Today’s outline

- Long-Term vs. Short-Term

- Review Estimates

- Raising Funding Cost ($STNE)

- Change in Regulation ($XP)

- The bumpy road ahead

- Portfolio (PRO)

- Watchlist (PRO)

- Notes from meetings ($Vale) (PRO)

Long-Term vs. Short-Term

EM equities have outperformed the S&P 500 since January (~+10%) primarily because of ease in China policies. In addition, EM’s Central Banks have led the hiking cycle, and commodities prices are skyrocketing.

It’s no news that Emerging Markets have been underperforming the DM markets since 2010, and, occasionally, there is the discussion whether the secular overperformance is doomed or not.

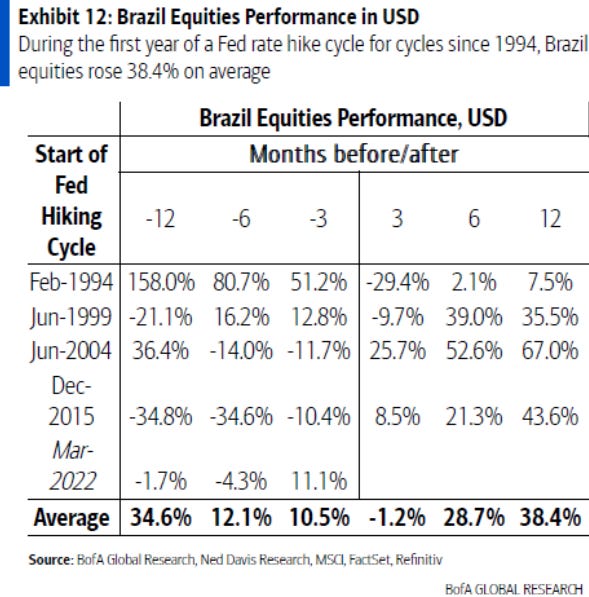

Recently, the BofA released a report showing that Brazilian equities outperform the market during the first year of a Fed Rate hike cycle since 1994, with equities rising 38.4% on average.

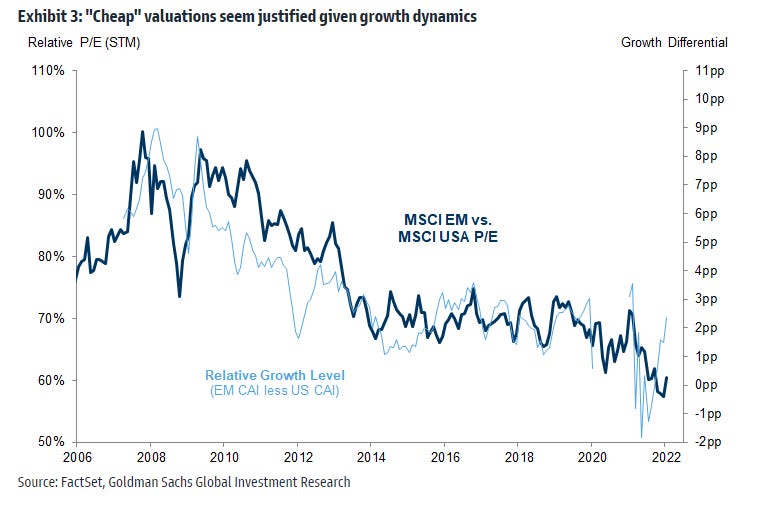

My pushback to the valuation argument on EM equities is that growth differentials have vanished over the years. The actual fundamentals don’t support that Emerging Markets close their discount to DM.

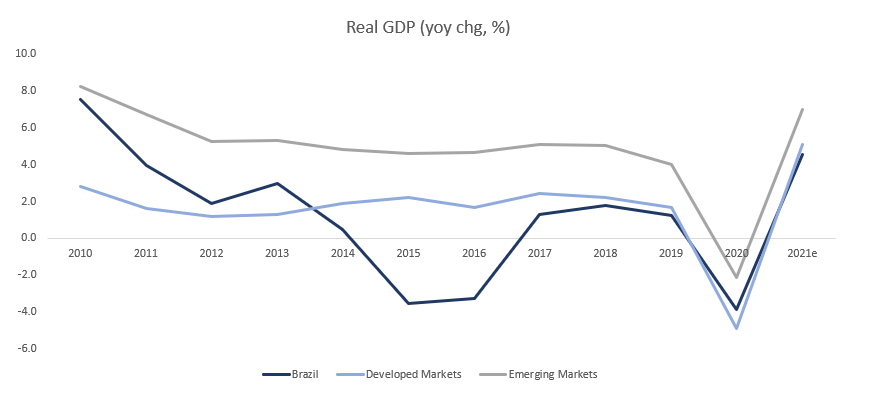

Unlike the early 2010s, when EM growth outpaced DM by ~5%, EM economies have grown roughly 2% above DM economies in recent years. In particular, Brazil has been lagging behind both EM and DM growth for almost a decade.

Nevertheless, the short-term performance of financial assets from emerging market countries has a higher correlation with commodities prices. Therefore, if commodity prices remain at a higher level for a more extended period, this will help EM countries to outperform DM.

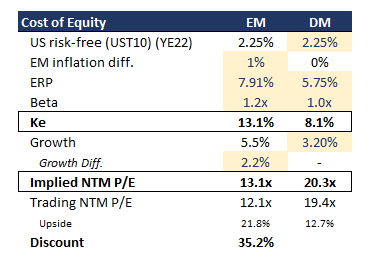

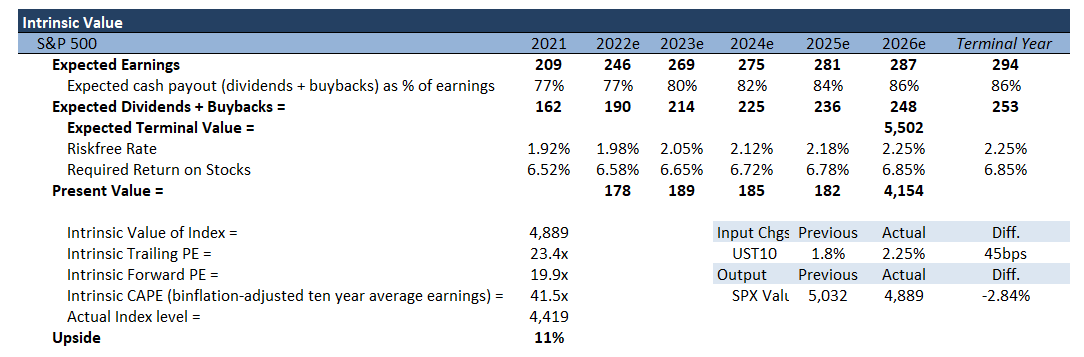

The table above is a picture of what the discount should be today. Since it’s hard to estimate a proper cash flow for the next three to five years instead, I decided to estimate returns for the next twelve months.

In the short term, considering growth differential for the next twelve months sounds reasonable to EM equities to outperform DM.

Also, it’s important to highlight that a higher sustainable price for commodities would allow an even more significant outperformance. The big question mark I have is about the durability of growth differentials.

Review Estimates

One exercise proven valuable across past years consists of reading sell-side estimates and creating reference points for that specific year.

That doesn’t mean foreseeing the future, but rather understanding what prices tell you. Indeed, estimating future cash flows is an arrogant exercise, but it helps you create your base rates on the market’s valuation.

For that, the S&P 500 is the mothership for all markets. On the table above, there is an estimate for the Index in 2022. What has caught my attention during my backtests is that the ERP and Risk-Free increased their importance as margin expansion lost its relevance.

That tells me that most upside risks are related to sales growth rather than margin expansion, and that cash flow duration has increased.

There is no recipe to follow if the market presents upside or downside risk to the model, but looking at the UST10 and growth rates over the years sounds like a plan.

Since you’ve been reading my stuff for more than a month, why don’t you redeem a free trial?

Stone

Every investor that pays attention to payment companies, or LatAm equities, has been wondering what will happen to Stone after the credit losses issue.

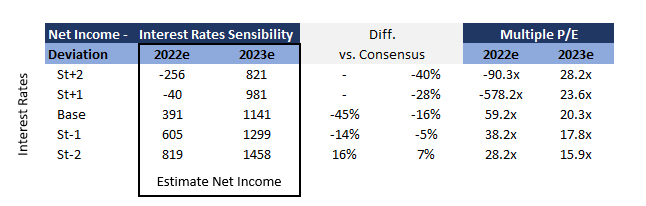

In this week's post, we reached out to this matter, specifically about raising funding costs, which will pressure STNE’s net income for the following years.

However, less volatility during rates cycles is more representative than the long-term rates. As discussed in a different edition (“Rates in Brazil and the $BRL”), the Brazilian CB has led the hawk cycle globally.

Also, an overshooting in rates would result in more volatility for $STNE’s quarterly earnings, limiting its re-rating capacity over the following years.

Change in Regulation ($XP)

CVM (Brazilian SEC) studies a potential end of IFA (Independent Financial Adviser) exclusivity. Currently, the legislation allows IFAs to work with multiple distribution platforms but only one broker-dealer entity, obligating IFA clients to open accounts with the corresponding broker-dealers.

The new regulation would allow more flexibility for IFAs and increase competition for their partnership among broker-dealers. For years, $XP used the regulation and its bargain power over IFA to reach better financial agreements.

Over 90% of its IFAs are under an exclusivity agreement, meaning they cannot sell products to their clients out of a $XP environment. In my view, I don't know how meaningful the measure is since the new regulation still allows contractually paid exclusivity.

$XP has spent over R$3bn for agreements with IFA's offices and R$1bn acquiring minority stakes in those companies. Also, $XP allows the most relevant ones to turn into broker-dealers, mitigating the risk. So all in, I don't believe in any material change for the business.

I talked to a few advisers. Indeed, they were celebrating, but because they’ll have greater firepower negotiating exclusivity with XP, rather than the proposed changes will have a meaningful impact on investors’ life.

The bumpy road ahead

In November of 2021, most economists expected two hikes over this year. After that, however, inflation presented itself as “less transitory” than expected, and now most banks are expecting seven hikes over 2022.

Also, on Friday, Russia’s concerns finally hit the markets after both the UK and the US suggested that Russia could soon invade Ukraine and advised their citizens to leave the country. By now, you probably notice that I don’t comment on politics, just on facts.

I think that foreseeing outcomes is an awful exercise when you can’t assess the results probabilistically. So instead, I’d improve and consistently apply my investment process, always looking to minimize losses.

“History plays with the bulls unless we see an economic recession. Most people cannot understand that you can only participate in a bull market if you survive the bear.

Perhaps, this isn’t a good year for leverage or to hold companies with a poor unproven operational track record. But, the less you lose today, the more you will make in the future.

Historically, companies with unmistakable competitive edges, the ability to adapt, considerable opportunities to reinvest their cash flow, and less affected by the macro thematic are enormous opportunities for those looking to compound interest on capital.” (Food for Thought, 2022-01-30)

PRO Content

Portfolio

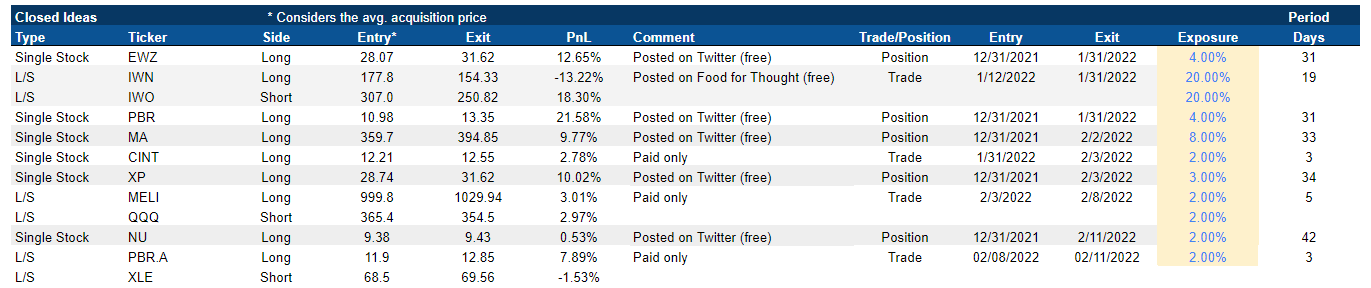

Honestly, I’m not satisfied with the Trade Book. I’m making money, but the fact that my readers are not having the opportunity of joining the trade with the exact timing bothers me.

I decided to make my portfolio spreadsheet available to every paid subscriber to you, auditing my profitability anytime you want.

I’m so blazed on transparency that administration and performance fees are considered in the portfolio performance. For me, that is your cost of money.

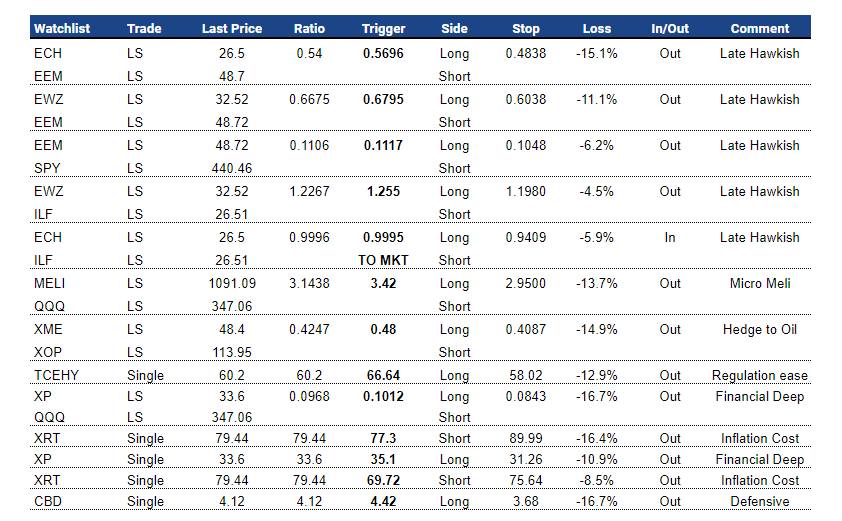

However, I found a way of solving the entry price puzzle without losses to you, my dear reader. Every week, I’ll make available a table of my watchlist, and I commit to getting out the trades on those prices and only in the stocks on the list. Still, if anyone asks to audit my spreadsheet, be my guest.

Portfolio

Cash ~6.5%

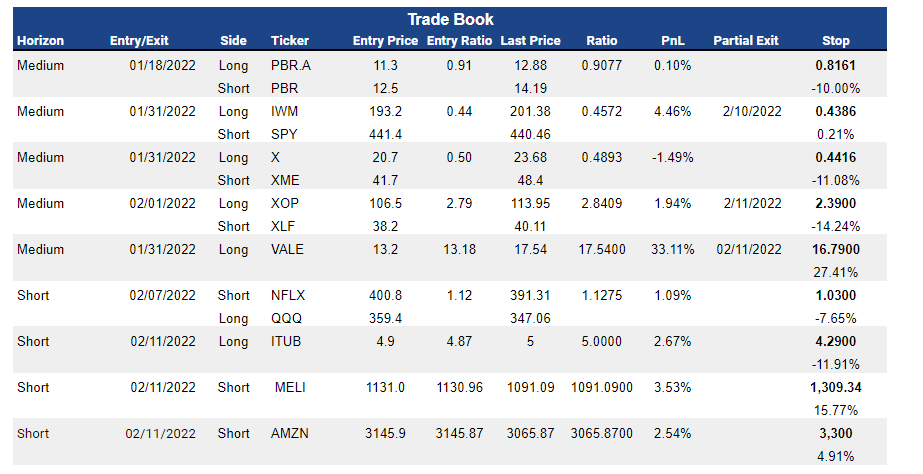

Trade Book

Watchlist

VALE

Recently, Vale’s new CFO (Mr. Pimenta) reached the sell-side to update about the company. I had the opportunity of joining a discussion with one of the participants, and there are a few highlights I would point out:

- Vale is highly committed to maintaining its high cash return story, even though management understands some low-Capex value accretive opportunities available.

My take: the company will keep looking for a $15bn net debt target to improve its cost of capital. Also, Capex should remain at $6bn (recurrent Capex), believing that Vale’s partners will make all investments. - The company is comfortable with the production guidance of 320-335mt for iron ore. Also, Mr. Pimenta reinforced that Vale will cut up to $1bn in expenses.

My take: It’s been years that we heard that Vale could achieve a 400mt production. However, I don’t think the company will deploy a higher Capex since the iron ore S/D looks balanced. This is a value over volume situation, where not growing is better than increasing sales volume. - China’s measures to stabilize economic growth should support crude steel production at around ~1bn tonnes, while global iron ore supply is tight for the 1H22. Also, adding capacity is becoming more complicated overall, and the availability of high-quality iron ore is challenging. Nevertheless, Vale is well-positioned to capture premiums, given its product portfolio.

My take: Vale expects the iron ore market to be more clearly split in two (low/high grade), with greater demand coming to high grande products. The company has been reinforcing this trend by investing in product innovation (green briquettes, for instance) to continue leverage.

Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money.