Hi.

As promised, in this post, I’ll review our quarterly update on Stone, presenting a short overview of key macro variables that affect the business, the next quarter's earnings, and a few inputs about the company.

Following any payment company may find valuable information about its capital structure in this post.

Also, we’re making available a simple cheat sheet for Stone, and our routine presentation about today’s post, so let us know if you have any questions about the spreadsheet (located next to the disclosure).

Before that, I’ll explain how I build my spreadsheets so that no misunderstandings are going forward.

In my humble opinion, a financial model is essential to understanding business dynamics. You may scrap an old spreadsheet and update its values for a new company, but this is worthless for me.

Since my goal is to better understand and create my own narrative regarding the business, using a standard model makes it more complicated.

I enjoy creating unique company models, so I hardly use the same spreadsheet for multiple companies, explaining why it takes much time to deliver a longer post.

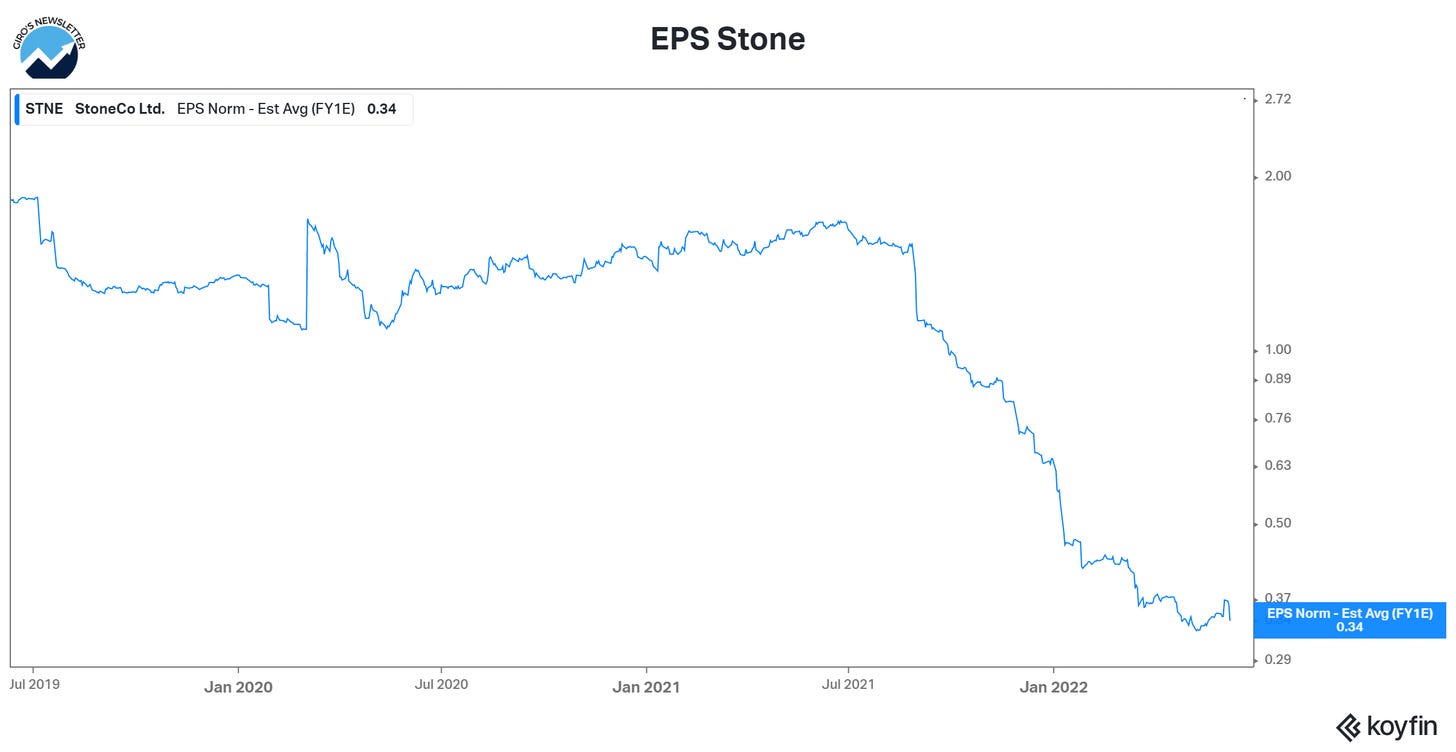

For instance, I disagree with the sell-side for not estimating Stone correctly for months. This is, of course, under a narrative I created for myself.

If I had copied someone else’s model, otherwise, that would not be possible. Also, I don’t look to discredit the sell-side, but as they publish their own estimates, they’re my peers.

Then, as my goal is to better understand the company, I don’t care much about the DCF. Instead, I use it to improve my knowledge about space.

Overall Picture

In February, we wrote an update about funding costs pressuring Stone's earnings in 2022, higher competition leading to higher sales and marketing expenses, and supply chain disruption affecting the hardware prices.

In short, our outlook for Stone is unchanged. Stone will likely continue to face challenges in posting significant earnings expansion.

First, even though Stone suspended the credit operations, the company lost a lot of financial resources due to credit losses and incremental investment in infrastructure related to tech.

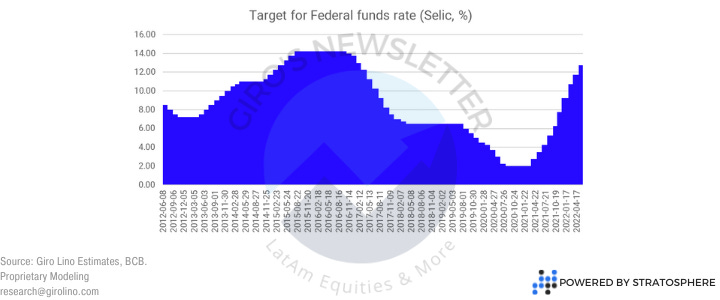

Second, Brazilian Central Bank has been increasing interest rates (+1,075bps in the cycle so far), pressuring Stone’s financial expenses and price pass-through.

Even though Stone announced new price policies in 2022 during its earnings call, as we flagged, it would not be enough to surpass the damage caused by higher rates.

Also flagged, there was an enormous downside risk to Stones earnings in 2022, that was in the R$750mn-R$1,000bn, while we were suggesting ~R$400mn. So after the 1Q22, we reviewed our number a notch down, to R$374mn.

Honestly, we were surprised that consensus reviewed earnings upward after the 4Q21. We believe they answered the price action movement. Who knows…

As of today, the consensus expects R$500mn for Stone in 2022. We disagree and believe these estimates have a downside risk because they were wrong before: they are not estimating the financial expense correctly.

We were glad to see more downward revisions after Stone announced its 1Q22.🙂

The Next Quarter

Reminder: If you wish to know our thoughts about the 1Q22, we wrote a post about it.

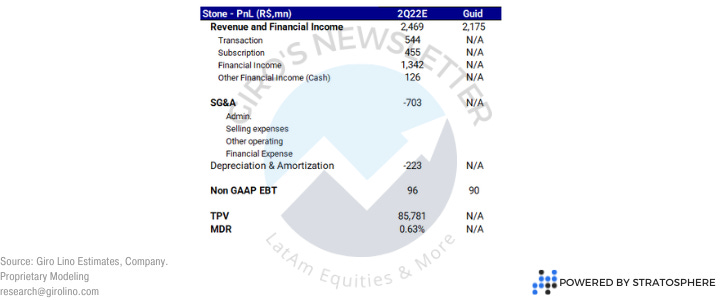

Looking forward, we were a bit surprised looking at Stone’s guidance for the 2Q22, mainly the revenue, which is underestimated, in our opinion.

Before explaining why we’ll give you a brief context; first, Brazil is a populist country. Politicians are always waiting for their time to urge miraculous, though impossible, solutions and blame someone for that.

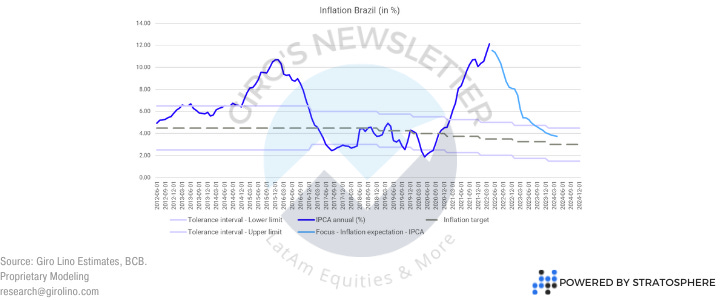

Second, Brazil lived with higher than expected inflation in the past decade. So because public spending is misallocated and the productivity deteriorates year after year, we have a country with low growth and higher inflation.

Third, this time is no different. Even though we believe inflation has peaked, nobody was expecting such an overshoot in the inflation.

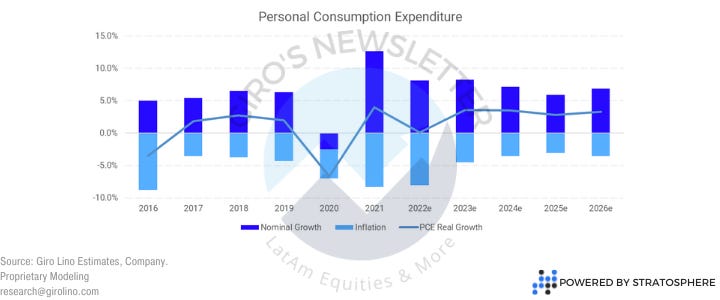

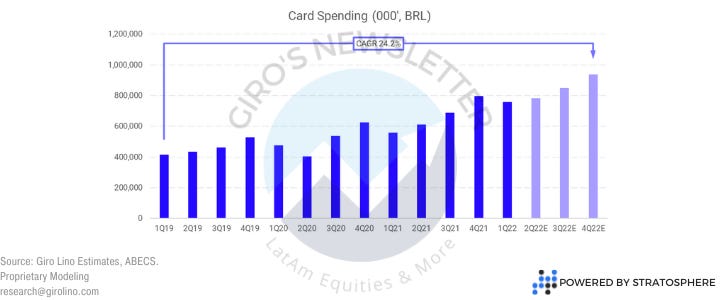

Since the Personal Consumption Expense (“PCE”) is a key leading indicator of performance for card transactions, Stone’s TAM is highly sensitive to inflation.

However, that does not mean that inflation boosts cash flow generation. Instead, considering the real consumption growth, we find a volatile indicator.

A consequence of higher inflation for Stone is the limited pricing power it imposes on the company, as we’ll see moving on.

So, even though inflation destroys value, we need to consider the short-term benefit of boosting its transaction business, favoring Stone’s TPV.

We updated our expenditure model in April, considering we were surprised by solid figures in the 1Q22. We believe this is why our expected TPV was in-line, despite beating the consensus expectation.

So, in our view, Stone’s guidance may not include an update for card spending after a strong quarter. Nevertheless, an alternative would be our estimated take-rate might prove too aggressive.

Considering the uncertain scenario, we believe that Stone and the overall industry may be waiting for the inflation peak for a review, which is totally acceptable. In the following illustration, we compare our expectations versus the proposed guidance.

Pivotal Questions

If we think about Stone, there are a few questions we need to address:

- Is Stone an asset-light company?

- Does Stone have pricing power?

- How does Stone depreciate its assets?

So, in the following lines, we’ll go through each of them. Now, if you like companies such as Klarna, Affirm, and Afterpay, you gonna like what you’re about to read.