Today’s outline

- Pay Attention to Meteorology

- Stay on Course

- Both sides of the coin

- China May Help

- PBOC Under Pressure

- Message is Clear

This Week Posts

- Two Years, Four CEOs, May 26th, 6 pages

- AWS is Unstoppable, May 25th, 7 pages

- Stone Preview, May 24th, 4 pages

- New Trade, May 23nd, 5 pages 🌟

- Food for Thought #18, May 22nd, 10 pages

Premium Posts in May 🌟

(Long-form only)

- MercadoLibre ($MELI) (Pinned), 29 pages

- Stone's Biggest Moat (Pinned), 14 pages

Milestone Watcher

→ 242 Pages, 85% Without a Paywall, 11h Expert Channel-Check Calls in May.

→ 1090 Pages In 2022, 1,700+ Hours Researching, 98 Issues Published.

Pay Attention to Meteorology

This week, there was a complete change in investors’ humor. As the S&P 500 rebounded almost 10%, the FinTwit community re-emerged from hiding, with everybody explaining how they nailed the market’s bottom.

Even though I’m 100% allocated in stocks, I’m still concerned this may not be the bottom. But, for now, I’d not take unnecessary risks since any butterfly effect is highly unpredictable by its nature.

The butterfly effect is the idea that small things can have non-linear impacts on a complex system. The concept is imagined with a butterfly flapping its wings and causing a typhoon.

Of course, a single act like the butterfly flapping its wings cannot cause a typhoon. However, small events can serve as catalysts that act on starting conditions.

For instance, one of the most documented butterfly effects was reported by the meteorology professor at MIT, Edward Lorenz.

After running experiments on weather behavior, he noticed that tiny changes significantly impacted the outcome, even though his model was relatively simple.

Lorenz had a computer model based on 12 variables, with inputs like temperature and wind speed, whose values could be depicted on graphs as lines rising and falling over time.

Lorenz was repeating a simulation he’d run earlier on a specific day, but he had rounded off one variable from 0.506127 to 0.506.

To his surprise, that tiny alteration drastically transformed the whole pattern his program produced over two months of simulated weather.

However, I believe there is a misconception about the term. The popular idea is that a butterfly effect is a small thing with a significant impact, with an implication that could be predicted or manipulated.

In my opinion, this is not what Lorenz meant. Instead, the reality is that small events in a complex system may have no effect or a massive one, and it is virtually impossible to know which will be the case.

His Chaos Theory helps us understand the most significant flaws of the financial market. Most decisions use linear models for estimating risk, ignoring the potential for derailment.

For instance, most analysts present a bear scenario for companies under coverage. Usually, they apply a multiple on key KPIs, such as growth, cost of equity, or margins, and build a sensibility table.

This is one of the worthless exercises that exist because even the slightest error in an initial setup renders the model useless as inaccuracies compound over time.

For the same example, if the cost of equity is raised by 3p.p., probably something else will happen that may affect the fundamentals.

So, considering this as a bear scenario is wrong, and adding inaccurate information to incorrect information doesn’t make you end up with the correct information.

Yet, this is not only about DCFs, risk models, etc. The exponential growth of error in a predictive model occurs in most systems, regardless of their simplicity or complexity.

Subscribe now

Stay on Course

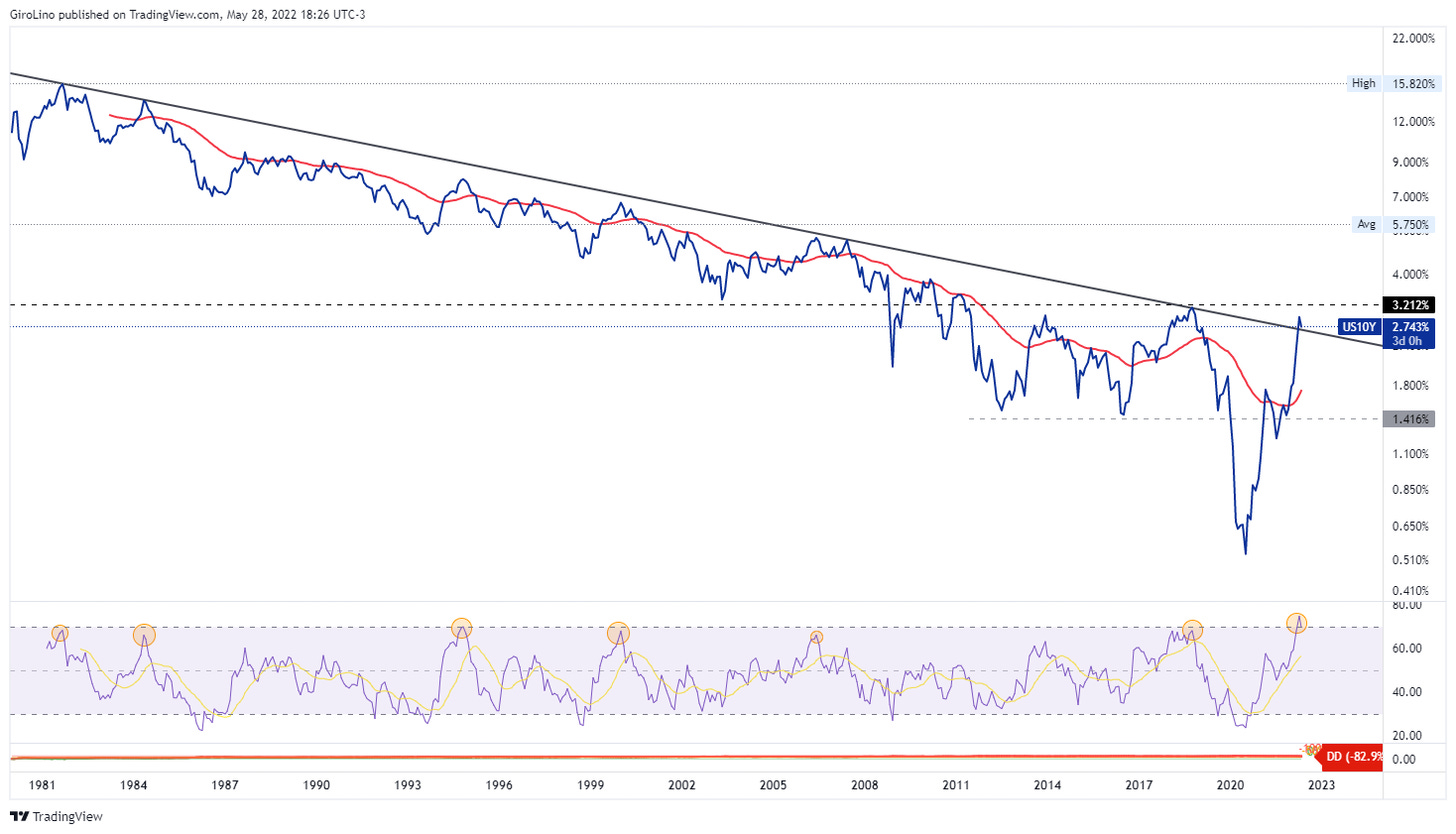

The 10-year Treasury bond continues to trade around the 40-year trend line since former FED chairman Paul Volcker triggered the bull run in Treasuries by squeezing 1970s inflation out of America.

Jerome Powell, the former Reverse Volcker, is now seeking to sound like Volcker when his political masters want him to be seen to be doing something about high inflation.

A few weeks ago, we wrote about how Powell was doubling down on peak inflation in March and that we saw a hard time for Powell to stay on course.

Still, we believe the most critical event in 2022 will be when the Fed decides to adjust its languages, as they did by dropping the word “transitory”.

So far, the current administration has been responsive to market prices, leading us to believe that the market will set the pace that Powell changes the statement, explaining why the chart above is the most important one that currently exists.

Whether this base case proves correct will, in the end, depend significantly on whether or not the Fed stays the course in terms of its current hawkish approach.

Both sides of the coin

Even though we believe the world may live with higher structural inflation from now on, we cannot ignore the Fed plays an important role, especially in deciding whether to keep a hawkish approach or not.

On the bull side, for having a policymaker responsive to market conditions, there has to be a good chance that the bond market rallies off a 40-year trend line.

Also, assuming that inflation peaked in March, and considering that a higher base point will help bring down inflation, assuming a 0.2% MoM growth going fwd, US headline CPI inflation will end 2022 up 4.7% YoY.

Even though markets are pricing a terminal rate a touch above 3%, don’t underestimate the current cycle. For example, Fed hikes in 1994 took the policy rate to 100-150bp above what was then.

From an inflation perspective, the 1980s are also a precedent to remember. It is perceived that the aggressive tightening in the 1994 cycle under Fed Chair Greenspan was more about a pre-emptive strike to stem any possibility of rising inflation.

Inflation was a much more pressing concern in the early 1980s. Fed Chair Powell was reminded of the decisive actions of the Fed in the early 1980s under Chair Volcker - and Powell did not push back against the 1980s narrative.

At that time, the Fed took policy 150-250bp restrictively. If the FED takes a restrictive policy above the neutral, the terminal rate could range between 3.5% and 5.0% — way above anyone’s expectations.

China May Help

Also, Jefferies made an exciting study about the correlation between Brent oil prices and 5-year forward inflation expectations.

The correlation between the Brent crude oil price and the US 5-year 5-year forward inflation expectation rate has been 0.89 since 2011.

Still, the five-year forward has declined below the critical 2.5% level after reaching a high of 2.7% in April, trading at 2.4%.

A sharply higher above the 2.5% level would again escalate concerns that inflation expectations are becoming unanchored.

It’s hard to question that a further surge in oil prices would not make the Fed’s job much harder, assuming the correlation holds.

However, even though we’re bullish on oil, we recognize that China’s strict lockdown policies suppress oil demand in the short term.

PBOC Under Pressure

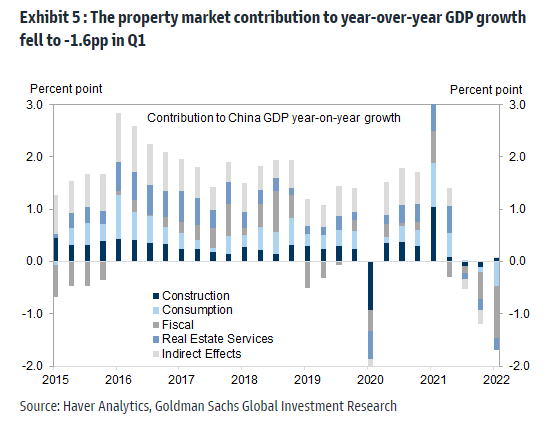

Admittedly, I had a different view about China’s growth after the Politburo, held by the end of April, even though this week’s data dumped our estimates.

Meanwhile, given this week’s data dump from China, it remains extraordinary that it was only 3 months ago that Premier Li Keqiang set China’s real GDP growth target for 2022 at a better than expected 5.5%.

This raised hopes Covid's policy was on the point of being relaxed, hopes that have since been dashed.

China’s April data were exceedingly weak. Housing starts and sales plunged 40% year-over-year. Credit growth came in at less than half of market expectations. As a result, many market participants slashed expectations for GDP growth between 1%-2%.

The meeting of the Politburo of the CCP, chaired by Xi Jinping, reiterated that China will “unswervingly adhere to the ‘dynamic clearing’ policy and resolutely fight against any words or actions that distort, doubt or deny China's anti-Covid policy”.

I was a bit scared by this comment. Xi is putting politics over the economy. Given recent econ data, probably it was not wise.

This means that criticizing Xi’s Covid policy is now to blame the Party. Hence, officials' focus has been on easing policies to mitigate the impact of Covid suppression, such as this past weekend’s cut in mortgage rates.

In recent weeks, China policymakers have stepped up their easing efforts toward the property sector. Examples include encouraging the use of Credit Risk Mitigation Warrants.

Translating: Evergrande, the CCP is ready for a new problem like this one. So, they allow three private developers to issue domestic bonds that the Chinese banks have reportedly been “instructed” to buy by authorities.

Following the announcement of a new floor mortgage rate on May 20, the floor mortgage rate for first-time buyers is now at 4.25%, the lowest level since 2008. There are no signs that the physical property market is rebounding.

Message is Clear

Obviously, the problem is that such easing policies will not have any real impact if the Covid suppression policy is tightly enforced.

We are concerned about the unintended negative consequences of this policy for the residential property market, as the lockdowns have caused a renewed downturn in inactivity in the past two months.

We view bond exchange transactions as efforts that provide short-term relief on credit stresses by pushing bond maturities to a later date but are not sufficient to resolve the credit issues.

Rather than conducting bond exchanges, increasingly, RMB bond issuers seek maturity extensions when they are unable to meet upcoming redemption payments.

Such transactions do not constitute an event of default, with bondholders agreeing to extend the repayment of the bonds, but we believe they do indicate stresses for the issuers.

So far, in 2022, 6 issuers have defaulted on their China onshore bond obligations, and in aggregate, they have RMB 30.2bn in a notional amount of onshore bonds outstanding at the time of default.

In addition, 11 issuers avoided defaults by conducting RMB 48.8bn bond extensions. Therefore, unlike in previous years, more issuers have conducted bond exchanges than having defaulted so far this year.

Despite the challenging market conditions for the China property credits, we see the recent policy easing measures as indicative of a clear leaning toward supporting the property sector.

Finally, believe the measures are likely to disproportionately benefit the stronger developers, and we expect further credit differentiation going forward.

Ultimately, smaller developers will get crushed for not having access to the Credit Risk Mitigation Warrants, generating an undesired effect of hitting hard unemployment rates and credit growth.