Welcome to Part II of our in-depth analysis of the Exito spin-off from CBD 0.00 (GPA or PCAR in this post). In our previous post, we examined the strategic rationale behind the spin-off and its potential benefits for both companies.

In this follow-up, we'll dive deeper into the financial aspects of the spin-off, exploring the valuation implications and the opportunities for value creation in both GPA and Exito as they operate as separate entities.

We'll also discuss the challenges each company might face and the potential risks for investors. So, buckle up, and let's get started with our comprehensive analysis of the Exito spin-off and its impact on GPA and Exito's future prospects.

Summary

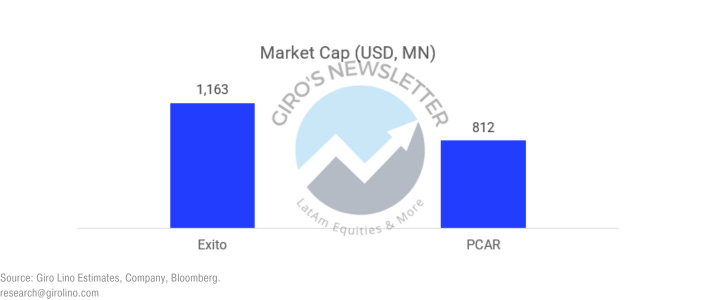

- The upcoming Exito spin-off from GPA presents a unique opportunity for investors. Currently, GPA has a market capitalization of USD 0.8 billion, while Exito's stands at USD 1.2 billion. Intriguingly, based on these figures, the market appears to assign little or no value to GPA's remaining operations after the spin-off. Under the current terms approved by the Board of Directors, shareholders will receive 4 Exito shares for every 1 GPA share – at present, Exito's price is USD 0.8 per share. A straightforward sum-of-the-parts analysis indicates that this undervaluation could be an oversight, as GPA's operations possess an intrinsic value that may not be fully reflected in its current market capitalization. By separating Exito and GPA, the spin-off will offer greater transparency into the financial performance and growth prospects of each business, potentially leading to a more accurate valuation of both companies.

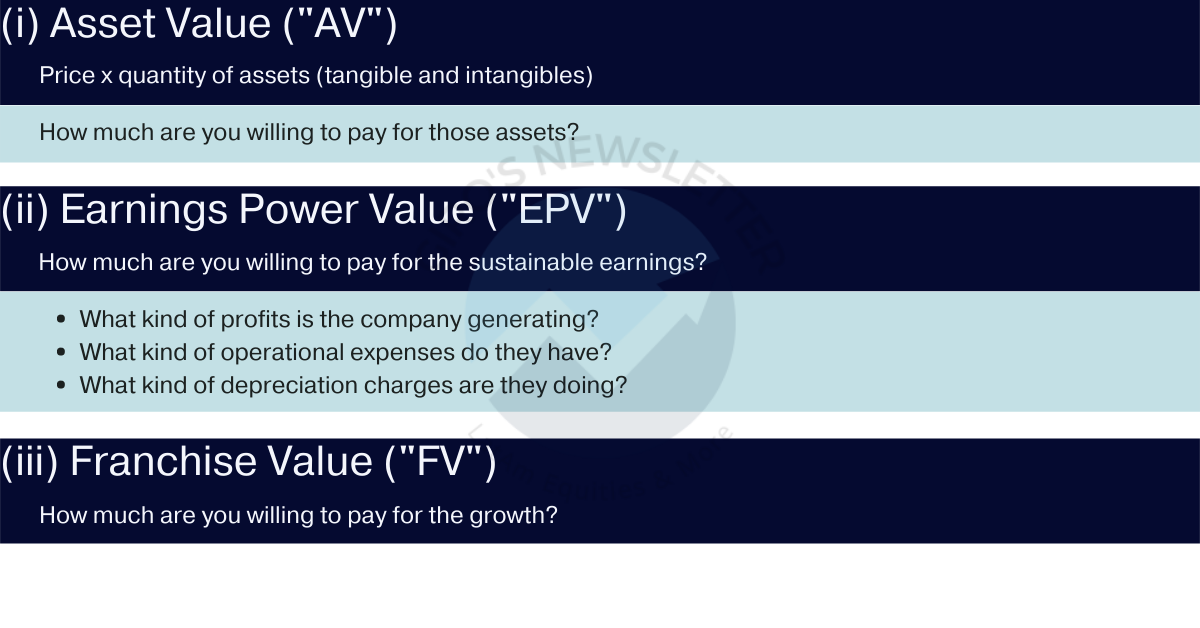

- Before diving into the GPA valuation, let's briefly review our investment evaluation process. In contrast to other posts, we will not delve into numerous operational metrics, as we believe that it is unnecessary given that the company is currently valued significantly below its liquidation value. The main focus of our valuation will be to answer the question: how much are you willing to pay for this company's assets? This will serve as the asset value step in our valuation process.

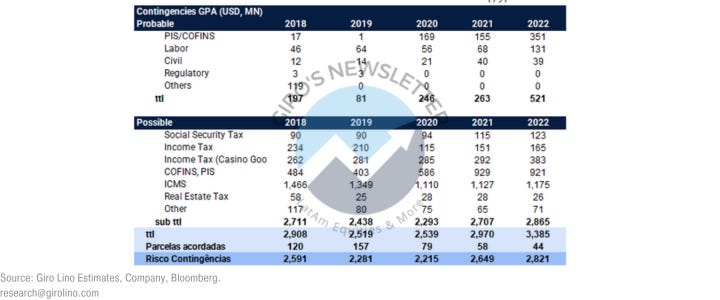

- Although GPA is going through a complex operational period, with management changes, high debt, asset sales, and financial issues at the controller, we believe that the greatest risk to our thesis lies off the balance sheet, specifically in the contingencies that GPA carries, which are not yet provisioned. Contingency risk refers to the possibility of uncertain and unforeseen events negatively affecting the company, both financially and operationally. In the case of GPA, several contingencies may pose risks, including litigation and legal proceedings, regulation and compliance, environmental and safety risks, and credit and counterparty risks.

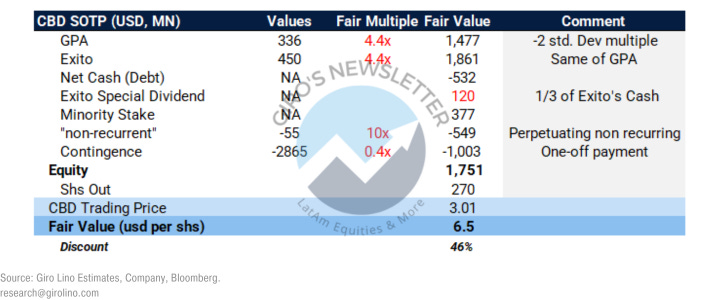

- Evaluating a company like GPA using a sum-of-the-parts (SOTP) approach can offer several benefits, particularly for companies with diversified operations or undergoing restructuring. In addition to assessing the spin-off of the Colombian operation, we also appreciate GPA's initiatives to financially deleverage the company through asset sales, a strategic measure aimed at ensuring sustainability and long-term growth. This initiative aims to reduce debt, improve the capital structure, strengthen the balance sheet, and increase operational efficiency. In this text, we will present the main arguments that support GPA's decision to deleverage its finances and discuss the assets available for capitalization, fair multiples for GPA and Exito operations, and the so-called "non-recurring" expenses.

Unleashing Value

The upcoming Exito spin-off from GPA presents a unique opportunity for investors. Currently, GPA has a market capitalization of USD 0.8 billion, while Exito's stands at USD 1.2 billion. Intriguingly, based on these figures, the market appears to assign little or no value to GPA's remaining operations after the spin-off.

Under the current terms approved by the Board of Directors, shareholders will receive 4 Exito shares for every 1 GPA share – at present, Exito's price is USD 0.8 per share.

A straightforward sum-of-the-parts analysis indicates that this undervaluation could be an oversight, as GPA's operations possess an intrinsic value that may not be fully reflected in its current market capitalization.

By separating Exito and GPA, the spin-off will offer greater transparency into the financial performance and growth prospects of each business, potentially leading to a more accurate valuation of both companies.

Valuation Review

Before we delve into GPA, let's first review our investment evaluation process. Unlike in other posts, we won't be focusing on a multitude of operational metrics. We believe this is unnecessary, given that the company is currently valued significantly below its liquidation value.

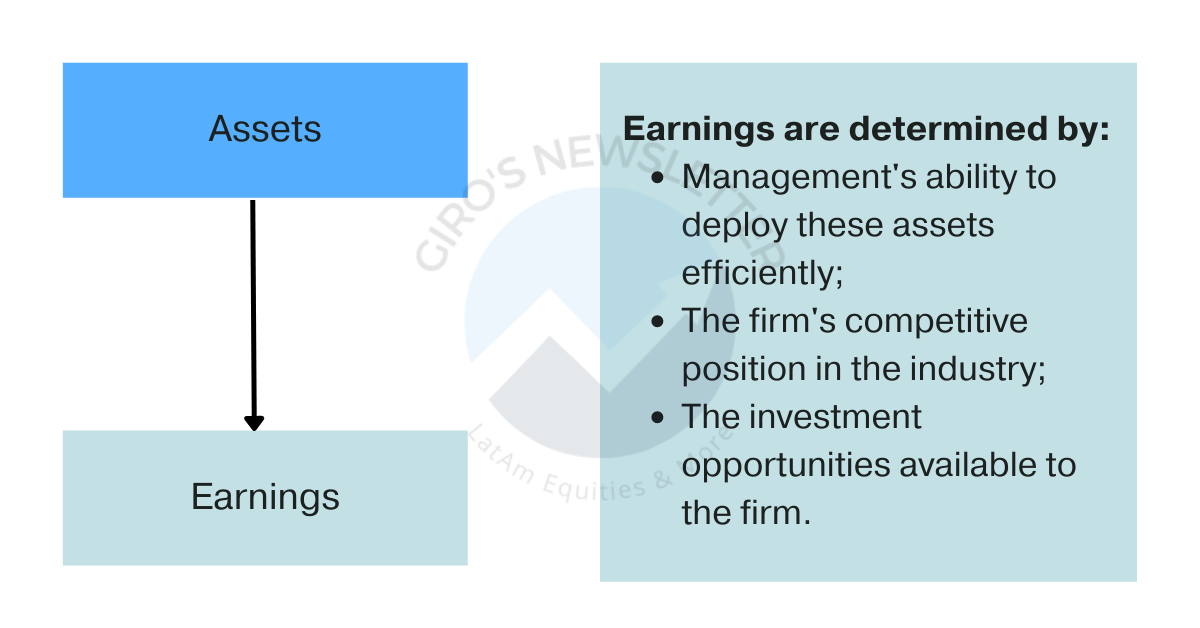

To clarify the main concept, let's start with a basic question: What is a firm? In essence, a firm is a collection of both tangible and intangible assets coupled with liabilities.

From these assets emerge earnings. These are largely determined by the management's efficiency in deploying these assets, the firm's competitive position within its industry, and the investment opportunities available to the firm.

In the process of evaluating the assets, our primary aim is to answer this question: How much are you willing to pay for this company's assets? This forms the asset value step in the valuation process, which is the only step we'll be using for GPA.

To keep things concise, if we were to continue, we would take into account what we refer to as Earnings Power Values. Essentially, this refers to a sequence of steady earnings.

These are earnings that the company can generate if all it does is replace depreciating capital. Thus, we call these sustainable earnings, which a company can generate by merely replacing whatever capital has depreciated.

For now, we'll put aside growth. This is what we refer to as the Earnings Power Values. Here, our focus will shift to the income statement.

We'll need to examine the profits the company is generating. What kind of operational expenses do they have? What sort of depreciation charges are they incurring? But remember, earnings grow.

The final step in the evaluation process will be to calculate the franchise value. How much are you willing to pay for growth? Note that we only consider growth in the very last step of our evaluation approach.

Growth will play a significant role in this course, but we'll need to approach it with care. Growth is the source of all the behavioral biases regarding valuation.

For GPA, however, we'll halt at the asset value. As previously mentioned, the company is so undervalued that we don't even need to assess its earnings power value.

We hope you're finding our short review of the valuation process insightful and valuable. We've taken the time to break down complex concepts into a digestible format, making it easier to understand and apply in the context of GPA.

Off-Balance Sheet Risk

While GPA is experiencing a complex operational period marked by management changes, high debt, asset sales, and financial issues at the controlling level, we believe that the most significant risk to our thesis lies in the balance sheet. Specifically, this risk pertains to the unprovisioned contingencies that GPA carries.

Contingency risks refer to the potential impact of uncertain and unforeseen events on the company's financial and operational performance. For GPA, several contingencies may pose risks, including:

- Litigation and legal proceedings: GPA may face lawsuits related to contractual disputes, product liability, labor issues, and intellectual property, among others. Such proceedings could result in substantial costs, fines, indemnities, or reputational damage.

- Regulation and compliance: Operating in a complex and ever-changing regulatory environment, GPA may encounter risks associated with legal and regulatory changes, such as import/export restrictions, environmental and labor regulations, and tax law compliance. Non-compliance can lead to fines, sanctions, and reputational harm.

- Environmental and safety risks: GPA may confront contingencies linked to environmental, health, and safety incidents, including chemical spills, workplace accidents, or natural disasters. These events can disrupt operations, necessitate cleanup and repair costs, create legal liability, and damage the company's reputation.

- Credit and counterparty risks: GPA may face credit risks involving its customers, suppliers, and business partners. Default by a major customer or supplier can impair the company's ability to fulfill its financial and operational obligations.

In this case, we perceive the most significant current risk to be the contingencies related to legal proceedings, regulation, and compliance, amounting to USD 2.8 billion. With USD 0.5 billion provisioned on the balance sheet, these contingencies are substantial.

Despite these large amounts, we will demonstrate below that, in various scenarios, we believe significant value remains on the table. It is crucial to note that while the contingency amounts are considerable, the minimum value of GPA could be zero, as this liability is not transferred to the controlled company following the spin-off.

Sum of the Parts

Assessing a company like GPA using a sum-of-the-parts (SOTP) approach can provide several advantages, particularly in cases of companies with diversified operations or undergoing restructuring. This method enables us to estimate the value for each part that GPA intends to divest, either through a spin-off or asset sales.

In addition to evaluating the spin-off of the Colombian operation, we also recognize GPA's efforts to financially deleverage the company through asset sales. This strategic move aims to ensure the business's sustainability and long-term growth.

The initiative intends to reduce debt, improve the capital structure, strengthen the balance sheet, and enhance the organization's operational efficiency. In this text, we will present the main arguments supporting GPA's decision to deleverage its finances.

- Reduction of financial costs: One of the most apparent reasons for deleveraging is to reduce financial costs associated with debt. With lower debt levels, GPA can decrease interest and fee payments, potentially resulting in significant improvements in profitability and cash flow.

- Improved profitability: Unlike other companies in the sector, we expect GPA to exhibit robust ROE expansion in the coming years. We believe that simplifying operations through asset sales and improved execution will lead to considerable gains in profitability.

Currently, market consensus does not imply any significant profitability gain in the coming years. Below, we consider the assets GPA has available for capitalization, accounting for potential haircuts on the sale value. These assets include GPA's stake in Cnova, the remaining stake in Exito, and other non-operating assets such as headquarters buildings, gas stations, and more.

Next, we consider the fair multiple for GPA and Exito operations to continue our analysis. GPA and Exito are currently trading at 2.9x and 3.0x EV/EBITDA 2024e, respectively, compared to local peers like Assaí (ASAI3) at 5x and Mateus (GMAT3) at 8x. This broad discount reflects GPA Brasil's weak results and concerns about corporate governance.

However, when analyzing the financial results of both companies, especially Exito, we believe the market is overly conservative concerning asset pricing. Contrary to consensus, we contend that Exito should be traded at a different multiple from its controlling company, primarily due to its under-leveraged balance sheet, high margin, and accelerated growth.

The final piece of our model is the so-called "non-recurring" expenses. Though labeled as such, GPA has recorded an average of USD 70 million in non-recurring losses annually over the past ten years, with non-recurring gains only in 2020.

Consequently, we apply a discount rate to the average expense of recent years, deducting it from our fair value. Combining the components, even perpetuating non-recurring expenses, considering billion-dollar contingency provisioning, and applying an aggressive discount on asset sales, we believe that GPA is significantly undervalued.

In the valuation above, we assigned a value of zero to GPA. We considered that contingencies would obliterate all value and lead the company into bankruptcy, which seems sufficiently conservative.

The main focus is the spin-off. As contingencies, minority interests, and non-recurring items all remain with GPA, the maximum loss on one side is 100%. In other words, we assume that GPA is worth absolutely nothing in our model, and the asset value lies solely in Exito.

In addition to Exito's strong fundamental metrics, this year, Nuveen and Moerus acquired a 5% stake in the company, which bodes well for those following the spin-off narrative.

We believe that not only foreign investors but also pension funds will need to include Exito in their portfolios since the Colombian market offers a limited number of companies with sufficient liquidity.

Currently, Colombian Pension Fund Administrators (AFP) have an interesting distribution of resources: 33.8% of the savings managed by AFPs are invested in domestic fixed income, 31.6% in foreign equities (as purchases of shares), 14.8% in alternative investments, 13.2% in domestic equities, 3.7% in short-term investments, and 3.9% in foreign fixed income.

Considering all these factors, we see Exito as an excellent investment opportunity for investors. On one side, the downside is extremely limited, with the parent company retaining all liabilities. On the other hand, we pointed out that GPA will become a free option, which is also advantageous. As a result, we will add Exito to our list of actionable investment ideas.

In conclusion, the Exito spin-off presents a compelling investment case. With limited downside risk and the potential for significant upside, investors should seriously consider adding Exito to their portfolios. Additionally, the ongoing efforts to deleverage and restructure GPA's operations could lead to improved profitability and value creation in the long run.

Actionable Ideas List

2023-04-07 BUY EWZS 1.72%↑

Buy at $11.50, stop-loss at $9,7, and gain at $16; skew 2.5:1

Current price: $12.14 (+5.6% gain)

2023-04-30 BUY CBD 0.00 at $3.03

Loading...