Inter has announced a material fact that it is proposing a new model for its corporate reorganization, which failed to happen at the end of 2021.

Under the new terms, the core proposal of migrating its shares to Nasdaq remains the same. In addition, local shares should be incorporated under a new holding structure (Inter & Co. Inc.), the listed vehicle with its BDRs trading in B3.

Shareholders can choose either by (i) directly owning the NewCo shares (if possible), (ii) redeeming its current locally listed shares in BDRs, or (iii) opt for the cash-out option, which will be limited to R$1.1bn (10% of the current free-float).

At the end of 2021, Inter tried to list its shares in the US, but the process was canceled. Inter offered a cash-out option for the shareholders (at R$45.84 per unit), with a R$2bn budget for the cash-out demand.

However, the stock price was trading substantially below the cash-out option, so the demand surpassed the threshold, leading Inter to cancel the offering.

In the current offer, the cash-out amount was defined at up to R$1.1 bn, but if more investors demand the cash-out option, the deal will continue, and this option will be prorated among shareholders that request it.

The cash-out price was defined as R$ 38.70 for each 6 Inter' shares, which means R$19.35 per unit (~17% above the last closing on last Friday). Only the shareholder that holds Inter's shares on April 15, 2022, will be eligible for the cash-out option.

Even though we believe that the market was anticipating the movement, the new conditions for the structuring maximize its favorable outcome.

About the company

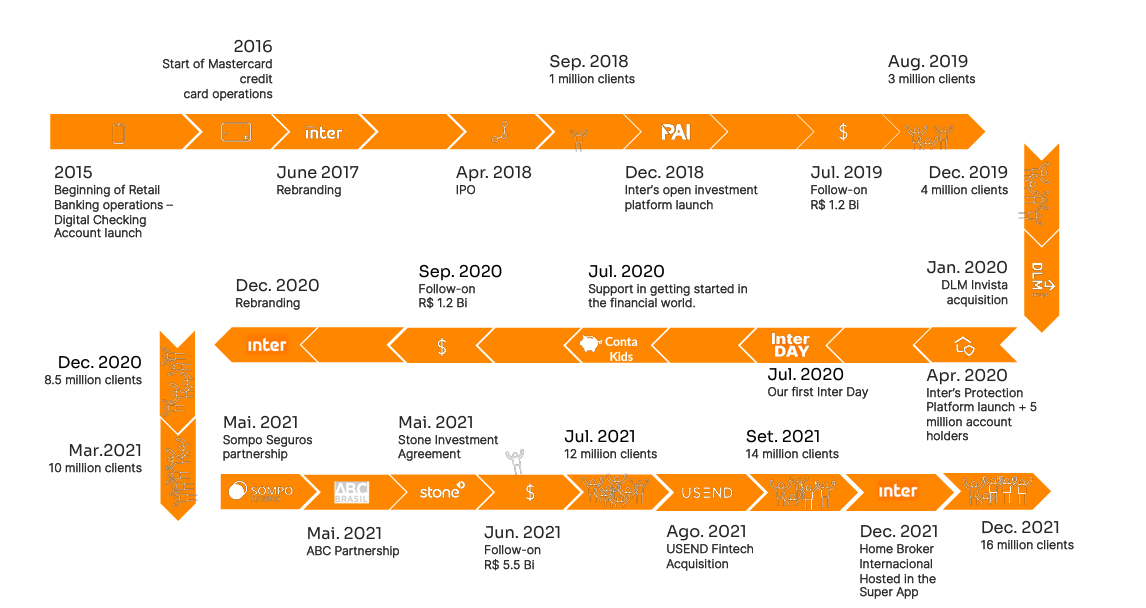

Founded in 1994 and based in Belo Horizonte, State of Minas Gerais, Inter has more than 26 years of history.

The company is a publicly-held corporation, listed on Level 2 of Corporate Governance of the Brazilian Stock Exchange and under negotiation by tickers BIDI3, BIDI4, and BIDI11.

Inter has grown and accomplished numerous achievements under the name Banco Intermedium, mainly in credit operations in the regional scope of Minas Gerais.

In 2015, João Menin became the new CEO, initiating a new cycle. Inter launched the Digital Checking Account, which represented one of the most important milestones.

With this change in strategy, Inter entered into retail banking. In 2017, the former Banco Intermedium made this change official with the brand repositioning, changing its name to Banco Inter.

In the following years, the mission was expanded, and the new name, more straightforward, shorter, and more friendly, reflected the evolution of the business. Finally, in 2020, the company rebranded to Inter.

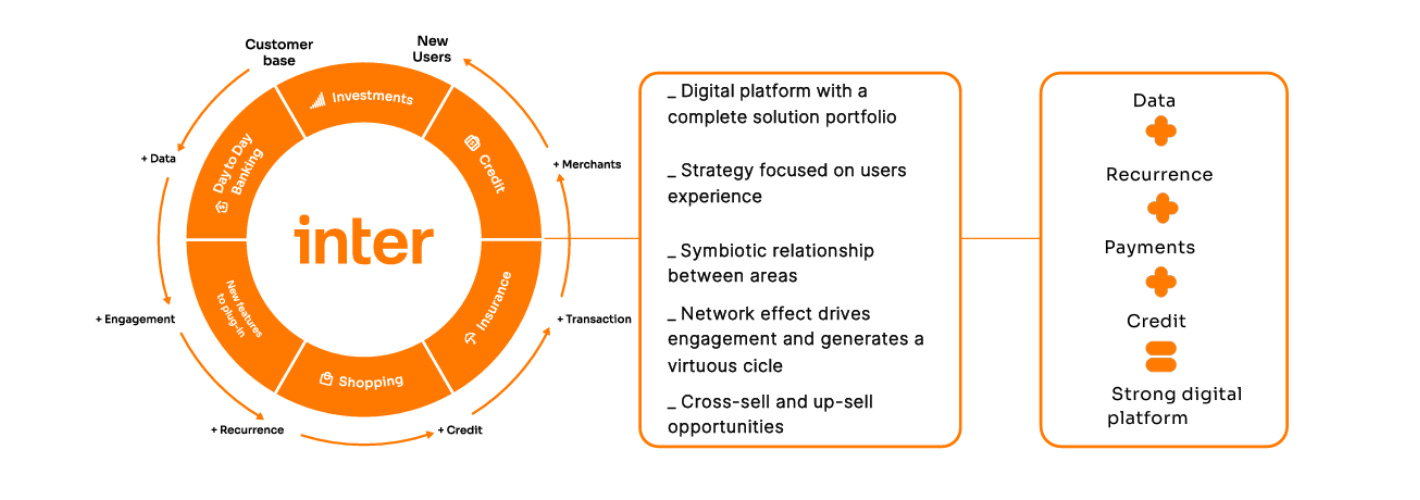

Inter is a complete platform for financial and non-financial products and services. Through its “Super App,” it operates in 5 business avenues: Day-to-day banking, Investments, Insurance, Credit, and Shopping.

The Digital Account is the gateway to a complete portfolio of products and services with a simple and easy-to-use interface.

The company offers credit products (real estate, payroll, and companies), investments, foreign exchange, insurance, consortia, checking account services and free transactions, credit and debit cards, in addition to a platform of non-financial products and services ranging from the sale of Gift Cards, cell phone recharge, telephone service via Intercel, to a complete digital shopping with more than 250 partner stores and retailers, with cashback on every purchase.

To support such a wide offer, similar to Nubank, Inter operates over several subsidiaries, forming the Grupo Inter (“Inter Group”):

- Inter DTVM and Inter Asset allow Inter to act as an open architecture digital platform in the investment market, with fixed and variable income products, investment funds, Home Broker, and wealth management, which make up Inter Invest.

- Inter Seguros, which in 2019 joined Wiz and started to act more strongly in the retail insurance market through the Inter Protection Platform.

- Inter Marketplace, also known as Inter Shop, offers non-financial products and services through partnerships with different stores, retailers, and service providers.

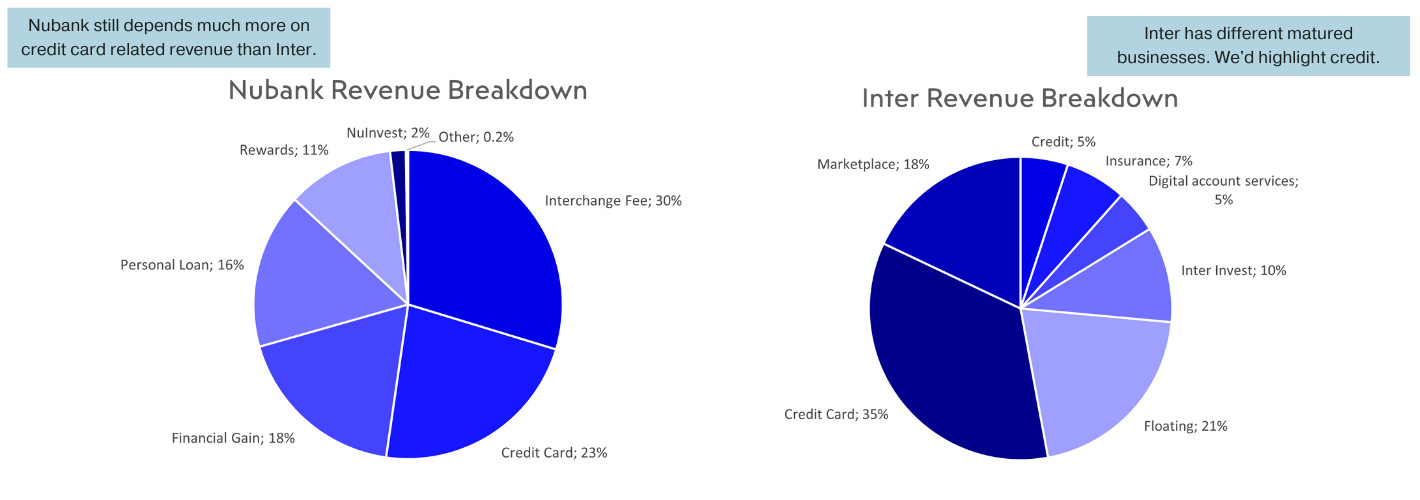

Compared to Nubank, Inter has been operating in the credit market for decades, especially in mortgage and payroll loans. However, only in the past 3/4 years, Inter has been growing its retail credit portfolio.