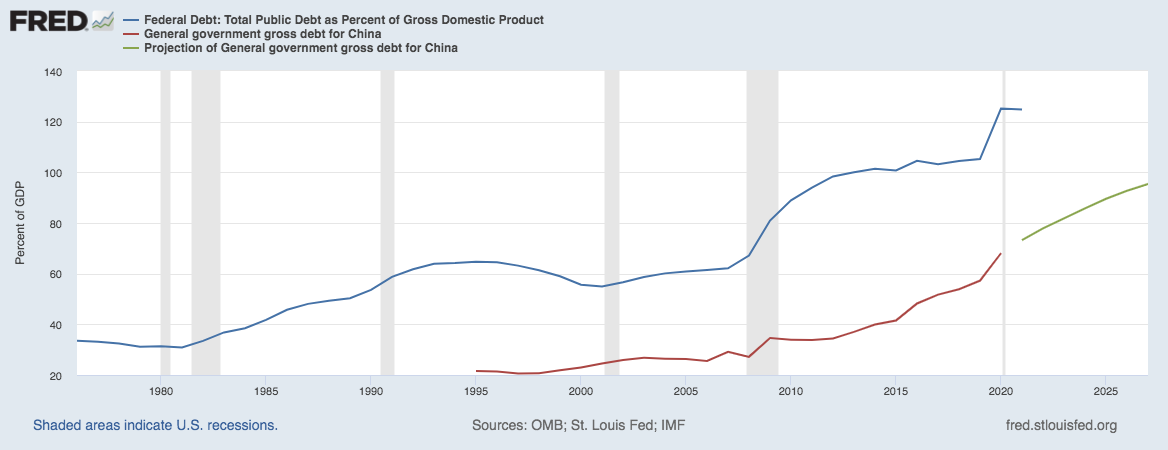

Against that backdrop, the US has little room for fiscal stimulation relative to China. According to the IMF, the government debt for the US stands at 130% of its GDP, compared with 72% at China.

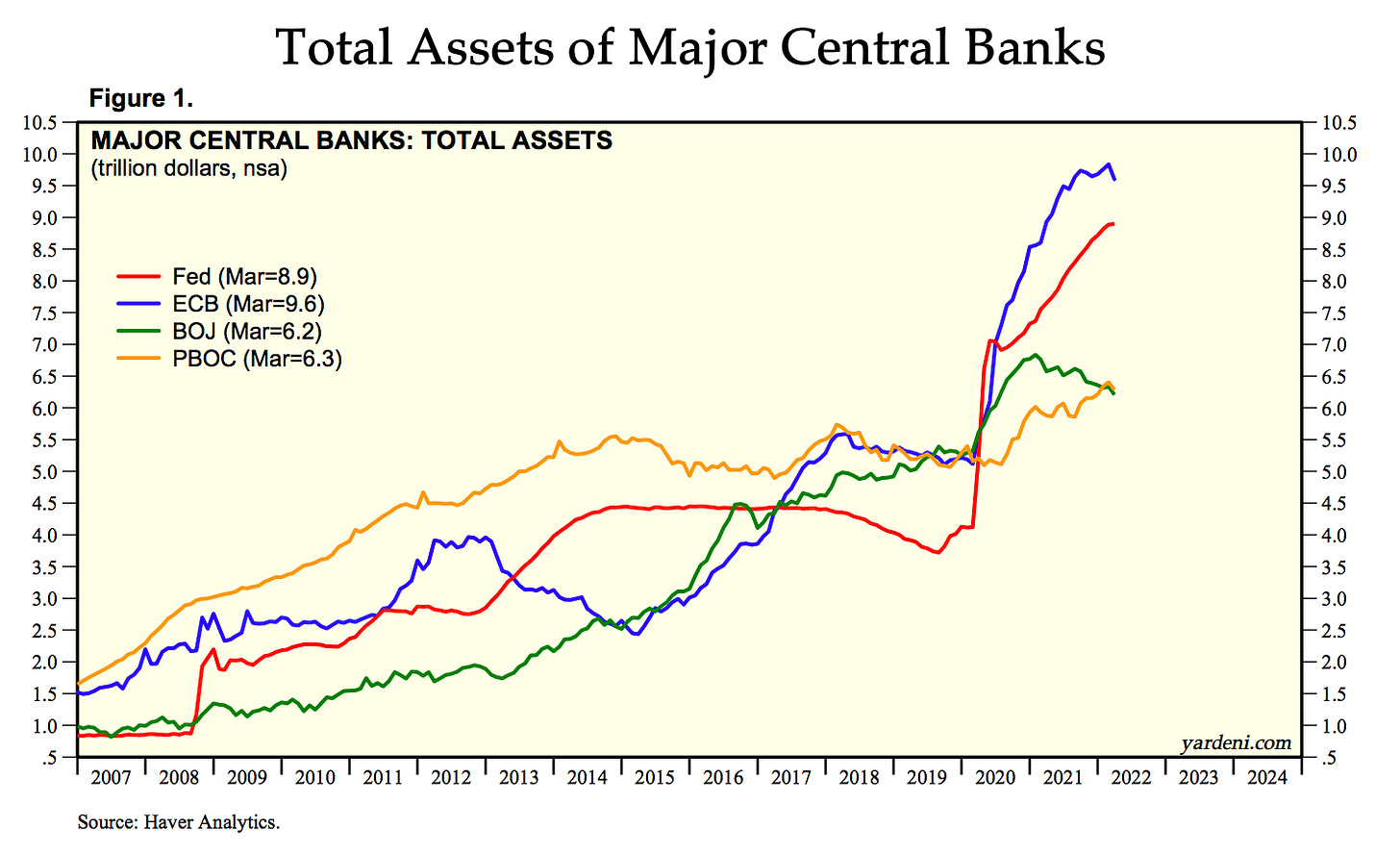

Likewise, the PBOC’s balance sheet has doubled since 2008, while the Fed has ballooned ten times, showing that China would have a lot of space to boost liquidity through a QE.

The divergence in the room for policy actions between the two countries will affect their relative growth prospects if stagflation pressures persist for longer than expected, with significant implications for the world economy and financial markets.

Set the Ground

The PBOC released a draft Financial Stability Law on April 6 to consolidate decrees put in place to manage risks to China’s financial sector.

Of particular interest among the law’s provisions is the plan to set up a financial stability fund that will enjoy liquidity support from the PBOC to diffuse financial stability risks.

The new plan has been rolling out in the past year. In April of 2021, Vice-Premier Liu said China must make a “full assessment” of financial threats and act firmly to prevent them from affecting social stability.

At the meeting, Mr. Liu mentioned the potential risks and disruptions to China’s continued economic recovery highlighted and warned about the likely rise of commodity prices and consumer inflation.

QE is Coming

Currently, the FED will shrink its balance sheet after years of quantitative easing (“QE”). However, the PBOC is gearing up to implement its version of QE—using its balance sheet to support the financial sector and the economy.

The policy divergence between the two central banks will have differentiated implications for the growth prospects of both countries and international financial markets and capital flows, especially for emerging markets.

The committee will manage the financial stability fund, financed by contributions from banks and other financial institutions, including infrastructure operators—such as securities clearing and settlement facilities.

Most importantly, the fund will enjoy a liquidity backstop by the PBOC. This move reflects China’s authorities’ concerns about the risks that the ongoing debt resolution of Chinese real estate developers will spill into other sectors, threatening overall financial stability and slowing economic activity.

These risks were exacerbated by renewed economic disruptions caused by the spread of the Covid variant Omicron, leading to the shutdown of Shanghai and the supply chain disruption triggered by the war in Ukraine.

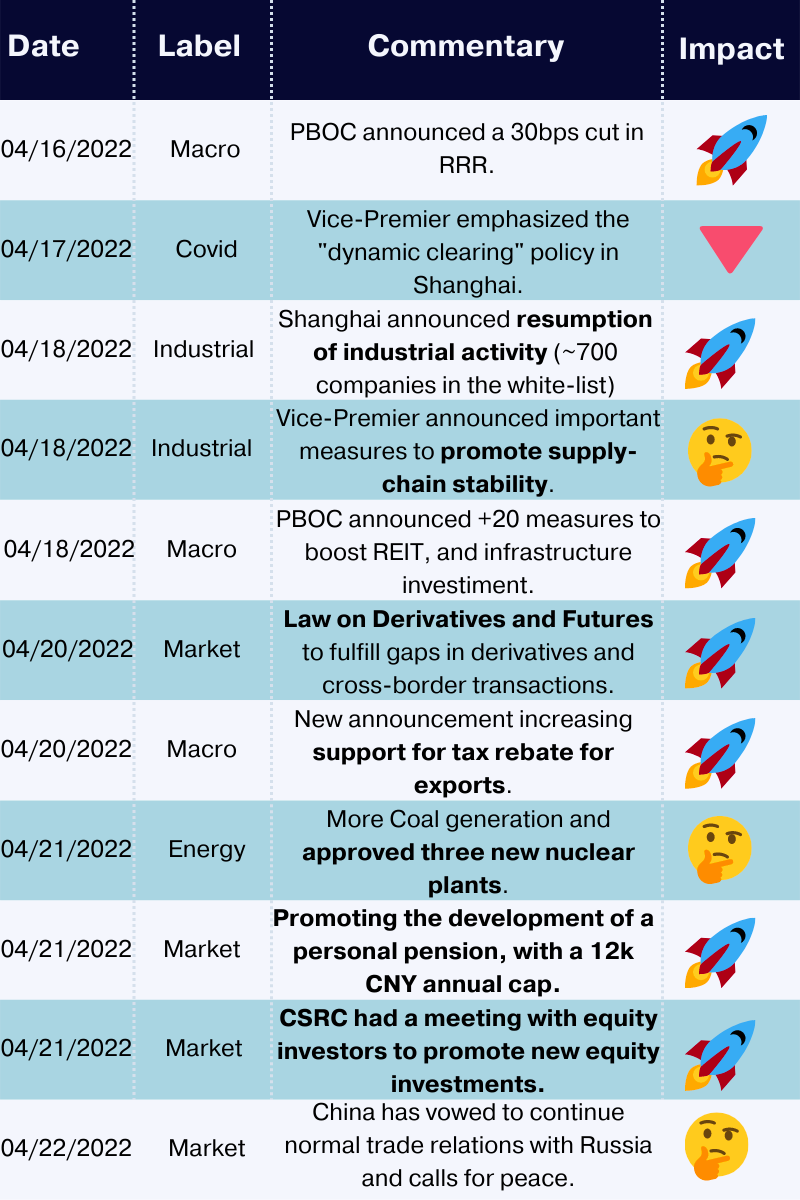

However, China mobilizes resources to support financial stability and moderately ease fiscal and monetary policy stances to sustain growth.

The PBOC has just reduced its required reserve ratio by 0.25p.p. to enable banks to lend more —helped by the fact that inflation is relatively subdued at 1.5%, with a target at 3%.

On the other hand, the US must do the opposite to correct for the generous policy accommodations in the previous decade — fiscal policy has been tightened and subtracted from growth since the beginning of 2021.

In addition, the Fed has raised its policy rate by 0.25p.p. and may increase it by 0.5p.p. in the next meeting.

The communication leans toward more hikes and a robust shrink in its balance sheet—to deal with a decades-high inflation rate of 8.5%.

The policy divergence will affect the US and China's relative economic and financial developments, with significant implications for the global economy and EM.

A consequence of the US interest rate rise is the US dollar strengthens, leading to outflows from EM to DM. For instance, in March 2022, EM had a US$10bn outflow, led by China, according to the Institute of International Finance.

However, China can manage such outflows as it has many tools for capital control and continues to attract substantial foreign direct investment (FDI) inflows, increasing ~40% YoY in the first two months of 2022 to ~US$40bn.

If the economic fallout from the war in Ukraine persists, China has ample policy space to support growth compared to the US.

Working with a base case that China pursues its QE roadmap, we know, based on the previous cycle, what it means for equities to boost liquidity in a low inflation environment.

Policy Summary

On Thu, the CSRC held a meeting with domestic institutional investors, encouraging the National Social Security Funds, banks, and insurers to raise their equity investments.

The PBOC and SAFE released comprehensive guidelines on policy support for the real economy.

Meanwhile, policymakers also emphasized minimizing costs to the economy and society to the extent possible, which implies more targeted approaches.

Possible implications:

- Overall supply chain might be more resilient than before, given the same outbreak severity, as policymakers are moving more swiftly to resume production once the local Covid situation appears to be under control;

- Structural imbalances between large and smaller companies might further increase as major production/investment projects, usually handled by large companies, might be given the “green light” and resume production ahead of other tasks when policymakers relax restrictive policies.

Summary

Throughout the post, we explained why we believe China might face a strong headwind in the 1H22 due to worse than expected lockdown and logistic bottlenecks.

However, in recent weeks, the government shifted to a pro-market policy, presenting a clear, supportive message and improving communication. Finally, we highlight:

Inflection point

We believe 2Q could disappoint vs. current market expectations due to the scale of Covid lockdowns but will mark a bottoming-out of growth quarters in our base case.

Key swing factors will depend on macro-supportive policies stimulating the economy/consumption and Covid containment/controls.

We present a bear case scenario of repeated lockdowns over 2022, which could push back inflection to late-2022.

Growth drivers

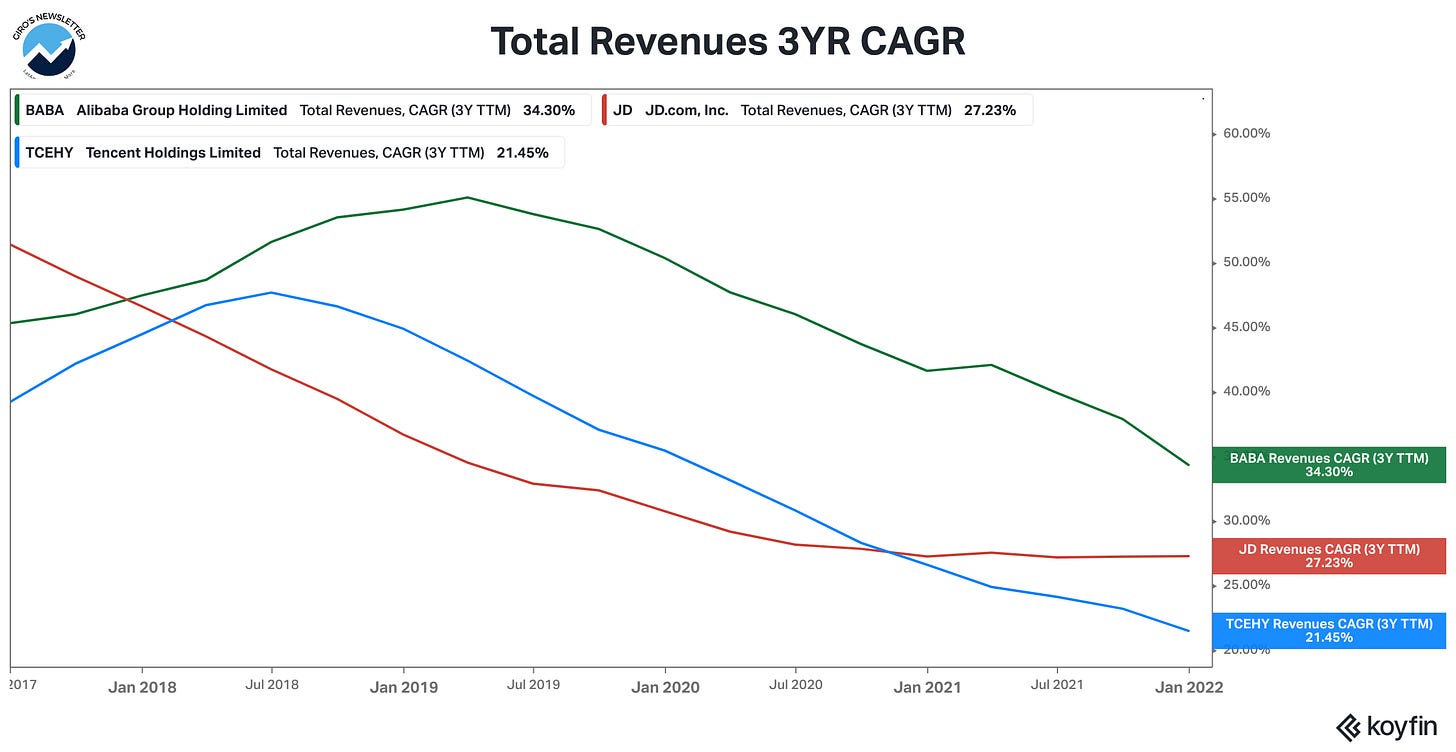

Large platforms are shifting focus from growing users to ARPU growth, while we see core businesses at leading platforms normalizing. As a result, we like under-monetized leading platforms with stable/gaining share and multiple new growth flywheels.

Valuation

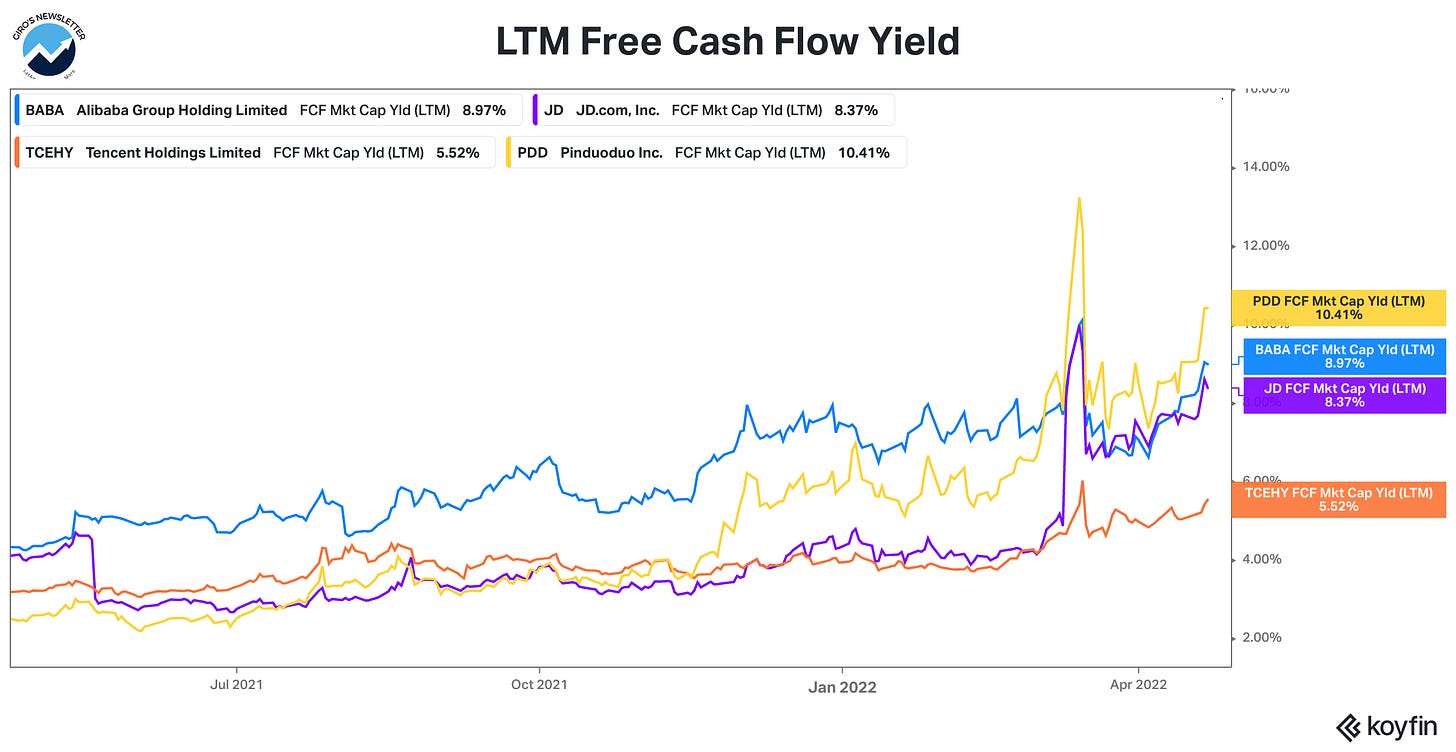

Due to weaker earnings momentum over the past quarters and regulatory constraints, Chinese Internet companies are trading at an all-time low P/E valuation.

Net cash represents on average >30% of China's Internet market cap across significant internet companies, with more disciplined spending driving improving FCF and increased buybacks.

The de-rating has brought Chinese long-term winners into GARP territory (growth-at-reasonable-price), where current share prices imply favorable risk-reward for patient investors.

Also, even though growth has been decelerating, it's impressively to find first-class companies trading at high single digits free cash flow yield, growing revenues above 20% yearly.

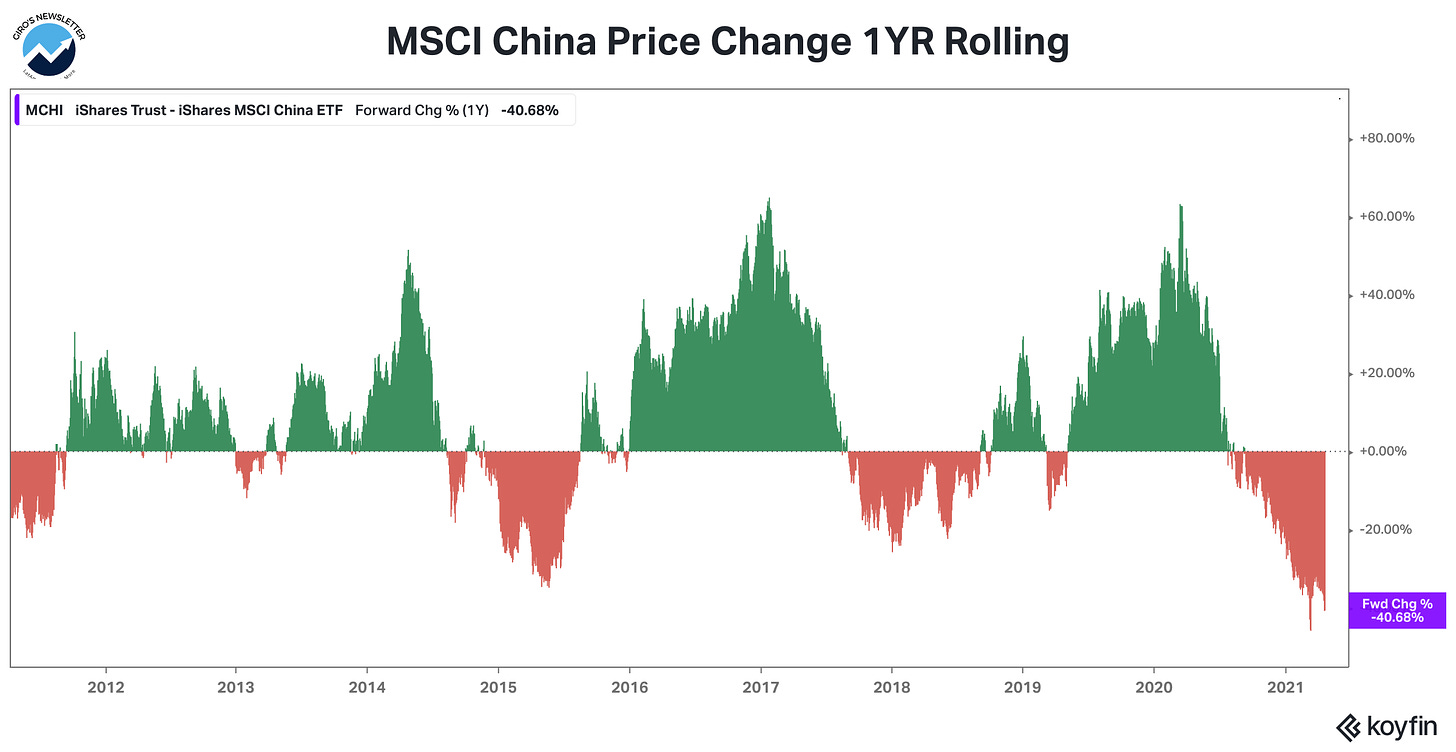

Finally, from a price-only perspective, Chinese stocks face one of the worst 12m performances in the past decade. Therefore, it will not surprise us if the downward pressure starts to fade by the end of the 2Q22.

Investability

Factors to consider include listing venue(s), dual-primary listings in HK that could benefit from being eligible for Southbound Connect (increasing instability for mainland investors), and negotiation progress between US-China on audit inspection.

Regulations

While regulation is unforecastable, 2022 has been a year of implementation for 2021's new rules.

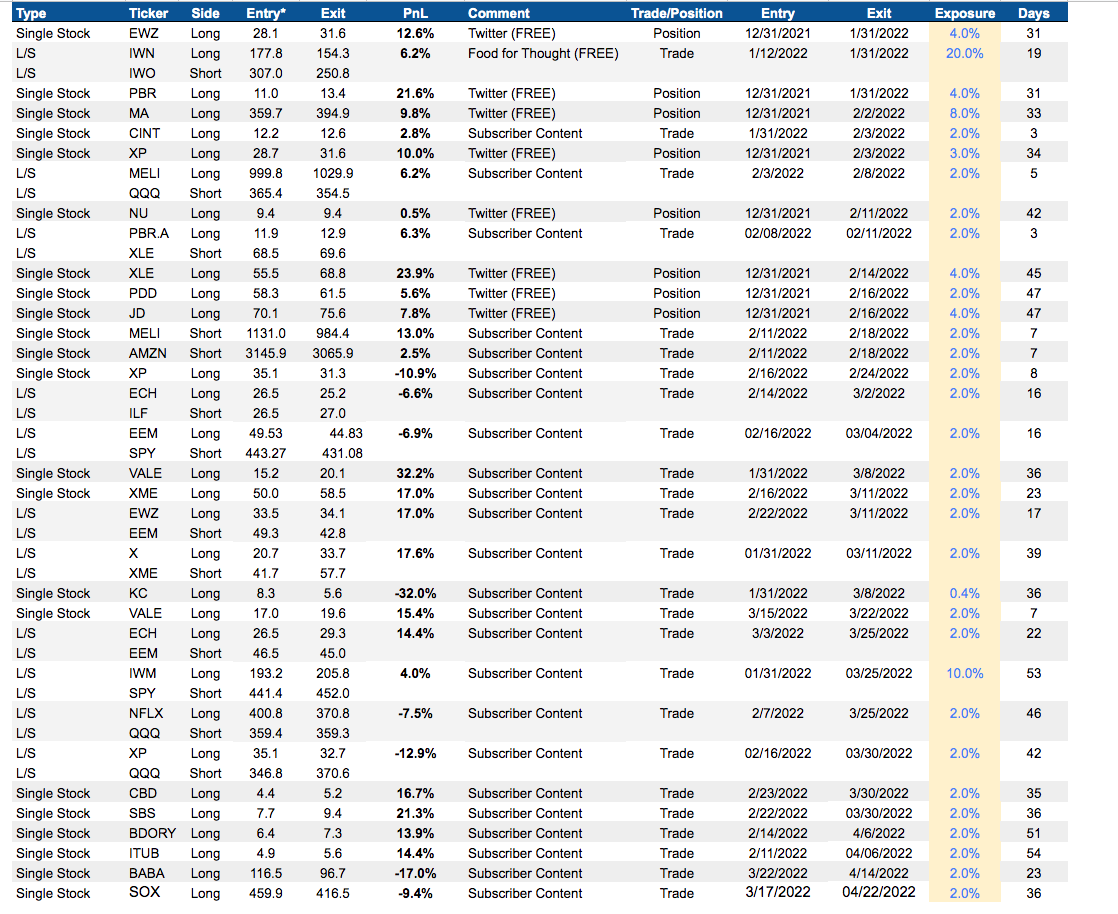

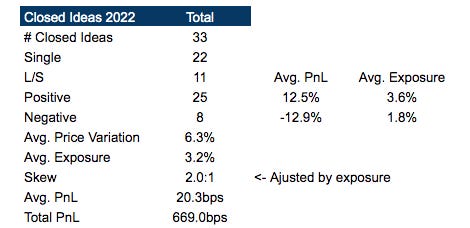

Closed Ideas

If you're a subscriber, don’t worry. I created a new section (“Trade Ideas”) to improve our communication. You can expect to receive all PRO content in your mailbox.

Also, all posts/ideas will be saved in this new section, so you can find any topic much more quickly from now on. : )

Still, if you're not a supporter, why don't you enjoy our week trial and get access to the paid content. All support means a lot.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.