Nubank's Credit Card Business and Digital Banking Revolution: Navigating NPLs in Latin America's Fintech Landscape

David Vélez, one of the co-founders of Nu Holdings Ltd., played a significant role in establishing the company, which has become a key player in the fintech industry.

In recent years, Nubank, the largest neobank in Brazil, has emerged as a trailblazer in Latin America’s financial sector, rapidly ascending to become one of the region’s leading digital banks. With its customer-centric approach and innovative banking solutions, including a robust credit card business and personal loans, Nubank has captured the loyalty of millions across Brazil and beyond.

However, behind this meteoric rise lies a growing challenge: an increasing rate of non performing loan ( NPLs Non-Performing Loans, loans in default or close to being in default. ) in its credit portfolio.

This troubling trend stands in stark contrast to the performance of traditional banks, which have successfully reduced their NPLs Non-Performing Loans, loans in default or close to being in default. during the same period. Additionally, Nu Holdings, Nubank's parent company, has seen fluctuations in its stock performance, reflecting the market's response to these challenges.

Our previous analysis explored Nubank’s credit strategy amid rising NPLs Non-Performing Loans, loans in default or close to being in default. Read more , highlighting the aggressive growth tactics and innovative financial products that have propelled the digital bank forward but also exposed it to higher credit risks.

As Nubank continues to navigate the complexities of the Latin American financial sector, it is imperative to understand the deeper reasons behind the increase in NPLs and what sets this digital banking pioneer apart from its more traditional counterparts.

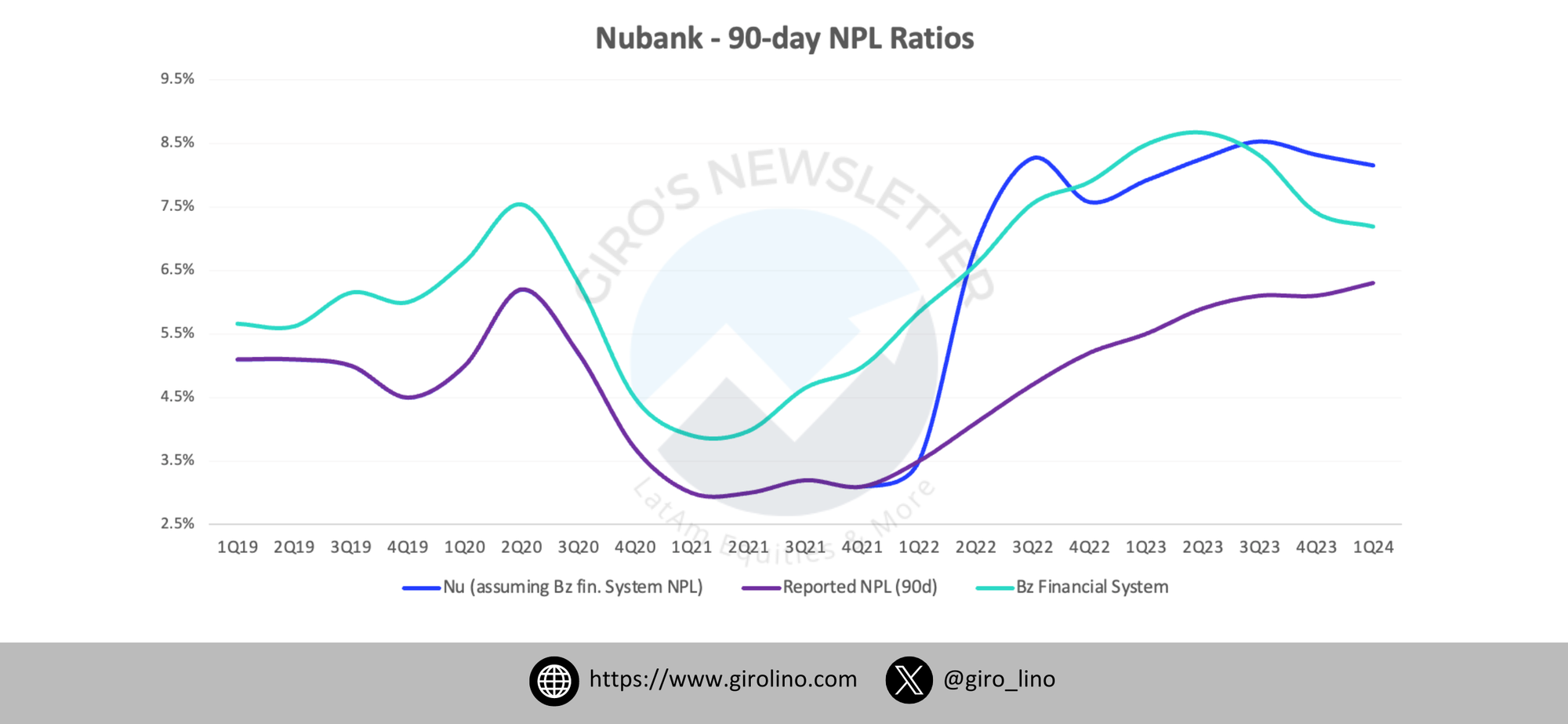

Nubank’s NPL rise in Q1 2024 provides key insights into the challenges facing digital banks in emerging markets. By analyzing Nubank’s NPL trends, strategic credit adjustments, and the impact of Brazil’s economic shifts and programs like Desenrola Brasil, we can gain a clearer picture of the fintech landscape in Latin America.

The increase in Nubank’s NPLs is particularly concerning given the broader trend of declining NPLs among traditional financial institutions. To comprehend this divergence, stakeholders, investors, and financial analysts must look beyond surface-level metrics and explore the underlying factors that influence the performance of digital banks versus traditional banks in the region.

This includes understanding the broader context of Latin American history and the challenges faced by new nations in the region, which have long grappled with political and economic instability.

This post aims to delve deeper into the elements contributing to Nubank’s rising NPLs within its credit card business and personal loan offerings. We will dissect Nubank’s business model, scrutinize the broader economic and market conditions in Latin America, and analyze Nubank’s credit strategies in comparison to those of traditional banks.

Additionally, we will examine the impact of customer behavior and demographics, the regulatory environment for digital banking, and the technological and operational factors unique to Nubank’s approach to financial services.

By weaving together these threads, we seek to unravel the complexities behind Nubank’s NPL situation and provide a comprehensive understanding of its current financial challenges in the competitive Latin American market.

This analysis will also offer insights into the potential strategies Nubank could employ to mitigate these issues and align its growth trajectory with sustainable financial health, ensuring its continued role as a leader in digital banking and financial inclusion across Latin America.

Digital Banking Business Model: Nubank is Revolutionizing Latin America's Financial Landscape

Nubank, a trailblazer in Latin America’s fintech industry, operates on a fully digital banking model that has disrupted traditional financial institutions across the region. Founded in 2013, this Brazilian neobank quickly gained traction by offering fee-free financial services through an intuitive mobile platform.

Unlike traditional banks with their extensive branch networks, Nubank eschews physical locations, instead leveraging advanced technology to deliver its services. This innovative approach allows for significant cost Savings The portion of income not spent on consumption. , which Nubank passes on to customers through lower fees and competitive interest rates.

The company’s primary target demographic includes younger, tech-savvy individuals who are often underserved by traditional banks. This group, characterized by lower income levels and less established credit histories, finds Nubank’s accessible and transparent approach to banking services particularly appealing.

By prioritizing financial inclusion, Nubank has rapidly expanded its customer base, attracting millions of users across Brazil, Mexico, and Colombia - key markets in the Latin American financial landscape. Nubank has also expanded into key markets in Central America and South America, regions of significant cultural and economic importance within Latin America. This expansion underscores the shared historical and socio-economic experiences that bind these regions together.

Nubank’s customer base is notably younger compared to traditional banks. A striking 59% of Nubank’s customers are under 35 years old, compared to just 30% for traditional banks. The difference is also pronounced in the under-45 demographic, with 81% of Nubank’s customers falling into this age group versus 52% for incumbents. Furthermore, Nubank anticipates a substantial real-income boost of approximately 70% over the next decade for a key subset of its young customers, particularly those aged 20 to 24. Form F-1.

Nubank’s market strategy emphasizes user experience and customer satisfaction. The highly rated mobile app and strong social media presence have helped Nubank build a loyal customer base. However, this strategy also means that Nubank’s portfolio includes a higher proportion of customers with less stable financial backgrounds than traditional banks.

Traditional banks, with their extensive branch networks and established customer bases, operate on a fundamentally different business model. They serve a broad range of clients, including high-income individuals and large corporations, which provides a diversified Revenue The income generated from normal business operations. stream. These banks also have more stringent risk assessment protocols and a longer history of managing credit risk.

In contrast, Nubank’s rapid growth and focus on underbanked segments introduce higher risk. Traditional banks have been able to leverage their diverse portfolios and conservative lending practices to reduce their NPLs, while Nubank’s emphasis on expanding access to credit has resulted in a higher proportion of loans to riskier customer segments.

Nubank's business model presents both challenges and opportunities:

- Digital channels enable scalability and cost efficiency

- Continuous investment required in cybersecurity and technological infrastructure

- Growth strategy includes entering new markets and expanding product offerings

- Careful balancing of risk and reward is necessary

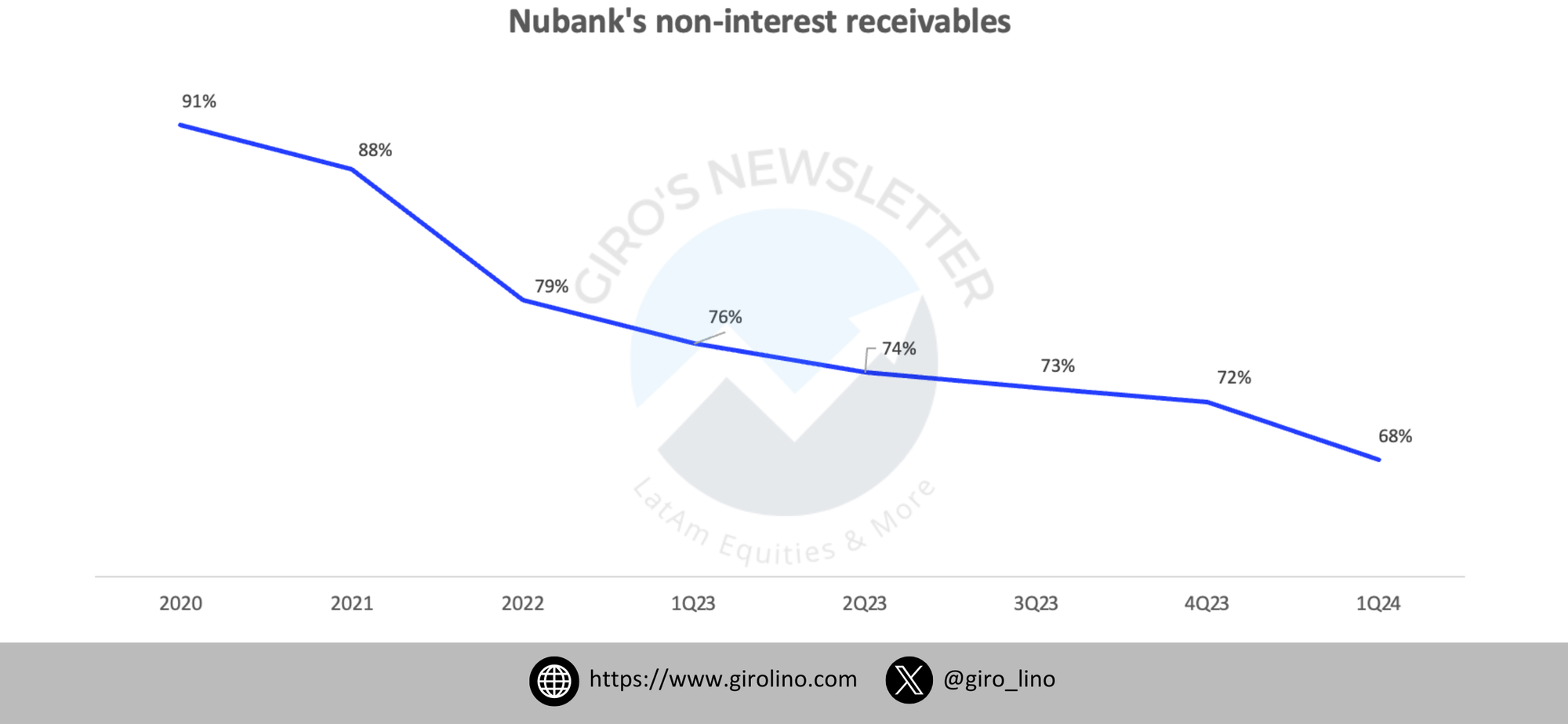

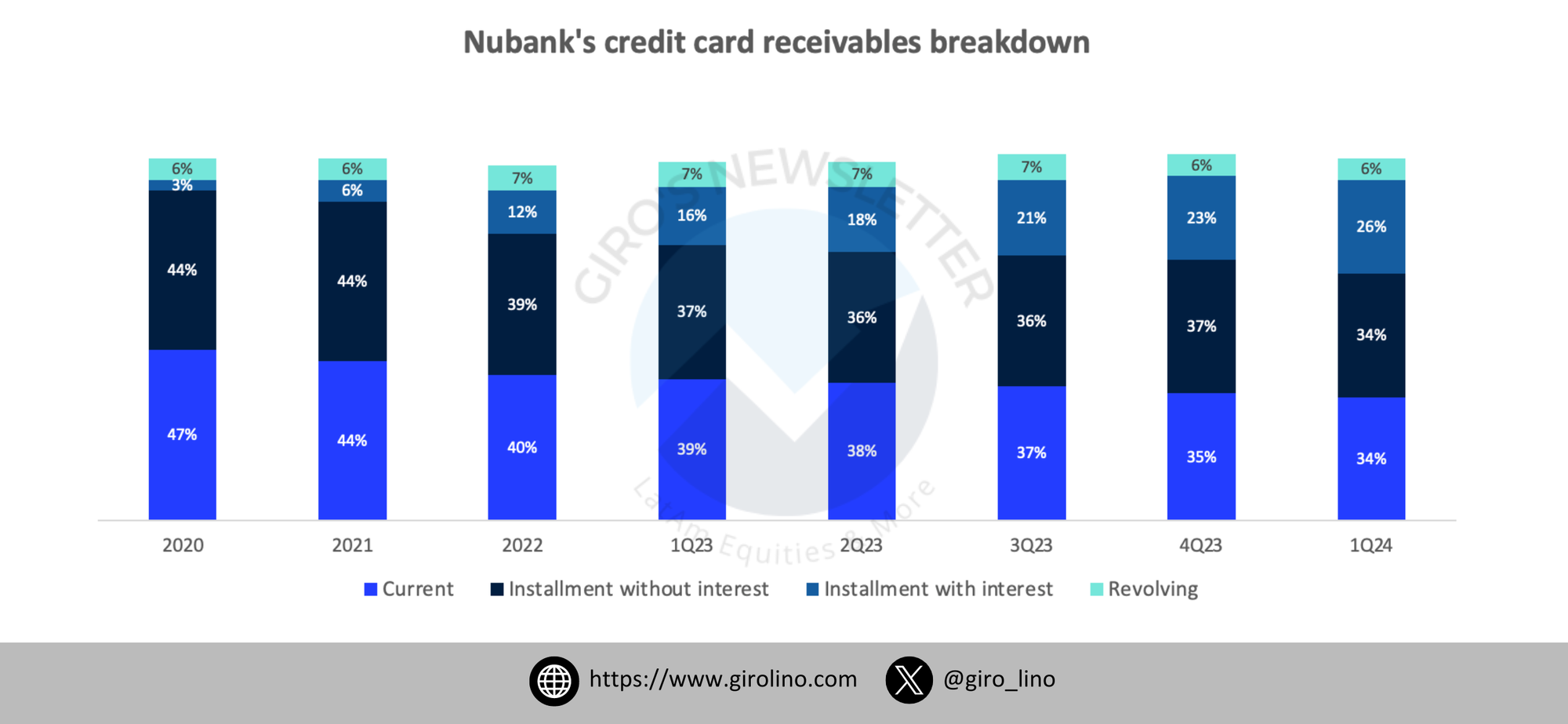

The increasing portion of interest-earning assets in Nubank's portfolio, such as credit card receivables and unsecured personal loans, has contributed to the rise in NPLs. While this strategy boosts revenue, it also exposes Nubank to greater credit risk, particularly during economic downturns.

Credit Strategy and Risk Management

The Brazilian neobank credit strategy and Risk Management The process of identification, analysis, and acceptance or mitigation of uncertainty in investment decisions. practices are central to understanding why its non performing loan (NPLs) have increased in its credit card business and personal loans portfolio, despite the improvement seen by traditional banks in Latin America.

Several key elements of Nubank’s approach to credit and risk in digital banking are contributing to its current challenges in the Latin American market.

Nubank, as a leading digital bank, has pursued an aggressive growth strategy, rapidly expanding its customer base by offering accessible financial products with minimal fees. This strategy has been effective in attracting millions of new customers, many of whom are underbanked or have limited credit histories.

However, this rapid expansion in the Brazilian and Mexican markets has come with significant credit risks. The historical significance of indigenous peoples in Latin America, with their diverse cultures and experiences, has also shaped the region's socio-economic landscape, influencing market dynamics and consumer behavior.

Unlike traditional banks, which often have more conservative lending practices, Nubank’s approach has resulted in a higher proportion of loans to riskier customer segments. Nubank’s aggressive customer acquisition and loan growth have led to an increasing portion of interest-earning assets in its portfolio, such as credit card receivables and unsecured personal loans. In Q1 2024, Nubank’s delinquency rates reached 8.2%, compared to the industry’s 7.2% in the Latin American banking sector.

Nubank utilizes advanced technology and data analytics to streamline its credit assessment and approval process for credit card loans and personal loans. This approach allows for quick decision-making and scalability in digital banking. However, it also means that Nubank's risk models are relatively new and less tested compared to those of traditional banks, which have been refined over decades in the Brazilian banking system.

The fintech's reliance on algorithms and automated decision-making for credit card transactions can sometimes overlook subtle indicators of credit risk. This has likely contributed to higher NPL rates as the models may not fully capture the financial behaviors and potential risks associated with Nubank's diverse customer base in the Latin American market.

Traditional banks typically have more stringent risk management frameworks, including comprehensive credit checks, higher collateral requirements, and more conservative lending policies. Nubank, in contrast, has prioritized accessibility and ease of use in its digital banking services, which has resulted in a more lenient approach to credit risk management.

Nubank's delinquency rate is impacted by its product mix and income bracket mix in the Brazilian and Mexican markets. For instance, the fintech's portion of credit card receivables that accrue interest has risen, which has added risk to its consumer loan book. In Q1 2024, the delinquency rate for Nubank's consumer portfolio was 8.2%, above the industry average of 7.2% in Latin America.

Nubank’s write-off policies have also influenced its NPL figures. In 2022, Nubank changed its write-off methodology for personal loans from 360 days overdue to 120 days, leading to an increase in the level of overdue loans classified as non-performing. This change has had a significant impact on Nubank’s reported NPLs, making its delinquency rates appear higher than those of traditional banks, which may use more lenient write-off policies.

In Q2’22, we reviewed and changed our write-off methodology for recovery of the contractual cash-flows of NPLs arising from unsecured personal loans from 360+ days to 120+ days. Figures consider this change. Our write-off methodology for credit cards remained unchanged at 360+ days. (1Q24 Earnings Release)

Additionally, Nubank’s loan loss provisions—funds set aside to cover potential loan defaults—have been substantial, reflecting the higher risk associated with its loan portfolio in the Brazilian and Mexican markets. While necessary for financial stability, these provisions also indicate the anticipated higher rate of defaults within its customer base across Latin America.

Nubank reports two main NPL ratios: the 15-90 days NPL ratio and the 90+ days NPL ratio. The 15-90 days NPL ratio is considered a leading indicator, while the 90+ days NPL ratio reflects more severe delinquencies. The 15-90 days NPL ratio is calculated by dividing the current NPL balance by the total balance average between the first and third months prior to the reporting period. The 90+ days NPL ratio is calculated similarly but uses the average balance from the fourth to the twelfth months prior.

Nubank’s methodology for managing NPLs also involves leveraging technology and data analytics to make real-time credit decisions and manage risk in its digital banking operations. This includes using artificial intelligence and machine learning to predict and manage NPLs across its credit card business and personal loans portfolio in the Latin American market.

Customer Behavior and Demographics in Nubank's Digital Banking: Impact on Credit Card Business and Personal Loans in Latin America

The behavior and demographics of Nubank’s customer base play a crucial role in understanding the increase in non-performing loans (NPLs) in its digital banking operations across Latin America. By targeting underbanked and financially underserved populations, Nubank has been able to grow rapidly in the Brazilian and Mexican markets but also faces unique challenges related to credit risk management.

Nubank’s customer base primarily consists of younger individuals and those with lower to middle income levels. This demographic, while enthusiastic about digital banking solutions, often has less stable financial backgrounds compared to the typical clients of traditional banks. Nubank’s client base has a larger share of low-income individuals than the broader Brazilian financial system. This demographic is more vulnerable to economic fluctuations, leading to higher delinquency rates.

Indigenous people, who often face unique challenges in accessing financial services, are part of this underserved demographic. Nubank’s approach aims to address these challenges by providing more inclusive financial products and services.

Income level is a significant factor influencing loan repayment behavior. According to the BCB, the delinquency rate for credit card loans among low-income individuals was 10% in February 2024, compared to 3.9% for higher-income brackets.. This disparity underscores the financial instability lower-income individuals face, who are more likely to default on loans during economic downturns.

The level of financial literacy among Nubank’s customers also impacts their financial behavior. Many of Nubank’s clients are first-time users of formal banking services and may lack the financial education necessary to manage credit effectively. This can lead to higher instances of missed payments and loan defaults in Nubank’s credit card business and personal loan portfolio.

Nubank’s user-friendly mobile app encourages active engagement with financial products, including credit cards and personal loans. However, the ease of access to credit can sometimes lead to irresponsible spending behavior, particularly among younger customers who might lack experience managing debt. This behavior contributes to higher delinquency rates as customers struggle to keep up with their repayments.

The utilization of credit products among Nubank’s customers is another critical factor in the Latin American market. Nubank has a higher portion of credit card receivables that accrue interest, which increases the overall risk of its consumer loan book. As of Q1 2024, 68% of Nubank’s credit card receivables were interest-bearing, compared to 49% for the broader Brazilian financial system. This higher reliance on interest-bearing credit increases the likelihood of defaults, especially among financially strained customers in Latin America.

Nubank’s rapid loan growth has also played a role in increasing its NPLs in the Latin American banking sector. By expanding its loan portfolio quickly, Nubank has taken on a higher volume of risky loans. Nubank’s above-average loan growth rate has artificially inflated its delinquency rate, with a positive growth effect of 80-100 basis points across its credit card business and personal loans.

Traditional banks in Latin America have a more diverse customer base, including high-income individuals and corporate clients, which provides a buffer against economic shocks. These financial institutions also have more rigorous credit assessment and risk management practices, reducing their exposure to high-risk segments. Nubank’s focus on financial inclusion and serving underbanked segments means a larger portion of its loan portfolio is inherently riskier in the Latin American market.

Nubank’s reliance on technology for customer engagement and credit assessment in its digital banking operations is both a strength and a challenge. While it allows for rapid scalability and cost efficiency in the Latin American market, it also means that the bank’s risk models are continuously evolving. This can result in gaps in credit assessment, particularly in accurately predicting the risk behaviors of new customer segments across Brazil, Mexico, and other Latin American countries.

Regulatory Environment for Nubank's Digital Banking in Latin America: Implications for Credit Card Business and Personal Loans

The regulatory environment significantly impacts the financial performance and risk management practices of banks in Latin America. For Nubank, navigating Brazil's regulatory landscape has posed unique challenges, particularly in managing its non-performing loans (NPLs) across its credit card business and personal loans portfolio. Understanding the regulatory context is essential to comprehend why Nubank's NPLs have increased despite the improvements seen in traditional banks in the Latin American market.

Brazil's banking sector is governed by a comprehensive regulatory framework designed to ensure financial stability, consumer protection, and market integrity in the Latin American financial market. The Central Bank of Brazil (Banco Central do Brasil) plays a crucial role in setting and enforcing these regulations. These regulations cover various aspects of banking operations, including capital adequacy, risk management, loan classification, and consumer protection for both traditional banks and digital banks.

Nubank, as a digital bank and challenger bank in Latin America, faces both opportunities and challenges within this regulatory environment. While fintech companies benefit from certain regulatory incentives aimed at promoting financial inclusion and innovation in the Brazilian market, they also encounter stricter scrutiny due to their rapid growth and evolving business models in digital banking.

One of the key regulatory challenges that Nubank has faced is related to changes in loan classification and write-off policies for personal loans and credit card loans. In 2022, Nubank adjusted its write-off methodology for personal loans from 360 days overdue to 120 days. This change significantly increased the level of overdue loans classified as non-performing, thereby raising the reported NPLs. Traditional banks in the Latin American banking sector, which often have more lenient write-off policies, did not experience a similar impact on their NPL figures.

Brazilian regulations require banks to maintain specific capital adequacy ratios to ensure they can absorb potential losses in the Latin American market. Nubank, like other banks, must comply with these requirements, which dictate the minimum amount of capital relative to its risk-weighted assets. Maintaining these ratios is challenging for rapidly growing fintechs that are continually expanding their loan portfolios in the Brazilian and Mexican markets.

Nubank must adhere to stringent consumer protection regulations designed to safeguard the interests of borrowers in the Latin American financial market. These regulations include requirements for transparent disclosure of loan terms, fair treatment of customers, and mechanisms for addressing consumer complaints. While these protections are essential, they also add to Nubank's operational complexity and costs, particularly in managing a large and diverse customer base across Latin America.

Fintech companies in Brazil and Latin America, including Nubank, are under increasing regulatory scrutiny as they continue to grow and disrupt traditional banking models. Regulators are keen to ensure that these companies manage their credit risks effectively and do not compromise financial stability in the Latin American banking sector. This scrutiny often results in additional compliance requirements and oversight, which can strain the operational capacities of fintech firms.

Nubank's increasing portion of interest-earning assets, particularly through PIX financing in the Brazilian market, has also attracted regulatory attention. PIX, an instant payment system launched by the Central Bank of Brazil, has facilitated easier and faster transactions. However, Nubank's push to promote interest-earning products through PIX financing has contributed to higher credit risk in its digital banking operations. Regulators closely monitor such developments to ensure that the risks are adequately managed in the Latin American financial market.

Traditional banks in Brazil and Latin America have established risk management frameworks and compliance mechanisms honed over decades. They benefit from stable regulatory relationships and have the resources to manage compliance efficiently. In contrast, Nubank's innovative and rapidly evolving business model requires constant adaptation to regulatory changes in the Latin American banking sector, which can be resource-intensive and disruptive for its credit card business and personal loans operations.

The regulatory landscape for fintechs in Brazil and Latin America is dynamic, with potential future changes that could impact Nubank's operations in digital banking. For instance, regulators might introduce stricter requirements for credit assessment and risk management to ensure the stability of the fintech sector in the Latin American market. Such changes could further influence Nubank's ability to manage its NPLs and maintain financial health in its credit card business and personal loans portfolio across Latin America.

Technological and Operational Factors in Nubank's Digital Banking: Impact on Credit Card Business and Personal Loans in Latin America

Nubank’s success and challenges in the Latin American market are deeply intertwined with its technological and operational strategies. As a leading digital bank in Brazil and Mexico, its reliance on technology provides significant advantages in scalability and user experience but also presents unique risks, particularly in the context of increasing non-performing loans (NPLs) in its credit card business and personal loans portfolio.

Nubank leverages advanced technology to offer seamless banking services across Latin America, utilizing artificial intelligence (AI), machine learning (ML), and data analytics to enhance customer experience and streamline operations. These technologies enable rapid credit assessment and personalized financial products, positioning Nubank as a leader in the fintech space in the Latin American banking sector. Additionally, Nubank offers an international credit card with no annual fee, which is accepted worldwide, highlighting the convenience and accessibility of managing finances globally through their app.

One of the key innovations of Nubank in the Brazilian and Mexican markets is its automated credit assessment process. By using AI and ML algorithms, Nubank can quickly evaluate credit applications and make lending decisions with minimal human intervention. This process relies on large datasets and complex models to predict creditworthiness in the Latin American financial market. However, while this allows for rapid scaling and cost efficiency, it also introduces potential gaps in risk assessment for credit card loans and personal loans.

Automated systems can sometimes overlook nuanced financial behaviors that traditional banks might catch through more rigorous, human-involved processes. For instance, the models may not fully account for sudden changes in a borrower’s financial situation or macroeconomic shifts in Latin America, leading to higher exposure to credit risk and subsequently, higher NPLs in Nubank’s loan portfolio.

The digital platform of Nubank is designed for scalability in the Latin American market, allowing the bank to onboard millions of new customers rapidly. The mobile-first approach provides an intuitive and user-friendly experience, which has been a major factor in Nubank’s rapid growth across Brazil and Mexico. However, the sheer volume of new customers can strain the bank’s operational capacities, especially in areas like customer support and risk management in its digital banking operations.

While Nubank’s technology-driven model brings operational efficiency to its credit card business and personal loans operations, it also presents operational challenges in the Latin American banking sector. The rapid expansion requires continuous investment in infrastructure and cybersecurity to protect customer data and prevent fraud. Any lapses in these areas can lead to significant operational risks, impacting the bank’s overall financial stability in the Latin American market.

Nubank’s credit portfolio management is another area where technology plays a crucial role. The bank uses data analytics to monitor and manage its loan portfolio, identifying potential risks and taking corrective actions. However, the growing portion of interest-earning assets, such as PIX financing, adds complexity to portfolio management. Nubank’s shift towards interest-earning products has increased its credit risk, contributing to higher delinquency rates.

The composition of Nubank’s credit products is a significant factor in its NPL rates in Latin America. Compared to traditional banks, Nubank has a higher proportion of credit card receivables that accrue interest. In Q1 2024, 68% of Nubank’s credit card receivables were interest-bearing, compared to 49% for the broader Brazilian financial system. This product mix, while beneficial for generation, also increases the likelihood of defaults, particularly during economic downturns in the Latin American market.

Nubank must continuously adapt its technological infrastructure to comply with regulatory requirements in Brazil, Mexico, and other Latin American countries. This includes implementing systems for detailed reporting, customer data protection, and compliance with loan classification standards. The dynamic nature of regulatory requirements in the Latin American banking sector means that Nubank’s technology stack must be flexible and robust to ensure ongoing compliance.

Nubank’s customer base in Latin America, primarily younger and tech-savvy individuals, readily adopts new technologies. This demographic is more likely to engage with digital banking services and use features like mobile payments and digital wallets. However, this also means that Nubank must stay at the forefront of technological innovation to meet customer expectations and maintain its competitive edge in the Latin American financial market.

Nubank's Renegotiation Strategy

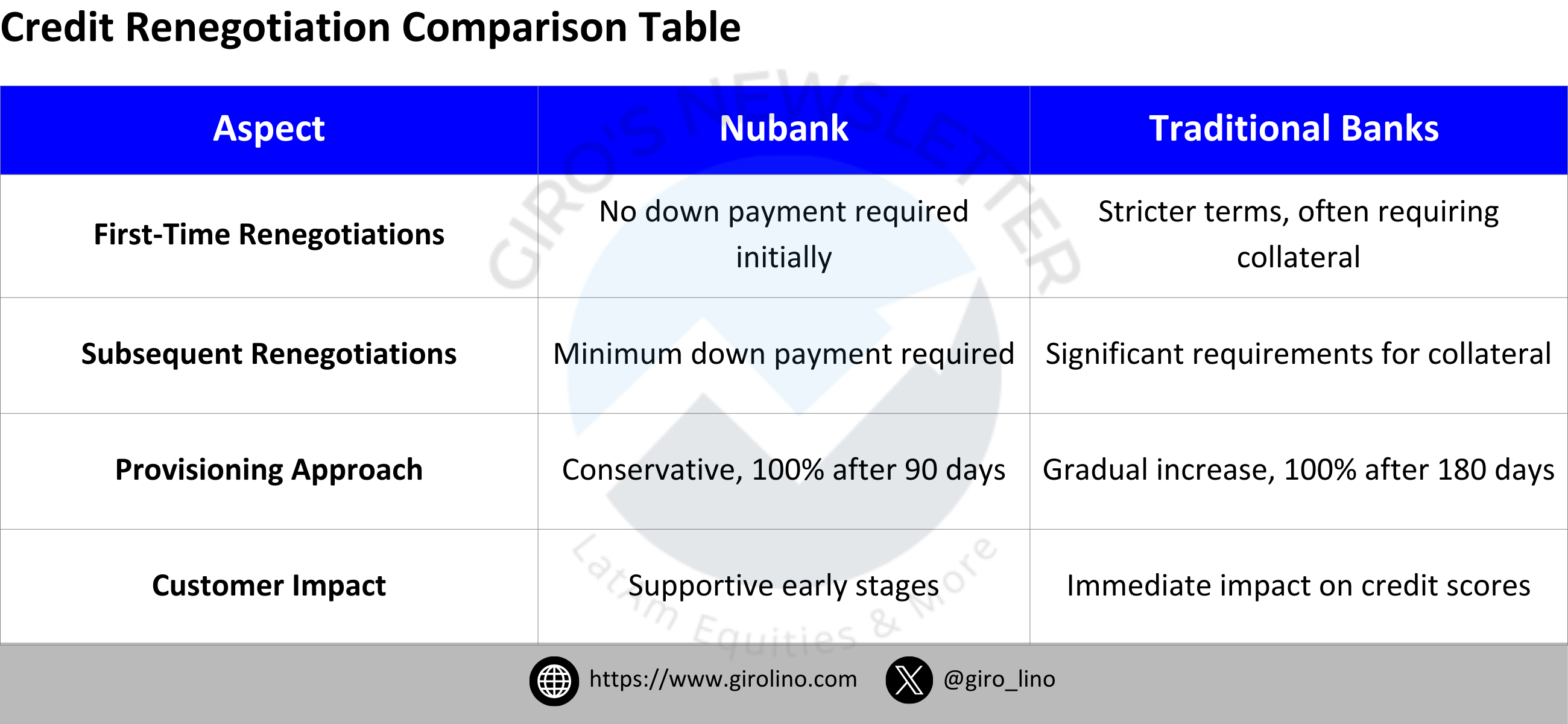

As Brazil and Latin America grapple with high interest rates and a challenging economic landscape, credit renegotiation has become crucial for borrowers seeking relief and banks aiming to manage risk effectively in the digital banking sector. While traditional banks like Itaú and Bradesco have historically followed stringent renegotiation policies, often requiring stricter terms and immediate impact on credit scores, Nubank has emerged with a distinct approach to balance customer support with prudent risk management in its credit card business and personal loans portfolio.

Nubank's renegotiation strategy involves a structured framework that adjusts credit provisioning and staging based on the timing and frequency of renegotiations. By offering more flexible terms during early stages, such as no down payments for initial renegotiations, Nubank provides a lifeline for customers facing financial difficulties. However, as renegotiations progress, Nubank's approach becomes more stringent, with minimum down payments required for subsequent renegotiations and a move to Stage 3 classification for loans 90 days overdue or on their second renegotiation.

Nubank's renegotiation strategy in the Latin American market involves a structured framework that adjusts credit provisioning and staging based on the timing and frequency of renegotiations. By offering more flexible terms during early stages, such as no down payments for initial renegotiations, Nubank provides a lifeline for customers facing financial difficulties in Brazil and Mexico. However, as renegotiations progress, Nubank's approach becomes more stringent, with minimum down payments required for subsequent renegotiations and a move to Stage 3 classification for loans 90 days overdue or on their second renegotiation.

Nubank's renegotiation process in the Latin American banking sector:

- Before the due date: Loans are classified in Stage 2, with increased coverage ratios compared to the original loan. No down payment is required for the first renegotiation, but subsequent renegotiations require a minimum down payment.

- On or around the due date: The classification remains in Stage 2, with similar provisioning. The first renegotiation requires no down payment if it occurs within specific days of the due date. Subsequent renegotiations always require a down payment.

- Long after the due date: Loans are classified in Stage 2 for up to 90 days past due and Stage 3 for over 90 days past due, with increased provisioning reflecting new loss expectations in the Latin American financial market.

Nubank's renegotiation portfolio in Latin America shows that approximately 60% of the total renegotiations are first-time renegotiations, while second renegotiations constitute about 25%. This strategy ensures that the coverage ratios are higher for renegotiated loans, reflecting a more conservative approach to potential losses in the digital banking sector. The requirement for minimum down payments in subsequent renegotiations helps mitigate credit risk further by ensuring immediate recovery.

In comparison, traditional Brazilian banks like Itaú Unibanco and Bradesco typically follow the guidelines set by the Central Bank of Brazil, which includes specific criteria for classifying loans as non-performing based on the number of days past due. These financial institutions often use econometric models and stress testing to project NPL ratios under various economic scenarios, as well as data envelopment analysis (DEA) to measure bank efficiency in the Latin American banking sector.

Traditional banks in Latin America tend to have more stringent renegotiation policies, often requiring collateral and higher interest rates. Loans are quickly classified as non-performing, leading to aggressive collection actions and rapid escalation to higher risk categories. Under BRGAAP, banks classify loans from A to H based on risk and overdue status, with higher provisioning required as loans become more delinquent in the Brazilian market.

Nubank's proactive and technology-driven approach to NPL management in its digital banking operations, along with its supportive renegotiation strategy, contrasts with the traditional methods used by Brazilian banks. While traditional banks follow a conservative, standardized approach to risk management, Nubank's flexibility and technological integration allow for more dynamic and real-time credit risk management in the Latin American financial market.

Conclusion

Nubank’s rise as a leading digital bank in Brazil is a testament to its innovative business model, customer-centric approach, and effective use of technology. However, the increase in its non-performing loans (NPLs) despite a decline in NPLs for traditional banks highlights several critical challenges that Nubank must address.

Nubank’s strategy of targeting underbanked and financially underserved segments has driven rapid growth but also increased its exposure to higher credit risk. The focus on younger, lower-income individuals means a larger proportion of its loan portfolio is vulnerable to economic shocks and financial instability.

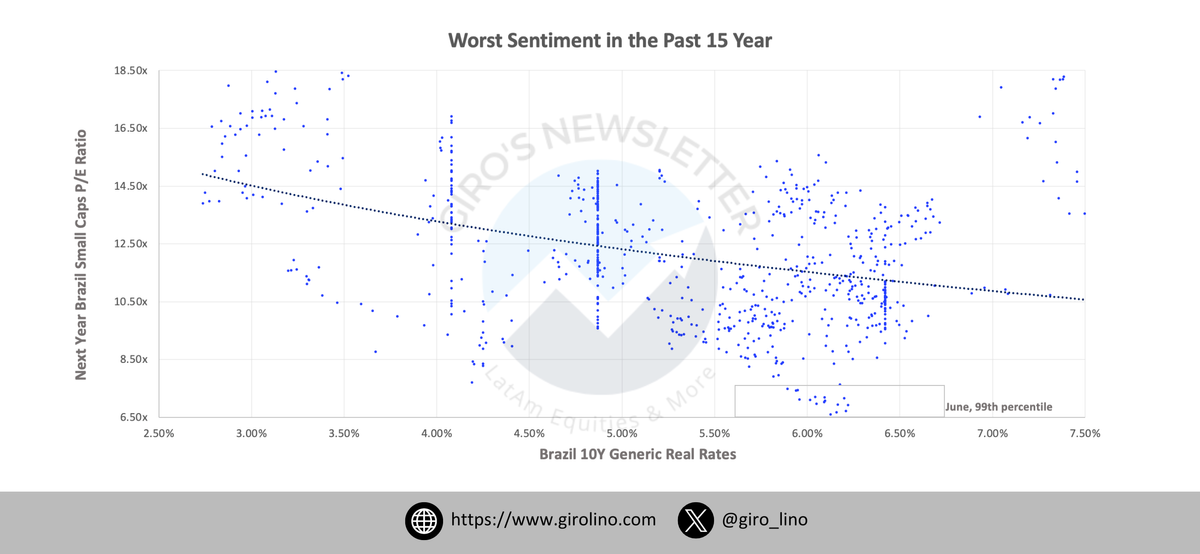

The broader economic environment, characterized by high inflation, fluctuating interest rates, and economic uncertainty, has particularly impacted Nubank’s customer base. These conditions have exacerbated financial stress among its borrowers, leading to higher default rates compared to traditional banks with more diversified and stable customer bases.

Nubank’s aggressive customer acquisition and loan growth strategy, while driving revenue, has resulted in a higher proportion of interest-earning assets and riskier loans. The reliance on automated credit assessment and relatively lenient risk management practices have also contributed to the rise in NPLs. In contrast, traditional banks’ conservative lending practices and rigorous risk assessment frameworks have enabled them to reduce their NPLs.

The financial behavior and demographics of Nubank’s customers play a crucial role in the higher delinquency rates. Lower-income individuals and first-time users of formal banking services often face greater financial instability and lack the financial literacy to manage credit effectively. This demographic is more susceptible to defaults during economic downturns, impacting Nubank’s overall NPL rates.

Navigating Brazil’s regulatory landscape poses unique challenges for Nubank. Changes in loan classification and write-off policies and stringent consumer protection regulations have significantly influenced its reported NPLs. Traditional banks, with established regulatory frameworks and conservative practices, have managed these pressures more effectively.

While enabling scalability and operational efficiency, Nubank's technological infrastructure also presents risks. Automated systems can sometimes miss subtle credit risk indicators, and rapid expansion can strain operational capacities. The increasing portion of interest-earning assets in Nubank’s portfolio has added complexity to credit portfolio management, contributing to higher delinquency rates.

Nubank's renegotiation strategy, which balances customer support with prudent risk management, involves a structured framework that adjusts credit provisioning and staging based on the timing and frequency of renegotiations. By offering flexible terms during early stages and requiring minimum down payments in subsequent renegotiations, NuBank can better handle the uncertainties associated with overdue credit while providing a pathway for customers to regain good standing.

Nubank must refine its credit strategy and risk management practices to address these challenges and stabilize its NPL rates. This includes enhancing its credit assessment models to capture better the financial behaviors of its diverse customer base and balancing growth with prudent risk management. It will also be crucial to improve financial literacy among its customers and adapt its technological infrastructure to meet evolving regulatory requirements.

Nubank’s experience underscores the importance of robust risk management and the need for fintech companies to adapt to economic, regulatory, and market conditions continuously. As the fintech sector continues to grow and innovate, balancing rapid expansion with financial stability will be essential for sustainable success.

In summary, Nubank’s increasing NPLs amidst a declining trend for traditional banks can be attributed to its unique business model, customer demographics, and operational strategies. By addressing these factors and implementing more rigorous risk management practices, Nubank can work towards reducing its NPL rates and achieving long-term financial stability. This analysis provides insights into Nubank’s current challenges and valuable lessons for the broader fintech industry.

Your Opinion Matters!

We're constantly striving to improve our content. Could you spare 2 minutes to let us know what you think? Your feedback is invaluable in helping us deliver the financial insights you need.