Associations linked to the e-commerce sector sent a letter to Mastercard’s (“MA”) management to complain about the increase in the so-called “interchange fee” charged by the card network.

As of April, sellers are expected to have a 0.5% increase in fees for online debit transactions and a 0.2% increase for credit payments. The costs may be passed on to consumers, warning the associations’ letter.

They are concerned with the MA’s initiative, stamped on about 55% of active cards in the country. The association is alarming that small entrepreneurs, already harmed by the economic crisis, will be the most affected.

The request is that the plan to increase the rate be immediately suspended. It is passed on to the issuing banks of MA cards.

One of the broad-reaching changes regarding increases has to do with when consumer credit cards are used to make purchases online. Visa (“V”) and MA are increasing interchange fees that will apply to many of these purchases.

Let us be fair. Generally, the networks will change their fee structure around this time, with plans for those changes to kick in April of each year.

The companies put many of their scheduled fee increases on hold in the last two years because of the pandemic.

V and MA are planning on moving forward with increases, so this would be the first widespread round of increases for merchants’ fees since the pandemic began.

— But Giro, how can MA increase interchange if there is a legal cap?

Let’s look at the law (only available in Portuguese). Probably the paragraph that caught everyone’s attention was:

⚠️BCB Circular No. 3.887/2018, which sets forth the maximum limits of (i) 0,5% for the average interchange fee, weighted by the value of the transactions; and (ii) 0,8% as the maximum amount to be applied in any transaction.⚠️

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

However, I’d add the following paragraph:

Ҥ 2 The maximum limits related to the interchange fee mentioned in the caput do not apply to:

I - non-face-to-face transactions;

II - transactions with corporate cards.”

So, MA and V could increase their respective take rates for e-commerce, though we couldn’t blame the associations for defending their interest.

Suppose I represented any member of the association.

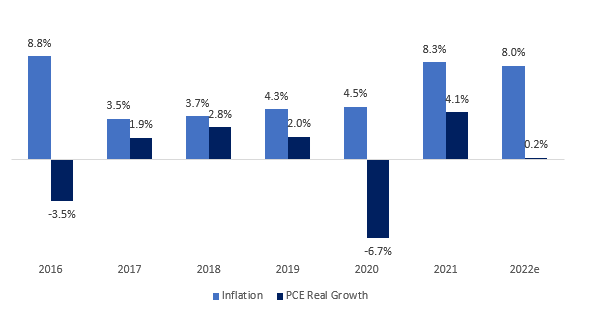

In that case, I’d call the government asking for an explanation about how inflation growth is greater than the real growth of personal consumption expenditure in an emerging country such as Brazil.

Giro’s Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.