The ranking is based on unique views, free/paid new subscribers, and open rate — all relative.

Top 5🌟

30 Days

- MercadoLibre ($MELI) 💙 (2nd consec wk)

- Food for Thought #16 (FED and China)💙 (2nd consec wk)

- $NU 1Q22: The Purple Wave 🔼

- Pix Handbook - Part III 🔼

I’m surprised on this one. Unique views literally doubled WoW. I know I’m biased, but my 100 pages write-up on Pix will be invaluable in a few quarters when “certain” companies start bragging about Pix MDRs. I’ll have it behind a paywall very soon. Read it. - Food for Thought #17 (About Stone)🔻(2nd consec wk)

7 Days

🌟 Top Percentile on Unique Viewers

5-min recap on what we wrote this week 🔥🔥🔥

→ AWS is Unstoppable🌟

This one was a beast. Will join the Top 5 very soon, and probably stay there for 30 days. This one is a must-read. 🔽🔽🔽

There are two general uses of clouds. One is what's it's called infrastructure as a service (“IaaS”), which Microsoft is an exceptional player.

That's more where the focus is on basically setting up VMs in the cloud-like storage. There are a few types of VMs, such as compute-focused, network-focus, and memory-focus.

So, if the solution is IaaS-based, it's more along those lines of typical storage, computing, and networking. That was more significant earlier on.

Nowadays, the trend is to leverage PaaS, a platform as a service. This makes the environment more cloud-native and cost-effective if they take advantage of the cloud provider's PaaS services.

That’s the winner model. You could have microservices functions in the case of Azure and Kubernetes. Then, you have the whole container movement where they want to break down an application to various components.

Initially, Microsoft decided to launch Azure Cloud, then came to infrastructure later. They went with the many services, and then they changed the infrastructure much later.

Microsoft focused on creating powerful VMs, alongside storage services for its products, then the microservice functions in Azure, which led to several changes in the infrastructure.

So, even though Microsoft has all the technology, the scalability and the architecture of the AWS platform are excellent.

In our opinion, that’s why AWS is superior. Microsoft did it backward! That’s why they have some challenges around scalability and reliability.

We’re not saying that Azure is not a good solution. We’ve never heard it. However, it is a usual complaint with certain limitations and restrictions in the service, resulting in some trust issues for a few clients.

AWS, on the other hand, every start-up uses its service. So the answer is always easy to use, scalable, and reliable.

The company started with the end goal of becoming a PaaS business, not just an infrastructure provider. Believe this is a brilliant and unique perspective that just a company like Amazon could possibly have.

Let’s remember that AWS was born to support the marketplace, creating microservices to improve Amazon’s business.

So, from ground zero, AWS was built as a microservice platform to solve the issues that a business such as Amazon had – this is possibly the best sandbox ever.

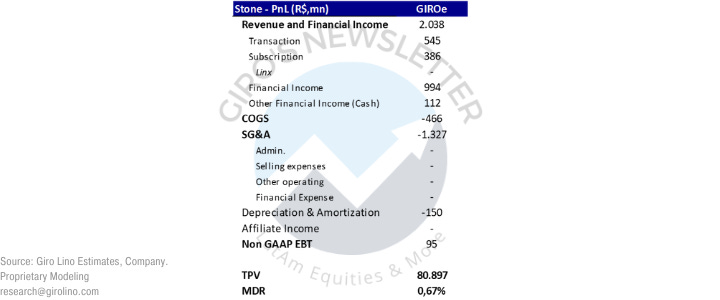

→ STNE 1Q22 Earnings Preview

With Stone’s earnings approaching, we decided to share our earnings preview for Stone’s 1Q22. Okay, so what you should be looking for in the earnings release?

Revenue, costs, operating expenses? None of those. Exactly, none. Earnings will be strong. Management has been looking for sell-side proactively, so this is obvious.

Regarding pricing policy, my channel checks suggest that Stone is automating the process. I’d love to see management commenting about it.

It’s been annoying receiving most of my information through channel checks, not from the company itself. I understand that the company is going through a lot, and lately has been tough to create streamlined communication.

According to sources from marketing and Stone’s hub, the pricing strategy varies by segment. In the core hubs, competitors are setting the prices, with nobody undercutting — at least in high competitive spots.

Repricing that began in 4Q21 and continued through 1Q22 is expected to result in somewhat elevated churn for 1Q22, as we anticipated previously.

Stone will present stronger than expected revenue growth. However, don’t get excited about it because there is evidence pointing out this quarter would be an outlier.

In the 1Q22, card transaction volumes grew 35.9% YoY, almost 100% above the previous years, meaning that Stone will present a more robust quarter, regardless of execution.

However, we foresee a higher than expected headwind from financial expenses, as many market participants still do not estimate it appropriately.

Many analysts use a % of TPV for estimating their respective financial expenses, which is okay if rates don’t change much over time. That’s not true for Brazil, though.

Finally, we summarize our expectations in the table below. Again, we believe that the market will welcome Stone’s earnings if they come as expected.

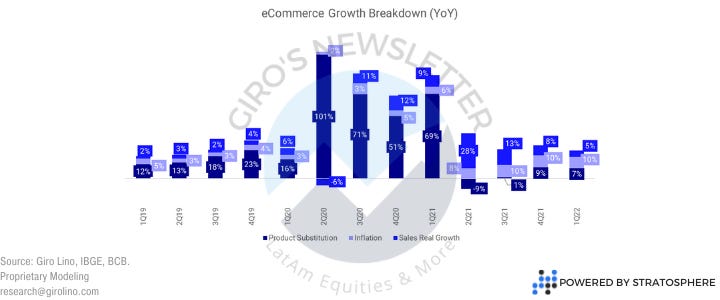

→ eCommerce Outlook 1Q22

In this post, I update the outlook for the Brazilian eCommerce market, the most relevant one in LatAm; Also, I take the opportunity to present more detail about the players that, in my opinion, will outperform in the following years.

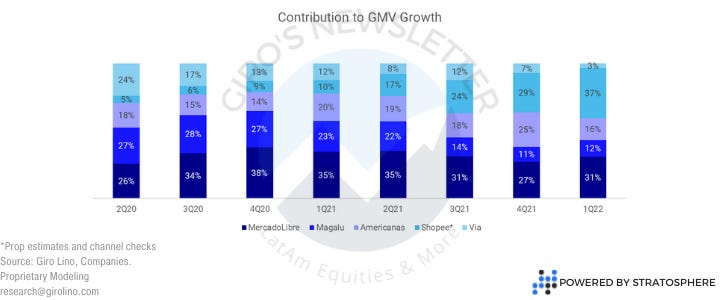

Sea Limited (or “Shopee”) and MercadoLibre (or “Meli”) have been executing consistent strategies, though the friction between both is still not high.

Also, show another piece of evidence to explain why I believe both can co-exist, even though local funds insist they’re locked horns with each other.

As discussed in our last post about Meli, high-frequency categories stood out in the quarter, benefiting players such as Meli and Shopee (from Sea Limited).

Also, our thesis that macroeconomic conditions do not change for eCommerce penetration growth keeps proving itself for another quarter.

We believe that Sea hit the roof in Brazil. However, we do not believe that Shopee “hit the roof” because they are not selling fridges.

Scale matters here, and looking at the same information from a different perspective is crucial for not overestimating growth.

Growing 176% YoY from a R$2bn GMV is much easier than doing it when you already have an R$18bn GMV. So the way we look at it is focusing on the GMV increase, not its variation.

So, considering only the top players, in the 1Q22, Shopee’s growth represented 37% of the total GMV generated by them, which is, obviously, a lot.

Looking in the past 10 years, there were just a few specific moments when a player yielded a contribution over 40%, in a very different context, though.

The competition was immature, and the eCommerce penetration was below 5%, so any marginal increase in specific categories could generate tremendous growth in the GMV.

Does it mean that Shopee is doomed? Absolutely not. We’re just saying the company will not grow 200% in a year, 190% in the next one, and then 170%, and so on. Thit only happens in spreadsheets. Reality is different, though.

Still, there is another question we need to address. Meli has been capturing low-hanging fruits in long-tail categories for over a decade, with little or no competition in a few spots.

Suddenly, an outsider drops into its market and grabs almost 6% of the market share. Clearly, Shopee is exploring a place that even Meli hasn’t. Why?

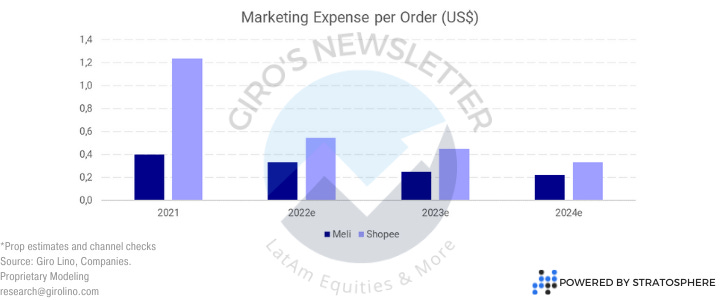

Even though we estimate a similar marketing expense per order for Meli and Shopee, we estimate that Shopee is spending much more money on active clients.

Considering Sea’s balance sheet, we doubt they’ll try to compete for the same spots against Meli in the foreseeable future. Instead, in our opinion, they’ll be focusing on gaining scale, diluting cost, and increasing engagement.

Unlike many analysts expect, Shopee has to be much bigger than Meli to match its cost of acquiring and maintaining clients. That is an arduous task.

Meli is a cash flow machine, generating per year in cash almost what Sea is actually burning in their operations in Brazil. So, being repetitive, it does not make sense for Shopee to compete against Meli. Otherwise, they’ll get crushed.