Hi 👋

The first post about Meli was on Jan 29th. A lot has happened since then. I had a draft 80% done. The original idea was to post it before Nu’s coming out.

After going through it a few times, I thought the best decision was to halt it and begin from scratch. I had pretty cool tables and a valuation model, but it was too complicated.

After years in the financial industry, you get used to writing very long and hard-to-read paragraphs, expecting to summarize a topic, when actually nobody reads that crap.

It’s unbelievable how analysts can come up with 30 pages length report, 6 lines of paragraphs, and tons of charts that could be summarized in a dozen bullet points.

I’m not doing that. The people who can add the most value to learning, in general, are the people who can kind of decipher the complicated research and explain it to anyone.

So, let’s do it step-by-step. To understand why I’m ridiculously optimistic about MercadoLibre, there are several topics we have to return to again and again. We make sure to move from one to another to keep the content fresh.

What’s definitely true, and I’ve heard this from other writers, too, is that when you sit down and try to force yourself to think about a topic, you’re never going to get it.

If you sit down and say, “Okay, I need to think about something; what am I going to write,” it won't work if you try to force your brain into that. Believe me, I tried that quite hard.

Where I think, and I’ve heard this from other writers, too, I think you get your best ideas just randomly. You’re walking the dog. You’re on Twitter shit posting — and only God knows how much I did. You’re just zoning off, and then it’s like, pop, you get an idea in your head.

You’re like, “Oh, I got to go to my computer right now and write this.” I collected the data a few weeks ago for this topic, but only this Thursday did I have my “pop” moment and start writing.

👉Good News✨

I’m writing the post about the POS machines we bought in February. I had to cover the essential topics. So, I went over a few hundred tests and am now good to move on to writing. Good stuff coming up next.

The outline

- E-Commerce at a Glance

- Superior Economies of Scale

- Economic Headwind Is Not a Concern

- Shopee Threat

- Meli’s Unit Economics

One-Pager

Skip it if you pretend to read the entire post (22 pages)

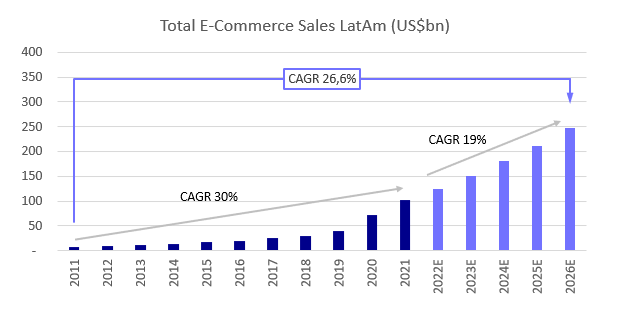

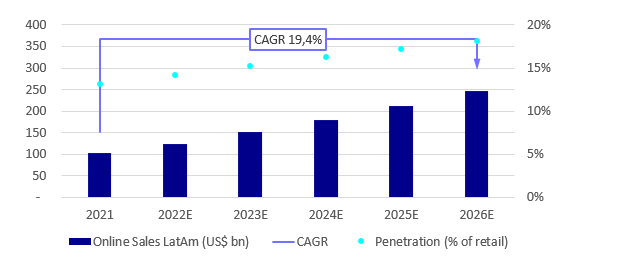

- LatAm eCommerce is a US$102bn market; supported by our proprietary industry model, we forecast growth to US$250bn in 2026. In 2021, eCommerce volumes represented 13% of overall retail sales in LatAm (excluding autos, restaurants, and services).

- While stay-at-home trends were a driver of outsized growth in 2019-21, we see a stronger-for-longer setup of a double-digit CAGR through 2026; we believe the Covid-driven bump will not flatten the future eCommerce penetration curve.

- Looking at 2021-26E, we forecast a 19% CAGR, with ~100bps of annual penetration gains, while the percentage growth rate is below pre-Covid levels, partly due to the more extensive base, penetration gains are more in-line with pre-2019 levels.

- In Brazil, logistics improvements have unlocked new categories, with companies including Magazine Luiza (“Magalu,” “MGLU”), Americanas (“AMER”), and Via (“VIIA”) investing in omnichannel logistics. At the same time, Meli continues its marketplace fulfillment center roll-out.

- Our industry model illustrates Meli's leading share across LatAm eCommerce; the backdrop in Brazil is competitive, while other countries are more fragmented. As a result, we see Meli leading with ~30% eCommerce market share in Brazil. Local operators Americanas, Magalu, and Via command a combined ~49%, and Shopee (owned by Sea Ltd) has been gaining ground (~6% 2021 share). We see Meli and Shopee as best positioned to gain share in Brazil, supported by favorable category mixes, including fewer electronics exposure.

- We see a mixed top-down backdrop for LatAm Retail into 2022, balancing physical store normalization with pressure from high inflation; on eCommerce, we remain bullish and forecast +21.5% USD growth.

- Despite this muted top-down backdrop, we remain bullish on eCommerce growth in the year ahead — low penetration is critical, ending 2021 at just 13.1% of retail sales across the region.

- From an eCommerce perspective, electronics/appliances/video games/media products account for ~15% of the Brazilian retail market but for ~50% of eCommerce GMV (versus 17%-25% in countries like the UK, China, and the US).

- In 2021, according to our estimates, the low recurrency GMV mix (including appliances and accessories) at 84% for Via, 71% for Magalu, 49% for Americanas, and 29% for Meli.

- While Meli has been diversifying away from the category — a company fact sheet shows 33% electronics mix in 2021, down from 65% in 2009 – the broadening initiatives for other platforms are earlier-stage in comparison.

- Our base case forecasts imply Shopee gains continued traction within the lower-ticket categories and younger / lower-income demographics where the company currently over-indexes, while logistics and fintech development remain barriers to a pivot to higher-ticket categories.

- After almost a dozen industry channel checks, we have enough confidence to estimate the marginal capital invested and, therefore, the ROIC for mature cohorts.

- Finally, it’s worth mentioning that Meli historically invested all its cash generated in the marketplace business to acquire customers and new ventures, leading unaware investors to believe that Meli operates an inferior business.

E-Commerce at a Glance

LatAm eCommerce is a US$102bn market; supported by our proprietary industry model, we forecast growth to US$250bn in 2026. In 2021, eCommerce volumes represented 13% of overall retail sales in LatAm (excluding autos, restaurants, and services).

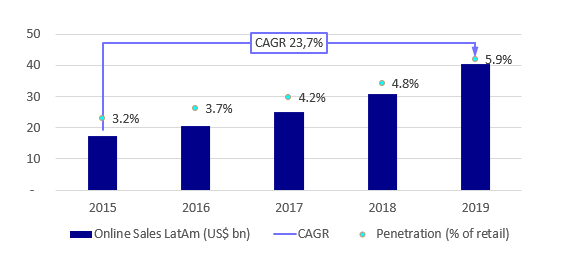

While this was up notably from 5.9% in 2019, the secular shift toward online retail had been in place well before the Covid-driven acceleration.

Supported by our bottom-up company estimates – and supported by the top-down consensus expectations, we build to a cumulative US$250bn market opportunity by 2026, representing a 19% 5-year CAGR and a US$145bn incremental GMV opportunity.

While stay-at-home trends were a driver of outsized growth in 2019-21, we see a stronger-for-longer setup of a double-digit CAGR through 2026; we believe the Covid-driven bump will not flatten the future eCommerce penetration curve.

As shown in the image below, between 2015 and 2019, LatAm eCommerce volumes increased at an 18% CAGR, with ~68bps of average penetration gains annually.

Considering initial Covid impacts in 2020 and subsequent Covid-wave disruptions throughout 2021, growth accelerated to a 51% 2019-21 CAGR (69% in 2020, 35% in 2021); annual penetration gains were ~360bps over these two years.

Looking to 2021 figures, parts of the world had not fully normalized/reopened, likely benefiting the eCommerce channel. However, we also see structural and behavioral change, given the persistence of growth in 2021 on a historically tricky comparison.

Looking at 2021-26E, we forecast a 19% CAGR, with ~100bps of annual penetration gains, while the percentage growth rate is below pre-Covid levels, partly due to the more extensive base, penetration gains are more in-line with pre-2019 levels.

This is consistent with our view of a step-change in eCommerce demand, supporting the go-forward penetration curve.

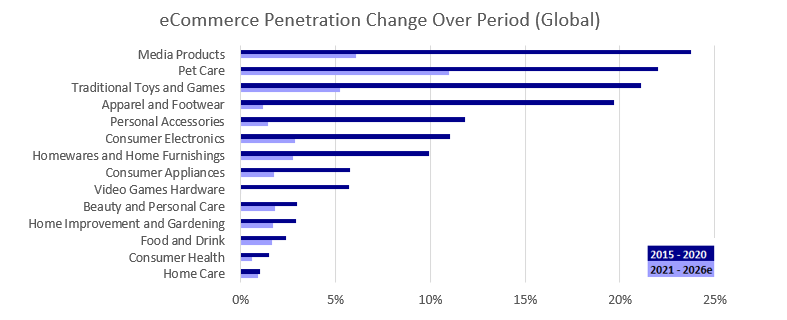

Further supporting our multiyear growth thesis, we highlight a trend of broad-based eCommerce gains even for the highest penetration countries and categories.

Comparative eCommerce penetration over sales by merchandise category is shown in the image below; these charts demonstrate the broad-based gains for online retail.

This depth and breadth support our conviction in a stronger-for-longer eCommerce growth outlook, even though we couldn’t estimate the penetration per category for LatAm.

Also, on a relative basis, forecast growth rates are higher for lower-penetrated regions (e.g., LatAm, ASEAN, Africa) and categories (e.g., grocery, personal care).

While there are headwinds (logistics and otherwise) in certain countries and verticals, we believe these barriers continue to come down; encouragingly, across the LatAm countries, we have yet to see a ceiling for eCommerce penetration.

At the country level, we estimate, on average, a five-year path from 12.5% to ~16.5% eCommerce penetration, supporting growth forecasts for markets in this phase of the eCommerce inflection.

The image below shows the eCommerce penetration curves for countries; we offer the overall penetration per country in LatAm.

We understand that countries like Mexico, Peru, and Chile offer a massive logistic headwind, lagging any substantial penetration gain.

We forecast a +7% CAGR for Mexico, with 12% penetration (10% today). Nevertheless, Mercadolibre (“Meli”) achieved +70% fulfillment penetration in the country as of 4Q21, and Walmex can reach ~90% of the population in ~10 minutes from its stores.

We highlight that Brazil and Argentina lead among LatAm countries for eCommerce penetration, even though the logistics headwinds were tremendous.

Also, we see a replicable path for increases across the region, primarily driven by logistics improvements; Therefore, we believe that the market is overly conservative in its growth assumptions on LatAm.

In Brazil, logistics improvements have unlocked new categories, with companies including Magazine Luiza (“Magalu,” “MGLU”), Americanas (“AMER”), and Via (“VIIA”) investing in omnichannel logistics. At the same time, Meli continues its marketplace fulfillment center roll-out.

For the other countries in the region, both omnichannel operators (such as Falabella) and marketplace operators (led by Meli) are increasing their focus on eCommerce.

For instance, Meli opened its first fulfillment centers in Chile and Colombia in 2021, supporting our view that company-driven service improvements can drive eCommerce growth above the conservative consensus expectation.

Superior Economies of Scale

Our industry model illustrates Meli's leading share across LatAm eCommerce; the backdrop in Brazil is competitive, while other countries are more fragmented. As a result, we see Meli leading with ~30% eCommerce market share in Brazil.

Local operators Americanas, Magalu, and Via command a combined ~49%, and Shopee (owned by Sea Ltd) has been gaining ground (~6% 2021 share).

We see Meli and Shopee as best positioned to gain share in Brazil, supported by favorable category mixes, including fewer electronics exposure, as will show soon.

If you wish to continue reading the post, access our Substack page...