Explore Casino Group's restructuring and the GPA-Exito spin-off, uncovering value and opportunities for shareholders amid financial challenges.

Welcome to the first part of a two-part blog series where we dive deep into an intriguing spin-off event set to occur in the coming months. Today, we'll examine the rationale behind CBD's decision to spin off its Exito operation and the potential implications of this strategic move.

As the parent company, Casino Group finds itself in a precarious financial position, grappling with a high debt burden that has become increasingly unsustainable. With a dire need for cash to deleverage its operations, the company is seeking alternative solutions to optimize its financial structure and create shareholder value.

In this first part, we'll explore the reasons behind the spin-off, delving into Casino Group's challenges and the strategic advantages of separating Exito from its core business. We'll also discuss how the spin-off could serve as a precursor to maximizing asset sale value, either by directly selling the stake in Exito or utilizing it as collateral for a financial transaction.

Parent Company

Casino Group, a prominent French retail conglomerate, has a long history dating back to 1898 when it was founded by Geoffroy Guichard. Over the years, the company has grown into a major player in the global retail industry through a combination of organic growth and strategic acquisitions. However, in recent years, Casino Group has faced significant financial challenges, struggling with mounting debt and dwindling profitability. The reasons behind these difficulties are multifaceted, and they can be attributed to several strategic, operational, and external factors:

- Aggressive expansion strategy: Casino Group pursued an aggressive expansion strategy, both domestically and internationally, which involved significant capital expenditures. This led to the accumulation of substantial debt that has become increasingly difficult to manage.

- Acquisition missteps: The company made a series of acquisitions that, in hindsight, may not have been as profitable or synergistic as anticipated. These acquisitions added to the debt burden without significantly contributing to the company's overall value.

- Competitive pressures: Casino Group operates in a highly competitive retail environment, with the rise of e-commerce and discount retailers posing significant challenges. The company has struggled to differentiate itself from its competitors, leading to lower market share and reduced pricing power.

- Operational inefficiencies: The company faced operational challenges, such as high overhead costs, low productivity, or weak supply chain management, that eroded profitability and made it difficult to service its debt obligations.

- Economic headwinds: Casino Group was negatively impacted by macroeconomic factors, such as economic downturns or currency fluctuations, particularly in its international operations. These headwinds affected the company's ability to generate revenues and profits, further exacerbating its debt situation.

- Shifts in consumer behavior: Changing consumer preferences, such as the increasing demand for online shopping, convenience, and sustainability, have put additional pressure on the company's traditional retail model, affecting its financial performance.

- Regulatory and political risks: The company might have faced regulatory or political risks in some of the markets it operates in, which could have adversely impacted its business and contributed to its financial difficulties.

Casino Group acquired a controlling stake in Companhia Brasileira de Distribuição CBD , also known as Grupo Pão de Açúcar (GPA or PCAR), in 1999. The acquisition was a result of Casino Group's strategic decision to expand its footprint in the promising and rapidly growing Brazilian retail market.

At the time, Brazil was considered an attractive emerging market with a burgeoning middle class and a growing demand for consumer goods. The acquisition of PCAR provided Casino Group with a well-established platform to capitalize on this growth opportunity and diversify its revenue streams.

Casino Group initially acquired a 24% stake in PCAR in 1999, and through a series of transactions, gradually increased its ownership over time. In 2005, Casino Group and the Diniz Group, the founding family of PCAR, signed an agreement, which led to the consolidation of both companies' retail assets in Brazil under the umbrella of GPA. This partnership further cemented Casino Group's control over PCAR.

The acquisition of PCAR was in line with Casino Group's broader international expansion strategy, which aimed to establish a strong presence in high-growth markets outside of France. However, Casino Group's aggressive expansion and acquisition strategies have contributed to its current financial challenges, including a high debt burden that has become increasingly difficult to manage.

Faced with these challenges, Casino Group has been forced to reevaluate its business strategy and explore various options to improve its financial position. This includes the consideration of spinning off some of its subsidiaries or divesting non-core assets to reduce debt and refocus on its core operations.

The company's ongoing struggle to address its financial challenges serves as a cautionary tale of the risks associated with aggressive growth strategies and the importance of adaptability in a rapidly changing retail landscape.

Overview on Spin-offs

Spin-offs have consistently proven to be a valuable mechanism for unlocking shareholder value, with many reasons contributing to their success. One key factor is the liberation of entrepreneurial forces and management autonomy that comes with separating from a larger corporate parent.

When a business is spun off, the management can better align incentives, such as stock options, with the performance of the new entity. This direct compensation system benefits both the spin-off company and the parent, fostering an environment where accountability, responsibility, and direct incentives can thrive.

Research indicates that the most significant stock gains for spin-off companies often occur in the second year after the separation. This suggests that it may take time for the entrepreneurial changes and initiatives to take effect and be recognized by the market. Importantly, this provides ample time for investors to research and make profitable investment decisions.

A crucial motivation behind the decision to pursue a spin-off is the desire of the management and the company's board of directors to increase shareholder value. While this is the primary responsibility of management and boards, it doesn't always manifest in practice. Instead, many organizations opt for mergers and acquisitions or expansion, even when it might not be in the best interest of the shareholders.

Spin-offs, on the other hand, involve shedding assets and relinquishing influence, all with the hope that shareholders will be better off after the separation. This commitment to shareholder value is an indication of the discipline and shareholder orientation that the spin-off process can bring to both the parent and the newly formed company.

In resume, investing in spin-offs or parent companies can result in a portfolio of strongly shareholder-focused businesses. The spin-off process allows the new entity to unleash its entrepreneurial potential, align management incentives with performance, and ultimately create substantial value for shareholders.

Use Case for Financial Restructure

The process of restructuring to focus on core business operations has become increasingly popular among companies in recent years. Typically, firms enhance their focus by either selling unrelated assets or spinning off unrelated divisions to their shareholders. While both asset sales and spin-offs can increase focus, there are some inherent advantages to spin-offs that warrant further exploration.

A significant distinction between the two approaches lies in the exchange of cash. In an asset sale, the seller receives cash, often motivated by liquidity constraints or a desire to pay down debt. On the other hand, a spin-off does not involve any cash exchange, meaning the primary motivation is not to generate immediate cash. This difference sets spin-offs apart from asset sales, which may be driven by financial distress or the need for a cheaper source of funds rather than efficiency improvements.

Asset sales may also occur when a buyer is willing to pay a high price for the assets, either due to a better use for them or an inclination to overpay for other reasons, such as excess free cash flow. Spin-offs, however, are not subject to these confounding factors, offering a more straightforward analysis of the restructuring process.

Furthermore, spin-offs often result in subsidiaries having leverage ratios that differ significantly from their parent companies, indicating that firms make strategic capital structure decisions during the spin-off process. Subsidiaries with lower leverage ratios tend to be smaller and have higher growth opportunities. Conversely, when subsidiaries are larger and possess greater collateral value, they exhibit higher leverage ratios than their parent companies. These findings suggest that factors such as size, growth potential, and collateral value play crucial roles in determining debt choices during spin-offs.

Spin-offs generally lead to a greater increase in focus compared to asset sales. In a spin-off, both the parent company and the newly formed subsidiary trade as separate entities, allowing for separate performance analyses. This level of scrutiny is not possible in the case of an asset sale.

While spin-offs do not generate immediate cash like asset sales, they present distinct advantages, such as increased focus, more transparent motivations, and the ability to analyze the performance of both the parent and the spin-off entity. Furthermore, a spin-off can be a strategic first step toward unlocking value and growth opportunities for both the parent and the new company.

There is a Precedent

Facing mounting financial challenges and high levels of debt in recent years, Casino decided to address these issues and unlock value. The group embarked on a strategic restructuring process that involved simplifying its corporate structure and spinning off or selling non-core assets in LatAm.

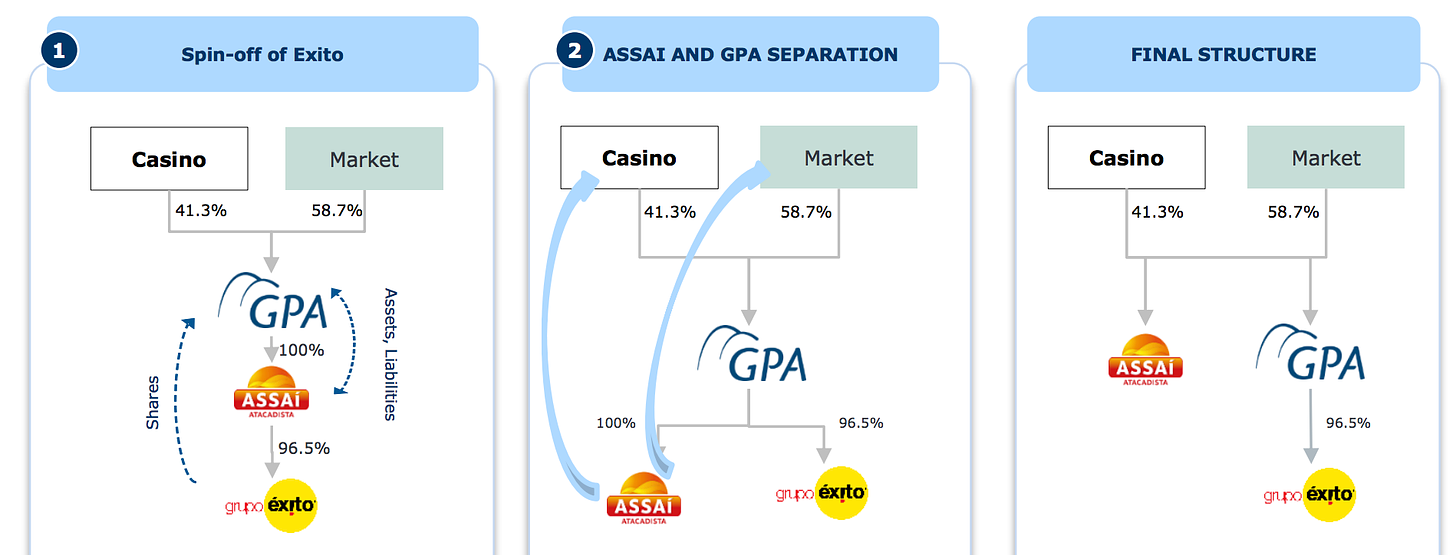

The first step in this restructuring process was the consolidation of Exito, a Colombian retail subsidiary, under Assaí, GPA's wholesale division. This move aimed to benefit from synergies between the retail businesses and expand the group's presence in the Latin American market.

However, as the need for deleveraging became more urgent, Casino decided to further streamline its corporate structure. To maximize value and improve focus on their respective businesses, Casino transferred Exito from Assaí to GPA. This transfer allowed Exito to operate within GPA's broader retail operations, enabling a more effective allocation of resources and management attention.

Following the transfer of Exito to GPA, Casino proceeded with the spin-off of Assaí. This strategic move separated Assaí from GPA, allowing both entities to concentrate on their core businesses and capitalize on growth opportunities in their respective markets. The spin-off of Assaí also helped Casino further simplify its corporate structure and reduce debt.

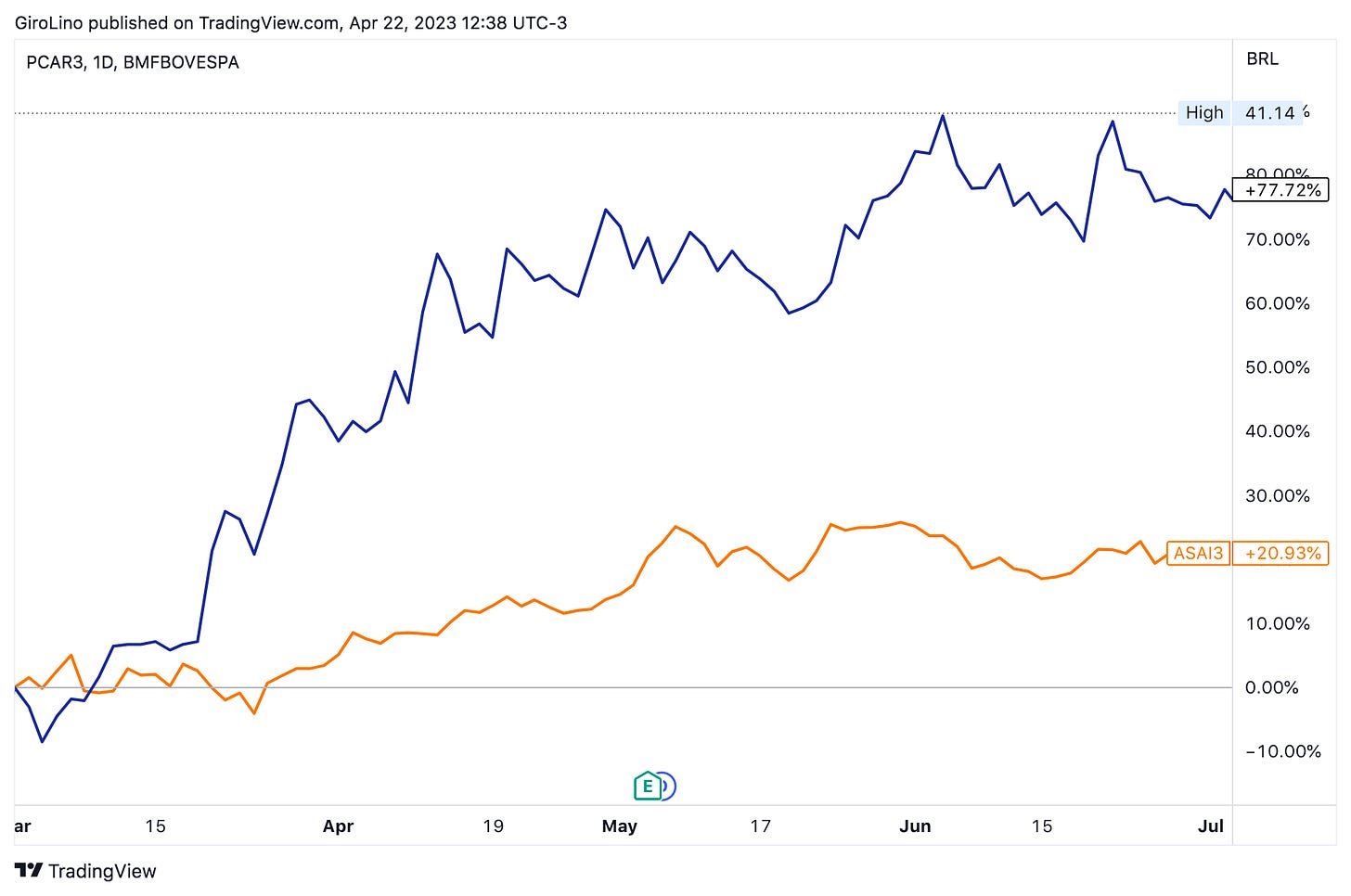

Assaí, a rapidly growing cash-and-carry wholesale business, had been operating under the umbrella of GPA for years. The spin-off allowed Assaí to become a separate publicly traded company, enabling it to pursue independent growth opportunities and allocate resources more effectively. The ticker for Assaí became ASAI3 after the spin-off.

GPA, on the other hand, could concentrate on its core retail operations without the complexities of managing a wholesale division. The spin-off allowed both companies to have distinct management structures and targeted strategies tailored to their specific market segments.

Shareholders of GPA received shares of the newly formed Assaí, in proportion to their existing GPA holdings. The spin-off was structured in a tax-efficient manner, ensuring that shareholders did not face undue tax implications.

The spin-off between GPA and Assaí was well-received by the market, as it allowed both companies to operate more efficiently and focus on their respective growth strategies. This move demonstrated the potential benefits of spin-offs in unlocking value, enabling better resource allocation, and fostering growth for both parent and spun-off entities.

The consolidation of Exito under Assaí, its subsequent transfer to GPA, and the eventual spin-off of Assaí were all part of Casino's broader restructuring effort. This strategy aimed to simplify the corporate structure, unlock value, and address the group's financial challenges. By separating these entities and allowing them to focus on their specific markets and strategies, Casino hoped to maximize the value of its assets and improve its financial position.

The Next Act

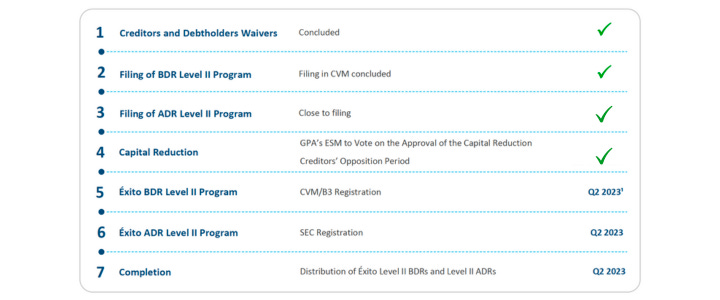

As part of Casino Group's ongoing strategic restructuring efforts to address its financial challenges, streamline operations, and unlock value, the company has set its sights on the next phase of this process: the spin-off of Exito, a Colombian retail subsidiary.

In previous restructuring steps, Casino Group consolidated Exito under Assaí, GPA's wholesale division, to leverage synergies and strengthen its presence in the Latin American market. Later, Exito was transferred from Assaí to GPA, allowing it to operate within GPA's broader retail operations and benefit from a more effective allocation of resources and management attention.

Now, with Casino Group's need for deleveraging and simplification of its corporate structure becoming more urgent, the decision has been made to spin off Exito. By separating Exito from GPA and allowing it to operate as an independent entity, both companies can focus on their respective core businesses, capitalizing on growth opportunities and optimizing their market strategies.

This spin-off also aligns with Casino Group's objective of maximizing the value of its assets. As seen in the successful spin-off of Assaí, separating businesses can lead to improved performance and a clearer focus on each entity's unique strengths and opportunities. Moreover, the spin-off of Exito offers potential benefits for shareholders, who may enjoy increased value as a result of the newly independent company's dedicated focus on its core operations.

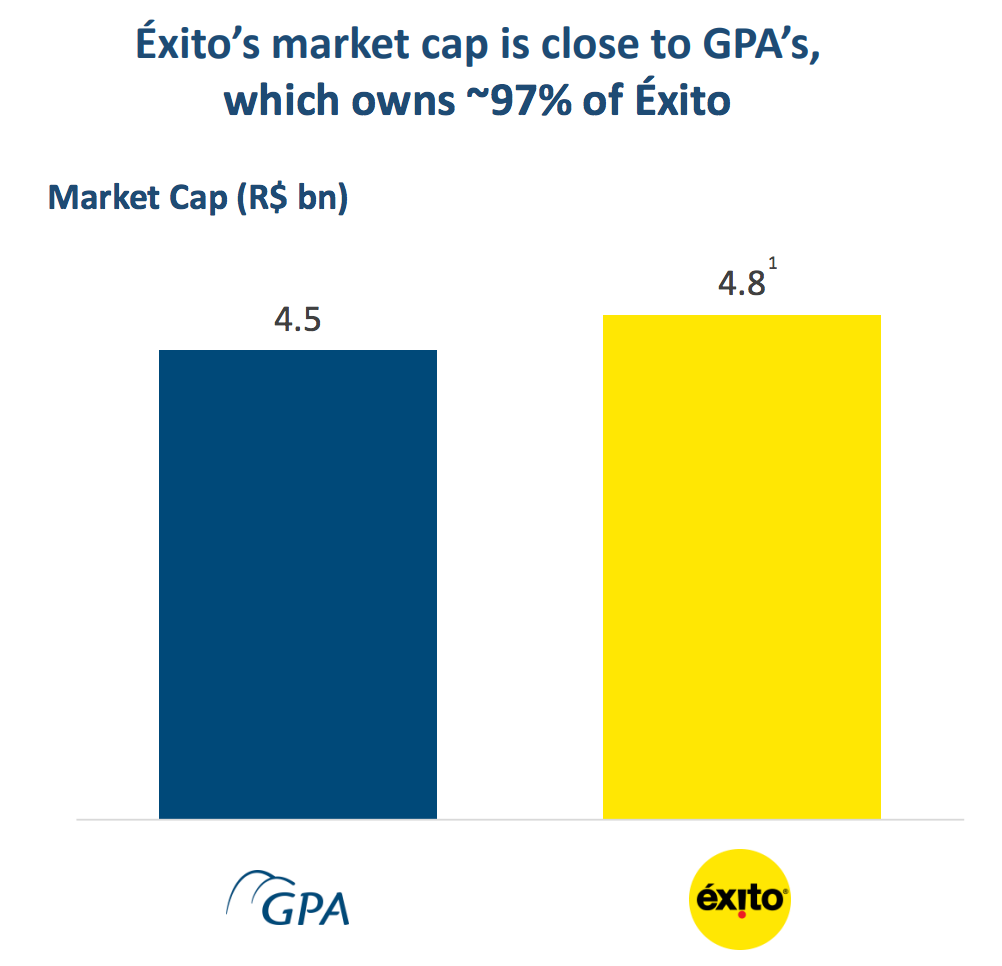

The upcoming spin-off of Exito from GPA presents a unique opportunity for investors to reassess the valuation of these two entities. Currently, GPA has a market capitalization of $4.5 billion, while Exito's stands at $4.8 billion. Interestingly, based on these figures, the market seems to attribute little to no value to GPA's remaining operations after the spin-off.

A simple sum-of-the-parts analysis suggests that this undervaluation might be an oversight, as GPA's operations have inherent value that may not be fully reflected in its current market capitalization. By separating Exito and GPA, the spin-off will provide greater transparency into the financial performance and growth prospects of each business, potentially leading to a more accurate valuation of both companies.

As we continue to explore this topic in next week's blog post, we will delve deeper into the financials of GPA and Exito, investigating the factors contributing to their current valuations and the potential implications of the spin-off. We will also assess the opportunities and challenges facing each company as they operate independently and focus on their respective core businesses.

Stay tuned for next week's in-depth analysis as we further examine the spin-off of Exito and its potential benefits for shareholders, as well as the prospects for value creation in both GPA and Exito as they embark on their new paths as separate entities.