If you enjoy Daily Crunch posts and would like me to do more, or find value in this newsletter project, please consider becoming a supporter. It makes a big difference.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The Ibovespa continued its winning streak by gaining another 6.1% in BRL in March (16% in USD), cementing its status as one of the best-performing equity markets in 2022 (#1 in LatAm🚀).

Most of the strong performance can be ascribed to a few sectors. Metals and Mining (mainly Vale) is the most significant point gainer, followed by Financials (banks and B3).

Combined, M&M and financials accounted for 65% of all the points gained so far in the year, with higher commodity prices and local interest rates.

If we include O&G, these sectors combined were responsible for ~80% of the performance YTD, even though these sectors represent ~60% of the index.🤔

The fact that most of the flows into Brazilian equities this year are coming from foreigners is also driving increased demand for more oversized caps and more liquid stocks.

As a result, banks, Petrobras, and Vale are among the most liquid and best-performing stocks in the index.

The other way to look at this info is that several sectors and stocks lag the index and could catch up as fiscal/political risk subside and long-term rates fall.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Also, in the current challenging geopolitical backdrop, Latin America in general and Brazil are well-positioned.

There are many reasons for this: i) geographic and economic insulation from Russia’s War; ii) considerable commodities exposure (grain, oil, and iron ore); and iii) attractive valuation entry points.

Nevertheless, with inflation showing signs of resilience, interest rates may take longer to start coming down. So, we took the opportunity to profit from trading with Brazilian banks.

Historically, Brazil’s big banks have an outstanding track record of going through crises with modest operational performance. Though benchmarking with global peers, Brazilian banks deliver excellent performance.

As commented a few weeks ago, while higher interest rates tend to benefit NIMs for most banks, there are risks from weaker GDP growth and high inflation, which can pressure loan growth and deteriorate asset quality.

However, Brazilian banks have been among the worst-performing banks globally. On the other hand, most banks globally have risen in the last 12 months, with only Turkish banks declining more than LatAm banks.

This is partly due to the region’s challenging macro and political environments.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Taking a look at the recent report from the sell-side, I’d highlight BTG Pactual’s report:

“We are again making minor tweaks to our portfolio. With inflation showing signs of resilience (the market raised its 2022 IPCA inflation forecast to 6.9% vs. 5.6% a month ago), interest rates, which may end their hiking cycle at 12.75% in May, could take longer to start coming down.

With that in mind, we decided to stick with our exposure to Brazil’s big banks (we have Itau and Banco do Brasil in the portfolio) that tend to perform well in an environment of high interest rates. In fact, we are increasing a little bit our exposure to banks by upping the weight of Itau in the portfolio to 15%, from 10% last month.

Following the same rationale, we are keeping exposure to consumption by high-income groups (less sensitive to higher inflation and interest rates) via apparel retailer Arezzo and mall operator Multiplan. We decided it would probably be too soon to move to consumption stocks more exposed to lower-end consumers, which tend to gain in an environment of falling SELIC rates.”

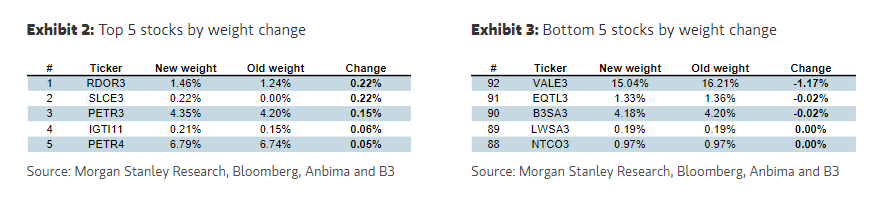

Also, the Brazilian stock exchange released the first official portfolio preview this week. In its report, Morgan Stanley analyzed which stocks will enter or leave the local equity benchmark according to the release:

Finally, on the fiscal front, the meetings reinforced our view the risks for the execution of the 2022 budget are reducing as we enter 2Q, and the losses should be limited to the tax exemptions announced so far.

Any extraordinary credit might not be supported unless geopolitical tensions escalate to more severe levels.

Giro's Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

On the monetary policy front, the impression is that the BCB has to see a material deterioration in 23e and 24e inflation expectations in the following months to decide on any additional increase after reaching a policy rate of 12.75% in May.

Real rates are currently at +7.3% (peaked at +8% in mid-March), which is incredibly high from any possible angle.

So, except for a further deterioration in the current scenario, the market will start looking for quality domestic names that leverage during easing cycles in a few months.

Finally, we had a few portfolio changes selling a few commodities names with outstanding performance, and are close to adding more companies that should benefit from the next cycle.