Check out our latest publications about Stone

With Stone’s earnings approaching, we decided to share our earnings preview for Stone’s 1Q22. Okay, so what you should be looking for in the earnings release?

Revenue, costs, operating expenses? None of those. Exactly, none. Earnings will be strong. Management has been looking for sell-side proactively, so this is obvious.

Instead, I’ll look for more information on the repricing strategy, take rate outlook, competition in the SMB segment, revamped credit business, and software initiatives.

Regarding pricing policy, my channel checks suggest that Stone is automating the process. I’d love to see management commenting about it.

It’s been annoying receiving most of my information through channel checks, not from the company itself. I understand that the company is going through a lot, and lately has been tough to create streamlined communication.

However, it’s not fair for smaller shareholders to receive news about the operation only after it was implemented. So the management has to choose between letting everyone know or nobody.

Usually, I leave industry channel check commentaries just for the premium section. Nevertheless, I’ll open an exception before talking about the numbers, given the lack of information.

The company said it will adjust prices as interest rates fluctuate going forward to maintain healthy spreads. However, price changes will not occur too frequently to avoid customer friction.

According to sources from marketing and Stone’s hub, the pricing strategy varies by segment. In the core hubs, competitors are setting the prices, with nobody undercutting — at least in high competitive spots.

Meanwhile, at TON, Stone launched a new product called Ultra TON, offering prices indexed to the Selic rate, and it counts for most of the recent sales.

Because of the cost structure, TON repricing doesn’t generate much churn because its CAC is really low, so pricing is competitive.

Repricing that began in 4Q21 and continued through 1Q22 is expected to result in somewhat elevated churn for 1Q22, as we anticipated previously.

We’ll update our readers about its credit strategy on the weekend, which we believe it’ll be back to being operational very soon.

Stone will present stronger than expected revenue growth. However, don’t get excited about it because there is evidence pointing out this quarter would be an outlier.

In the 1Q22, card transaction volumes grew 35.9% YoY, almost 100% above the previous years, meaning that Stone will present a more robust quarter, regardless of execution.

We expect that Stone will return to old habits, executing a solid quarter in the core business, regardless of the secondary companies, such as software.

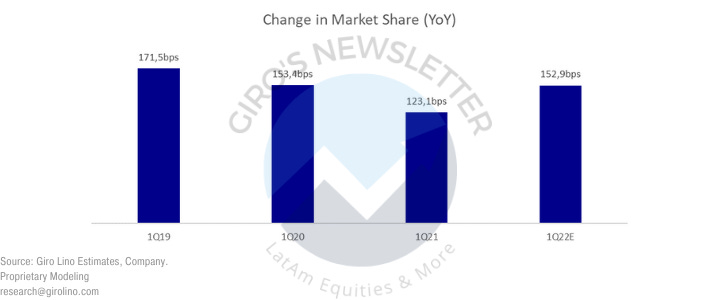

For the 1Q22, we estimate a 153bps market share gain due to more substantial than expected TPV growth and printing a turning point versus the previous years, and because the 1Q21 was especially weak.

We believe that our revenue is optimistic versus the sell-side consensus. While the analysts expect sales from US$391 to US$423 in the quarter, we have US$425 due to higher than anticipated TPV growth.

However, we foresee a higher than expected headwind from financial expenses, as many market participants still do not estimate it appropriately.

Many analysts use a % of TPV for estimating their respective financial expenses, which is okay if rates don’t change much over time. That’s not true for Brazil, though.

Also, we’re curious about Stone’s D&A. Unline consensus, we expected higher than expected D&A due to investment in POS machines, although the consensus doesn’t consider it. It may pose an upside risk to our numbers, though.

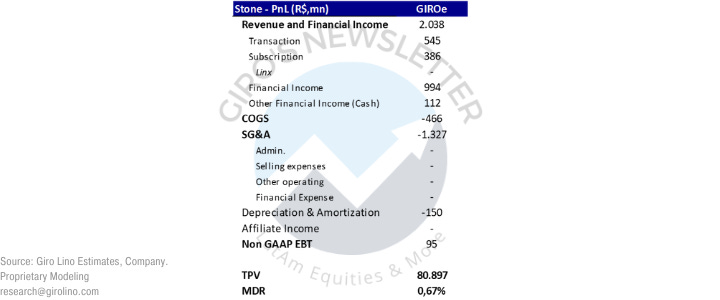

Finally, we summarize our expectations in the table below. Again, we believe that the market will welcome Stone’s earnings if they come as expected.