After XP Inc. (XP) and BTG Pactual (BPAC11-BS) released their earnings, I’ve been thinking about the financial advising industry in Brazil and would like to tease my readers about a question I’ve been asking myself about XP.

But, first, I’ll provide context to the conversation. The investment industry in Brazil was concentrated in the leading commercial banks (Itaú, Santander, Bradesco, and Banco do Brasil).

The most significant chunk was concentrated in fixed income investments and big bank products and very few expressive or, let's say, relevant independent investment firms, which I mean asset managers, so investment fund managers.

Between 2016 and 2017, there was a significant change in the financial market, with several funds rising amidst an easing cycle and a lower inflation environment. The newcomer that took the throne with a predominant position was XP.

From its inception, XP tried to replicate the Charles Schwab platform in the U.S. The primary goal was to give access to smaller investors to mainstream fund managers and complex financial products.

This process started through small independent financial advisory firms, called IFAs in the US, and AAI in Brazil.

For years, XP had a ton of low-hanging fruits recruiting traditional retail bankers to quit their job and join XP with a lot of financial leverage, the so-called rebate (a percentage over the asset that the advisor had under custody).

Eventually, XP supported advisors in creating their own firm, called an independent financial advisory firm, and operating under XP’s banner — with exclusivity.

In my opinion, this was the big move that took XP to a platform level. Now, the company unbounded its risk to individual companies that are obligated to operate with XP and sell its product.

When they became independent financial advisors, they started to bring their own clients to their own structure.

Eventually, the strategy worked, and XP became bigger and gained a lot of bargaining power with the hedge fund industry in Brazil.

It helped them grow their own platform, which has now become one of the leading investment platforms in Brazil.

Many other smaller platforms are offering the same model, XP's well-developed already, but paying more significant commissions and bigger rebates to convince these professionals to join their own platforms and not the big ones.

For instance, a particular Private Bank in Brasil hires hundreds of employees by offering a competitive Hiring Bonus under a lock-up period.

Also, as the independent financial advisory firms became more prominent players, they gained leverage for negotiating better rebates with different banks.

About five or six years ago, watching this movement, BTG started to see this business as a good business and launched its own operation.

According to channel checks, they didn’t do it before because management wasn’t confident about having physical branches like the incumbents' banks.

Once the model was proven and validated, with clients migrating to digital banks and mobile banking, the model became much more attractive to industry players.

BTG decided to make the movement and build its own retail platform as a digital bank and not as a traditional bank with street branches.

The market has a really extended network of independent financial advisors, independent hedge fund managers, and many smaller platforms.

Even though advances such as digitalization and facilitated onboarding are beneficial to the public community, we may not ignore the quality of the service.

In 2021, Brazil had ~17k AAIs (vs. 12.7k in 2020). XP employees almost 10k and frequently announce they’d like to grow much more, comparing IFA’s numbers to the country's 35k/40k individual bank managers.

If you just google terms related to AAI, the results are weird. This is because XP and other players are “recruiting” you before getting certified.

The form they obligate you to fill out to receive the educational content includes income, LinkedIn page, professional experience, etc. And, as the illustration below shows, right below the education content FAQ, they mention topics related to salary.

It gets worse. In 2016, there were 630 candidates approved in the test to become an IFA, versus ~6.5k in 2021. Most of the growth comes — obviously — from inducing the person to become a financial advisor.

As the illustration below shows, Suno, a company controlled by XP, published a post explicitly telling how much money an IFA could make.

Also, they classify IFAs as “Self-Employed,” which is essential. IFAs work for offices under service contracts, and most are not directly hired by the offices.

However, when joining the firm, advisors must sign a contract that, in many cases, transfer most of the business liabilities to the advisor, de-risking the office and XP’s business.

I mean, the incentives are distorted. Most pages are about bringing new resources (increasing net new money) and how to become an IFA asap. I’m not sure that someone hired with this pitch cares much about its clients' money.

So, I’d like to bring a provocation. Financially, for the company, it sounds like a no-brainer to keep expanding operations, considering its profitability.

However, if you’re genuinely a client-oriented firm, investing aggressively in expanding a product that doesn’t generate value for customers doesn't make sense.

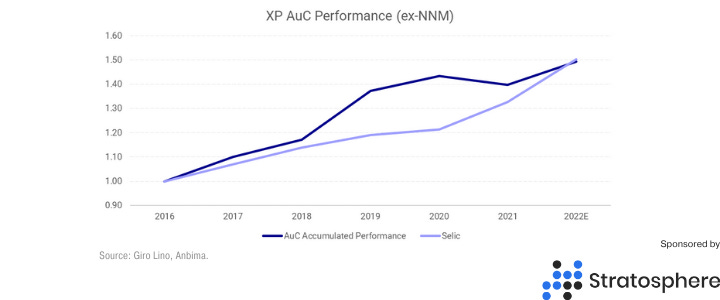

Unfortunately, that is not what we see with XP. Instead, considering the company’s AuC and excluding the net new money (“NNM”), we achieve a decent proxy for the AuC profitability over the years, as the illustration below shows.

Well, again, this is just a provocation. But, obviously, there is a reason for the company to sustain its expansion through the following years.

Nevertheless, I’ll answers this question in my Deep Dive about XP. So far, I have investigated companies such as Stone, MercadoLibre, Vale, Petrobras, and many others.

I’m running a poll on Twitter to decide the next Deep Dive. So make sure to participate and share it.

Finally, on Saturday, I have a new post about Stone. I’ll present my new top-down model for the Brazilian Payment Industry and update my model, including the readers’ interactive model.

Also, I bring good news for subscribers. As you may have noticed, I improved our newsletter in terms of quality, transparency, and content assortment.

I re-built most of the intelligence I had during my buy-side industry experience. So, I’m pleased to announce a new feature for premium subscribers. From now on, Deep Dive posts will have a complimentary presentation, expanding our offering bundle.

Now, premium subscribers receive unique research pieces, fully automated interactive models, thoughts about the investment process, and individual presentations to simplify access to the research material.

I get it. It’s not easy to read 30 pages and remember it all a week later. This is why I came up with the presentation idea. It’s another significant improvement I’ve been working on.

Yet, if you’re not a subscriber, I strongly recommend giving it a try. I bet you’re not going to find anything like that somewhere else.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.